In-kind donations are invaluable support for nonprofit organizations. Unlike monetary contributions, in-kind donations consist of goods and services that directly benefit the organization — from office supplies and furniture to professional services and software. However, the unique nature of in-kind contributions requires meticulous documentation. Given these stakes, creating and using a standardized in kind donation receipt template is the best practice.

What Is In Kind Donation Receipt?

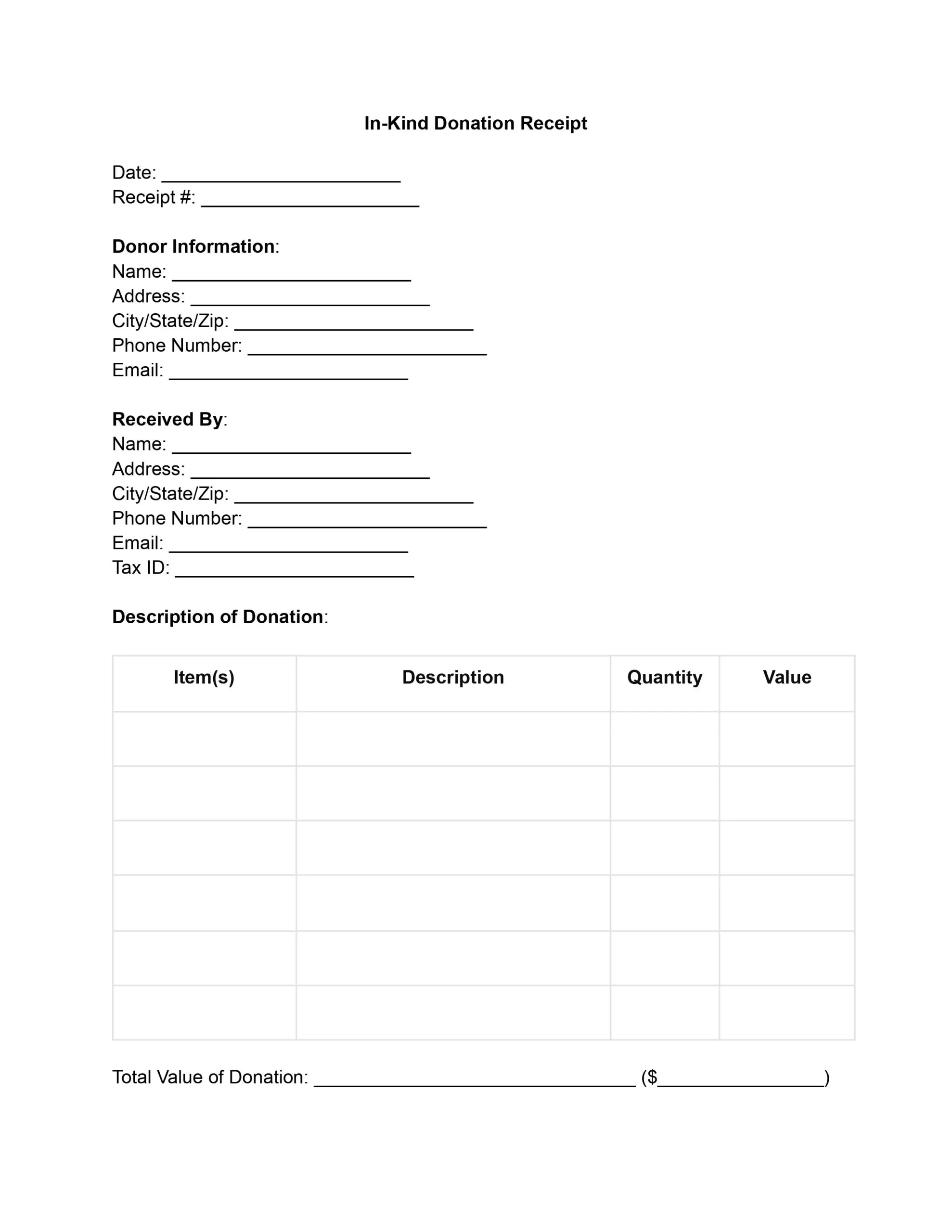

An in kind donation receipt letter is a document nonprofit organizations provide to donors who contribute goods or services instead of cash. This receipt serves several functions for both the donor and the recipient organization. It recognizes the donor’s generosity, keeps a record of both parties’ contributions, and is essential in the financial and tax reporting processes related to charitable giving. A gift in kind receipt template includes several elements:

- Date of Donation. Marks when the contribution was made are crucial for tax and record-keeping purposes.

- Donor Information. The donor’s name, address, and contact details for acknowledgment and future communication.

- Description of Donated Items. This details what was donated without specifying a cash value. For goods, this could be a list of items; for services, a summary of the work performed.

- Condition and Estimated Value. The gift in kind receipt may note the condition of goods and, in some cases, an estimated value based on the donor’s assessment.

- Organization Information. The name, contact information, and tax-exempt status (including the tax ID number) of the nonprofit organization receiving the donation.

An in kind receipt provides a tangible record of donor contribution, which can be used for tax deduction purposes under IRS regulations. These receipts also help nonprofits maintain accurate records of contributions received, aiding in financial reporting, budgeting, and planning.

Filling Out Gifts In Kind Receipt Template

By following these steps, you can ensure that the donation receipt is completed accurately and thoroughly, reflects the value of the contribution, and meets legal requirements for tax documentation.

1. Fill in the Date of Donation

Record the exact date when the donation was received. This date is crucial for both the donor’s and the organization’s records, especially for tax purposes.

2. Enter Donor Information

Please include the donor’s full name, address, and, if applicable, contact number or email address. It ensures the donation can be accurately attributed and allows for proper acknowledgment.

3. Include Organization Information

Document the name of your nonprofit organization, its contact information, tax-exempt status, and tax ID number. This information reassures donors of the legitimacy of their donation and aids in their tax preparation.

4. Describe the Donated Items or Services

Provide a detailed description of the items or services donated. For physical goods, list the items and their condition. For services, describe the nature of the service provided and the time spent.

5. Estimate and Note the Value of the Donation

While the donor is typically responsible for determining the fair market value of the donated goods or services for tax purposes, the receipt can note this estimated value if the donor provides it. Be clear that it is an estimate and not an official appraisal.

6. Authorized Signature

An authorized representative of the nonprofit organization should sign the receipt. It formalizes the document and adds a level of verification.