Maryland Limited Power of Attorney Form

A Maryland limited power of attorney is a legal document that grants a specific individual, known as the “agent” or “attorney-in-fact,” the authority to act on behalf of another person, the “principal,” but only in specific situations or for particular tasks. This designation is “limited” because it restricts the agent’s power to certain activities.

A limited power of attorney in Maryland may authorize the agent to handle real estate transactions, manage financial accounts, or make medical decisions exclusively when the principal is unavailable or incapacitated. The principal can tailor the powers granted to the agent to suit specific needs or circumstances, and these powers can be made effective immediately or triggered by specific events.

Use other Maryland power of attorney forms if you need to grant broader authority without limits.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

In Maryland, the creation of a limited power of attorney must adhere to specific legal requirements to ensure its validity. This allows the designated agent to perform actions on behalf of the principal within the scope of the authority granted. According to Maryland Code, Estates and Trusts, § 17-110, specific procedures and conditions must be met during the signing process:

- The power of attorney must be documented in writing.

- The principal must sign the document, or it must be signed by another individual in the principal’s physical presence and at their express direction.

- The principal’s signature, whether in physical or electronic form, must be acknowledged in the presence of a notary public.

- At least two adult witnesses must attest and sign the document. These witnesses must sign in either the physical presence of each other and the principal or an electronic setting, or a combination of both.

These requirements protect all parties involved by ensuring the document’s authenticity and preventing potential fraud. Once these conditions are satisfied, the power of attorney becomes effective, granting the agent the ability to act within the limits specified in the agreement as per MD Code, Estates and Trusts, § 17-203.

Maryland Limited Power of Attorney Form Details

| Document Name | Maryland Limited Power of Attorney Form |

| Other Name | Maryland Special Power of Attorney |

| Relevant Laws | Md. Estates and Trusts Code Ann. § 17-203 |

| Avg. Time to Fill Out | 8 minutes |

| # of Fillable Fields | 32 |

| Available Formats | Adobe PDF |

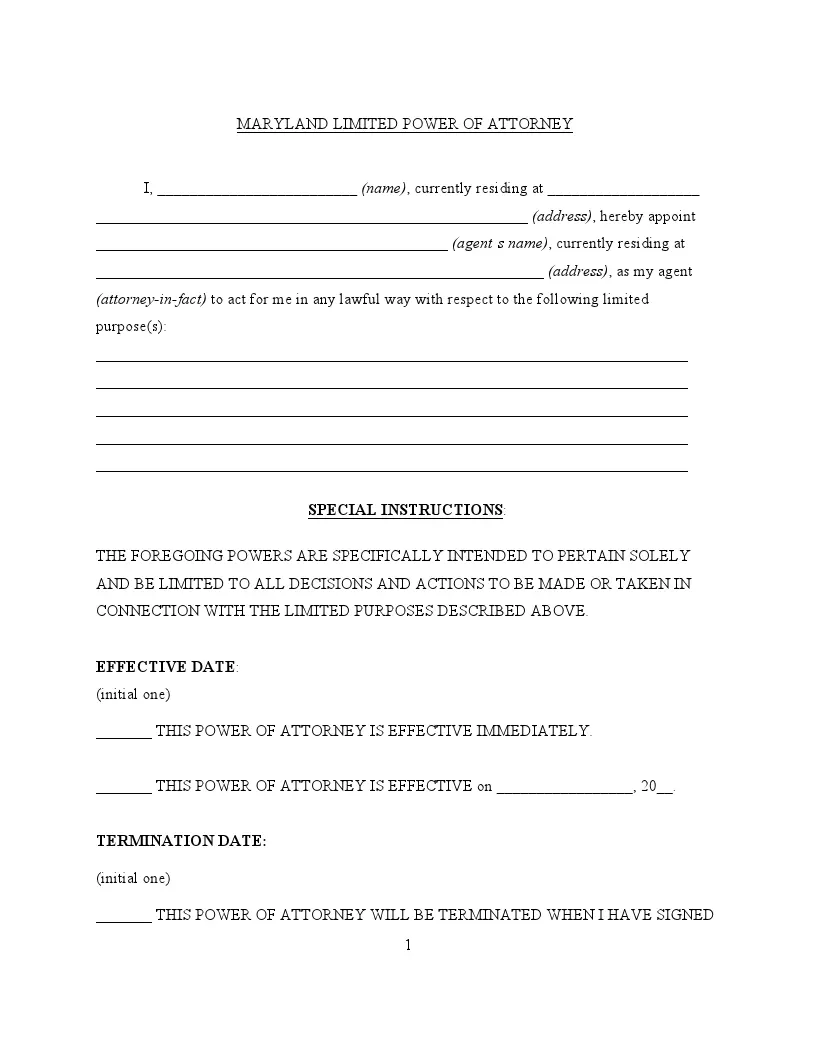

Filling Out Maryland Limited POA

Completing a Maryland limited power of attorney form involves several steps to ensure it is legally valid and accurately reflects your intentions. The process must adhere to Maryland’s legal requirements to ensure that the agent can effectively perform the duties within the designated scope.

1. Fill Out the Agent Information

Start by entering your full name and address, as indicated at the beginning of the form. Directly below, write the name and address of the person you appoint as your agent. This person will be able to act on your behalf in the capacities you designate.

2. Select Specific Powers

The form lists various powers you can grant your agent, such as managing financial accounts, real estate transactions, or other specified activities. Check the boxes next to the specific powers you want to delegate. Be precise to prevent any confusion or unintended authority.

3. Effective and Termination Dates

Indicate when the power of attorney will become effective. If it is not meant to start immediately, specify the date it should begin. Additionally, fill in the termination date if the authority is meant to expire on a specific day.

4. Include Special Instructions

If you have any specific wishes or guidelines, the agent should follow, detail these in the “Special Instructions” section. It can include compensation details if you wish to provide payment for the agent’s services.

5. Principal’s Signature

Sign and date the form in the designated area. Ensure this is done in the presence of two adult witnesses and a notary public.

6. Complete Witness and Notary Sections

Have the two witnesses sign their names and provide their addresses and contact information in the respective fields. The notary public will then fill out their section, acknowledging the signing of the form, and affix their seal if applicable.

7. Distribute Copies Accordingly

Ensure that copies of the completed and signed power of attorney are given to your agent and any successor agents, and retain a copy for yourself. It may also be wise to provide a copy to financial institutions or other entities requiring it.