Millions of people worldwide face food insecurity every day, and donating food is a direct, powerful way to address this pressing issue. These donations allow individuals, businesses, and organizations to make a tangible difference in the lives of those who need it most. Against this backdrop of generosity and compassion, free food receipts have a critical role. More than just a piece of paper, it becomes a link between donors and recipient organizations.

For donors, free food receipt provides a tangible record of their contribution, affirming their commitment to making a difference. For charitable organizations, these receipts are essential for managing donations effectively, ensuring that every item donated can be accounted for and utilized to its fullest potential. Moreover, these receipts hold significant value for compliance with tax regulations, enabling donors to claim deductions and encouraging continued generosity.

The Role of Food Donation Receipts

From a practical standpoint, food donation receipts offer substantial benefits to donors. Most notably, they enable individuals and businesses to claim tax deductions for their charitable contributions. Under tax laws, donations to qualified nonprofit organizations can be deducted from one’s taxable income, making the act of giving financially beneficial for the donor. However, to use this advantage, donors must have a detailed receipt that includes the date of the donation, a description of the food items given, and an acknowledgment from the recipient organization.

Using a free food receipt template offers numerous advantages for individuals and organizations involved in the charitable distribution of food. This approach streamlines the process of documenting donations, making it more efficient, accurate, and compliant with legal requirements. Our templates provide a ready-made format that can be quickly filled out and customized as needed, saving valuable time and effort. This is particularly useful for organizations that regularly handle large food donations.

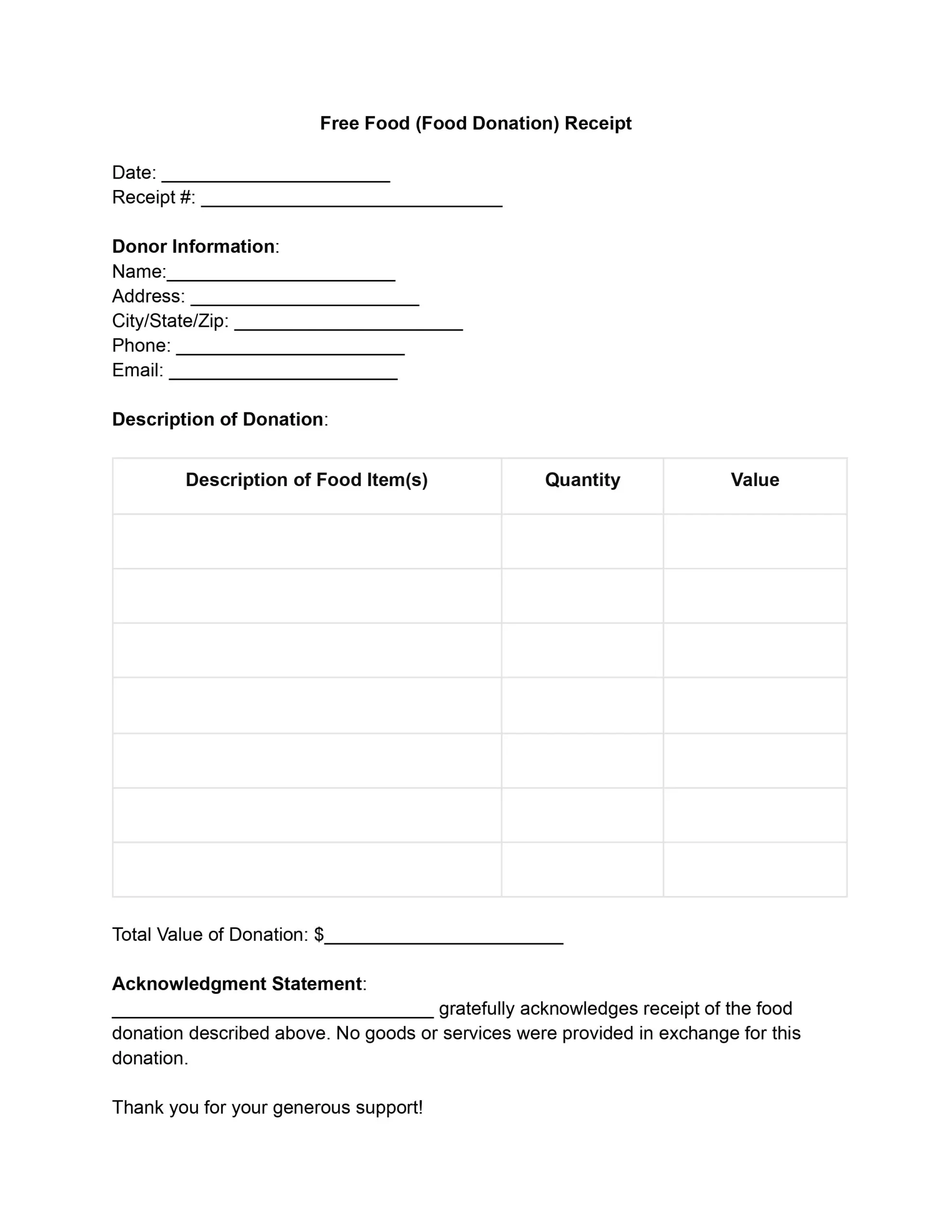

How to Fill Out a Free Food Receipt Template

By following these steps, you will ensure that the food donation receipt is accurate and includes all information necessary to validate the donation and facilitate any tax deductions.

1. Date and Receipt Number

Begin by entering the current date and a unique receipt number. These details are crucial for tracking and referencing the donation.

2. Donor Information

Complete the donor information section with the name, address, city/state/zip, phone, and email of the person or entity donating. This information is essential for maintaining records and acknowledging the donation.

3. Description of Donation

For each food item donated, fill in the corresponding fields’ description, quantity, and total value. This part requires detailed input to reflect the donation’s nature and worth accurately.

4. Total Value of Donation

Calculate and enter the sum value of all food items donated. This figure represents the total monetary value of the donation, which is important for both the donor’s and the organization’s records.

5. Acknowledgment Statement

Replace the placeholder with the organization’s name to personalize the acknowledgment statement. This confirms the donation receipt and ensures no goods or services were exchanged for it, which is a necessary declaration for tax purposes.

6. Signature and Organization Information

The authorized representative of the receiving organization should sign the receipt to validate it. Additionally, print the name of the signatory and fill in the organization’s name, address, contact information, and Tax ID. It formalizes the document and provides essential details for the donor’s records.