A church donation receipt is a simple yet powerful document that serves a dual purpose. For the church, these receipts are proof of its stewardship of the resources entrusted to it, promoting a culture of transparency and accountability. For donors, these receipts are important documents acknowledging their generosity and supporting their eligibility for tax deductions under the law.

Creating, distributing, and managing these receipts is not only an administrative necessity but also an ethical one. In this light, understanding how to write and manage a church donation receipt letter for tax purposes is crucial.

What Is a Church Donation Receipt Letter?

A Church Donation Receipt is a document a church provides to individuals or entities who have made charitable contributions. For the donor, it is a record of their contribution detailing the donation date, amount, and nature (monetary or in-kind). This documentation is crucial for tax purposes, as donations to recognized charitable organizations, including churches, may qualify for a tax deduction under IRS regulations.

From the church’s perspective, issuing a donation receipt is a practice of good governance and transparency. It acknowledges the receipt of the donation, thereby building trust and goodwill between the church and its community of supporters. Furthermore, it helps the church maintain accurate records of all contributions received, essential for financial reporting, budgeting, and planning. Key elements often included in a church donation tax deduction receipt are:

- The church’s name and contact information confirm the receipt’s authenticity.

- The donor’s name is included to personalize the acknowledgment and ensure the donation is recorded against the correct individual or organization.

- The date of the donation is necessary for both the donor’s and church’s records, especially for annual tax preparation.

- A detailed description of the donation, including whether it was a monetary gift or an in-kind donation. For in-kind donations, a description and possibly a value of the goods or services provided.

- A statement confirming the church’s tax-exempt status under IRS Section 501(c)(3), which is relevant for the donor’s tax deduction claims.

- A declaration that no goods or services were provided in exchange for the donation, if applicable, which is a requirement for the contribution to be tax-deductible.

By providing these receipts, churches comply with legal requirements and strengthen their relationships with donors, encouraging future generosity and participation in the church’s mission and activities.

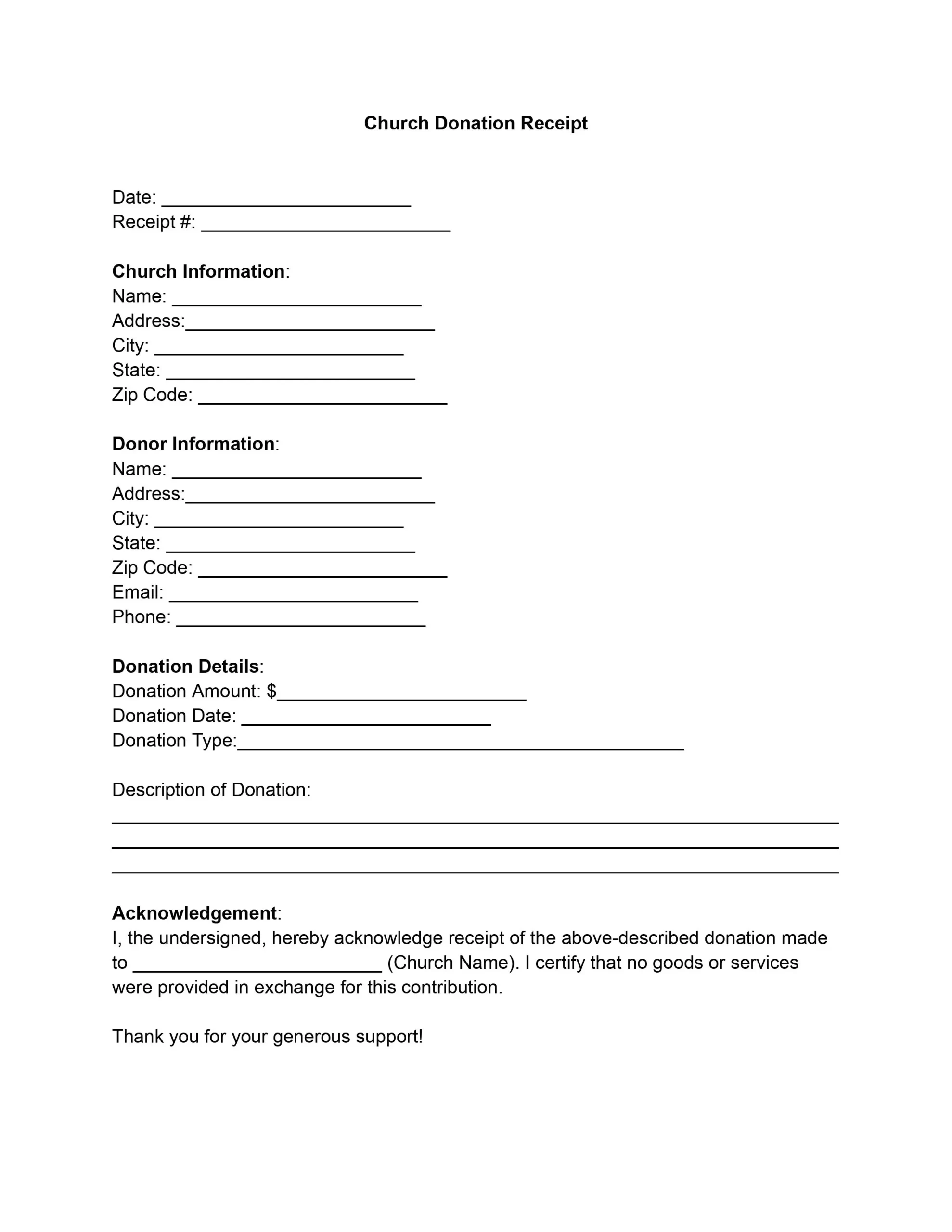

Filling Out Church Donation Receipt Template

By following these steps, you will ensure the church receipt template is completed correctly, providing all the necessary information.

1. Date and Receipt Number

Enter the current date and a unique receipt number for record-keeping purposes. This helps both the church and the donor track the donation.

2. Church Information

Fill in the church’s name, address, city, state, and zip code. This section identifies the church as the recipient of the donation and ensures that the receipt is recognized as an official document from the church.

3. Donor Information

Enter the donor’s name, address, city, state, zip code, email, and phone number. This section is crucial for personalizing the receipt and keeping accurate records of who has contributed to the church.

4. Donation Details

Specify the donation amount in dollars, the date the donation was made, and the type of donation (such as cash, check, or in-kind). If the donation is in-kind, briefly describe what was donated. This part is essential for tax purposes and for the donor to remember what they contributed.

5. Acknowledgement

In the space provided, restate the church’s name to acknowledge the receipt of the donation described above. This statement is a formal acknowledgment from the church confirming the donation receipt.

6. Certification of No Goods or Services Provided

Signify that no goods or services were provided in exchange for the donation. This declaration is necessary for the donation to be tax-deductible under IRS rules.

7. Authorized Signature

The person authorized by the church to issue donation receipts should sign here to validate the receipt. Additionally, add the signer’s name and title and enter the date. This section is critical for the authenticity of the receipt, showing that an official church representative has confirmed the donation.