Massachusetts Real Estate Purchase Contract

Citizens of Massachusetts who plan to sell or acquire commercial or residential property are empowered to enter specific premise covenants to avoid unfavorable emergencies and guarantee their funds remain safe. Follow our review to learn why you should create a Massachusetts real estate purchase agreement, shield yourself from potential problems, and follow the state requirements to close the deal legally.

Purchase instruments establish binding relations between the current premises owner and the potential one and ensure the title transaction complies with federal and state laws. The agreements aim to reflect the focal aspects of the deal and register all negotiated decisions on paper.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

It is recommended to construct a contract when the parties decide on transaction of various types of premises:

- A separate house for a family

- Condominium

- A joint interest community estate

- Commercial property

- Duplex

- Other

When a potential purchaser finds it necessary to acquire the property, they should state an offer relying on the price asked, terms, and peculiarities reflected in the fillable purchase and sale agreement. Also, the buyer is empowered to propose their price, adjust the conditions, ask for guarantees to cover contingencies, and name the earnest money amount.

The seller, on the other hand, obtains a decision-making window. If the current owner complies with the buyer’s offer, the parties construct and acknowledge the agreement. Otherwise, the seller offers a counter-proposal to make both deal participants comfortable with the sell and purchase terms.

Components of Sale and Purchase Covenants

Nowadays, users are encouraged to find possible contract templates on the Internet or ask for qualified assistance and construct a custom agreement. We offer our advanced online tools to generate and tailor the required document in a PDF format. If you decide to build a Massachusetts sale and purchase agreement yourself, ensure you include the mandatory components and the negotiated details.

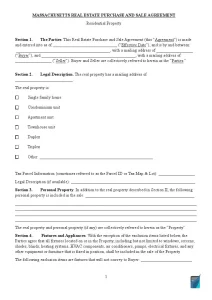

Covenants for the commercial or residential property must contain the following list of details:

- Parties’ identities. Here, the contact preparer should enter the legal names of both parties and their mailing addresses.

- A legal description of the sold property. Explain the property type and submit the physical address.

- Purchase price and financing details. Name the actual price of the house for sale and specify the buyer’s ability to buy the premises.

- Earnest money amount. This deposit amount ensures that the buyer will not back out of the purchase unexpectedly. Still, the seller keeps the non-refundable earnest money deposit to cover the expenses and compensate for the detrimental effect if they do.

- Other assets included. If the premises are sold fully furnished or with other assets included in the deal, the parties should enter the inherent info in the sell and purchase covenant. However, it is recommended to leave a comment even if the real property is sold solely with no additional items.

- Closing details, including the closing dates and liability for expenses.

- Jurisdiction. Here, the preparer should specify the state of jurisdiction—Massachusetts.

- Other terms and conditions, including the property condition, obligatory disclosures, and termination terms.

- Acknowledgment. Include the seller’s and buyer’s printed names, signatures, and indicate the calendar date when the covenant is completed. If the parties seek assistance from licensed agents, they should also append their signature and name.

Massachusetts sale and purchase agreements are not limited to the disclosed above aspects, as they may cover more features if needed. We offer the essential points to keep in mind when entering the contract.

Can the Seller Call Off the Deal?

The parties become legally bound after signing the agreement, which means there are few lawful opportunities to terminate the contract. However, if the seller decides to call off the deal, below is what they can do to avoid violating the law.

1. Prepare a Call Off Addendum

This document is prepared beforehand and attached to the agreement. It allows the seller to call off the deal at any time before the title registration procedure. Still, most purchasers will refuse to include the addendum in the contract.

2. Make Use of the “Under Review” Period

The seller has up to five days after signing the agreement to terminate the paper. They are empowered to cancel the deal before the legal representatives thoroughly verify the covenant.

3. Termination Terms

Each contract contains breach terms and termination conditions. Use the covenant to understand your range of powers.

4. Contact the Purchaser

If none of the above-listed methods are applicable, we recommend reaching out to the buyer and asking them to void the paper. There’s always a chance that the acquirer shows understanding and cancels the deal.

Massachusetts Residential Purchase and Sale Agreement

If one wishes to transact a residential real property in Massachusetts, they create a purchase and sale agreement to reflect on paper all stipulations negotiated between the parties. If both the seller and the acquirer agree on the contract terms, they are welcome to sign the document, indicate the move-in date, and close the deal.

However, keep in mind that all buyers are empowered to turn to a third party for a qualified inspection of the premises before signing the covenant. Depending on the inspection results, the acquirer can estimate the real property and propose a counteroffer if needed. The counteroffer usually includes unforeseen expenses, as some property condition demands a complete replacement of electricity, roofing, flooring, or other contents.

Massachusetts Commercial Purchase and Sale Agreement

Like residential property contracts, a Massachusetts purchase and sale covenant for commercial estate includes the essential components that outline the negotiations’ focal aspects. By the moment the parties arrive at an agreement and sign the document, the buyer is liable to pay the discussed deposit.

The significant difference lies in the disclosure list added to the covenant. Under § 15.301 of the Code of Massachusetts Regulations and Title 5 of the Massachusetts Environmental Code, the seller must submit a paper explaining septic system data. The Title 5 Addendum states that the commercial estate has been inspected within two years before the sale is conducted.

Required Seller Disclosures in Massachusetts

Massachusetts enters the list of the “buyer beware” states, meaning that the acquirer takes liability for any undisclosed material defects. Still, the state advances mandatory requirements. All sellers hold legal responsibility to submit certain disclosures. Otherwise, the current owners may become subject to penalties and fines. Most of the below-listed disclosures are demanded during residential property sales. Make sure you prepare and examine the related document before the sale and purchase agreement is authorized.

1. Lead-based Paint Disclosure

All premises built before 1978 must be supported with lead-based paint disclosure if the current owner plans to sell the property. This compulsory requirement is regulated by § 4852d, Title 42 of the US Code.

2. Title 5 Addendum

The disclosure shares the information that the property is equipped with a septic container. The paper is necessary when selling residential and commercial estate and is advanced by § 15.301 of the Code of Massachusetts Regulations.

3. Seller’s Statement of Estate Condition

Massachusetts does not technically oblige the sellers to provide this data. However, the state laws mention certain legal liabilities for intentional misrepresentation of the premises’ condition and block the purchaser from executing the needed inspections to estimate the current property condition. The seller completes the Seller’s Statement of Estate Condition to avoid possible penalties after the sale is confirmed.