New Jersey Limited Power of Attorney Form

A New Jersey limited power of attorney form is a legal document that allows a person to designate another individual, known as an agent or attorney-in-fact, to perform specific actions or make decisions on their behalf for a designated period. In contrast to a general power of attorney, which provides extensive powers, this document restricts the agent’s authority to specific tasks or circumstances.

Depending on the conditions specified in the limited power of attorney, tasks may include managing financial transactions, selling assets, or making investment choices. The form is usually only effective for particular events, periods, or circumstances, making it a customized solution for specific legal requirements.

You can use New Jersey power of attorney forms to appoint trusted agents to act on your behalf to ensure proper legal representation.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

The creation of a limited power of attorney is governed by specific legal requirements under the New Jersey Revised Statutes – Revised Durable Power of Attorney Act (§ 46-2B-8.1 – 46-2B-19). The document must clearly outline the principal’s authorization for an attorney-in-fact, who can be either an individual or a qualified bank, to perform specified acts on the principal’s behalf. The designated attorney-in-fact is legally empowered to manage designated tasks as outlined in the power of attorney agreement.

A notary public must certify the document’s signing to lend further legal credibility. Moreover, the principal retains the right to revoke the power of attorney at any time, as detailed in § 46-2B-8.10 of the statute. This revocation must be executed with the same formalities as the original power of attorney to be effective, ensuring that the principal’s intentions are clearly documented and legally upheld.

New Jersey Limited Power of Attorney Form Details

| Document Name | New Jersey Limited Power of Attorney Form |

| Other Name | New Jersey Special Power of Attorney |

| Relevant Laws | New Jersey Revised Statutes, Section 2B-15 |

| Avg. Time to Fill Out | 8 minutes |

| # of Fillable Fields | 32 |

| Available Formats | Adobe PDF |

Filling Out New Jersey Limited POA

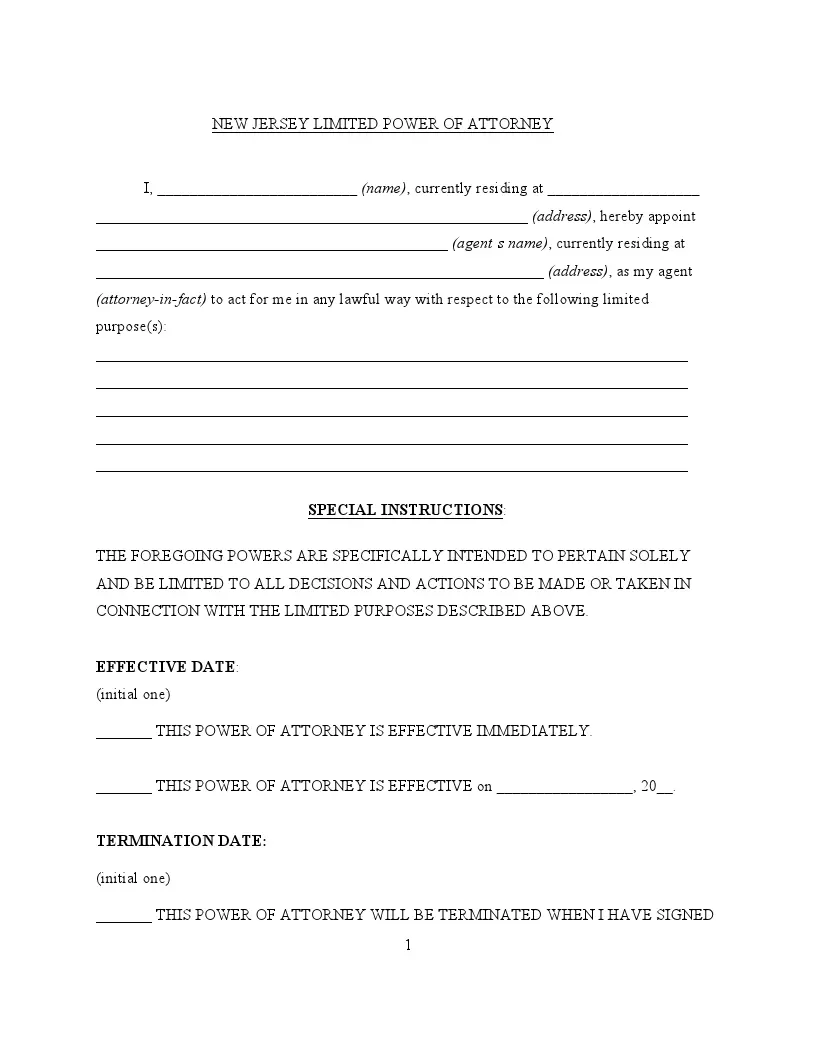

A limited power of attorney in New Jersey allows you to appoint an attorney-in-fact to handle specific legal or financial decisions on your behalf. Here’s how to complete the form to ensure it meets all legal standards and accurately reflects your intentions.

1. Fill in Principal and Agent Details

Start by entering your full name and address where indicated. Then, identify the person or entity who will act as your attorney-in-fact. This individual or bank should be someone you trust, as they will have significant control over the specified aspects of your affairs. Include their full legal name and contact details.

2. Specify Powers Granted

Clearly list the powers you are granting to your attorney-in-fact. Be specific about the tasks you want them to handle, such as managing real estate transactions, banking activities, or making healthcare decisions. This clarity will prevent any confusion regarding their authority.

3. Set the Duration

Determine the period during which the power of attorney will be effective. Specify if it begins immediately and when it will expire, whether on a specific date or upon completing the designated task.

4. Add Any Special Instructions

If there are any specific conditions or limitations on the powers granted, list them in this section. It may include restrictions on selling particular properties or limitations on the types of financial transactions authorized.

5. Sign in the Presence of a Witness

Under New Jersey law, your signature on the power of attorney form must be witnessed by at least one adult who is not the attorney-in-fact. This witness must also sign the form, attesting to your capacity to understand and voluntarily execute the document.

6. Obtain Notarization

Bring the completed form to a notary public. The notary will verify your identity and witness your signature, then notarize the form to add a layer of legal authentication. This step is critical for the document’s acceptance in most legal and financial institutions.