For donors, the satisfaction of contributing to a cause they care about is often reward enough. However, the importance of receiving a donation receipt cannot be understated. Donation receipts play a significant financial and legal role for both the donor and the recipient.

For nonprofit organizations, issuing donation receipts is a fundamental practice that underscores transparency, accountability, and trustworthiness. These documents are indispensable for donors who seek to claim tax deductions, offering formal proof of their charitable contributions. Furthermore, they allow companies to keep detailed records of their financial contributions, assuring compliance with tax laws and regulations.

Importance of Nonprofit Donation Receipts

A donation receipt is a formal document from nonprofit organizations to donors acknowledging a charitable contribution. This receipt serves several critical functions and contains information regarding the donation, including the donor’s name, the donation amount (whether monetary or in-kind), the date of the donation, and a statement that no goods or services were provided in exchange for the contribution if that is the case. It also includes the nonprofit organization’s name, contact information, and confirmation of its tax-exempt status under relevant laws. The primary purposes of a nonprofit donation receipt are:

- To serve as proof for tax deductions. Donors use these receipts when filing taxes to claim deductions on charitable contributions.

- For record-keeping. Both donors and organizations use receipts to keep track of donations made and received, respectively.

- To comply with legal requirements. Issuing receipts helps organizations adhere to tax laws and regulations concerning charitable donations.

A donation tax receipt is a critical document that solidifies the relationship between donors and nonprofit organizations, ensuring transparency, accountability, and mutual benefit.

Benefits of Using Donation Receipt Templates

Implementing donation receipt templates offers numerous advantages for nonprofit organizations, streamlining operations and enhancing donor relations. These standardized forms ensure consistency, accuracy, and efficiency in the written acknowledgment process, providing a reliable framework that benefits the organization and its supporters. Here are all the benefits of using templates for donation tax receipts:

- Templates guarantee that every receipt contains all the necessary information, maintaining a uniform standard across all communications.

- Templates save valuable time and resources by simplifying the creation of charitable donation receipts, allowing staff to focus on more important tasks.

- Pre-defined fields reduce the risk of errors, ensuring that each receipt accurately reflects the donation details.

- Well-designed templates project a professional image, reinforcing the organization’s credibility and the seriousness with which it treats donations and donor information.

- Templates can be designed to include all legally required information, aiding in adherence to tax laws and regulations.

Adopting donation receipt templates is the best practice for any nonprofit organization. It can significantly improve the administrative processes and build positive relationships with donors. The consistent, efficient, and professional handling of donation receipts also aids in operational management. This approach ultimately supports the organization’s mission, encouraging ongoing support from its community of donors. By using templates and automating the process of sending donation receipts, you can help your nonprofit grow by saving time on financial management tasks.

Filling Out Donation Tax Receipts

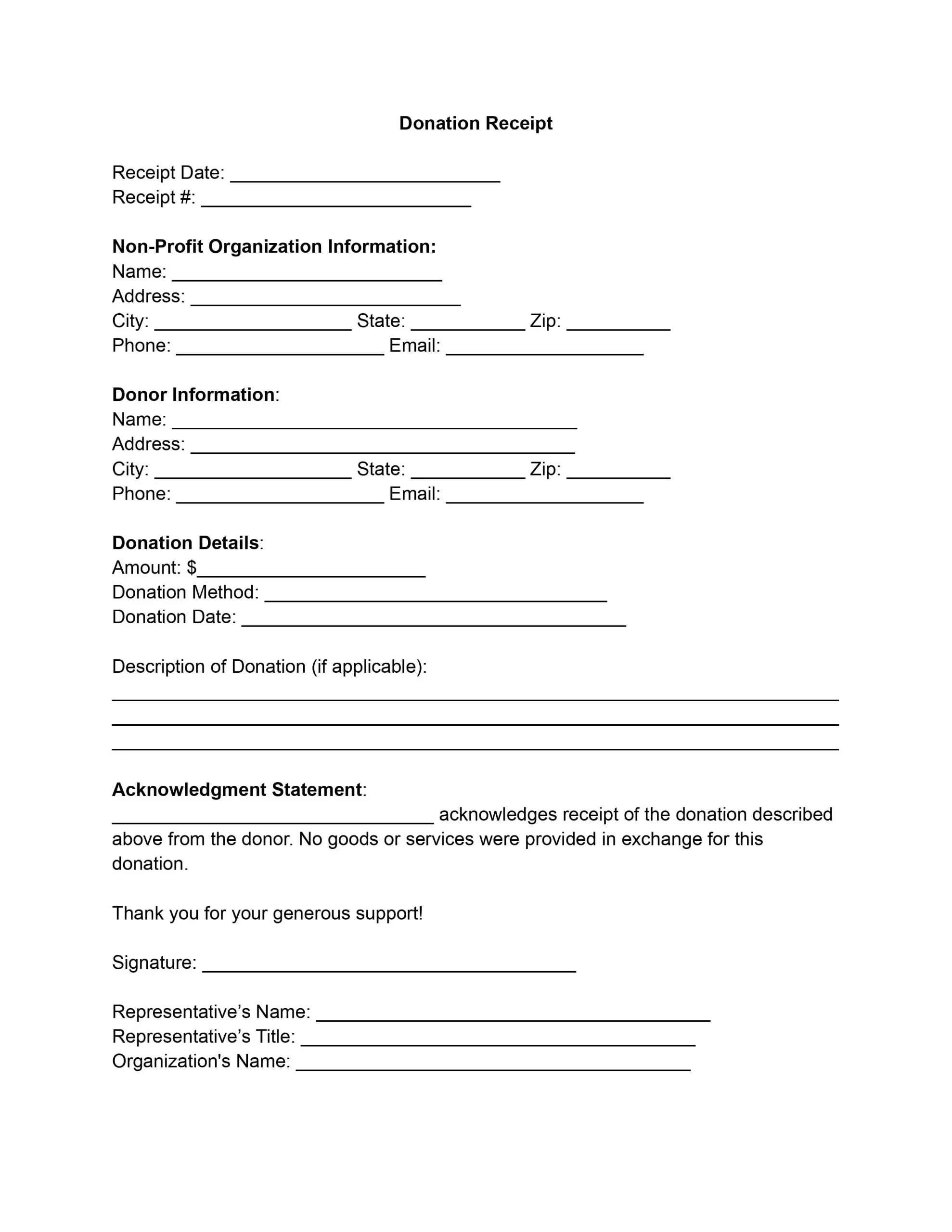

To correctly fill out the donation receipt template provided, follow these detailed steps.

1. Fill in the Receipt Date and Number

Begin by writing the current date and a unique identifier for the receipt. This will help you organize and track donations.

2. Nonprofit Organization Information

Enter the full name, address, city, state, zip code, phone number, and email address of the nonprofit organization receiving the donation. This step is crucial for ensuring the receipt is officially tied to the correct organization.

3. Donor Information

Fill in the donor’s name, address, city, state, zip code, phone number, and email. This personal information is essential for record-keeping and sending acknowledgments or updates.

4. Donation Details

Specify the donated amount in dollars, the method of donation (such as cash, check, or online transfer), and the exact date of the donation. This information provides clarity on the financial aspects of the contribution.

5. Description of Donation

If the donation includes a non monetary item or a non cash contribution, describe them in detail in the provided space. It might include the type of items, condition, and other relevant details that could be important for inventory and valuation.

6. Acknowledgment Statement

Replace the placeholder with the organization’s name to personalize the statement acknowledging the donation receipt. Confirm that no goods or services were exchanged. It’s an essential detail for the tax deductible donation receipt. When documenting donations to religious organizations, note on the donation receipt if the contribution was in exchange for intangible religious benefits.

7. Sign and Provide Representative Details

The nonprofit’s authorized representative should sign the receipt and add the representative’s name, title, and organization’s name to validate the receipt officially. This step is critical for confirming the authenticity of the receipt and the donation.