Exhilaration may be evident when engaging in significant transactions, such as obtaining your ideal home, purchasing your first automobile, or acquiring a rare piece of artwork. However, with great transactions come great responsibilities, and a simple deposit receipt is essential in such cases.

A deposit receipt is tangible proof of a payment made on a larger total. It’s the first step in a mutual trust between buyer and seller, securing the item or service in question and ensuring that both parties have a clear record of the commitment. In essence, this document memorializes the transaction details and plays a central role in protecting the interests of all parties involved.

What Is a Deposit Receipt?

A deposit receipt is a document that records the initial payment a buyer makes toward purchasing a good or service, with the full payment to be completed at a later date. This receipt is a formal acknowledgment that the seller has received a certain amount of money as a deposit from the buyer. It outlines critical details such as the transaction date, the total amount to be paid, the deposit amount received, and the balance due. Furthermore, it often includes both parties’ names and contact information, a description of the transaction item, and the terms regarding the deposit’s refundability.

Deposit receipts play an integral role in a wide array of transactions, serving as a safety measure that provides buyers and sellers peace of mind throughout the sales process. Their use is most prevalent and vital in scenarios involving significant investments or when a trust bond is essential before the full transfer of ownership. Some common situations where deposit receipts are indispensable include:

- Real Estate Transactions. A deposit receipt is crucial in purchasing property, renting, or entering a lease agreement. It secures the buyer’s interest in the property while financing and inspections are completed.

- Vehicle Purchases. A deposit receipt is vital in vehicle transactions, whether from a dealership or a private seller. It confirms the buyer’s commitment to purchase and the seller’s agreement to hold the vehicle for the buyer, often while final loan approvals are obtained.

- Custom Orders and Services. For services or custom-made items, such as a wedding dress or a bespoke piece of furniture, a deposit receipt records the initial payment and outlines the project’s scope, timeline, and final costs.

- Rentals and Leases. Security deposits for rental properties are also documented through deposit receipts. These receipts protect the landlord and tenant by detailing the conditions under which the deposit is fully refundable at the end of the lease term.

In each scenario, the deposit receipt acts as a binding agreement that ensures accountability and transparency. It protects the buyer’s deposit and provides a clear path forward towards the completion of the transaction. Setting out the terms and conditions of the sale helps prevent disputes and misunderstandings.

Why Use Deposit Receipt Template?

A receipt template provides a uniform structure, ensuring that every document reflects high professionalism. This uniformity is crucial for businesses that strive to maintain a consistent image and operational standard. It reassures clients and partners of the seriousness and professionalism you handle transactions.

Using a pre-defined format significantly reduces the risk of omitting crucial details that could lead to misunderstandings or legal disputes. A deposit slip template prompts including all essential information, such as payment terms, deposit conditions, and transaction specifics, ensuring clarity and mutual understanding between the company and client.

Moreover, well-designed deposit receipt templates include all the details for legal stipulations relevant to any business, such as refund policies and conditions under which the deposit might be forfeited. This comprehensive approach to capturing the terms of the agreement protects against potential legal issues, providing a solid foundation should any disputes arise.

While receipt templates offer a standard layout, they also allow customization to suit specific needs or align with your branding. This flexibility ensures that while the essential elements remain constant, the deposit receipt can be adapted to reflect the unique aspects of each deal or the business’s identity.

Key Components of a Deposit Receipt Template

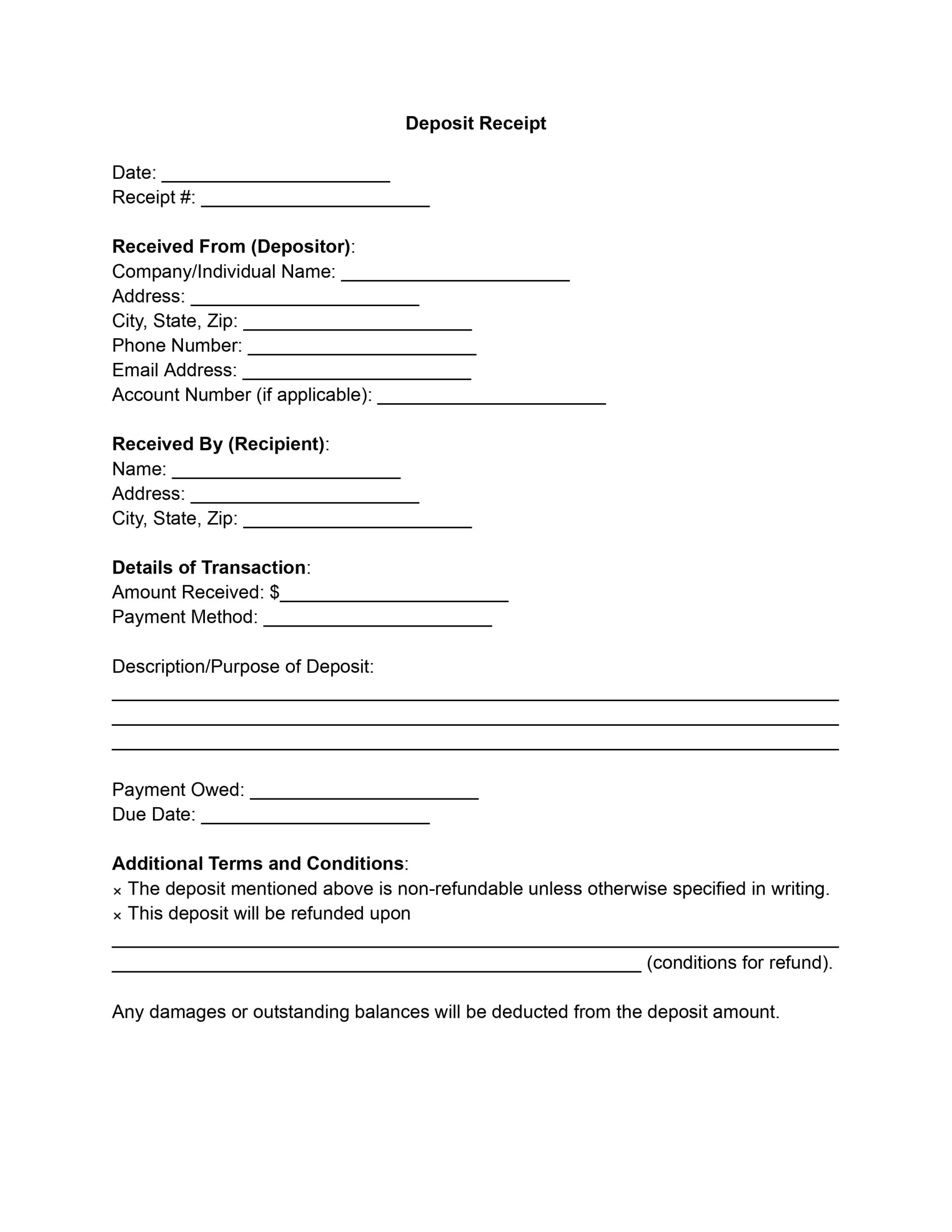

To ensure every deposit receipt meets the highest standards of completeness and reliability, certain components must be integrated into every template. Central to the effectiveness of this document are the elements that make it both informative and legally binding. So, each deposit receipt includes:

- Date of the Transaction. Marks the official day the agreement was reached.

- Detailed Information about the Parties. This section identifies the buyer and seller clearly, including contact details.

- Description of the Item or Service Purchased. Offers a clear understanding of what is being transacted.

- Amount of the Deposit Paid. This section indicates the initial payment towards the total cost.

- Total Purchase Price. It shows the full agreed-upon price for the item or service.

- Conditions for Deposit Refundability. Outlines under what circumstances the deposit is refundable or not.

- Signatures of Both Parties. Confirms the agreement to the buyer and seller’s terms.

Whether you’re conducting a large-scale purchase or a smaller transaction, the integrity of a deposit receipt lies in its details and the mutual understanding it builds between buyer and seller.

How to Edit Deposit Receipt PDF Template

By following these steps while working with our PDF editor, you ensure your deposit receipt is filled out thoroughly and accurately.

1. Date and Receipt Number

Start by entering the current date at the top of the receipt. It establishes when the transaction took place. Next, fill in the receipt number, which is crucial for record-keeping, future tracking, and accounting purposes.

2. Information of the Depositor

Please provide the details of the individual or company making the deposit, including the name, address, city, state, zip code, phone number, email address, and account number or account details, if applicable. It will ensure that both parties are easily identifiable.

3. Information of the Recipient

Input the recipient’s name and address details, including the city, state, and zip code. This section identifies who is receiving the deposit and for what purpose.

4. Details of the Transaction

Specify the amount received and the payment method (e.g., cash, cheque, bank transfer, other). Provide a clear description or purpose of the deposit, such as “security deposit for rental property” or “cash deposit for dress.” This clarifies the nature of the transaction.

5. Payment Owed and Due Date

Indicate any remaining payment owed beyond the deposit and the due date for this payment. It will help both parties understand their financial obligations moving forward.

6. Additional Terms and Conditions

Please read and understand the terms and conditions of the deposit’s refundability. Then, fill in any specific conditions for refunding the deposit. This section is crucial for legal clarity.

7. Acknowledgment

The acknowledgment section is where you confirm the details of the transaction. Fill in the deposit amount again, including the date and specifically what the deposit is for. This summary confirms both parties’ receipt and understanding of the terms.

8. Signatures

Finally, the recipient and the depositor should sign and date the receipt at the bottom. It acts as a formal agreement to the terms and conditions outlined in the deposit receipt.