In the hospitality industry, the exchange between a hotel and its guests isn’t just about providing a comfortable stay; it also means creating an environment of trust and openness. At the core of this exchange is an often overlooked document: the hotel receipt. This simple slip carries significant weight. The hotel receipt serves as the final touchpoint in the guest’s experience and a tangible stay record.

Hotel receipts are crucial in providing guests with clear, detailed billing information. By meticulously itemizing charges from room rates to service charges, these documents ensure that guests understand precisely what they are paying for. This clarity is a cornerstone of customer service that can directly influence a guest’s overall satisfaction and likelihood to return or recommend the hotel to others.

What Is a Hotel Receipt?

A hotel receipt is a document a hotel provides to its guests, summarizing the financial transactions during their stay. It formally acknowledges the payment received for services the hotel offers, including but not limited to accommodation, food, and any additional amenities or services the guest might have used.

This document details all charges incurred by the guest, including room rates, taxes, fees for additional services (like room service, laundry, or spa services), and any other miscellaneous purchases. This itemization ensures transparency, allowing guests to review the services provided and verify the charges for their stay. It also acts as proof of payment for the guest, confirming that the services detailed on the receipt have been paid for. It’s particularly important for business travelers who may need to submit receipts for expense reimbursement or personal record-keeping.

In many jurisdictions, a hotel receipt is a legal document that both the hotel and the guest can use in case of any disputes regarding the payment. It helps maintain a legal record of the financial transaction between the guest and the hotel. Beyond its financial and legal roles, a hotel receipt is a tool for customer service. This document can include additional information, such as loyalty program points earned or a thank-you note.

Why Is It Beneficial to Use Hotel Receipt Template?

Using a hotel receipt template offers significant advantages for the hotel and its guests, streamlining the billing process and ensuring consistency across all transactions. Here are the key benefits of employing a template for this important document:

- A simple receipt template ensures that every bill form maintains a consistent format and appearance, reflecting the hotel’s professionalism and attention to detail.

- Templates speed check-out by pre-filling standard information, allowing staff to quickly generate accurate and comprehensive receipts.

- With predefined fields and calculations, hotel receipt templates reduce the risk of billing errors and ensure guests are charged correctly for their stay.

- Customizable templates allow hotels to include their logo and branding elements, reinforcing brand identity with every receipt issued.

Including a hotel receipt template in the operational workflow streamlines administrative processes and helps create a positive and transparent relationship with guests. Using professional receipts also saves time and resources and strengthens a hotel’s reputation for quality service and reliability.

How to Edit Our Free Hotel Receipt Template?

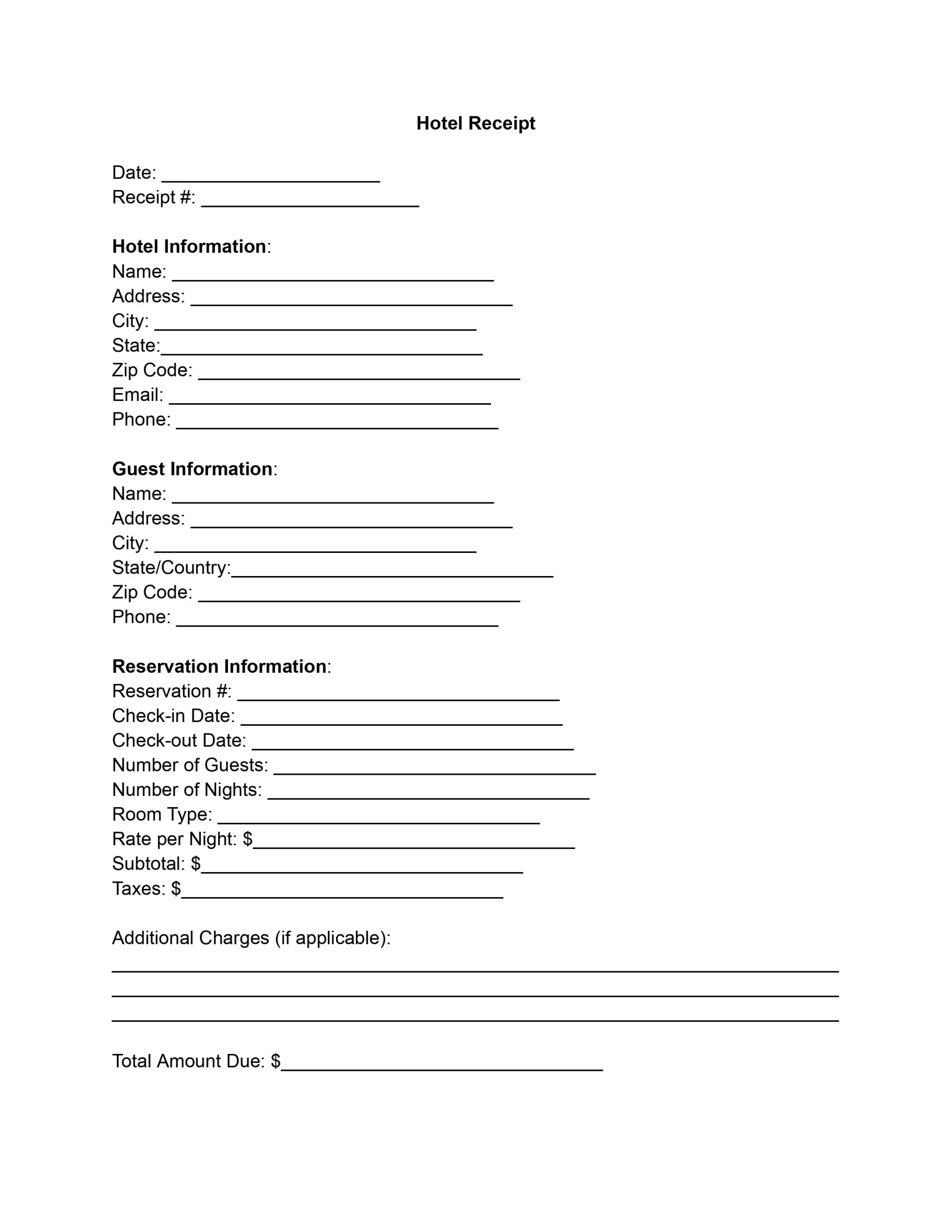

Filling out a free hotel receipt template involves a step-by-step process that accurately records all necessary information. This guide will walk you through each form section to help you complete it thoroughly.

1. Fill in the Date and Receipt Number

At the top of the template, enter the current date the receipt is issued. Directly below, assign a unique receipt number for record-keeping and easy reference.

2. Enter Hotel Information

Input the hotel’s full name, followed by its complete address, including the city, state, and zip code. Provide the hotel’s primary email and contact phone number, ensuring guests have the means to reach out with any inquiries or concerns.

3. Provide Guest Information

Record the guest’s name and contact information: street, city, state or country, and zip code. Add the guest’s phone number to maintain a line of communication for any needed follow-up.

4. Detail Reservation Information

Indicate the reservation number associated with the guest’s stay. Specify the check-in and check-out dates to outline the duration of the stay. Mention the number of guests and the number of nights spent. Describe the room type the guest opted for and list the rate per night. Calculate and note the subtotal for the stay and include any taxes applied.

5. Describe Additional Charges

If the guest incurred extra charges beyond the hotel room rate and taxes (such as for room service purchases, mini-bar, parking fees, or other amenities), describe them clearly and include each amount.

6. Calculate Total Amount Due

Summarize the financials by adding the subtotal, any taxes, and additional charges to find the total amount due from the guest.

7. Record Payment Information

Document how the payment was made, noting the payment method (e.g., credit card, cash). State the payment status to indicate whether it is completed, pending, or partially paid. If relevant, include the transaction ID for payment tracking.

8. Finalize with Authorization

Conclude the receipt by having a hotel representative sign off on the transaction, affirming its accuracy and completion. The representative should also print their name and title and date the authorization, ensuring everything is fully documented and official.

Legal Considerations on Fake Hotel Receipts

Creating or using fake hotel receipts carries significant legal risks, including allegations of fraud. For guests, submitting fraudulent receipts for reimbursement or tax deductions can lead to severe consequences, such as criminal charges, fines, and damage to one’s reputation. For hotels, issuing a fake receipt undermines customers’ trust and can result in legal action, hefty fines, and a tarnished reputation.

The legal framework governing these transactions varies by jurisdiction but generally includes provisions to prevent misleading or deceptive conduct. For example, hotels must not overcharge or include hidden fees that are not disclosed to guests when booking. Compliance with these laws is crucial to avoid legal penalties, including fines and sanctions, which can harm the hotel’s reputation.

Keeping precise and detailed records also aids in compliance with tax obligations and is essential for resolving any disputes that may arise. From a taxation perspective, accurate receipts are necessary to document revenue and justify deductions, ensuring that hotels meet their fiscal responsibilities. Inaccurate or incomplete records can lead to audits, penalties, and interest charges from tax authorities.