Triple Net Lease Agreement

Triple net leased assets have become common investment opportunities for investors looking for a consistent stream of income with minimal risk. It has advantages for both renters and owners. In this setup, tenants have flexibility, allowing them to personalize their space without having to purchase personal property. Investors, on the other hand, can get long-term secure returns with appreciation.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What is a Triple Net Lease Agreement?

A triple net lease (also known as NNN lease) is a lease agreement under which the tenant or lessee agrees to cover all of the estate’s costs such as commercial property taxes, building insurance, and upkeep. These charges are in addition to rent and utility fees, and in the absence of a triple, double, or single net contract, the lender is typically responsible for all payments.

Consider the following before using your commercial real estate property for a triple net lease investment:

- It requires the tenant to bear the majority of the fees associated with the property.

- As a result, the rent paid under the agreement is typically lower than a standard lease agreement.

- However, the roof, structure, and common areas like the parking lot, may still be the responsibility of the landlord.

- The creditworthiness of the tenant determines the capitalization cost, which is used to measure the lease price.

- Vacancy considerations, tenant improvement charges, and rental fees are all factors that investors consider when investing in high-quality real estate.

Triple Net vs. Gross Lease

Gross Lease

A triple net lease is the polar opposite of a gross lease where property taxes, pensions, and house repairs are all paid for by the landlord. To offset these extra charges, the tenant’s annual rent is considerably higher. A gross lease can specify that the occupant is responsible for all utilities.

In real estate, a gross lease is the most common type of lease used by residential landlords. Leasing is paid in advance, and the landlord is responsible for all types of expenses. Other than utilities and mortgage payments, the three main recurring costs associated with purchasing property are building insurance, real estate property taxes, and regular maintenance.

Triple Net Lease

In a net lease, the tenant is responsible for one or more of these fees and is liable for property taxes under a single net lease. On the other hand, a double net lease requires tenants to pay for both taxes and benefits. Meanwhile, a triple net or NNN lease makes the tenant responsible for all three.

Triple net leases are most often used for freestanding commercial buildings with a single occupant, although they may also be used for other sorts of properties. This type of lease usually has a 10-year or longer introductory period with escalating rent adjustments built-in. Though a single net lease or a double net lease almost have the same setup, only the triple net allows for more convenience on the part of the landlord. This is because the tenant will be responsible for paying for the following:

- Base rent – the amount of rent without the additional fees

- Utilities – electricity, water, and other bills

- Own operating expenses – If the tenant is operating a business, he or she will shoulder all of his or her business’s payables.

- Repair costs and upkeep- This includes any need for area improvement or repair.

- Taxes and insurance premiums- Before entering into an NNN lease, the tenant may check if all real estate taxes have been updated. Likewise, property insurance must also be discussed before signing because the tenant will be taking over insurance maintenance upon signing the contract.

- Common Area Maintenance (CAM) contribution – The additional fee for shared areas like parking spaces or the lobby.

When to Use a Triple Net Agreement

- When occupying a commercial space.

Commercial leases are mostly triple net with the square footage determining the amount of rent. A triple net lease is typically more cost-effective for industrial tenants than the gross rent model. In this case, the landlord deducts all running costs from the annual gross rent.

- When you want to save by “sharing.”

Good properties with low vacancy rates are appealing to tenants for a triple net lease because the burdens of taxes, insurance, and upkeep are shared by a larger group of fellow tenants. Renters pay a lower prorated share of the continuing fees while paying a lower monthly payment by spreading those expenses out to more tenants. The same applies to their CAM contribution.

- When you’re in it for the long run and have the funding for it.

To compute if a triple net lease could be right for your commercial real estate property, you can add your monthly property taxes and premiums to the total amount of rental square footage in the property, then split the number by the total amount of rental square footage in the building. Examine the more recent maintenance fees to see if they’re going to escalate over the lease term. Looking at expected fuel rates in the near future is a good way to make this decision. Divide the number by the rental square footage of the house after you’ve arrived at a rough estimate.

- When you’ve fully calculated extra costs.

The method is pretty straightforward if you’re renting a whole building to one tenant. However, you must include the maintenance of common spaces such as restrooms, hallways, and the building lobby if you have several tenants. You also should calculate the annual expenses of cleaning, utilities, and equipment, and divide the cumulative number of rental square feet of the commercial property by the sum of annual expenses to get a fairly clear computation.

Benefits and Risks of Triple Net Leases

Investors and landlords reap from triple net leases in different ways. However, before entering into a triple net lease arrangement, all parties should understand the constraints of this form of a commercial lease. Economic components such as inflation, property repair expenses, and the number of tenants are just some of the factors to consider in determining if a triple net lease is right for your property.

Landlord’s perspective

The majority of triple net commercial lease arrangements are set up to guarantee long-term tenant occupancy (up to 20 years). This is beneficial to renters because it eliminates the cost and losses associated with a property that is vacant between tenants. Furthermore, you don’t have about as many landlord obligations for an NNN lease as you will for a traditional lease. However, when commercial property prices in the neighborhood rise, tenants who are locked into a long-term lease agreement may lose their ability to raise the rent, which can impact their income in the long run.

Tenant’s perspective

An NNN lease is typically cheaper than a standard lease (also called a gross lease) so the owner doesn’t have to think about any of the variable costs of buying the property. During the leasing period, the landlord estimates how much property taxes, insurance, and repairs would incur, and the savings are handed down to the tenant. Because of this, for the operations, upkeep, and unforeseen fees of the company location, tenants must have a good credit record. In an NNN lease, the tenant pays for all other fees on top of the rent.

Investor’s perspective

An NNN lease deal is a relatively low-risk transaction for an investor since the occupant is responsible for almost all of the expenses involved with the property—from taxes and maintenance to daily repair costs.

When the underlying assets are leased, owners can use a 1031 tax-deferred exchange to buy in another triple-net-lease property without paying taxes. However, there’s also the possibility that a tenant will default. Investors can suffer losses as they are attempting to fill the vacancy.

An NNN lease is a good agreement to consider, but in the end, it is up to you to determine by weighing all the benefits and risks involved.

Triple Net Lease Agreement Form Details

| Document Name | Triple Net Lease Agreement Form |

| Other Name | NNN Lease Agreement |

| Avg. Time to Fill Out | 16 minutes |

| # of Fillable Fields | 97 |

| Available Formats | Adobe PDF |

Filling Out the Triple Net Lease Agreement

Step 1 — Download the Agreement Form.

Upon choosing a compatible format, download the commercial lease template to start editing.

- Triple Net Lease Template – Open Office Format (.odt)

- Triple Net Lease Template – Microsoft Office Format (.docx)

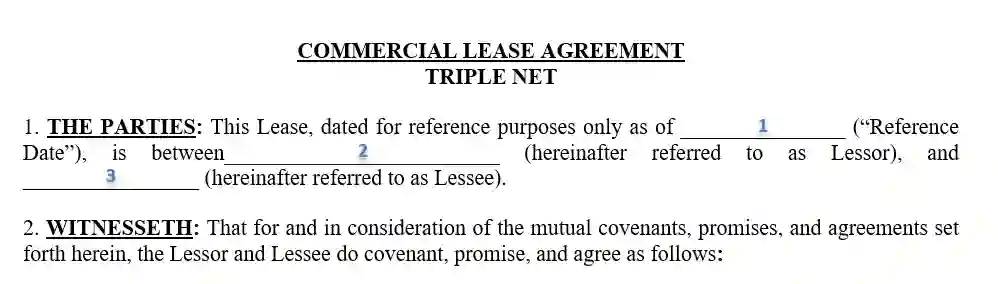

Step 2 — Fill out the opening paragraph

- Blank 1: Write the date when the agreement was made or signed.

- Blank 2: Full name of the property owner or landlord.

- Blank 3: Full name of the tenant or person renting the property.

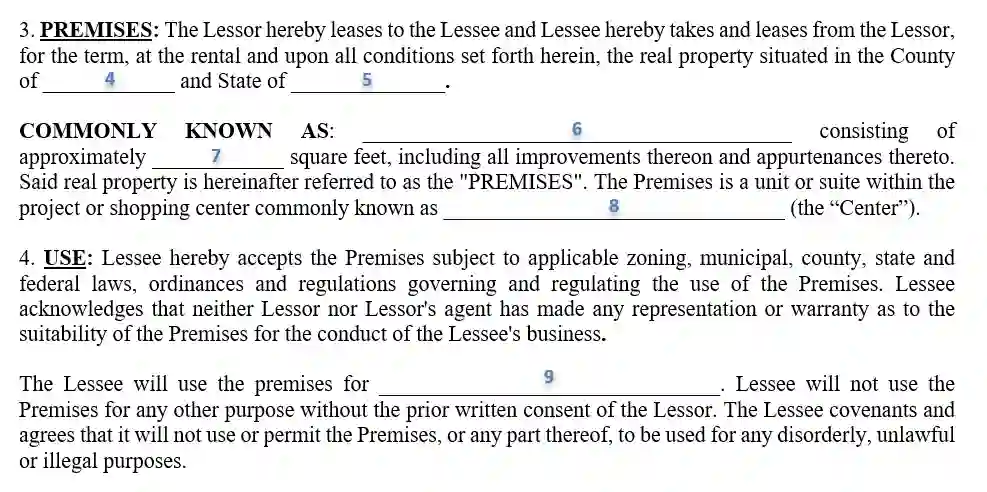

Step 3 — Describe the premises and how they will be used.

- Blank 4: Exact county where the property is located (as reflected on the address)

- Blank 5: US state

- Blank 6: Write the exact address (complete with Zip code).

- Blank 7: Add the total square foot or floor area of the premises.

- Blank 8: If the property is known for a specific name (e.g. “Emerald Hall”), you may include it in the NNN commercial lease agreement. Otherwise, place a unit name.

- Blank 9: Write the nature of the business or specific purpose for renting.

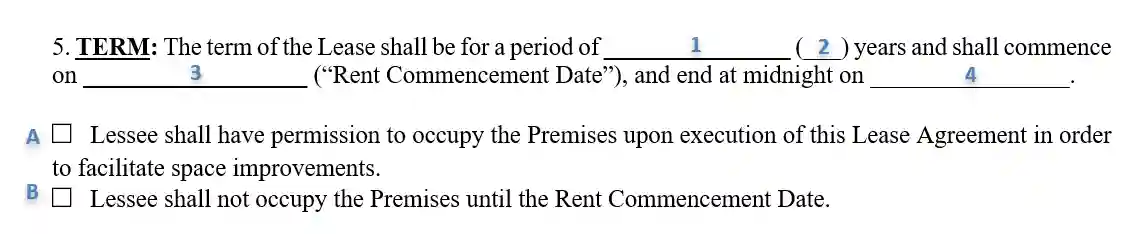

Step 4 — Discuss the terms of the agreement.

- Blank 1: The number of years the tenant will stay on the premises. Make sure to write this in words (e.g. “five”)

- Blank 2: The number of years in numerical format (e.g. “5”)

- Blank 3: The first day when the tenant may start occupying the premises. Depending on the owner, this may happen more than 20 days before the actual start of the payment in order to conduct repairs.

- Blank 4: The date when the tenant must vacate the premises unless the contract is renewed.

- Box A: Tick this box if the landlord allows the tenant to occupy the space before the commencement date.

- Box B: Tick this if the commencement date (Blank 3) will be strictly followed.

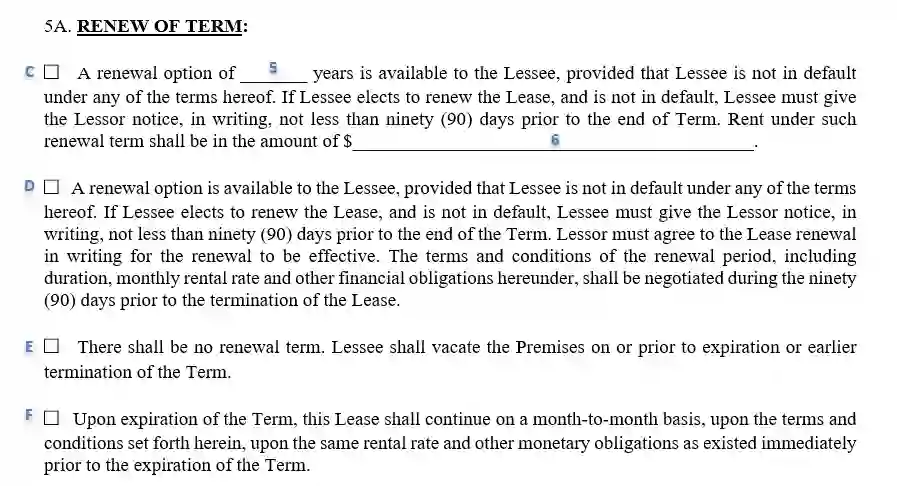

- Box C: Choose this box if the agreement allows for an extension without needing an entirely new contract. If applicable, indicate the extended number of years on blank 5.

- Box D: Select this option if both parties prefer to negotiate new terms once the first agreement ends. This would usually entail a new contract. Make sure to send a letter of intent at least 30 days before the expiration of the old contract.

- Box E: If there is no option to renew or extend the commercial lease contract, tick this box.

- Box F: Similar to Box C, this option allows for a more convenient extension. The lease agreement will simply continue upon expiration until a party ends it through a written notice.

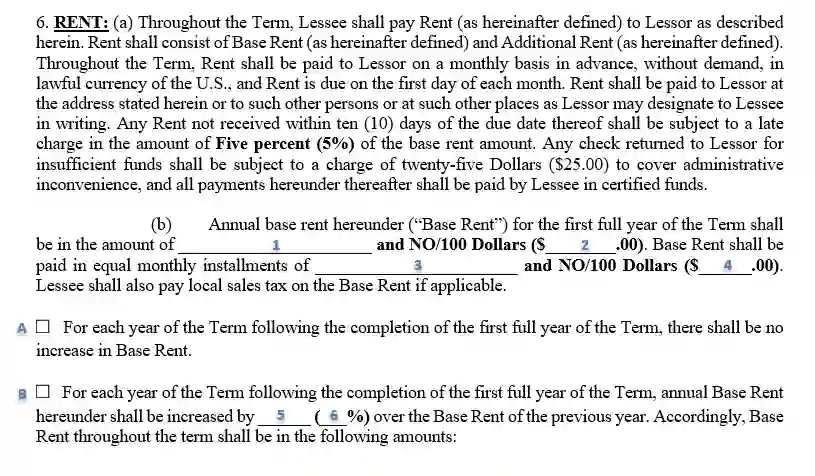

Step 5 — Finalize the financial aspects of the triple net lease.

- Blank 1: The total amount of an entire year’s rent in words (e.g. “Forty-eight thousand Dollars”). This should be equivalent to the amount on Blank 3 multiplied by 12. Make sure there are no cents (also known as “NO/100 Dollars”) on the amount to avoid complications.

- Blank 2: Now, write the numerical equivalent of the rent on Blank 1 (e.g. “$48,000”).

- Blank 3: Write the monthly equivalent of the rent in words (e.g. “4,000.00”). You may compute this by simply dividing the amount on Blank 2 by 12 months.

- Blank 4: Add the numerical form of the amount on Blank 3.

- Box A: If both the landlord and tenant agree that there shall be no changes in the rent amount as stated in this section, tick this box.

- Box B: If the rent increases on a yearly basis, select this box then write the percentage of increase in words on Blank 5 (e.g. “three percent”). Then, add the numerical format on Blank 6 (e.g. “3”).

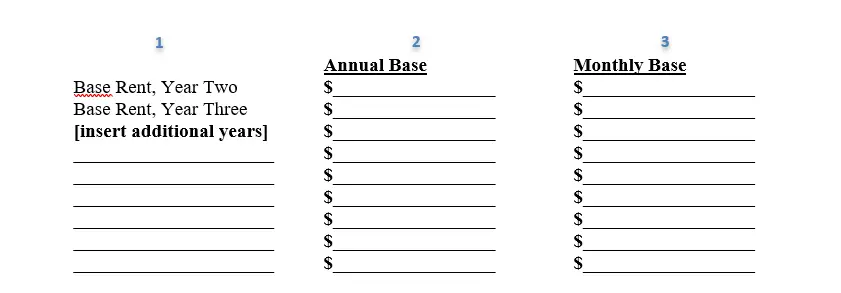

Step 6 — Add a rent computation for the NNN lease.

Refer to your computation on Step 4. Then, itemize the computation for the columns above.

- Column 1: This is a title or marker for each row. Simply add “Base Rent, Year #” on the succeeding blanks below.

- Column 2: Write the amount of the yearly base rent (refer to Step 4, blank 2).

- Column 2: Add the respective monthly rent (refer to Step 4, blank 4).

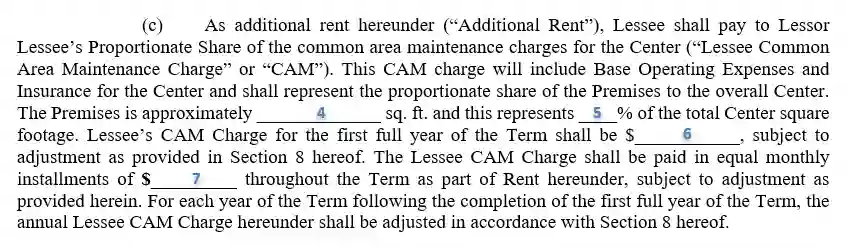

As part of the triple net commercial lease, additional charges should also be discussed and clarified. Write the following information for the paragraph above:

- Blank 4: Write the size of the rented area (refer to Step 3; Blank 7).

- Blank 5: If the premises are part of the landlord’s building, mall, or a bigger commercial area, write how much of that bigger area it comprises (e.g. “5”).

- Blank 6: The property owner or the building administrator will usually compute the CAM (Common Area Maintenance) fees for the tenant. Once this has been computed, simply write the yearly fee on Blank 6.

- Blank 7: Based on the total yearly CAM amount, get the monthly CAM contribution by dividing it by 12.

- Blank 8: Write the tax amount for the entire year on Blank 8.

- Blank 9: Add the monthly contribution by dividing Blank 8 by 12.

The paragraphs above explain the defaults pertaining to the financial aspects of the lease. It is best to read everything thoroughly before signing.

Step 7 — Secure a deposit.

- Blank 10: Write the monthly rent amount on the space provided. This will be considered the “security deposit,” which should be given upon contract signing.

Step 8 — Check the rest of the provisions

Section 8 discusses additional charges due to “Common Area Maintenance” (CAM), which is charged on a monthly basis.

In a triple net commercial lease, the tenant pays all the utility fees as explained above.

Likewise, payment of real estate taxes shall be shouldered by the tenant.

Section 11 above explains that the tenant must comply with all laws and regulations.

Section 12 details the rules and proper procedure for making repairs and alternations.

For section 13, the amount depends on the value of the property and should be checked with a real estate insurance agent. It would be best for the tenant to only pay for the minimum premium as part of the property’s insurance maintenance.

Section 14 protects both the landlord and tenant from any inconvenience or legal problems caused by either party.

Section 15 protects the landlord from any financial obligations unpaid by the tenant. This gives the landlord the right to take possession of the tenant’s non-exempt property until the overdue balance is paid. The balance may also be taken from the security deposit.

The above section discusses how both parties are not responsible for property destruction caused by “acts of God,” such as typhoons, earthquakes, and the like.

Step 9 — Complete the instructions for repair.

- Blank 1: The period of time (in days) during which the property owner must complete the repair.

- Blank 2: The number of days when a written notice must be sent after the “triggering event” (e.g. fire or earthquake) happened.

- Blank 3: The number of months remaining on the lease when the event occurred.

Step 10 — Add contact details.

- Blank 1: Full name

- Blank 2: Address line 1

- Blank 3: Address line 2 (including state and zip code)

- Blank 4: Area code, office landline number, and local number

- Blank 5: Complete mobile number

- Blank 6: Complete landline number connected to your fax machin

- e

- Blank 7: Your main e-mail address.

Complete the above information for both the lessor (landlord) and the lessee (tenant).

Step 11 — Read the standard provisions.

Section 19 explains that the tenant cannot make any legal claims against the landlord for situations that are out of his or her scope.

Sections 20 to 22 detail how the premises may be used.

The above explains what happens if the premises will be labeled “unusable”.

Section 24 lists all situations that will be equivalent to a “breach” in the contract.

Following section 24, section 25 explains how breaches can be remedied.

- Blank 1: Write the penalty or fee that should be paid by the tenant if he or she extends his or her stay at the premises without the notice of approval from the landlord. This may be computed based on the extended number of days.

Sections 27 to 28 explain the remaining guidelines before taking any action. 29, on the other hand, prioritizes the welfare of persons with disabilities who may visit the premises.

Section 30 discusses the legal basis for the enforcement of the triple net lease contract.

Step 12 — Summarize the obligations that come with the lease.

- Box A: Tick this box if there is no third party or guarantor involved in the triple net contract.

- Box B: If a guarantor should be named, add his or her full name on Blank 1.

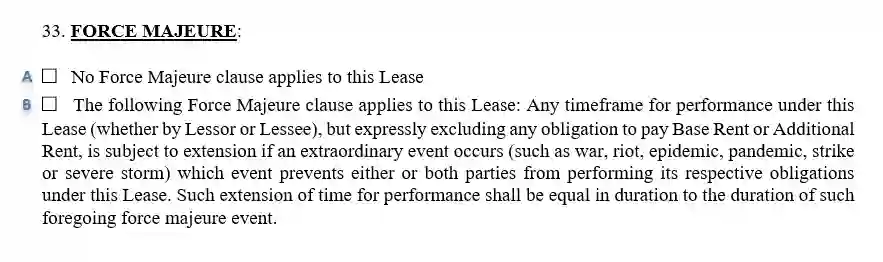

Step 13 — Choose what happens during an extraordinary situation

- Box A: Select this box if the time frame indicated in the contract should not be affected by any extraordinary event (e.g. wars, pandemics, etc.). In such a scenario, tenants will still be required to pay within the agreed time period.

- Box B: Tick this if both parties are open to adjusting during such instances, except for the due date of the payment.

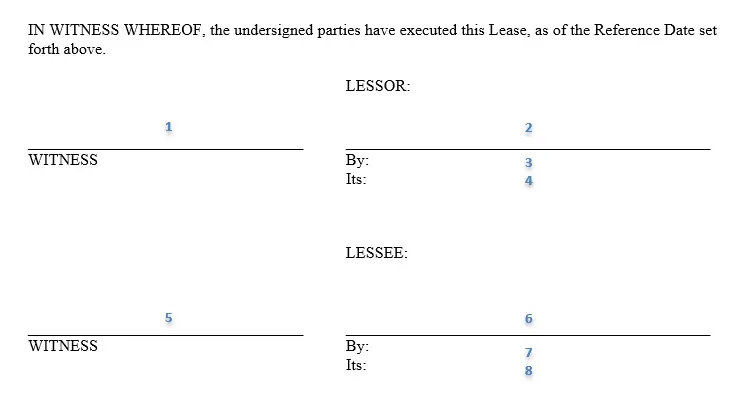

Step 14 — Finally, sign the agreement.

- Blank 1: Name of witness (from the landlord’s party)

- Blank 2: Signature of the Landlord or an assigned representative

- Blank 3: Full name of the landlord (a company name, if applicable)

- Blank 4: Position in the company (if applicable)

Repeat the same information for the tenant on blanks 5 to 8.

NNN leases can be tricky and detailed, but these are often the most convenient set up for the landlord and tenant. However, both parties must be aware of the consequences and responsibilities involved in this type of lease. Fortunately, Formspal’s free template discusses everything in detail to eliminate ambiguity in commercial NNN contracts.