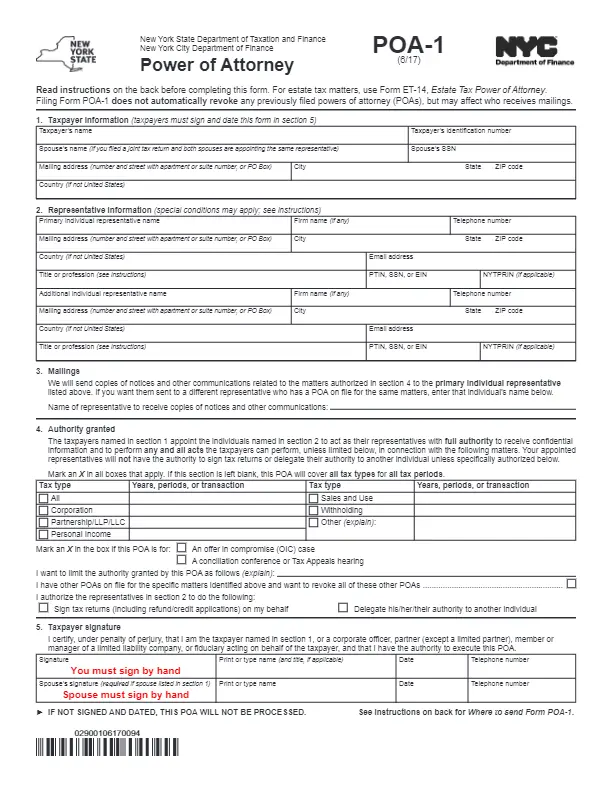

The New York Tax Power of Attorney form (also called POA-1) is normally created when the taxpayer needs to delegate certain tax-related powers (except estate tax) to another person. Such a document is mostly used by individuals who manage their entities’ tax matters, but it may also be necessary for out-of-business individuals.

New York power of attorney – click to see all the POA documents you can draft for this state.

Execution of this paper is regulated by NY Gen Oblig L § 5-1502M (2019). An agent is granted various powers:

- Prepare, sign, and file insurance contributions and returns;

- Pay taxes due;

- Collect refunds;

- Post bonds;

- Receive confidential information;

- Exercise elections under federal and local tax law;

- Represent the principal in tax matters;

- Designate other persons to represent the principal in tax matters;

- Other specific powers mentioned in the agreement.

Remember that section 73(8) of the New York State Public Officer’s Law restrains a former government worker from appearing or practicing before a former company for two years after leaving public service.

All representatives are authorized to act on their own unless you indicate your wish for them to act jointly in this document.

If the form is being completed by an individual and their spouse and designates the same attorney-in-fact, the spouse’s personal data should be indicated in the paper. If the spouses have chosen to designate different agents, each of them needs to complete an individual form.

Only individuals (not firms) can be selected to represent the taxpayer. You can choose more than one agent if you wish.

If you are not designating a tax professional, indicate your relationship in the New York Tax Power of Attorney.

The taxpayer may choose to submit their POA-1 application online, through US mail, or by fax. Once the form has been processed, there is no need to send any extra documentation.

New York Tax Power of Attorney Form Details

| Document Name | New York Tax Power of Attorney Form |

| State Form Name | New York Form POA-1 |

| Relevant Link | New York Department of Taxation and Finance |

| Where to File? | Per fax or mail to: NYS Tax Department POA Central Unit W A HARRIMAN CAMPUS ALBANY NY 12227-0864 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 57 |

| Available Formats | Adobe PDF |

Filling Out New York Tax POA

We recommend using our form-building software to generate a personalized form for submission. It is worth mentioning that creating a new Tax POA does not revoke the previous forms you have executed in the state of New York.

If the taxpayer decides to revoke one attorney-in-fact and has appointed more than one in the POA form, they are all withdrawn automatically. You will need to create a new POA indicating those persons you wish to act on your behalf in such a case.

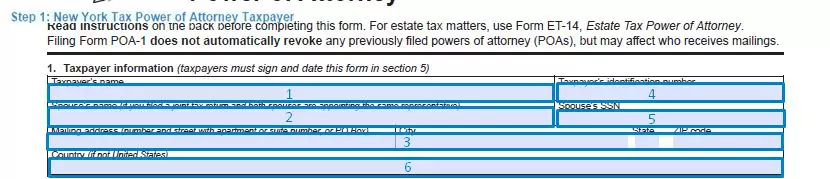

1. Enter the Taxpayer’s Personal Data

The taxpayer should provide their full name, ID number, mailing address, and spouse’s info (if applicable).

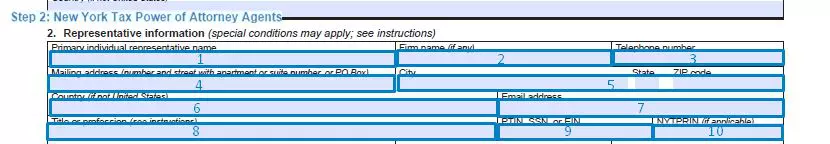

2. Provide the Representative’s Information

You may choose to designate one or more representatives. Indicate the primary agent’s full name, firm name (if any), telephone number, mailing address (including city, state, and ZIP), country (if not US), email address, title or profession, relevant ID number, and NYTPRIN (if applicable). If you are appointing an alternative representative, provide the same information about them.

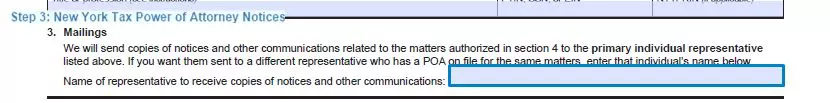

3. Name the Agent to Receive Mailings

All notices and written communications will be sent to the primary attorney-in-fact indicated in this form. If you wish another individual to receive these documents, write down their name in this section. Keep in mind that this person should be either an additional agent you are appointing above or a valid agent indicated in another effective POA form.

4. Choose the Authorities You Are Granting

The representative you are designating is about to be conveyed the right to possess full powers to act on your behalf unless you limit those powers in this section of the document. Years, periods, or transactions are also mentioned herein. If you leave the section blank, your attorney-in-fact will perform any acts you can perform as the taxpayer.

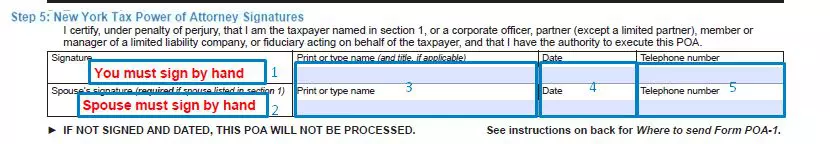

5. Sign the Paper

The taxpayer declares to have provided true and correct information by affixing their signature, dating the form, providing the name or title in print (or titling it), and writing down the telephone number. If the taxpayer’s spouse is designating the same agents to represent them in tax matters, the spouse must sign the form and provide all other data.