One Time Credit Card Authorization Form

A one time credit card authorization form is a document that cardholder signs to grant a merchant permission to charge their credit card for a single transaction. This form is critical in transactions where the merchant and customer might not interact face-to-face, such as online purchases or over-the-phone payments. The one time credit card payment authorization form typically includes the cardholder’s credit card details, the amount to be charged, and a signature that validates the transaction.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Why Use One Time Credit Card Authorization Form?

Merchants can significantly reduce the risk of fraudulent transactions using one-time authorization forms. Since the authorization is for a single transaction, the potential for unauthorized charges is minimized, safeguarding the merchant and the cardholder. Merchants also are required to adhere to PCI standards, which include strict guidelines on the storage and handling of credit card information. One-time authorization forms allow compliance with these standards by ensuring that sensitive cardholder data is not stored longer than necessary.

Moreover, one-time authorization forms give consumers precise control over their financial transactions. They can ensure they are only charged for the specific amount they have authorized for a particular transaction, reducing the likelihood of billing errors or unauthorized charges. One time credit card authorization forms streamline the payment process, especially for one-off purchases or services where setting up recurring payments is unnecessary. It makes shopping or paying for services online or over the phone more convenient and straightforward.

So, one-time credit card authorization forms play a crucial role in modern commerce by balancing the need for convenience with the imperative for security. For merchants, they simplify compliance and reduce fraud risk, while for consumers, they offer greater control and peace of mind.

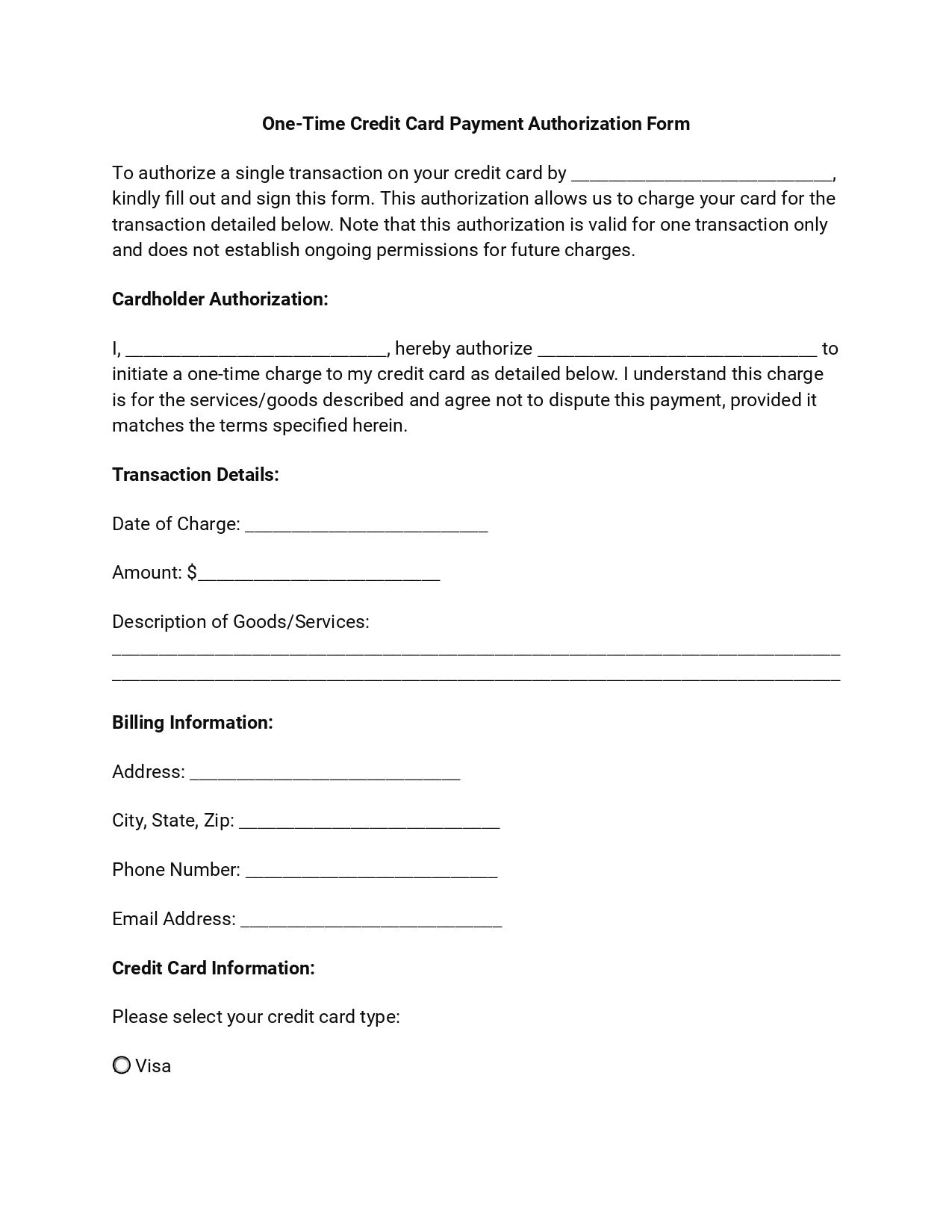

Components of the One Time Credit Card Authorization Form

This document, crucial for single transactions, captures the necessary details to process a payment while protecting the cardholder’s information. Here are the essential components that constitute one time credit card payment authorization form:

- Cardholder Information. Ensuring the merchant has accurate details of the person authorizing the payment.

- Credit Card Details. Critical for processing the transaction while maintaining security measures.

- Transaction Details. This section clarifies the payment’s specifics, including the amount and date.

- Authorization Statement and Signature. The cardholder’s confirmation of the transaction offers legal and procedural clarity.

In addition to these essentials, including merchant information and, optionally, terms and conditions can further extend the effectiveness of the form. Together, these components provide a framework that protects the interests of all parties.

Filling Out One Time Credit Card Authorization Form

Following these steps ensures a lawful transaction between you and the merchant, safeguarding both parties’ interests and providing a solid foundation for financial transactions.

1. Identify the Merchant

Enter the merchant’s name or the name of the company you authorize to charge your credit card. It ensures that the authorization is correctly directed and there are no misunderstandings about who receives the payment.

2. Cardholder’s Full Name

As the cardholder, write your full name exactly as it appears on the credit card. It establishes your identity as the authorizing party and aligns with the details on the credit card to prevent any transactional discrepancies.

3. Define the Transaction Amount

Specify the exact dollar amount you authorize to be charged to your credit card. It’s crucial to double-check this figure to prevent any errors in the amount to be debited from your account.

4. Specify the Transaction Date

Indicate the date on or after which the transaction can be processed. This date gives both parties a clear timeline for when the charge is expected to occur, providing a mutual understanding of the transaction’s timing.

5. Describe the Goods or Services

Detail the goods or services you are paying for. This description clarifies the payment’s purpose, aids in record-keeping, and ensures both parties are aligned on the transaction’s purpose.

6. Billing Information

Fill in your billing address, phone number, city, state, zip code, and email address. This comprehensive billing information is used to verify the transaction and for any necessary follow-up or receipts.

7. Card Details

Write your card type and fill in your cardholder name, account/credit card number, expiration date, CVV code, and billing zip code. These details are vital for processing the transaction.

8. Sign and Date

Conclude by signing your name as the cardholder and dating the form. Your signature is the final step in validating the authorization, making the document legally binding. Ensure the date matches or precedes the transaction date for clarity.