If a taxpayer decides to transfer their authority on tax-related matters to another person, the two parties should sign a Tax Power of Attorney form. The Ohio Department of Taxation administrates the state tax system and is responsible for issuing all kinds of tax-related forms and declarations. All tax-related legal forms apply either to business structures or individuals. You can refer to the Department’s official website for a complete list of every existing tax type and its requirements.

Suppose a taxpayer cannot comply with their tax obligations before the Department of Taxation in person or suddenly becomes incapacitated. In that case, they should use the Department of Taxation Declaration of Tax Representative (Form TBOR-1). Using this form, one can appoint an agent to represent them and act on their behalf in all cases regarding taxation. The principal defines the scope of powers that he or she would like to grant to an agent.

Check out all the Ohio power of attorney forms you can create by clicking on this link to our Ohio article.

Thus, by using the Ohio Tax Power of Attorney form, the principal authorizes an appointed agent to represent him or her before the state Department of Taxation. All tax declarations and related documents contain confidential information that cannot be released without the taxpayer’s official consent. Upon verification, the power of attorney form will give the agent access to the taxpayer’s data on business deals, private property, or other financial transactions. The document enables the agent will be able to do the following on the principal’s behalf:

- file petitions or complaints

- perform audits

- request alternative taxation methods

- present legal arguments during hearings

- testify before the Department of Taxation employees.

However, there are certain exceptions to the agent’s authority. According to the Ohio Revised Code, a tax representative can only sign forms specifically requiring the taxpayer’s authorization. Please note that the appointee may not be able to sign Voluntary Disclosure Agreements, Settlement Agreements, or any other binding documents with the Department of Taxation on behalf of the taxpayer unless the legal representative has a license to practice law.

Ohio Tax Power of Attorney Form Details

| Document Name | Ohio Tax Power of Attorney Form |

| State Form Name | Ohio Form TBOR-1 |

| Relevant Link | Ohio Department of Taxation |

| Where to File? | Per email/fax or mail to: Ohio Department of Taxation P.O. Box 1090, Columbus, OH 43216-1090 |

| Avg. Time to Fill Out | 17 minutes |

| # of Fillable Fields | 102 |

| Available Formats | Adobe PDF |

Filling Out Ohio Tax POA

Obtain the latest version of the Ohio Tax Power of Attorney form to fill it out. You may find it online or just use our software tools to build and download one. There are several parts to the document. Please, follow our step-by-step instructions when filling out the form:

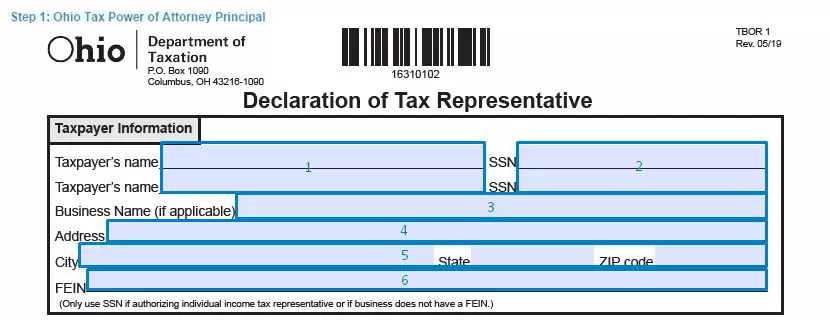

1. The first part of the document is entirely about the principal. Enter the taxpayer’s full name on the first line. If it is a business entity transferring its authority, enter this entity’s legal name on the corresponding line. Leave the line empty if no business entities are involved. Then, insert the taxpayer’s legal address (regardless of whether it is an individual or a business entity). Use Federal Entity Identification Number (FEIN) for a business entity or a Social Security Number (SSN) for an individual.

2. The next step will require the legal representative’s personal and contact information. Enter the agent’s full name, including their title (if applicable). Then fill in the agent’s legal address in compliance with the information in their identification document. Indicate the representative’s contact information, including the fax number, daytime telephone number, and e-mail address.

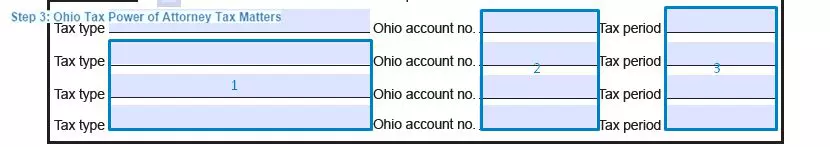

3. Indicate the tax matter you would like to transfer to the legal representative. Tick the corresponding box at the beginning of this section for all tax-related issues or write down the specific issues you would like the representative to focus on. Specify the tax type, Ohio Account number, and taxation period.

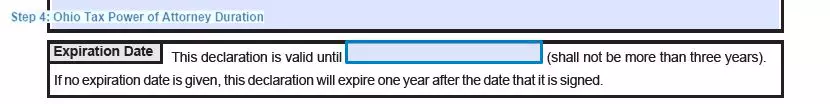

4. Decide on the period during which the power of attorney will stay valid. You can put down a time frame of not more than three years.

5. If the principal is willing to impose any restrictions on the agent’s authority to act on his or her behalf, the taxpayer should use the next section to affix the limitations.

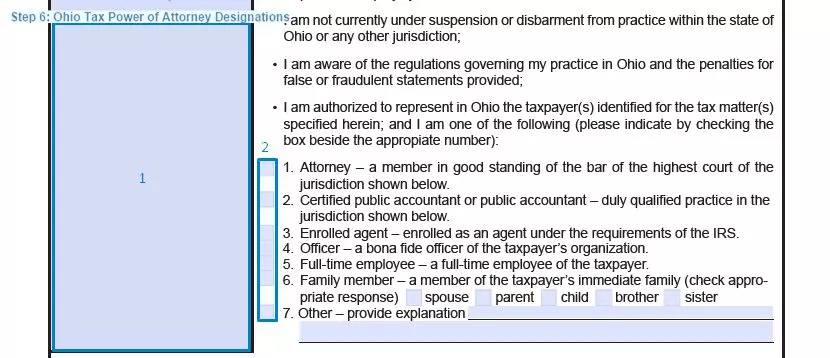

6. The next section is intended for the representative to fill in. The new Attorney-in-Fact has to accept his or her new responsibilities by giving written consent. The appointee shall agree to make a declaration under penalties of perjury and tick the corresponding box to indicate their relation to the taxpayer. If there are several designations, mark each of them in the next section.

7. The Attorney-in-Law provides his or her signature at the end of the form. At this point, the authority to sign tax-related documents is already considered transferred to the agent. Thus, the principal’s signature is no longer needed.

8. Serve the document to the Ohio Department of Taxation via e-mail or send it to the address indicated at the end of the POA. If you ever need to revoke the power of this form, just repeat the same procedure one more time and submit the relevant document to the Department of Taxation.