A service receipt is a formal acknowledgment a business or an individual service provider provides to a client upon receiving payment for services rendered. This document details the nature of the service provided, including the date, description, total cost, and any other relevant transaction details. Similar to a sales receipt, which confirms the purchase of goods, a service receipt template confirms the completion and payment of a service.

Service receipts provide a complete transaction record, minimizing misunderstandings or disagreements. They are also essential for accounting, allowing firms to keep accurate earnings records, handle taxes correctly, and plan their budget. A filled receipt for service template can be used as evidence in legal cases such as disputes, audits, and reviews.

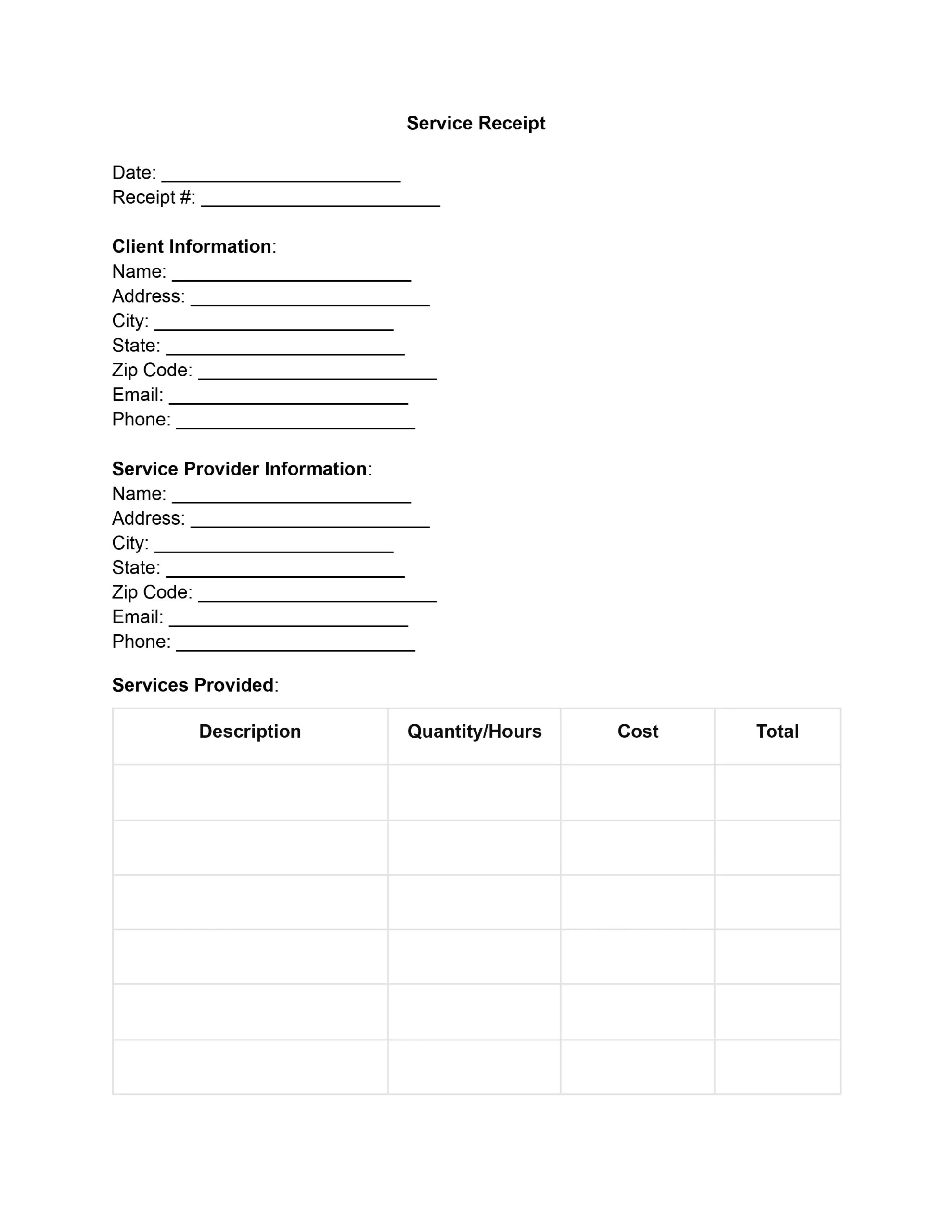

Key Elements of a Service Receipt Template

A well-structured service receipt is a record that substantiates the exchange of services for payment between a provider and a client. Here are the key elements that are included in a receipt for services template to ensure it’s comprehensive:

- Date of the service provided. The specific day when the service was delivered, vital for record-keeping and financial tracking.

- Detailed description of the service. This should include a clear and concise explanation of the services rendered.

- Cost of the service rendered. The amount charged for the service before adding any taxes or discounts.

- Information about the service provider. Details such as the name of the service provider, contact information, and physical or mailing address.

- Information about the client. Similar to provider information, this includes the client’s name, contact details, and address.

- Payment method and details. Specifies how the payment was made (e.g., cash, credit card, bank transfer) along with payment terms (such as the due date if not paid upfront).

- Any applicable taxes. Details of any taxes applied to the service could vary depending on the service location and nature.

- Total amount charged. The final amount paid by the client, including the service cost, taxes, and any additional charges.

- Signature or digital confirmation from the provider. Verification of the transaction and agreement to the terms of the service rendered.

Service receipt templates ensure that every transaction is documented clearly and professionally. This documentation supports financial management and legal compliance and builds trust between service providers and their clients, establishing a foundation for ongoing business relationships.

How to Fill Out Services Receipt Template

Following these steps ensures that your receipt template for services rendered is filled out comprehensively, facilitating smooth financial transactions.

1. Date and Contact Information

Start by entering the date the service was provided at the top of the service receipt form. Underneath, include the service provider’s and the client’s names, contact information, and addresses. It ensures that both parties are easily identifiable and the receipt is anchored to a specific transaction date.

2. Service Description

In the designated section, provide a detailed description of the service rendered. If the service is part of a package or bundle, list the components to clarify exactly what was provided. This transparency helps prevent misunderstandings and reinforces the value delivered.

3. Cost Details

Enter the cost of the service rendered in the appropriate section. This should be the base price before any taxes, discounts, or additional charges are applied. Separating these elements on the receipt makes it easier for the client to understand the pricing structure.

4. Payment Information

Detail the client’s payment method, such as cash, check, credit card, or electronic transfer. Include payment terms, like due dates for partial payments or late payment policies if relevant. This section is crucial for financial records and setting clear expectations about payment practices.

5. Taxes and Total Amount

Calculate and specify any taxes applicable to the service provided. Then, add all charges together to indicate the total amount charged. Ensuring accuracy in this step is vital for compliance and maintaining a trustworthy relationship with your client.

6. Final Confirmation

Conclude by obtaining a signature or digital confirmation from the service provider. It’s like a seal of approval for the information provided and the transaction’s completion.

7. Distribution

Finally, distribute the completed receipt of services template. Provide the client with a copy (digital or physical), and keep a copy for your records as well. Managing and storing these receipts is crucial for legal compliance and effective business administration.