Medical receipts are more than just proof of transaction. They are vital tools that ensure the smooth operation of the healthcare system. Medical receipts are critical to maintaining transparency and accountability between healthcare providers and patients by meticulously recording services provided, costs incurred, and payments made.

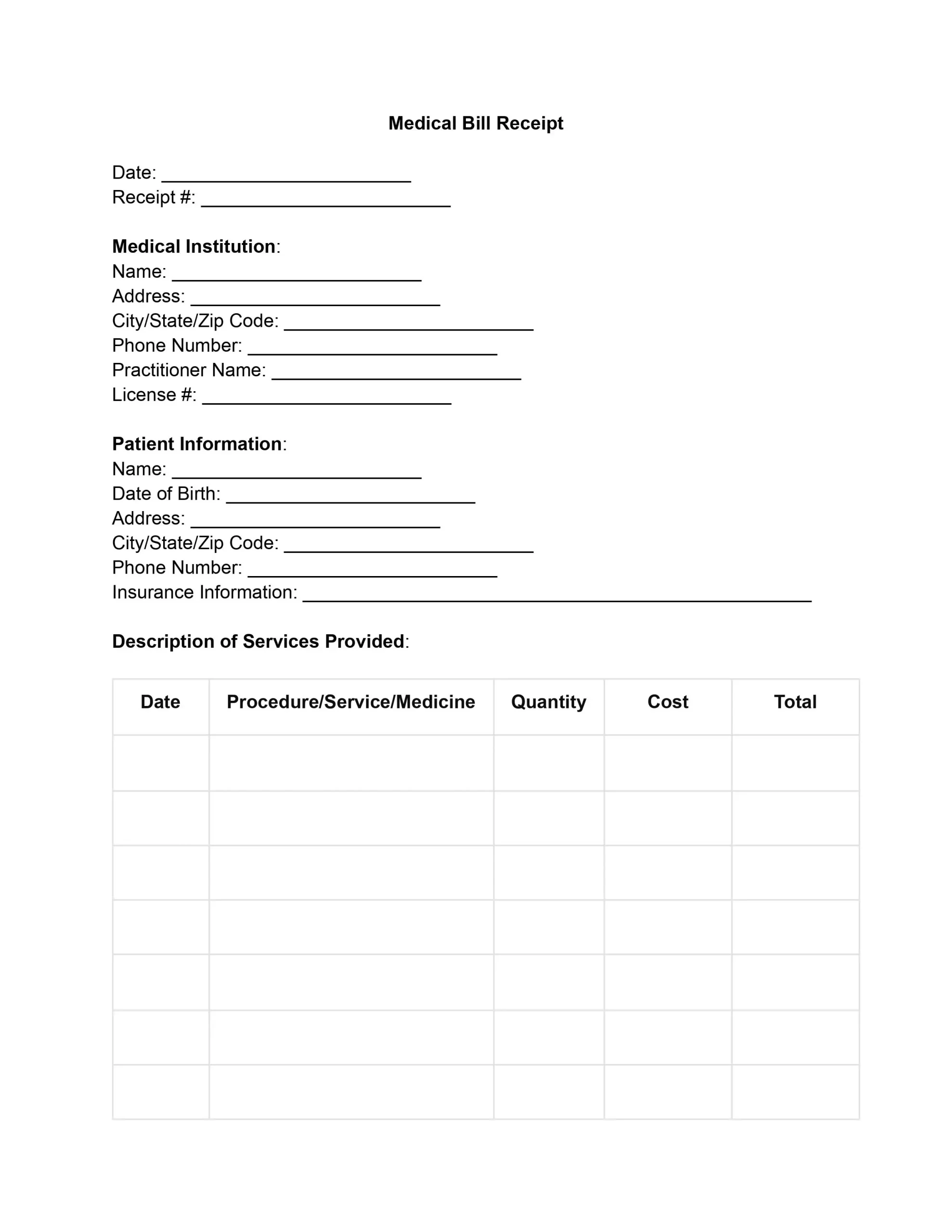

You don’t have to create this document from scratch. Simply use our medical invoice template. Designed to cater to a wide array of medical services and practices, this basic receipt form ensures no detail is overlooked. Whether a routine check-up or a complex surgical procedure, the medical receipt template adeptly documents every aspect of the patient’s care.

What is a Medical Bill Receipt Template?

A medical receipt template is a standardized document healthcare professionals use to generate a detailed record of the medical services offered to patients. This template captures the essence of the transaction — listing medical services provided, associated costs, and payment details — and serves as an essential document for insurance claims, legal compliance, and financial management.

A medical receipt is a formal acknowledgment that a healthcare service has been rendered and payment has been made or is due. The purpose of these receipts is not limited to just proof transactions. They can be handy in managing healthcare delivery’s financial aspects, enabling the provider and the patient to keep track of expenses for treatments and services. On any medical receipt, you can typically find the following items:

- Patient Information. It includes the patient’s name, service date, and sometimes additional identifying information like a patient ID or date of birth.

- Provider Details. The name, qualifications, and contact information of the healthcare provider or the facility that offered the medical service.

- Services Rendered. A detailed list of the medical services performed, which could range from consultations and examinations to treatments and surgeries, including the date these services were rendered.

- Product Details. If applicable, a list of any medical products or prescription information, along with their prices.

- Cost Details. A breakdown of the costs associated with each service or product, including itemized costs, total cost, any discounts applied, and the final amount charged.

- Payment Information. This section details the payment, including the payment method, the amount paid, and any outstanding balance. It also indicates if the payment was made at the time of service or if it will be billed later.

- Insurance Information. If the patient used health insurance, details about the insurance claim, including the insurer’s name and the amount covered, might be included.

For patients, these receipts are essential for personal record-keeping, insurance claims, and tax deductions related to medical expenses. This receipt is also essential for financial accounting for a healthcare provider or other medical institution. Medical receipts help the medical facility track revenue and manage the financial aspects of the practice. For insurance companies, medical receipts are critical for verifying claims and reimbursing costs covered by health insurance policies.

Benefits of Using Medical Services Receipt Template

Using a standardized medical receipt template significantly streamlines the billing and payment process. It ensures that all financial transactions related to healthcare services are documented consistently, making it easier for billing departments to issue invoices and for patients to understand their charges. This efficiency reduces the likelihood of errors and delays in payment, leading to a smoother financial operation within healthcare practices.

Accurate and thorough record-keeping is crucial for any medical practice’s financial health and for patients managing their personal healthcare expenses. Medical receipt templates facilitate this by ensuring that every transaction is recorded uniformly, making tracking and managing financial data easier. This accuracy is essential for internal accounting and auditing processes, helping save time and maintain financial records’ integrity over time.

Moreover, detailed and comprehensive medical receipts can help expedite the approval of claims, ensuring that patients are reimbursed promptly for out-of-pocket expenses. Similarly, healthcare providers benefit from this streamlined process, as doctor receipt assists in timely compensation for services rendered.

Legal Considerations on Medical Bill Receipt

Ensuring that a medical bill receipt complies with tax laws and regulations involves a careful approach to documentation and adherence to specific guidelines set forth by tax authorities. A compliant medical bill receipt must include comprehensive details about the patient and medical institution. It includes names, addresses, and, where applicable, taxpayer identification numbers (TINs) or social security numbers (SSNs). These details are essential for tax authorities to verify the legitimacy of the personal receipt and the medical expenses claimed.

Each service performed or medicine administered must be listed with a clear description, the date the service was rendered, the quantity (if applicable), and the cost. This comprehensive breakdown is necessary to distinguish between deductible medical expenses and those not eligible for deduction.

The receipt should itemize the subtotal of the services provided before taxes, the tax charged, the amount of taxes applied, and the total amount due after taxes. Compliance with tax laws requires accurate calculation and reporting of taxes. If the items purchased are exempt from taxes, this should be noted on the receipt to clarify why taxes are not included in the total.

Creating or using fake medical bills is illegal and unethical. These documents are often fabricated with the intent to deceive — for insurance fraud, obtaining medications or services without proper payment, or tax evasion. The consequences of using fake medical bills can be severe, including criminal charges, financial penalties, and loss of professional licenses for healthcare providers.

Filling Out Free Medical Receipt Template

If you need to write a medical receipt, just use our free template and follow the step-by-step guide below.

1. Fill Out the Date and Invoice Number

Start by entering the current date at the top of the receipt. This should be when the transaction happened or the receipt was issued. Next, fill in the unique number assigned. This number is crucial for record-keeping and tracking payments, so ensure it follows any sequential numbering system your institution uses.

2. Enter Medical Institution Details

Provide the name of the business name where the services were rendered. Include the complete address, city, state, zip code, contact number, and the institution’s phone number to ensure the receipt is properly identified. Also, specify the practitioner’s name and license number to add to the credibility and traceability of the receipt.

3. Complete Patient Information

Fill in the patient’s full name, date of birth, residential address, city, state, zip code, and phone number. This section ensures the receipt is accurately linked to the correct patient. Additionally, include the patient’s insurance information, such as the provider and policy number, which is essential for billing purposes.

4. Detail the Description of Services Provided

For each service provided, enter the date, the specific procedure, service, or medicine provided, the quantity, and the cost per item. Sum these amounts to provide a total cost for each entry. This part of the receipt offers a transparent breakdown of the services and their costs.

5. Calculate the Subtotal, Taxes, and Total Amount Due

After listing all services, calculate the subtotal of the costs. Then, apply any applicable taxes, specified as a percentage, to compute the total tax amount. Add this tax amount to the subtotal to determine the amount due for the medical services provided.

6. Indicate Payment Details

Select the patient’s payment method, marking the appropriate option (cash, credit card, check, or other). If paying by check or credit card, include the check or card number. Also, note the payment date, which may differ from the service date, especially if the payment was made after the services were provided.

7. Provide Any Special Instructions

Include specific instructions or notes relevant to the services provided, the billing process, or follow-up care in the designated “Special Instructions” section. It can include instructions for medication, follow-up visits, or any other comments deemed necessary by the healthcare provider.

8. Obtain Authorized Signature

The final step involves the healthcare provider or an authorized personnel signing the receipt to validate it. The signature confirms that the information provided on the manual receipt is accurate and that the services were rendered. Also, print the name of the person signing the receipt to ensure clear identification.