Business Purchase and Sale Agreement Template

In business, it’s important to know not only when to start a new venture but also when to curb your losses and sell your business. But selling a business is nothing like selling a car or even a home. Apart from a brand, a business may own real estate, products, intellectual property, working tools, and other assets that should be included in the sale. To make the process of selling the business super clear and make sure that both the seller and buyer act in an honest way and don’t have misunderstandings, they can sign a business purchase agreement or business transfer agreement.

If you’re going through a sale of a business or just want to learn more about this topic in case you may need it later in your business life, feel free to continue reading this introductory article and get yourself a free purchase of business agreement template to study.

What Is a Business Purchase Agreement?

A business purchase agreement is quite a lengthy document in most cases. Unlike most other sale or purchase agreements, it has to go over dozens, often hundreds of business access and possible liabilities. It will also typically contain several other agreements like the non-solicitation or non-disclosure agreement. With dozens upon dozens of pages of text full of language only a lawyer could understand, it’s no wonder why many business owners prefer to delegate dealing with this agreement to their legal team.

Now, even if you have a rather small business, it’s worth hiring an attorney or law firm to provide legal advice. You could potentially be putting yourself in harm’s way should the business deal go to court to save a few hundred dollars. That said, you should probably read the agreement a couple of times over.

The first thing to understand is that a business purchase agreement does not transfer the ownership of a business from the seller to the buyer. It describes the agreement of both parties on how do they intend to go about the process of purchasing a business. It covers how the transfer of ownership is going to take place. The legal document that actually transfers the ownership is the bill of sale and handing that bill to the buyer should typically be included in a business purchase agreement.

When You May Need a Business Purchase Agreement

A business purchase agreement is a legally binding contract that formalizes the terms of transfer of ownership of a business from the seller to the purchaser. You need to sign one when you’re selling a business, not matter how small. It’s not legally required, but you definitely want to have one in place to make sure both parties keep to their word and complete the transaction as agreed upon.

This doesn’t only apply to selling and purchasing a business as a whole. You may also want to sign a purchase agreement when you’re buying or selling business assets or company shares. Business assets may include real estate, tools and machinery, intellectual property, etc.

For both the seller and buyer, this agreement serves as a final step in negotiations and as a guarantee that the sale is going to close successfully. If it doesn’t and either the buyer refuses to go through with the purchase or the seller refuses to transfer the ownership of a business, the case could go to court as this contract is legally binding.

Benefits of Using a Business Purchase Agreement

While bulky and full of legal jargon, a business purchase agreement is a necessary part of transferring ownership of a business. It has three key benefits that make it integral to the process.

No place for misunderstandings

The worst thing that can happen to you as a business owner selling a business is coming to a meeting to close the sale only to learn that the buyer expected more than you intended to sell. They agreed to pay a set price for everything the business has, but you were meaning to save a couple of assets or shares. Or you were expecting a lump sum payment and the buyer wanted to pay in parts. That could end up rather ugly as verbal agreements often tend to do.

With a business purchase agreement, you have zero risks of ending up in a similar situation. All the assets of the business accounts receivable and date of closing are written in the contract and agreed upon by both parties months before the deal takes place.

Planned-out workflow

There cases where the purchase of a business may take months before closing. Whether the business owner wants to finish a contract before transferring ownership, giving employees ample time to find new job opportunities before terminating contracts, or the buyer wants to do their due diligence, the process can be long and arduous.

A well-written and meticulous business purchase agreement explains each step of the sales process in as much detail as possible. It can describe the operations of the business in the period before the sale, the condition precedent for the sale to close, and other provisions that the negotiators agreed upon.

This not only makes it way easier for the business owners to handle the matter but allows for outsourcing the process to the legal team or an escrow.

Legally-binding guarantees

Lastly, no matter how much trust there is in a business relationship, there should always be a contract signed between the parties. A legally-binding business purchase agreement makes sure that both the buyer and seller stick to their representations and warranties. Doing otherwise could potentially mean the hurt party will take the case to court, and most likely win.

For instance, if after reading the agreement the court rules the business in question a marketable title, it may either enforce the purchase of the title by the buyer who signed the contract or impose penalties.

How to Purchase an Existing Business

A novice entrepreneur may think that the hardest thing when it comes to the purchase and sale of a business is acquiring financing for the operation. However, it may be about the easiest part of the whole process. The main issue is not applying for a loan and receiving a bill of sale on your hands. It’s finding out whether it’s worth buying a particular business.

Find a business worth buying

Let’s be honest, there aren’t a lot of businesses for sale, and finding one, especially in a smaller city, may prove tough. To find suitable candidates, try these:

- Business sale websites

- Business brokers

- Investment firms

- Local community in the industry

Once that is done, it’s time to see whether this business is any good.

Evaluate the business

A business with a good-looking logo and great interior design isn’t worth a penny if it’s not turning in a profit. To assess the value of a business, you may look at these factors:

- What is the current return on the investment

- How much is the business earning

- How big is its cashflow

- What is the value of the business’s assets

Obtaining this information would probably require you to contact the business owner, so make sure to start your relationship on a positive note.

Negotiate the price and assets to be bought

If after looking into the business’s paperwork you decide buying it will be a net positive for your wealth, it’s time to start the first round of negotiations. The main points for your first formal negotiations should be the purchase price, security deposits, and the list of assets included in the sale. At this point, you may want to hire an attorney or a law firm to help sort out the legal matters.

Send a letter of intent

With that done, you may continue with the next formal step — sending the letter of intent. This letter, LOI for short, is a non-binding document that doesn’t require you to go through with the purchase, but merely outlines your intentions.

Research some more

What is binding in the LOI is the non-disclosure clause, that is if you include one. It is after submitting this letter that you may be given closer access to the company’s internal documents. Use this opportunity to research financial statements, tax obligations, and other liabilities the company may have undisclosed.

Sign a business purchase agreement

After your due diligence is done and the seller did theirs too, the decision has to be made. If you are to go through with the purchase, you’ll have to create and sign a business purchase agreement. You will find detailed instructions on that below. Feel free to consult with the free purchase of business agreement template provided on this page.

Close the sale

With a purchase agreement signed, there’s nothing left to do then go through each point of the process. Follow your agreement together with the seller of the business, provide the payment in either lump sum or in parts, and receive a bill of sale that transfers the ownership of the business from seller to buyer.

What Information Should Be Included in the Agreement?

Even though each purchase agreement would be vastly different depending on the type of business and type of sale at hand, there are some crucial components of this document that are absolutely required. Here is what you may expect to see in a typical purchase agreement.

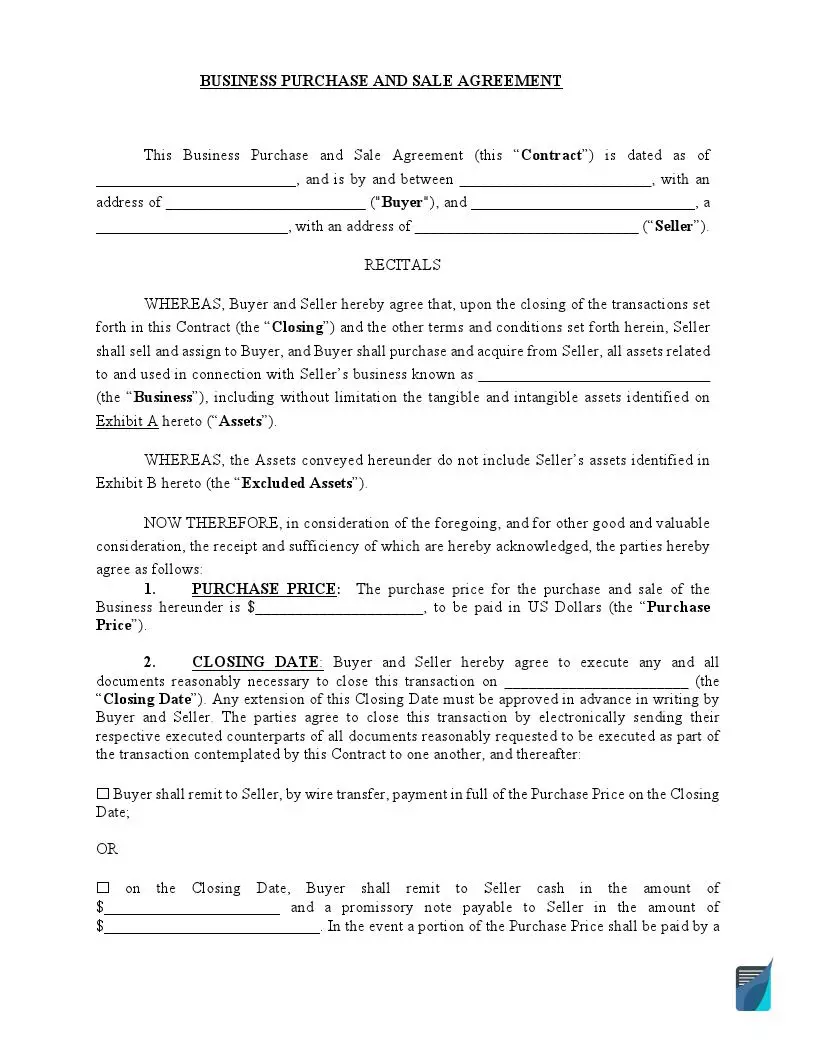

Buyer and seller personal information

At the very top of any business purchase agreement, you can expect to find the personal information of both buyer and seller. That includes their full names and residential addresses.

Business name and assets description

The next piece of information you will see on all documents like this is the description of the business being sold. This includes its full legal name and the description of all assets that are a part of the transaction. But that’s only one side of the coin, there are also liabilities that a business may have.

Any loans the business may have will going to be transferred to a new owner along with the business itself.

Representations and Warranties

In a purchase agreement, the seller and purchaser will make a series of statements about their intentions — representations and warranties. The clause containing these will also typically include provisions for when warranties are breached by either party.

Purchase price and payment breakdown

Pricing and a breakdown of how the full price is to be paid are next on the list. This section of the document will go on in detail on how the funds and ownership of business assets are going to be exchanged. Accounts receivable disambiguation also should appear in this section.

Closing conditions and date

One of the most crucial parts of the purchase of business agreement is the closing conditions and the closing date. Should the conditions of the closing not be met, the deal is called off and the purchaser does not hold legal responsibility to continue with the deal.

If the conditions are met, however, they’re legally bound to do so. The bill of sale is given to them on the closing date after payments agreed upon are made and the transaction is considered complete.

Non-competition and non-solicitation provisions

Lastly, many purchase agreements contain non-competition and non-solicitation clauses. In essence, these mean that the seller of the business would not run another business that competes with the one they just sold. Nor would they try to solicit their patrons to transfer from the sold business to a new one.

Filling Out the Business Purchase Agreement Template

Going into a deal with a simple template form is not advisable as it’s better to customize your template and make it suit your business. You also should receive legal advice before creating a legally-binding purchase agreement. That said, here’s how you should fill out your business purchase agreement template once you’ve customized it.

Step 1. Fill in personal information

The first step is to write in your full name and address. Use the address where you reside constantly and can receive mail at.

Step 2. Fill in the business name

The next filed to fill in is the name of the business being sold. Make sure to include the legal name of the business, not just the trademark.

Step 3. Fill in the purchase price

The next field requires you to write a full price of the business that both the seller and purchaser agreed upon.

Step 4. Fill in the closing date

The field below is reserved for the closing date. Fill in the date when the deal should be closed. It’s better to make sure it’s a business day to avoid confusion.

Step 5. Fill in payment details

With that out of the way, specify how the payments for the business purchase are to be made. If the payment is going to involve a promissory note or another form of postponed payment, indicate that and specify the amount that is going to be paid after the closing date.

Step 6. Fill in business trade name

After the part detailing representations and warranties, the seller should fill in the business trademark name. This clause makes sure that the seller will change their trademark or DBA name to one unrelated to the company they’re selling.

Step 7. Fill in accounts payable

As accounts receivable are covered above, it’s time to fill in accounts payable. Normally, the business seller takes it upon themselves to pay all accounts payable before the closing of the deal, but if there are any exceptions, they should be noted in this section.

Step 8. Fill in the non-competition clause

Now that most of the details are ready, it’s time to fill in the optional clauses. The seller should the time frame where they promise not to compete with or interfere in the operation of the business being sold.

Step 9. Fill in the consulting clause

The seller may also choose to provide free consultation for some time after the sale. If they do so, they should specify the time frame.

Step 10. Indicate your state

The last bit is before signing the document is filling in the state where the business is going to be run.

Step 11. Describe the assets excluded and included in the deal

This step should probably be done before filling in the free business purchase agreement template. In the exhibits attached to the document, you should describe the business assets that are going to be transferred to the new owner and the ones that aren’t a part of the transaction.

You should do so in detail, providing addresses of properties and registration numbers of businesses and intellectual property. Make sure that this part of the agreement is correct before attending the signing.

Step 12. Sign the document

With all that cleared, you should re-read the document for typos and mistakes and sign it, both buyer and seller. The document is legally binding when signed and the only thing you have left to do now is go through with the provisions outlined in it.