Financial transactions must be clear and secure. The paid in full receipt is an important document that helps to ensure this. Such a seemingly simple piece of paper has significant weight, acting as unmistakable proof of payment between two parties. A paid in full form confirms the completion of a financial commitment, whether it be the settlement of an invoice for services delivered or the last payment on a loan.

What Is a Letter of Payment in Full?

A paid-in-full receipt is a crucial document in the financial world. It symbolizes the completion of a payment transaction. An invoice paid in full is a formal acknowledgment from the receiver (payee) that they have received the entire amount due from the sender (payer), thereby settling a debt or obligation. This receipt is often presented after the final payment installment, indicating the end of a financial arrangement.

The filled paid in full template confirms that the specific debt or obligation intended for the payment has been fully satisfied. This is particularly important in transactions where partial payments have been made over time. Upon receiving the full payment, the issuance of this receipt provides concrete evidence that the payer has fulfilled their financial commitment in full, leaving no outstanding balance.

So, a paid in full document protects both parties involved. For the payer, it serves as documentation that they fulfilled their payment commitment, shielding them from any future claims of unpaid debt arising from the transaction. For the payee, it’s proof that the money was received in full, which can be helpful for accounting and financial audits.

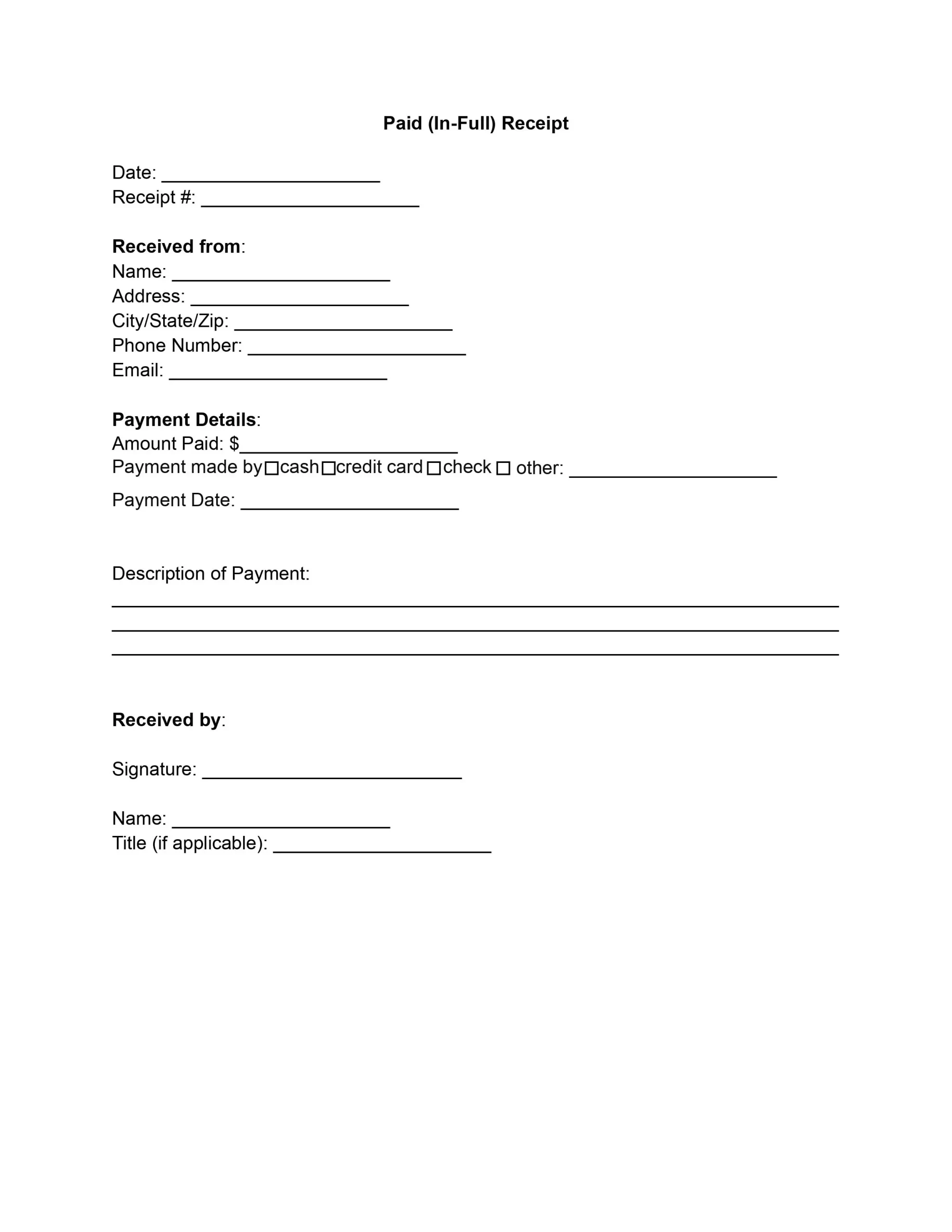

Businesses use a standardized template for paid in full receipt letters to capture all necessary details, including the date of payment, the amount paid, and parties involved. Such clarity prevents confusion and helps maintain accurate financial records, which are essential for accounting and tax purposes.

Creating a paid in full receipt becomes a straightforward process with a template. This efficiency saves time and effort for businesses, especially when dealing with numerous transactions. Templates ensure no critical information is overlooked, streamlining the payment process and allowing businesses to focus on their core operations.

Moreover, using a clear and formal paid in full letter sample helps prevent errors such as double billing. It is a definitive record that a payment has been made in full, safeguarding against accidental claims that the debt remains unpaid. Including a paid in full invoice template in the payment process is a simple but useful step that may considerably improve financial transaction management. It maintains legal and financial integrity while creating a professional environment favorable to developing strong, long-term commercial connections.

How to Edit Paid in Full Receipt Template

Following these steps, you can quickly edit a paid in full receipt form to represent a transaction’s specifics.

1. Customize the Header

Edit the header section of the template to include your business information. It typically involves entering your business name, address, contact number, and logo. Ensure this information is accurate and up-to-date to maintain professionalism and credibility.

2. Input Transaction Details

Fill in the transaction details for which the receipt is being issued. It includes the payment date, the total amount paid, the names and contact details of the payer and payee, and a description of the transaction or service provided. Double-check these details for accuracy to avoid any future disputes.

3. Acknowledge Payment

Include a statement that acknowledges the receipt of payment in full. This statement should indicate that the specified amount covers the debt or obligation, leaving no outstanding balance. This acknowledgment is crucial for the receipt’s validity.

4. Add Payment Method

Specify the method of payment used by the payer, such as cash, check, credit card, or bank transfer. Including this detail provides a clear record of how the payment was made, which is helpful for accounting purposes and resolving potential payment disputes.

5. Signatures

Ensure there is a section at the bottom of the template for signatures. Both the payer and the payee should sign the receipt to validate it. The signatures serve as a mutual agreement that the information presented in the receipt is accurate and that the payment has been received in full.

6. Review and Save

Carefully review the entire receipt to ensure all information is correct and complete. Check for any spelling or numerical errors. Once satisfied, save and download paid in full receipt.