Sales Contract Template

When you’re buying a cup of coffee at your local artisan coffee shop that roasts its own beans, you probably don’t need a sales contract. What if you’re the owner of the said coffee shop and need to buy a monthly supply of coffee beans to roast?

If you only have an oral agreement, your supplier can decide not to sell at the last moment, which would potentially cost you thousands of dollars. This is why sales contracts exist. This written agreement formally regulates the relationships between the buyer and seller of either goods or services.

To find out more about what a sales agreement is and how to create your own, continue reading this article. If you already know all the ins and outs of the matter, go ahead and download your free copy of a sales contract template.

Sales Commission Agreement – used between two parties, where one party supplies goods or services, and the other obliges to promote and sell the supplied goods or services for a commission for each successful sale.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Is a Sales Contract?

A sales contract or a sale of goods contract is a legal document that delineates the relationship between buyers and sellers of certain goods or services. Its function is not like that of the bill of sale, even though the two are quite similar. While a bill of sale simply signifies the transfer of ownership between the two parties, a sales agreement, in many cases, predates the bill of sale and formalizes the agreement to buy and sell a certain amount of goods.

This document also describes all the details of the transaction. It explains how and when the buyer is going to pay for the goods, whether the payment is going to be in a lump sum or in parts. It also sets forth the exact dates on which the payments and the delivery of goods is going to take place. The same goes for the implied warranty of merchantability or fitness, risk of loss, and multiple other factors that go into making a deal.

When to Use a Sales Contract

Not all purchases call for an agreement between the seller and the buyer. You only need those for either large purchases like a car or real estate, and for business-related purchases. The Uniform Commercial Code that governs these types of contracts in the US states that the minimum price of goods being exchanged should be $500 for commercial transactions and $5000 for transactions between individuals. Under that sum, oral contracts should be enforceable by law, but it may be rather difficult to prove in court that the oral contract did take place.

That said, here are the top four reasons to create and sign an agreement between the buyer and the seller as well as a couple of alternatives that may work for you depending on the situation.

Avoiding miscommunication

Miscommunication kills any and all business deals. You may have been expecting that you’re buying goods with a warranty of merchantability, but they’re sold as-is. Or you needed a shipment on a specific date but the seller shipped them right away and you’re now stuck paying for storage.

In an average deal, there are multiple factors that can go astray, and, depending on the gravity of the error, may cost you thousands of dollars. You certainly can have an oral agreement and even talk through all the details, but oral agreements have a single flaw that renders them borderline useless. People tend to forget things, and if you don’t have your agreement in writing, there’s basically no proof that, say, the delivery should be paid by the buyer.

A sales agreement solves this problem painlessly. Every bit of the deal from the date of delivery to how the buyer can inspect the goods is set forth in writing and signed. There could be no miscommunication in this scenario.

Purchase with a payment plan

Another scenario where you need to put the entire agreement in writing is when you’re not paying not with a lump sum but in parts. In this case, this legal document establishes the effective date of the deal, the deposit sum, and the way the rest of the payment is delivered to the seller. If that’s the main reason for creating a sales agreement, it may also need a promissory note to go with it. This document is written by the buyer and essentially is a legally enforceable promise to pay a certain amount of money over a said period.

Long-term business purchases

If both parties are meaning to have a long-term deal, you probably need a sales agreement. This agreement may set forth dates of all delivery operations and payment details of the buyer. The reason why either party would want to sign a written agreement on this type of deal is that it provides warranties to both the buyer’s and the seller’s parties.

Simply put, a sales agreement may be the thing that prevents missed payments and poor delivery timing. Both parties know that they may be sued for damages for breaking the terms of the agreement. So when a seller or a buyer agrees to certain terms, they will make sure to follow them to the letter, causing no trouble for the other party.

Secure purchases over $500

As per the Statute of Fraud in the Uniform Commercial Code, contracts for the sum of over $500 should be in writing to be recognized by the law. The legal system will enforce an oral contract if it’s under this sum, but no more than that as one party may try to defraud the other and this threshold was set as the arbitrary sum that most people can afford to lose.

If you’re making a larger business purchase, you may make use of a free sales agreement template and set every detail in writing. However, it’s not your only option. You can learn more about alternatives below.

Alternatives to the sales agreement

A sales agreement may be a great solution for plenty of purchases, but you don’t need one for every purpose above $500. As per the Uniform Commercial Code, if the buyer and the seller want the agreement to be enforceable by the law the agreement has to be in writing. But that doesn’t necessarily mean you need a sales agreement.

For smaller purchases, especially private, not business ones, other forms of written documents can be enforceable. For instance, if the seller sends a buyer a pro forma invoice, it is legally binding. The same goes for purchase orders and order acknowledgments. The only drawback is that while you can legally prove the fact of the agreement between the seller and the buyer, you will have a hard time proving the details. If details like whether the risk of loss depends on and shipment costs are paid by the buyer or the sender matter to you, you’d have to create and sign an agreement.

Sales Agreement vs. Bill of Sale

While sales agreement and bill of sale serve a very similar purpose, they’re not the same. To put it simply, a bill of sale indicates that the ownership of the thing being sold passes from the seller to the buyer. A sales agreement is usually signed before goods and money are being exchanged. This document establishes the intent of the buyer to buy and of the seller to sell said goods or services.

A sales agreement also contains a lot more information like the date of the delivery, buyer’s and seller’s warranties, etc.

Benefits of Using a Sales Agreement

The main benefit of creating and signing a sales agreement between seller and buyer is that you can avoid miscommunication. This means that any provisions like the implied warranty of merchantability and fitness, date of delivery, whether the buyer may inspect the goods prior to the purchase, etc are put in writing. This leaves no room for misunderstandings that may potentially hurt the parties involved.

What Are the Warranties in Sales Agreements?

In legal documents, warranties are not what the common use of the word means. Warranty, implied or express, is a legally binding claim about the product. An implied warranty is determined by the law that governs commercial agreements. For instance, the warranty of merchantability and fitness for regular use is implied by the mere fact of the seller’s willingness to sell. The same goes for the warranty of title, i.e. the seller’s claim to have the legal right to own the goods they’re selling.

Then, there’s an express warranty. This type of claim or promise either by the seller or by the buyer that is explicitly stated. This may be a warranty of fitness for a particular purpose, i.e. a water tank that would fit a specific size of fish. Express warranty can be established simply by the seller’s conduct — if they’re not sure the product would fit the buyer’s needs, they shouldn’t be selling it to the buyer. However, it’s always best to include that warranty in the sale agreement.

What is the Risk of Loss?

Whenever there’s shipment of goods involved, either by the third party or the seller, there’s a risk of loss. Items are lost all the time by USPS and can be lost by the seller as well. A good agreement between buyer and seller elaborates on which of the parties is going to take that loss when the property doesn’t reach its destination.

Normally, if a third party handles the shipment, it should be insured and they will cover the cost in case of a loss. In terms of the sales agreement, this means the risk of loss is on the buyer. However, the seller may handle the delivery themselves. In this case, the seller is the party responsible for covering the cost of loss items.

What Should Be Included in a Sales Agreement

Want to create a sales agreement? You can use free software on FormsPal to create your own agreement, customize it and print it out. Here are the main components you need to include in the agreement.

Seller and Buyer

The entire agreement wouldn’t make sense if there would be no information about the seller and the buyer. This is why the very first clauses should clearly establish the people or entities that are acting as a seller or a buyer in the agreement.

In some cases, you don’t have to include their address, just stating the name or the name of the business would be enough. However, it’s always best to include it for clarity.

The goods

Since the agreement at hand is about the sale of goods, the other detail you need to include is the description of goods being sold. Depending on the type of sale you’re doing, you may only include a purchase order where the goods are described. If the seller does not have any other documents describing the goods, the parties should add information about those.

Price and payment terms

The price for the goods also should go into the agreement — both the price for the individual items and the sum total. If the buyer intends to pay not with a lump sum, but in parts, that should be put in the agreement. It should specify whether there’s a promissory note or any other document that specifies the payment terms.

Delivery details

Depending on the way the seller and the buyer go about the delivery, you may also need to include information on the details of the delivery. At the very least, you’d want to include the information about the date of delivery and upon whom lies the risk of loss. If you want to be super clear on who is responsible for the lost goods, it’s best to explain what party is responsible in different scenarios so that both parties understand their responsibilities.

Inspection period and warranties

While some warranties are implied, it wouldn’t hurt to put them into the agreement along with the express warranties. If you as a buyer require the product fit for a particular purpose, make sure to ask the seller to provide an express warranty of fitness.

To make sure the seller delivered on their promise, the buyer reserves a certain inspection period. This period should be explicitly stated in the agreement. During the period, the buyer has the right to inspect goods and see if they are indeed what the seller has promised. If they don’t fit the standards set forth by the buyer, they can legally ask to change the goods or demand a refund. In the case where the buyer makes this claim after the period is over, they do not have legal standing.

Governing law

This is an optional thing to include, but some agreements include the governing law clause. This clause defines which state’s laws govern the deal.

Filling Out the Sales Contract Template

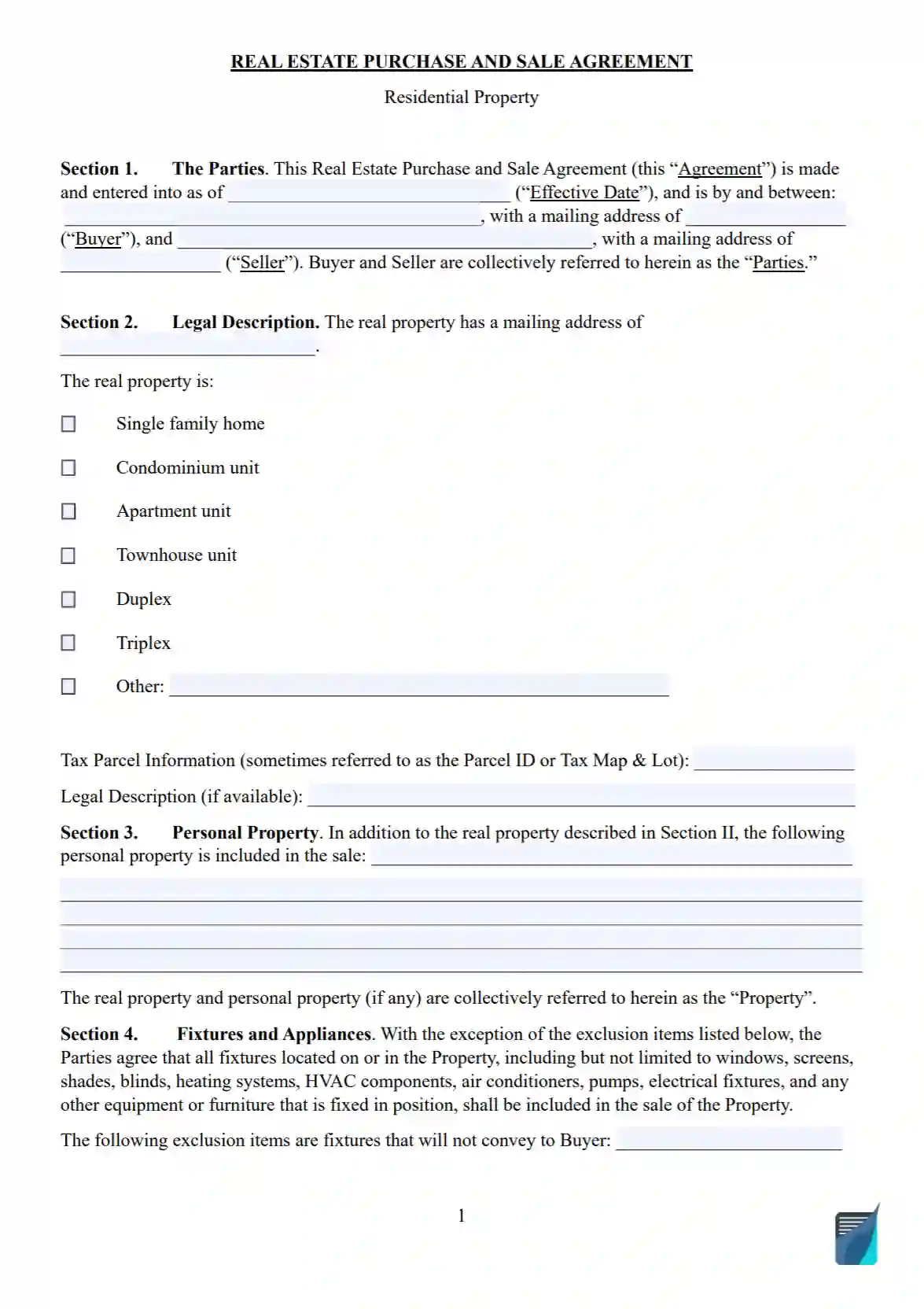

If your case doesn’t require customization and you only want a standard sales agreement template, you can download one here. Here’s how you fill it out, step by step.

Fill in the effective date of the deal

The first thing you should fill in is the effective date of the deal. That is the date of the signing of the agreement between the seller and the buyer. If you’re preparing the agreement beforehand, fill this part on the date of the signing.

Fill in the names of seller and buyer

The next step is to fill in the seller’s and the buyer’s names. Put the full name in the form and add the mailing address. If the deal is between two businesses, you need to add the address of the business registration. Further in the document, the parties will be referred to as the seller and the buyer.

Describe the product

If you have a document that describes the product, simply fill in the PO (purchase order) number and attach the document to the agreement. If not, you’ll have to briefly describe the product.

Fill in the date of delivery

With that done, fill in the date at which goods will be available for pickup or delivery. There’s also the option for the seller to make them available for the buyer at a reasonable time, but it’s always best to provide a solid time frame.

Fill in delivery details

The next step is to check the boxes next to the delivery details. In this section, you need to choose several responsibilities for both parties. You will have to note whether the seller or the buyer is going to take responsibility for the delivery costs and whether the seller may ship the goods in batches or in one shipment.

Fill in warranty details

The warranty clause in the sales agreement contract provides a time frame for the warranty of merchantability. For a sale of goods manufactured by the seller themselves, they should be the one determining this time frame. In the case of retail sales, the warranty period doesn’t extend farther than that of the manufacturer.

Fill in your state

The last step is to fill in the state where the deal between the buyer and the seller takes place. This is to make sure it’s clear local commercial laws apply.

Read the entire agreement

Once you’re done with it, read the agreement again and make sure you understand and agree with every clause written in it. Both the seller and the buyer should do that. Seek legal aid if any part of the document is confusing, as you don’t want to be signing legally binding documents you don’t understand.

Print out the form and sign it

With that out of the way, all you’ve left to do is to sign the agreement. Put your name on it and sign at the bottom of the page.