Credit Check Authorization Form

A person may need to write a credit check authorization when applying for several finance-related jobs, renting a home, or taking out a loan. Since this is personal information, assigned people can obtain a detailed description of a credit report only with written permission for a credit check.

Therefore, lenders must know a person’s credit score based on past credit history. Based on these results, the lender determines the amount of interest and how much of the deal they are willing to give approval for. The landlord needs to understand whether the tenant is conscientious and has a virtuous enough credit record to be trusted.

Similarly, for an employer, especially in sensitive areas where the employee will be responsible for financial decisions, the employer has the right to ensure that the candidate has clean money handling history. However, under the Fair Credit Reporting Act, individuals cannot view the employee’s private information without a consent document.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Is a Credit Report Authorization Form?

A credit report authorization form is a written document that a person can provide to an individual or organization to review their credit report. This permission does not apply to access all accounts or financial information about a person but only shows a report on loans (debts and their payments). Also, the document and procedure must be carried out according to the Fair Credit Reporting Act rules.

What Is a Fair Credit Reporting Act?

Any personal information about a person and access to it is regulated at the level of federal and state laws. The Fair Credit Reporting Act (FCRA) is a legal regulation that controls the accuracy, honesty, and protection of personal data. These laws ensure that the data that will appear on a person’s credit history is infallible and protects them in the event of any inaccuracies by mistake or sloppiness.

The Fair Credit Reporting Act also controls the procedure for third-party access to credit report information and limits the number of scenarios when such a request can be received. Not all types of verification require personal consent, but any use of the information received in decision-making may be criminally punishable.

Who Can Request the Credit Report?

The three most common types of requestors may ask for a credit report disclosure. Based on the person’s credit score, they can determine whether they want to proceed with their services or not in compliance with FCRA.

- Creditors

Any insurance company or a creditor can request access to the person’s credit report. Based on the results, they can accept or reject the request for insurance or credit.

- Financial institutions

The financier will check the credit report before approval when the person requests a loan or mortgage.

- Employers

If the person wants to work in finance-related job positions, the employer can require information about their credit history before sending the job offer.

- Landlords

The landlords can run various background checks for the potential tenants before deciding whether to accept them. However, in case of rejection, the landlord must explain why they opt for rejection of the candidate or risk breaking FCRA.

What Is the Procedure for Obtaining Access to Credit Report?

There are limited scenarios when the organization can access the credit report without prior authorization from the individual. For most individuals and entities, the process of accessing the credit report is pretty much the same.

Step 1. Inform the individual

Regardless of whom might need access to consumer credit reports, they must provide an argument and valid reason to do it. Running the credit check behind the person’s back may have legal consequences and can not be the reason for any decision regarding the person.

The person must be aware of what personal information will be disclosed and how it can be used. Also, the requested party must clarify who will pay for the credit report fee before running it.

Step 2. Get a credit report authorization form

An organization or individual who wants to view a credit report must obtain a written credit report authorization form that states that the person is willing to give access to their personal information.

This Fair Credit Reporting Act Disclosure must include personal information about the person or organization requesting the information and information about the person authorizing access. These personal details include the date of birth, social security number, driver’s license number, and prior street address history for the past seven years. The written form must clearly state why the organization or individual needs access to the person’s credit history.

Step 3. Get the applicant’s signature

It is necessary to obtain the applicant’s signature under the credit report authorization form. Usually, the signature must be handwritten, but it is also allowed to get through one of the available electronic signature platforms.

Step 4. Get the consumer credit report

The requester can use an online credit bureau or credit reporting agency to verify the identity and run the background check. In cases such as a rental agreement, there is a cash-on-delivery fee of $25 to $75 for access to credit reports depending on the credit bureau charges. Credit report information will be available 24-48 hours after submitting the credit report request.

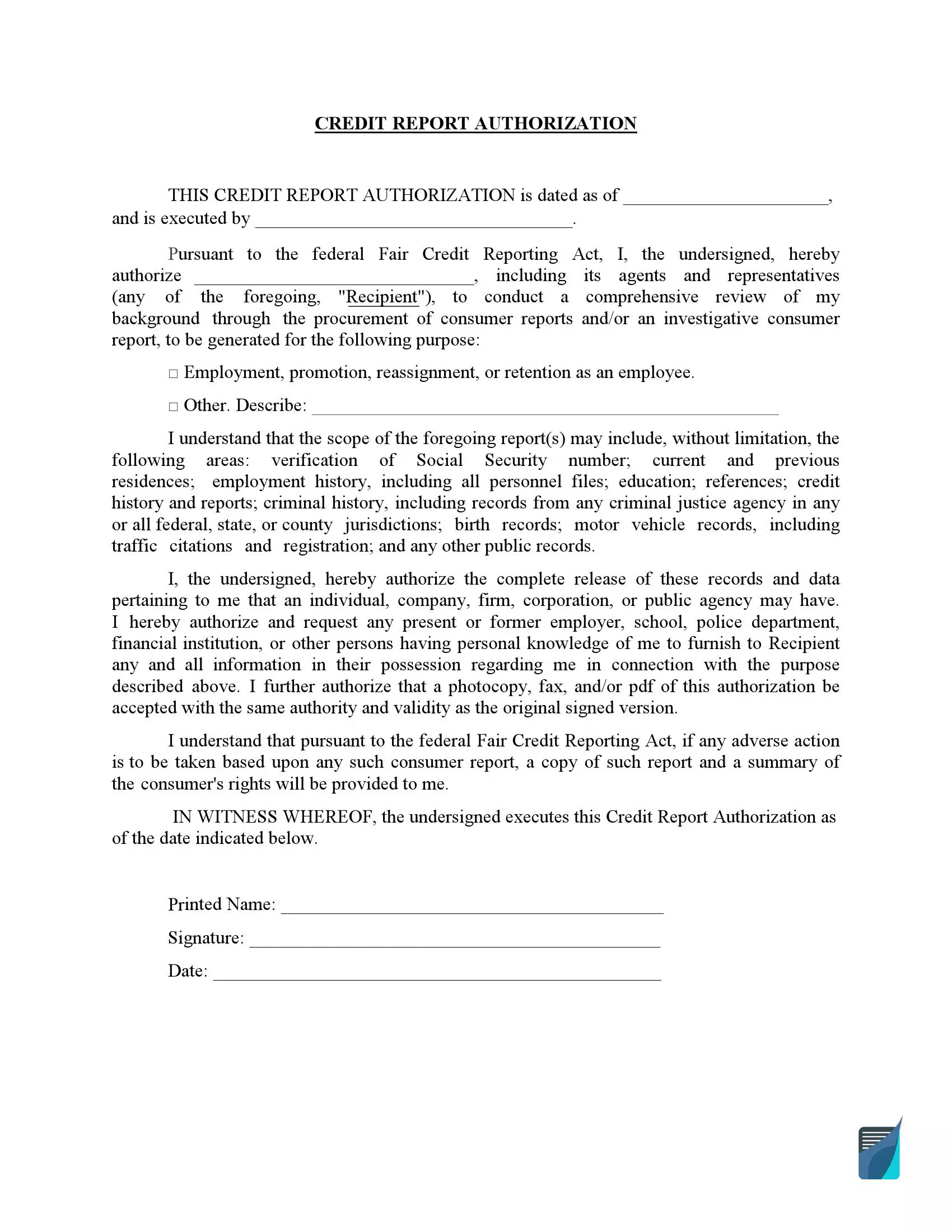

Filling Out the Credit Report Authorization Form

As mentioned above, it is required to inform the person about the intent to run the credit check on them and obtain the credit report authorization that would allow requesting disclosure of such information from credit report check services.

Usually, the person who grants permission to get a credit report will be named an applicant. The organization or person who obtains access to the report will be referred to as a requester or recipient. The applicant must provide all requested information for enabling the report check.

You can download the credit report authorization form from our website or get a fillable template. There is no uniform consent form as it can be varied depending on who is a requester and the purpose of such check. However, any proper consumer credit report consent form must contain specific clauses and be filled out correctly. You are recommended to follow the steps below to complete the form with no hassle.

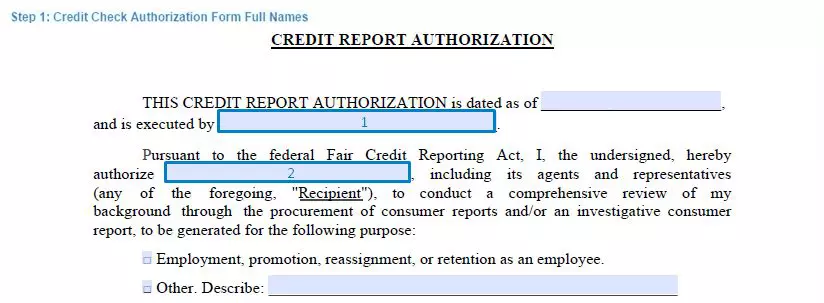

Step 1. Fill out the printed names of the applicant and the requester

Both parties must provide their full names in the credit report authorization form. Failing to indicate the proper name can lead to problems with getting and using the credit report.

Step 2. Add the applicant’s personal information

For credit reporting agencies to be able to identify the person and verify their credit record and avoid any risk of identity theft, the applicant must provide the following information:

- Social security number

- Date of birth

- Driver’s license number

- Previous residential history (for the past seven years)

This part can be excluded and provided separately from the check authorization form if the person doesn’t want this information disclosed to anyone but the credit bureau.

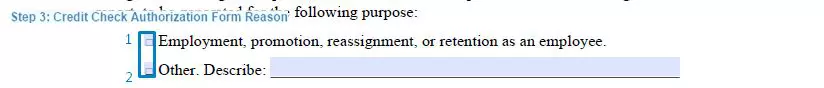

Step 3. Provide the legitimate reason for credit check

Any access to a credit record is not permitted unless a clear and applicable situation requires it. For most casts, the credit check is needed for employment, promotion, reassignment, or retention as an employee. You can underscore the appropriate option. If there is another legitimate reason, it’s required to describe it in the space provided.

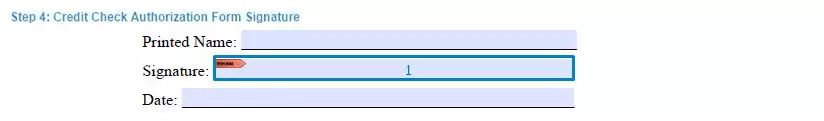

Step 4. Sign the document

Until the credit report authorization document is not correctly signed, it is not considered valid. That is why check that the applicant provided their signature.

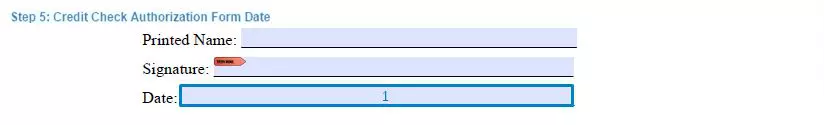

Step 5. Indicate the date when the permission is granted

Access to the credit report will be enabled only after the date indicated on the credit report authorization. It is crucial to make it adequately stated at the end of the document.

FAQ

Can I sue for an unauthorized background check?

Yes, you have the right to sue for the damage in case the credit bureau provided false credit information or if the information was pulled improperly and violated the FCRA. No one can pull out the individual credit report without credit report authorization or for an impermissible reason, even close relatives or spouses.

Does a consumer credit report consist of any criminal records?

No, your credit report will not include the criminal history. Also, it doesn’t count for your credit score. The only information that the potential landlord or employer may see through the credit report are open lines of credit, loans, and late or missed payments. Also, any harmful information except for bankruptcy can be removed after seven years.

Can I access my credit check and see my credit report?

Any individual has a right to get access to their credit report whenever they need it. Also, the individual can ask to provide the credit score given to them on the basis of the previous consumer records.