Mortgage Lien Release Form

A mortgage release (also referred to as satisfaction of mortgage), is a document that is acquired by the homeowner from the original mortgage lender (the lender who holds the lien – security for the mortgage loan).

The mortgage release is essentially a confirmation from the loan company that the borrower has satisfied the agreed-upon terms of the loan. This document acknowledges that all parties involved (lender and borrower) agree that the loan has been fully paid off and is “satisfied.” In other words, the borrower has fully repaid their loan to the lender as agreed upon in the original loan terms (this includes late fees or any other payments by the lender).

The parties to a mortgage release are also referred to as a mortgagee (the party lending money) and mortgagor (the party borrowing funds in order to purchase a home or other piece of property).

Once this type of release of liability form has been prepared by the financial institution, it must be sent and updated to your local land or county recorder. After being updated, a clear land deed shall be returned to the property owner.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

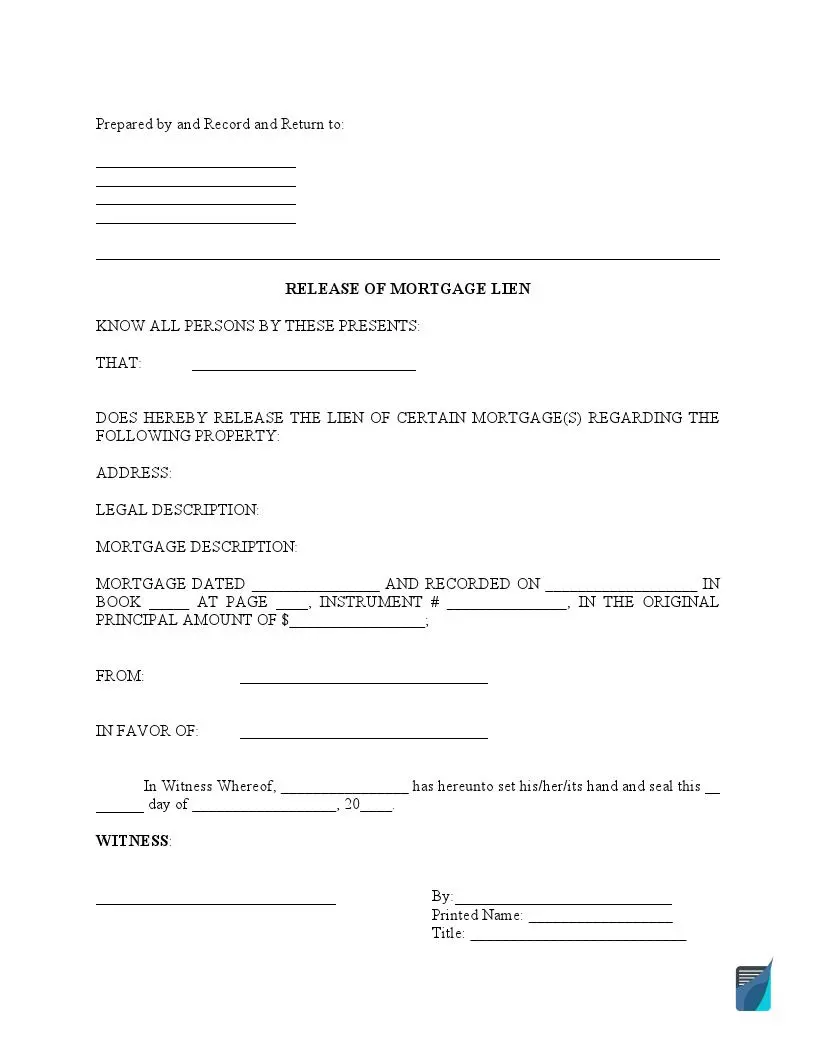

What Should Be Included in a Mortgage Release Form?

The form is typically quite simple and includes only the essential information about the fact of the borrower having paid the mortgage.

The following information should be included in the document:

- Mortgagee’s name

- Mortgagor’s name

- Total amount of the mortgage debt

- Closing date of the mortgage (date of termination)

- Complete legal description of the real estate which must contain the tax parcel number

- Confirmation that payments and the original terms of the loan have been completely satisfied

- Confirmation of the lender being released from filing a lien against the real estate

- Signatures with dates from all pertinent parties

Mortgage Lien Release Form Details

| Document Name | Mortgage Lien Release Form |

| Other Names | Satisfaction of Mortgage, Property Lien Release |

| Avg. Time to Fill Out | 11 minutes |

| # of Fillable Fields | 31 |

| Available Formats | Adobe PDF |

How to Complete a Mortgage Lien Release (Satisfaction of Mortgage)

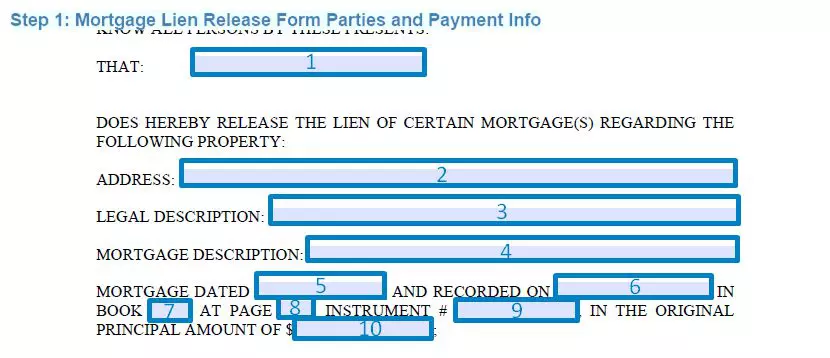

Identify the parties involved

All pertinent parties should be documented in the mortgage release form. The two essential parties will be the debtor and lender. The debtor is the party who acquired funds to secure payment for their property – home, apartment, building, or another place of living, and in return, used that newly acquired property as collateral for the loan. The lender is the general financial body that lent funds to the debtor, which was used in the purchase of their new home.

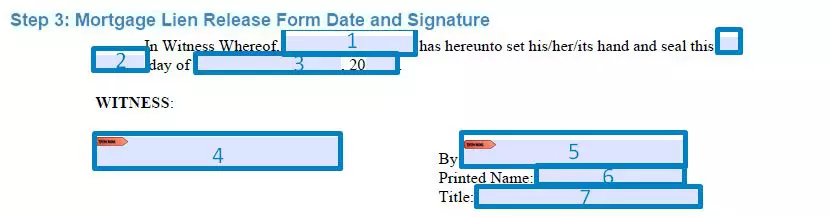

Put signatures and complete the mortgage release form

A mortgage release form should be signed by the debtor, but only after it has been prepared by the lender. Some states will also require a witness to be present during the signing. Among such states are Michigan, Vermont, Ohio, South Carolina, Georgia, and Arkansas. They have statutory requirements for validity of deeds that require the signing of deeds with the presence of both witnesses and the notary public.

At the same time, certain counties in specific states might require deeds to be witnessed as well. This is why it is vital to check the requirements of your local county recorder’s office for the completion of mortgage release forms.

Submit and record the form

After the above has been completed and notarized, the document should be recorded and sent to the local land record’s office. Depending on the state, it may be called the County Clerk’s Office, County Recorder’s Office, Register of Deeds, or Land Registry Office.

Once the mortgage release form has been filed appropriately, the lien is considered extinguished. The borrower can no longer keep their mortgage statements, promissory notes, and other mortgage documents.

If you need a form customized for your needs, use our online document builder. Just answer a few questions regarding the mortgage and get the ready document in just several minutes.

Consequences of Not Filing a Mortgage Lien Release

Each state has individual statutory limits in which the mortgage release form will be required to be filed. In the case the financial institution lending money does not file and record the mortgage release form, they will be fully accountable for all damages and penalties that will be paid to the debtor. Along with that, the debtor may not be able to sell the property in the future if they can not provide legal proof that their mortgage was paid in full and the lien has been extinguished.

How to Fill out the Document?

Filling out a mortgage release form is a pretty simple process, but even then, it requires attentiveness in terms of filling the document properly.

Step 1

Start with the name of the document placed in the middle of the top corner of the document. Then, write the names of the parties in the mortgage agreement, the dollar amount of the mortgage debt, and the date of payment. Along with that, include the number of the Book of the public records.

Step 2

Further, the document should tell that the mortgage has been canceled by payment.

Step 3

Finish this section of the document with the date and signature of the lending party.

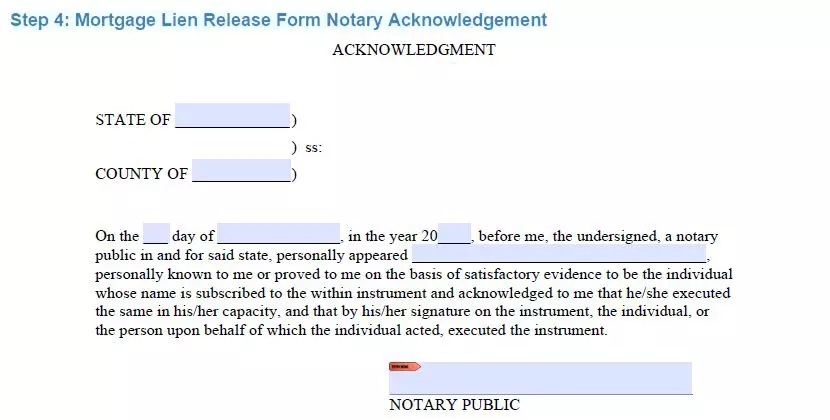

Step 4

Now, the document should be notary acknowledged. The section should mention the state and county, the names of the parties who appeared in front of the notary public, the instrument they are executing, and the date of the acknowledgment plus the signature of the notary, and the date of expiration of their commission.

Are There Any State-specific Mortgage Release Forms?

Please note that some states might require filling in specific mortgage release forms. Among such states are:

- Wisconsin (the form is called the Satisfaction of Mortgage and can be found at the Wisconsin Department of Transportation website)

- North Carolina (the form is called Certificate of satisfaction and can be found in the North Carolina General Statutes, Chapter 47)

- Minnesota (this is the form 20.5.2 that is called Satisfaction of Mortgage; it can be found on the website of the Minnesota Commence Department in the category Uniform Conveyancing Forms)

- New York (the form is provided by the Department of Housing and Preservation and Development and is called the Multifamily Mortgage Payoff/Satisfaction/Release Request Form)

- North Dakota (the form is called A certificate of the satisfaction of a mortgage and can be found in the North Dakota Century Code, Section 35-03-16)

- Pennsylvania (the form is called the Satisfaction Piece and is provided by the Pennsylvania Statutes, Section 721-5)

- South Carolina (the form is called the Mortgage Lien Satisfaction Affidavit and is provided in the South Carolina Code of Laws, Section 29-3-330)

If you need a mortgage release form, you can easily get one on our website. Three formats (PDF, ODT, and DOC) are at your disposal – just choose the one that fits you best and download it. Then, you can fill in the needed information in blank spaces and use the mortgage release form for your own legal purposes.