Louisiana Real Estate Purchase Contract

The Louisiana Real Estate Purchase Agreement is an official document that declares the conditions that both the real estate seller and buyer have accepted. This paper describes the details concerning the purchase of either residential or commercial premises, including its price, payment schedule, parties’ responsibilities, and other important information.

If commercial property is being sold, Agent Disclosure has to be given to both parties. The seller should attach the Residential Property Disclosure to inform the buyer about the condition of the premises in writing if this type of real estate is about to be obtained. This requirement is not supported by federal law but must be followed in the state of Louisiana.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

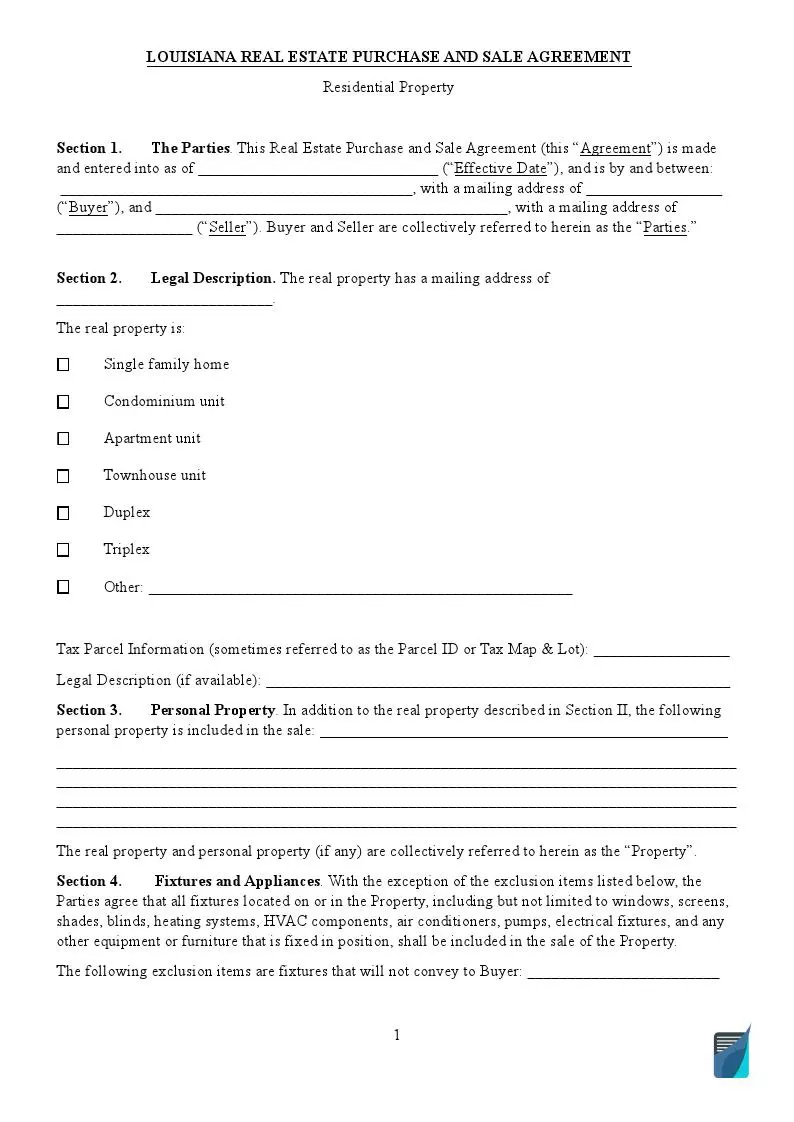

Louisiana Residential Purchase and Sale Agreement

This type of fillable purchase agreement template consists of nine pages. You will find the information about the following in the document:

- Parties’ Personal Data

- Property Description

- Price

- Manner of Payment

- Survey

- Title

- Miscellaneous

The contract can be terminated. The purchaser must have all their monetary funds returned in case termination takes place.

By signing the agreement, the buyer agrees to accept the premises as it is, with all defects, latent or otherwise, unless other conditions are described in the paper.

If the licensed real estate agents are involved in the deal, they should be entitled to payment for the services they perform as outlined in a separate written agreement.

Both seller(s) and homebuyer(s) have to provide signatures, print their names, and date the paper to gain validity. If any agents perform representative functions, they have to append signatures as well.

Louisiana Commercial Purchase and Sale Agreement

This type of Louisiana Real Estate Purchase Agreement has some similarities to the one presented above. However, creating an agreement for commercial property is more complicated. A professional lawyer must observe the complete paper to avoid any mistakes or unwanted misunderstandings between the parties.

The document consists of 14 fillable pages where you should provide information about the premises, the price, how you expect these monetary funds to be transmitted, the cure period, the closing of the purchase, assignability, and other issues.

The buyer will have a definite period indicated herein to inspect the premise and determine its material condition. In case the buyer finds the property unsatisfactory, they are allowed to terminate the offer in writing.

The set of documentation below has to be attached:

- Title Commitment

- Disclosure Statement

- Other Management Agreements

- Studies and Reports

- Written Notices

- Water Rights

- Copies of Leases

- Extra Papers Related to the Property

The buyer can choose among three payment options: all cash, bank financing, and seller financing. Opting for the first will mean that the potential homeowner can afford to commit the full-price transaction without a loan. If so, the seller will inform the buyer if the transmitted monetary funds are not acceptable. Bank financing implies taking a loan and paying the required amount within the indicated period. Seller financing means that the lessor agrees to provide a certain sum for the lessee under the conditions described in the paper.

The deposit in U.S. dollars has to be paid to the lessor in any case. According to Louisiana law, this earnest money will be paid back after the termination of this agreement.

If any part of the contract is found ineffective, only that particular part will have to be modified, not the whole document.

According to the contract, if the parties appear to have a dispute over the agreement, they should mediate before going to court—both the seller and the buyer have to pay their parts for the service in this case. In the event of disagreement, you should try to settle the conflict through neutral, binding arbitration.

This agreement must be witnessed to become effective. By appending their signatures, the seller(s) affirm that the premises are not hazardous for the potential owners’ health.

Required Seller Disclosures in Louisiana

Different disclosures have to be attached to the contract depending on its type. If the seller is offering residential premises, the following must be submitted:

According to 42 U.S. Code § 4852d, all homeowners should provide the buyers with the Lead-Based Paint Disclosure if their property was built before 1978 to prevent future dwellers from probable health deterioration.

- 9:3198 states that the seller is also required to complete a Property Disclosure document in good faith to the best of their belief.

If the owner of the commercial property is about to sell it, the Agency Disclosure has to be given not only to the buyer but also to the seller. It contains a detailed description of who the customer and the client are, what is meant by the term agency, and what a licensed agent is accountable for. This paper is required according to § 37:1455(21).

- 37:1455(21) obliges your agent to attach the Dual Agency Disclosure if they act as a dual agent. You will find information about the services a dual agent can provide for their clients and the confidential information the licensee cannot disclose.

As written in the disclosure, the licensee can act as a dual agent only with your consent. It is highly advised to consult your independent advisor or attorney before allowing the agent to represent both seller(s) and buyer(s) during the commercial property sale and purchase act.