Articles of Incorporation Template

A corporation is one of the most common business formats in the USA as it limits the personal liability of business owners, provides easier access to capital, and gives some other benefits to a business.

When a business owner is about to structure a new or established company as a corporation, the very first thing they should do is create articles of incorporation. This is a set of documents containing important information about the company that is filed with the respective governmental agency in the state where a company decides to incorporate.

Read this article to learn what should be included in articles of incorporation and where you can find a proper template for such a substantial document.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Articles of Incorporation: What Is It?

Articles of incorporation are a set of documents that comprises essential information about a corporation such as the business name, address, amount of stocks to be issued, purpose of a business, its duration, registered agent, incorporator, etc.

Articles of incorporation are required by state laws, and each of the states makes companies go through a specific procedure of filing the articles. But the common thing for all states is that the articles of incorporation are submitted to the secretary of state office.

Articles of Incorporation vs Bylaws

In articles of incorporation, the general information about the corporation such as the business name, its location, etc. is outlined.

In their turn, corporate bylaws outline the rules concerning the business structure including the formation of top management and other roles in the company. They usually go along with the articles of incorporation and together form the legal basis of the company. Bylaws are usually drafted after the creation of articles of incorporation.

What Is Included in Articles of Incorporation?

Usually, articles of incorporation have the following contents:

Name of business

A business that wants to form a corporation should specify the name it will use to represent its products or services. It will differ from the names of other business entities by including “Inc”, “Incorporated” or another equivalent or abbreviation at the end. This way, a corporation stands out from the list of non-incorporated businesses.

Corporation type

Corporations can be of different types, and the type of business should be clearly outlined in articles of incorporation. A company that is about to get a corporation status can choose to register as:

- a stock corporation (a for-profit organization that issues shares of stock to stockholders in order to gain profit; each share implies a certain amount of ownership in the corporation)

- non-stock corporation (a for-profit organization in which there are no shareholders and which is owned by its members)

- a non-profit corporation (an organization that was incorporated for purposes other than making profits)

Depending on the selected type of business, a certain fee should be paid to the secretary of state office.

Name and address of the incorporator

An individual who is preparing incorporation documents and takes on the responsibility of setting up a business of this type is referred to as an incorporator. Their formal duties are filing the articles of incorporation with the respective agency in the state where the business resides. An incorporator is also responsible for providing all the legal papers that are needed before an entity gets the status of a corporation. Once the business is set up, there are no other formal duties an incorporator should follow. Please note that some states might require more than one incorporator.

Name and address of a corporation registered agent

In any corporation, there should be an individual who will be getting important correspondence on behalf of the entity. Such a person is called a registered agent. They should be available during standard working hours and get legal papers and important documents at any time. If businesses are operating outside of the area of registration, they commonly hire a registered agent service.

Names and addresses of top management

Articles of incorporation should also provide information about the board of directors such as their names and addresses. Along with that, the names and addresses of corporate officers might be included too.

Scope of activity

In articles of incorporation, a business entity should disclose what products or services they are providing. Depending on the purpose of incorporation, every state would impose different regulations.

Duration of the business entity

A business might outline in articles of incorporation that they will be working for a fixed period of time. On the other hand, they might indicate that they are going to operate perpetually.

Articles of Incorporation Laws by State

| STATES | FILING FEE | WHERE TO FILE? | STATE LAW |

| Alabama | $100 | Alabama Secretary of State – Business Services Division | Alabama Code, Title 10A |

| Alaska | $250 (for nonprofit and religious articles of incorporation – $50) | Alaska Division of Corporations, Business and Professional | Alaska Statutes, Sections 10.06.208-10.06.215 |

| Arizona | $60 (for nonprofit – $40) | Arizona Corporation Commission – Corporations Division | Arizona Revised Statutes, Section 10-202 |

| Arkansas | $45 (online fee) or $50 (paper fee) | Arkansas Secretary of State – Business and Commercial Services Division | Arkansas Annotated Code, Section 4-27-202 |

| California | $100 | California Secretary of State Business Entities Filings | California Corporations Code, Sections 5120-5122 |

| Colorado | $50 | Colorado Secretary of State | Colorado Revised Statutes, Section 7-102-102 |

| Connecticut | $250 for up to 20,000 authorized shares | Connecticut Secretary of State – Commercial Recording Division | Connecticut Revised Statutes, Chapter 601, Section 33-636 |

| Delaware | at least $89 | Delaware Division of Corporations | Delaware Code, Title 8, Sections 101-116 |

| Florida | $70 | Florida Department of State Division of Corporations | Florida Statutes, Section 607.0202 |

| Georgia | $100 (online fee) or $110 (paper fee) | Georgia Secretary of State Corporations Division | Georgia Code, Section 14-2-202 |

| Hawaii | $51 | Hawaii Business Registration Division | Hawaii Revised Statutes, Section 414-32 |

| Idaho | $100 (typed) or $120 (not typed); for nonprofit – $30 (typed) or $50 (not typed) | Idaho Secretary of State | Idaho Statutes, Section 30-29-202 |

| Illinois | $150 + minimum $25 franchise tax + $6.25 processing fee | Illinois Secretary of State – Business Services Department | Illinois Compiled Statutes, Chapter 805, Section 5/2.10 |

| Indiana | $75 (for electronic filing) or $100 (other than electronic); for nonprofit – $20 (electronic) or $50 (other) | Indiana Secretary of State Business Services Division | Indiana Code, Section 23-1.5-2-9.1 |

| Iowa | $50 (for nonprofit – $20) | Iowa Secretary of State | Iowa Code, Section 490.202 |

| Kansas | $90 (paper fee) or $85 (online fee); for nonprofit – $20 | Kansas Secretary of State | Kansas Statute, Section 17-6002 |

| Kentucky | $40 + $10 organization tax fee for corporations with 1000 shares or less; for nonprofit – $8 | Kentucky Secretary of State | Kentucky Revised Statutes, Section 271B.2-020 |

| Louisiana | $75 | Louisiana Secretary of State – Commercial Division | Louisiana Revised Statutes, Section 12:1-202 |

| Maine | $145 | Maine Secretary of State – Bureau of Corporations, Elections, and Commissions | Maine Revised Statutes, Title 13-C, Section 202 |

| Maryland | at least $120 | Maryland State Department of Assessments and Taxation | Maryland Annotated Code, Corporations and Associations, Section 2-104 |

| Massachusetts | at least $250 (for up to 275,000 shares); for nonprofit – $35 | Massachusetts Secretary of the Commonwealth | Massachusetts General Laws, Chapter 156D, Section 2.02 |

| Michigan | at least $60 (for up to 60,000 authorized shares); for nonprofit – $20 | Michigan Department of Licensing and Regulatory Affairs – Bureau of Corporations, Securities & Commercial Licensing – Corporations Division | Michigan Compiled Laws, Sections 450.1202-450.1209 |

| Minnesota | for business corporation – $135 (by mail) or $155 (online or in-person); for cooperative – $60 (by mail) or $80 (online or in-person); for nonprofit – $70 (by mail) or $90 (online or in-person) | Minnesota Secretary of State | Minnesota Statutes, Section 302A.111 |

| Mississippi | $50 | Mississippi Secretary of State | Mississippi Annotated Code, Section 79-4-2.02 |

| Missouri | at least $58 (for up to $30,000 authorized shares) | Missouri Secretary of State – Corporations Division | Missouri Revised Statutes, Section 351.055 |

| Montana | $70 (for nonprofit – $20) | Montana Secretary of State | Montana Annotated Code, Section 35-14-202 |

| Nebraska | at least $60 (for up to $10,000 authorized stock + $5/page) | Nebraska Secretary of State | Nebraska Revised Statutes, Section 21-220 |

| Nevada | $75 (for $75,000 authorized shares or less) + $125 initial list of officers fee; for nonprofit – $50 | Nevada Secretary of State | Nevada Revised Statutes, Sections 78.035-78.037 |

| New Hampshire | $100 | New Hampshire Secretary of State – Corporations Division | New Hampshire Revised Statutes, Section 293-A:2.02 |

| New Jersey | $125 (for nonprofit – $75) | New Jersey Department of the Treasury | New Jersey Statutes, Section 14A:2-7 |

| New Mexico | at least $100 (for up to $100,000 authorized shares); for nonprofit – $25 | New Mexico Secretary of State – Corporations Bureau | New Mexico Annotated Statutes, Section 53-12-2 |

| New York | $125 + $10 minimum share tax; for nonprofit – $75 | New York Department of State – Division of Corporations, State Records and Uniform Commercial Code | New York Consolidated Laws, BSC Sections 402-403 |

| North Carolina | $125 (for nonprofit – $60) | North Carolina Secretary of State – Business Registration Division | North Carolina General Statutes, Section 55-2-02 |

| North Dakota | $100 | North Dakota Secretary of State | North Dakota Century Code, Section 10-19.1-10 |

| Ohio | $99 | Ohio Secretary of State | Ohio Revised Code, Section 1701.04 |

| Oklahoma | at least $50 (for up to $50,000 authorized shares); for nonprofit – $25 | Oklahoma Secretary of State – Business Filing Department | Oklahoma Statutes, Section 18-422 |

| Oregon | $100 (for nonprofit – $50) | Oregon Secretary of State – Corporations Division | Oregon Revised Statutes, Section 60.047 |

| Pennsylvania | $125 | Pennsylvania Department of State – Bureau of Corporations and Charitable Organizations | Pennsylvania Code, Title 19, Chapter 23 |

| Rhode Island | $230 (for less than 75,000,000 shares of authorized stock) | Rhode Island Secretary of State | Rhode Island General Laws, Section 7-1.2-202 |

| South Carolina | $135 | South Carolina Secretary of State – Division of Business Filings | South Carolina Code of Laws, Section 33-2-102 |

| South Dakota | $150 (online fee) or $165 (paper fee); for nonprofit – $30 | South Dakota Secretary of State | South Dakota Codified Laws, Sections 47-1A-202 to 47-1A-202.3 |

| Tennessee | $100 | Tennessee Secretary of State – Division of Business Services | Tennessee Code Annotated, Section 48-12-102 |

| Texas | $300 (for nonprofit – $25) | Texas Secretary of State – Corporations Section | Texas Statutes, Business Organizations Code, Section 3.005 |

| Utah | $70 (for nonprofit – $30) | Utah Department of Commerce – Division of Corporations and Commerical Code | Utah Code, Section 16-10a-202 |

| Vermont | $125 | Vermont Secretary of State – Division of Corporations | Vermont Statutes, Title 11A, Section 2.02 |

| Virginia | $75 (for 25,000 authorized shares or less) | Virginia State Corporation Commission | Virginia Code, Section 13.1-619 |

| Washington | $180 (by mail or in-person); for nonprofit – $30 | Washington Secretary of State – Corporations Division | Washington Revised Code, Section 23B.02.020 |

| Washington D.C. | at least $220 (for authorized capital up to $100,000); for nonprofit – $80 | District of Columbia Department of Consumer and Regulatory Affairs – Corporations Division | Code of the District of Columbia, Section 29–302.02 |

| West Virginia | $100 (+ $1 online processing fee); for nonprofit – $25 | West Virginia Secretary of State – Business and Licensing Division | West Virginia Code, Section 31D-2-202 |

| Wisconsin | $100 (for nonprofit – $35) | Wisconsin Department of Financial Institutions – Corporation Section | Wisconsin Statutes and Annotations, Section 180.0202 |

| Wyoming | $100 (for nonprofit – $25) | Wyoming Secretary of State – Business Division | Wyoming Statutes, Section 17-16-202 |

How Should Articles of Incorporation Be Filed?

First, one should make sure all of the necessary provisions are included in the articles of incorporation. The contents should comply with the state legislature and regulations governing company registration. Among the most important information are the name and address of a corporation, names, and addresses of top management and registered agent, the purpose of incorporation, the duration of business, etc.

Second, a filing fee should be paid. It will depend on the type of corporation that is being formed and the state of incorporation and is usually in the $50-$500 range. An incorporator can use pre-printed articles of incorporation form provided by the secretary of state office or our online form that complies with the requirements of the respective agencies.

Once state officials review the articles of incorporation and make sure all the rules are followed, the applying company gets a corporation status.

How to Register a Business as a Corporation?

Registering a business as a corporation essentially means creating a separate taxable entity from the owners of the company. The owners do not hold personal responsibility, and their liability is limited to the number of their shares in the corporation’s stock. But to register a corporation successfully, certain formalities should be followed.

Chose the state of incorporation

Commonly, the state of incorporation is the state where a company conducts most of its business transactions. But tax policy is what matters as well which is why a lot of businesses decide to incorporate in a state with the favorable tax treatment of corporations, for instance, Nevada or Delaware.

A corporation can also be formed in multiple states, but then, it will have to pay fees in each state where it operates.

Pick a name

In the majority of states, a corporate name should be different from names that have already been taken or reserved in a corporate name database of a state. When it comes to a corporation name, it should include the word “corporation,” “incorporated,” or the appropriate abbreviations.

Another important thing to mention is that in many states, a corporation cannot take a name that would affiliate with a governmental agency or bank.

To alleviate the task for yourself, you can first conduct a search of available corporate names online.

File the articles of incorporation

The next step is filing the articles with the secretary of state office. It should be done by a corporation’s registered agent – either an individual who is 18 years old or older or an entity residing in the state of incorporation. Once mentioned in the article, the registered agent will be responsible for getting legal documents on behalf of the corporation.

You can use fill-in-the-blank articles of incorporation that are provided by most states or our articles of incorporation template that you can find on our website. Once you fill in the articles of incorporation, you can submit them online, fax, mail, or deliver in person at the secretary of state office. However, it would be wise to first check your state’s filing requirements such as filing methods and fees.

Draft the bylaws

After filing the articles of incorporation, the bylaws of the business entity should be submitted. They are meant to establish the rules and regulations governing the corporation, for instance, the frequency and method of holding meetings, duties of corporate officers, etc. However, filing bylaws is not a formal requirement in many states, and these states only require to create the document and keep it on the business premises.

Issue stocks (for a stock corporation)

A newly-created corporation usually issues stocks at the first meeting of the board of directors. It is one of the most important questions at the meeting along with the adoption of bylaws and the assigning of corporate officers.

It is the corporation’s board of directors that establishes the price per share for the company’s stock. When shares are issued, shareholders might exchange cash or property for them.

Get a federal tax ID number

The Internal Revenue Service (IRS) should issue a federal tax ID number (or an Employer Identification Number – EIN) for your corporation. An application can be made by different communication means – phone, mail, or online on the IRS website. The time for processing an application and getting the number will depend on the chosen channel of communication. The quickest way is getting an EIN by phone or online request (typically, allows to get the number immediately), the longest – by mail (can take up to 4 weeks).

Register for business taxes

When you know where your corporation will operate and you have your federal tax ID number, you need to register for business taxes. In the majority of situations, the revenue agency in the state of operation will be the agency responsible for tax registration. Please note that if you have employees, you will have to receive a state tax ID number. Among the documents that are needed to get this number are the articles of incorporation, corporate bylaws and some other documents, and a federal tax ID number.

Another category of taxes a corporation with employed people should register for is unemployment insurance and compensation taxes. Or, if your company is about to sell merchandise, you might need to get a sales and use tax permit before operating in the chosen state or states.

Registering for corporation taxes can take place online on the website of the state department of revenue or in person.

Get necessary licenses and permits

The last step before a corporation can be operated legally is obtaining licenses and permissions. In general, the type of licenses you need to obtain depends on the type of business, state, and local government.

For instance, one of the most required licenses by most states is a general business license to operate in the chosen state. If a corporation is involved in retail, it might need to obtain zoning permission. If a business is based on providing professional services, an occupational license of the state of operation will be needed.

Some industries, like healthcare, gaming, cosmetics, agriculture, education, aviation, etc., are more highly regulated than others and consequently, will require more licenses and permits.

To check what requirements for corporations are imposed by your state, you can use the website of the Small Business Administration.

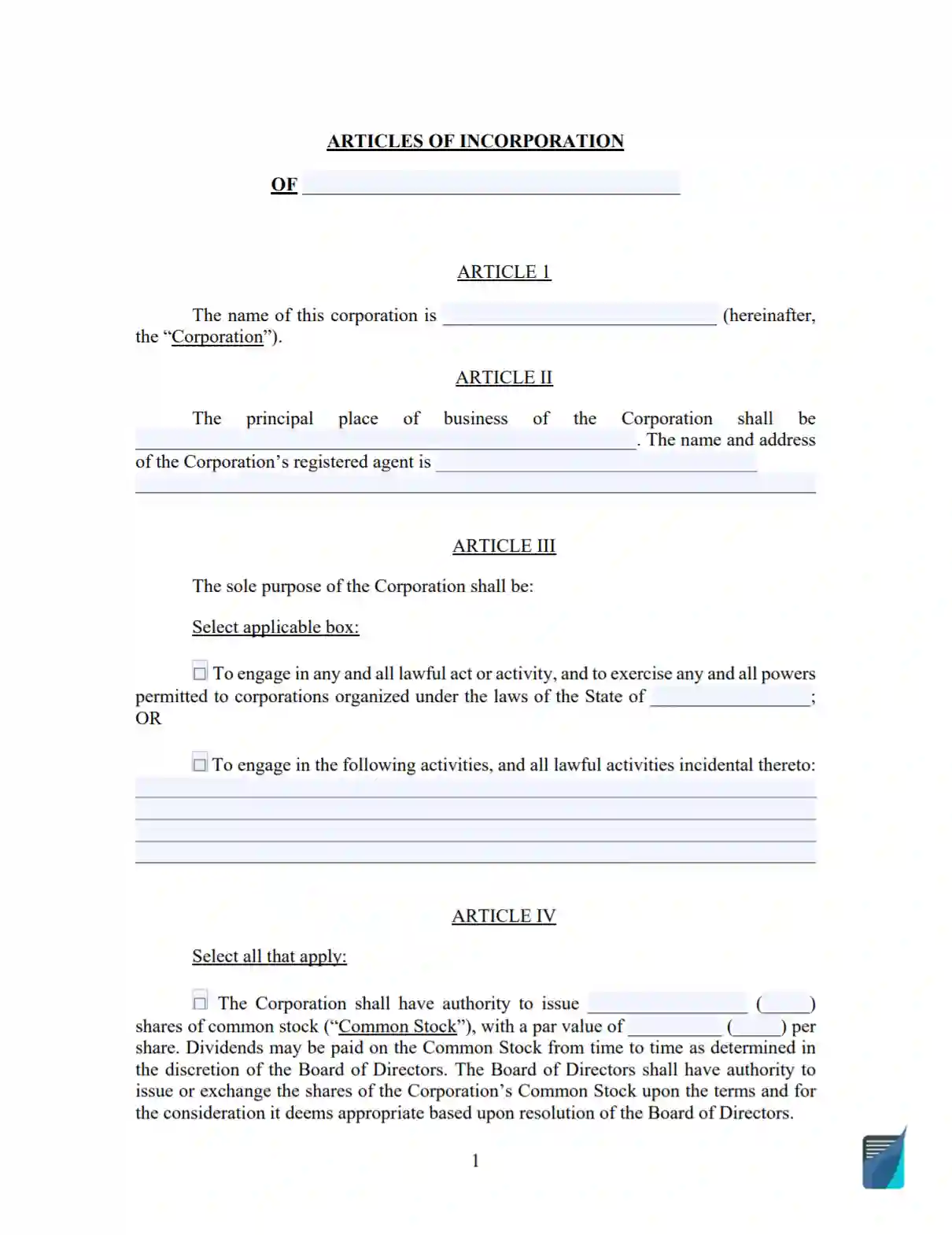

How to Fill out Articles of Incorporation?

Before the incorporator files the incorporation articles with the respective agency, the document should be prepared thoroughly as it will influence the success of a corporation registration.

Step 1

At the top of the first page, write the name of the document and the name of the corporation underneath it.

Step 2

Include the principal place of business, mailing address, and the name and address of the registered agent.

Step 3

The next should be the section with the purpose of the business. You can choose to write that your business might be engaged in all lawful activities or only the activities you list in the articles of incorporation.

Step 4

If you are going to register a stock corporation, mention the total number of shares of stock the company will issue and the value of each of them. Also, specify whether your company has the authority to issue shares of common stock, serial common stock, or preferred stock.

Step 5

Mention the total number of directors, that is, the members of the governing board of your corporation. Mention the powers of the board of directors, for example, appointing corporate officers. If you don’t plan to elaborate on the roles and duties of the officers in the articles of incorporation, you can write that the business structure and powers of corporate officers will be set forth in the bylaws of the business entity.

Step 6

In the next paragraph, specify the name and address of the incorporator (it might be the same person as the one chosen as the registered agent).

Step 7

The next section of the articles is meant to tell the duration of the corporation. Mention whether your business is perpetual or will be existing till a certain date.

Step 8

Include the paragraph that will tell that it is the board of directors that has powers to create, change, and repeal the bylaws of the corporation which will be created after the articles of incorporation.

Step 9

It would be wise to include a broad paragraph about the indemnification of covered persons that is, the board of directors, shareholders, corporate officers, and employees, from any liability in regards to the corporation and its business unless the violation was intentional.

Step 10

As the last step to filing the incorporation articles, the date of the document along with the name of the company should be written. The articles of incorporation should be signed and filed by the incorporator.

Now, when the incorporation articles are ready, the incorporator can take them to the secretary of state office and file them along with the other documents that are needed to register a corporation.

Any business that is about to get the status of a corporation should craft the articles of incorporation. Using a proper template and filing it properly is the first step to form a corporation. Make sure to use our online document builder if you want to get a customized document and not bother about missing out on important information about your business.