Donating clothing to charitable organizations is more than just clearing out your closet — it’s an act of kindness that extends warmth and support to those in need. It also offers a tangible benefit to you, the donor. The United States Internal Revenue Service (IRS) allows individuals to claim charitable donations, including clothes, as tax deductions. However, the key to these benefits lies in proper documentation — hence the importance of clothing donation receipts.

What Is a Clothing Donation Receipt?

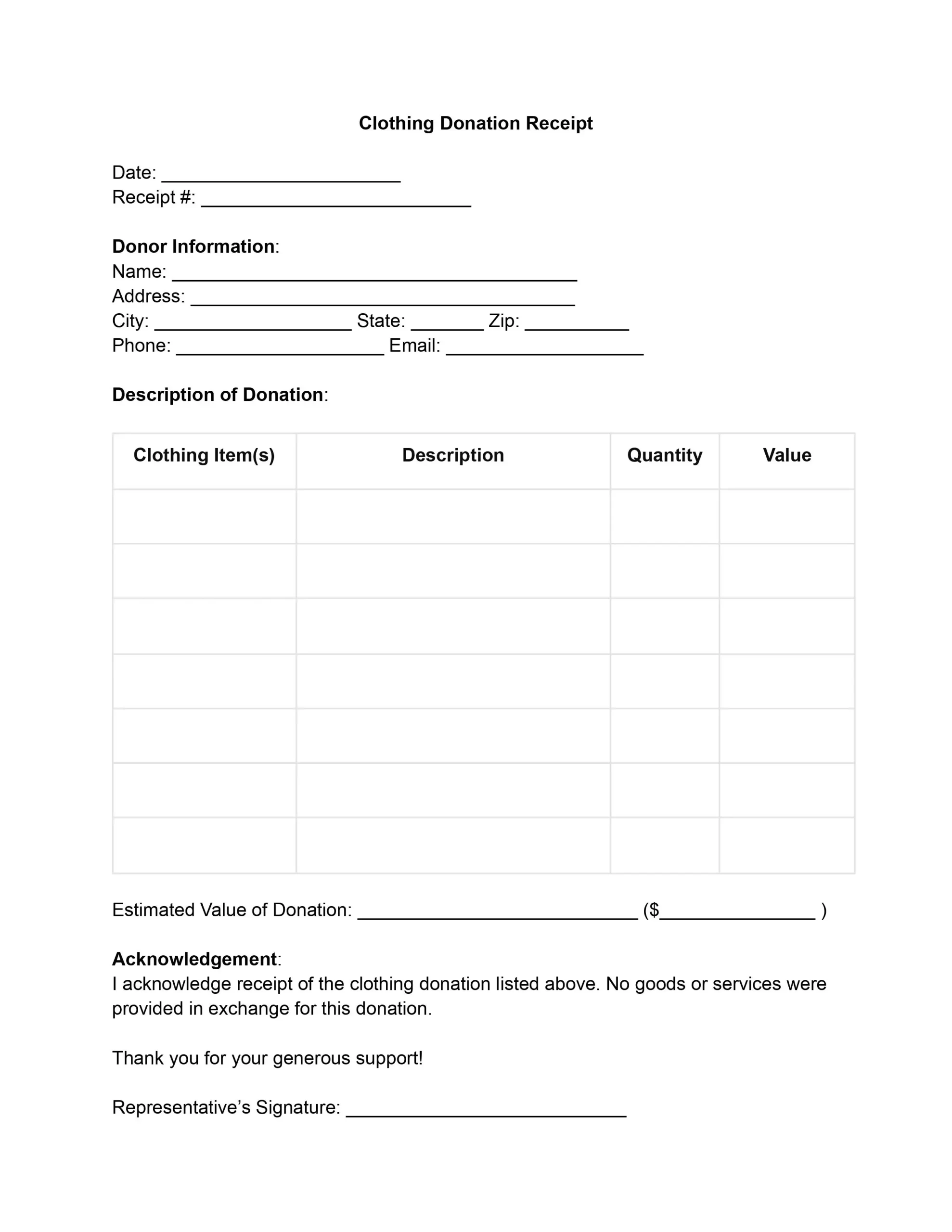

A clothing donation receipt is an official document a charitable organization provides to a donor who has donated clothing items. This receipt is proof that the donor has made a contribution of clothing to the organization. It’s crucial for both the donor and the charity for record-keeping purposes.

For the donor, a clothing donation receipt is crucial for tax purposes. In the United States, donations to qualified charitable organizations can be deducted from your taxable income, potentially lowering your tax bill. The receipt must include specific information to be valid for tax deduction purposes, such as the date of the donation, the name and address of the charitable organization, and a detailed list of the items donated.

The Internal Revenue Service requires donors to have a written acknowledgment from the charity for any contribution worth $250 or more. However, securing a receipt for donations of any value is wise, as this proves your charitable contributions.

The receipt usually lists the items donated and sometimes their condition and fair market value. Although it is the donor’s responsibility to estimate the value of the donated items accurately, some organizations provide guidelines or assist in determining this value. A clothing donation tax receipt also contains the charity’s details, confirming that the donation was made to a legitimate, tax-exempt organization recognized by the IRS.

Editing Clothing Donation Receipt Template

Using a clothing donation receipt template effectively streamlines the process of documenting charitable contributions of clothing, benefiting both the donor and the charitable organization. Here’s a step-by-step guide on how to edit such a template.

1. Filling in Charity Information

At the beginning of the template, you’ll find sections dedicated to the charity’s information. Carefully fill in the charity’s name, address, and other contact details. This part of the receipt is crucial for identifying the recipient organization and verifying its legitimacy and tax-exempt status.

2. Document Donation Details

Next, focus on the donation details section. Here, you will input the date of the donation and your personal information, including your name and address. This step is essential for creating a record of when the donation was made and who made it.

3. List Clothing Items

List each piece of clothing you donate in the designated area for clothing. Include a description of the items, their quantity, and their estimated value. This information is vital for both the charity and you for record-keeping and determining the value of your donation for tax deduction purposes.

4. Calculate Total Value

After itemizing the donated clothing, calculate the total value of all items combined. Enter this amount in the template, ensuring it is clearly stated numerically. This total value is essential for tax documentation.

5. Finalize the Receipt

The bottom section of the template is reserved for the charity’s authorized signature and the printed name of the individual representing the charity. This part validates the receipt, confirming the charity’s donation acknowledgment. If you’re preparing the document for a physical signature, leave this area blank until it can be signed in person.