ACH Authorization Form

The Automated Clearing House (ACH) network is a dynamic system that facilitates the bulk processing of transactions across the United States. ACH payments stand as a testament to the advancements in financial technology, enabling secure, direct bank-to-bank transfers with ease and reliability.

ACH payments are designed as an electronic alternative to traditional paper checks and cash transactions, offering a streamlined approach to transferring funds. Whether for managing payroll, savings, paying bills, or receiving payments, the ACH network offers a versatile solution that caters to various financial needs. Among these, the ACH authorization form is a critical legal document that enables the seamless flow of electronic transactions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Are ACH Authorization Forms?

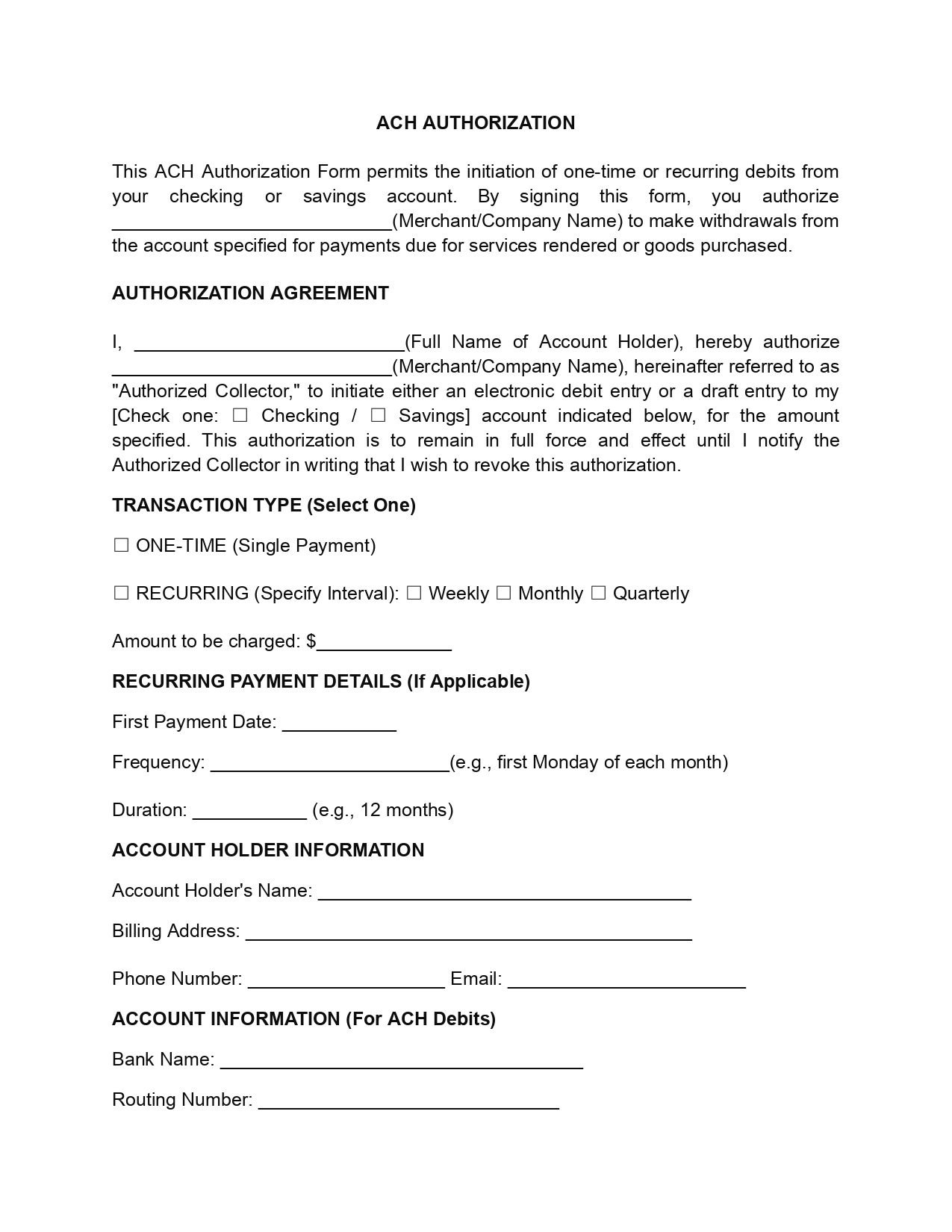

An ACH authorization form is a document businesses or individuals use to obtain permission from a bank account holder to initiate electronic funds transfers to or from the account. ACH network facilitates electronic payments and transfers between bank accounts in the United States.

The form typically includes essential information such as the account holder’s name, checking account number, bank routing number, authorization amount, frequency of payments or transfers, and the purpose of the ACH transactions. The account holder grants consent for the specified transactions by signing the ACH authorization form.

These forms are commonly used for various purposes, including setting up recurring payments, direct deposits, bill payments, and transferring funds between accounts. Both parties must retain a copy of the signed ACH form for record-keeping purposes and to ensure compliance with electronic fund transfer regulations.

Types of ACH Debits and Credits

Understanding these two types’ distinctions is essential, as each serves unique business purposes and requires specific authorizations. ACH credits are transactions where funds are pushed into a bank account. Examples include payroll direct deposits, tax refunds, and pension disbursements. ACH debits, on the other hand, are transactions where funds are pulled from a bank account. Typical instances of ACH debits include:

- Bill Payments. Utility companies, mortgage lenders, or credit card companies withdraw due amounts directly from a customer’s bank account.

- Subscription Fees. Services like online streaming platforms or software subscriptions automatically deduct monthly fees.

- Insurance Premiums. Automatic deductions for monthly or quarterly insurance premiums.

For ACH credits, the authorization form primarily serves as consent from the recipient, allowing the sender to deposit funds into their checking account. In the case of ACH debits, this document acts as a protective measure for consumers, giving explicit permission to businesses to withdraw specified amounts from their bank accounts. The ACH authorization form, therefore, not only complies with regulatory standards but also improves openness and confidence in the payment process, regardless of whether money is transferred into or out of an account.

Components of an ACH Authorization Form

This form template, integral to both sending and receiving funds, must include several critical components for compliance with regulatory standards:

- Contact Information. Essential for facilitating communication, this includes the names, addresses, and phone numbers of the account holder and the financial institution.

- Account Details. This section details the bank name, routing number, and account number, ensuring funds reach their intended destination.

- Transaction Type. Specifies whether the transaction is a debit (withdrawal) or a credit (deposit), guiding the flow of funds.

- Transaction Type. Specifies whether the transaction is a debit (withdrawal) or a credit (deposit), guiding the flow of funds.

- Payment Amount. Clearly states the amount to be transferred, which is crucial for fixed and variable transactions.

- Payment Frequency. Outlines how often transactions will occur, whether one-time, monthly, or otherwise, setting expectations for both parties.

- Authorization Statement. The legal backbone records the account holder’s consent for the transactions outlined in the form.

- Date and Signature. Provides a timestamp and signature (or digital consent), sealing the agreement and authorizing the transactions.

Every detail, from account numbers to payment schedules, must be double-checked for accuracy. Even small errors can result in processing delays, transaction failures, or unintended customer financial disputes.

How to Fill Out ACH Form Template?

Following these steps will ensure that your ACH authorization request form template is filled out correctly and legally, allowing for smooth and secure electronic transactions.

1. Fill in Contact Details

Enter the contact information for the account holder and the entity requesting the authorization. It includes names, addresses, and phone numbers to ensure clear communication channels.

2. Specify Account Details

Please carefully provide the bank’s name, routing number, and checking or savings account number involved in the transaction. It’s crucial to double-check these details to prevent any potential issues with the transaction.

3. Detail the Payment Amount and Frequency

For transactions with a fixed amount, specify this on the form. If the payment amount will vary, you must outline how this will be determined. Also, state how often these payments will be made, whether a one-time or monthly event or at another specified frequency.

4. Include an Authorization Statement

This section is vital because the account holder gives explicit permission for the detailed transactions. Read and understand this part thoroughly before agreeing to the terms.

5. Sign and Date the Form

Your signature and the date the form was signed are required to validate the authorization. If you are filling out the form electronically, follow the instructions for electronic signatures.

6. Submit the Form to the Requesting Party

Once you’re confident the form is complete and correctly filled out, submit it to the party requesting authorization. Always keep a copy for your records, as it might be necessary for future reference or in resolving any disputes.

Cancellation Period for ACH Authorization

The cancellation period for an ACH authorization, essentially the timeframe within which you can revoke or cancel the authorization before a transaction is processed, can vary based on the agreement with the entity initiating the ACH transaction and the policies of the involved financial institutions.

Entities initiating ACH transactions typically require advance notice to cancel an authorization. This notice period can range from a few days to several weeks before the scheduled transaction date. The exact requirement should be outlined in the authorization agreement. Banks and financial institutions may have specific timelines within which you must notify them to stop an ACH debit. It’s common for banks to require at least three business days’ notice.

Under NACHA rules, which govern ACH transactions in the United States, consumers can revoke authorization at any time, provided they give sufficient notice for the revocation to be acted upon before initiating the transaction. The practical implication is that if you wish to stop a payment, you should notify the transaction originator and your bank as soon as possible.