Recurring Credit Card Authorization Form

The recurring credit card authorization form is a simple yet powerful tool that streamlines the recurring payment process for businesses and their clients. This form is essentially a green light from the customer, giving businesses the thumbs up to charge their credit card for goods or services at set intervals without asking for permission for each transaction.

Whether for monthly subscription services, routine bill payments, or any recurring charge arrangement, these authorization form templates serve as the backbone for a seamless, automated billing process.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Are Recurring Payments?

A recurring payment is an automatic transaction where a customer authorizes a merchant to charge their credit card for goods or services regularly. This setup is advantageous for ongoing subscriptions, gym memberships, car, loans, utility payments, or any service agreement requiring periodic payments. Recurring transactions streamline the billing process, ensuring that payments are made timely without requiring manual input from the customer for each transaction.

From a business perspective, recurring payments provide a stable and predictable cash flow essential for budgeting and financial planning. For customers, they’re the epitome of convenience, eliminating the need to remember payment due dates or make individual transactions manually. This system promotes a seamless transaction experience, increasing customer loyalty by making transactions effortless and worry-free.

Understanding Recurring Credit Card Authorization Forms

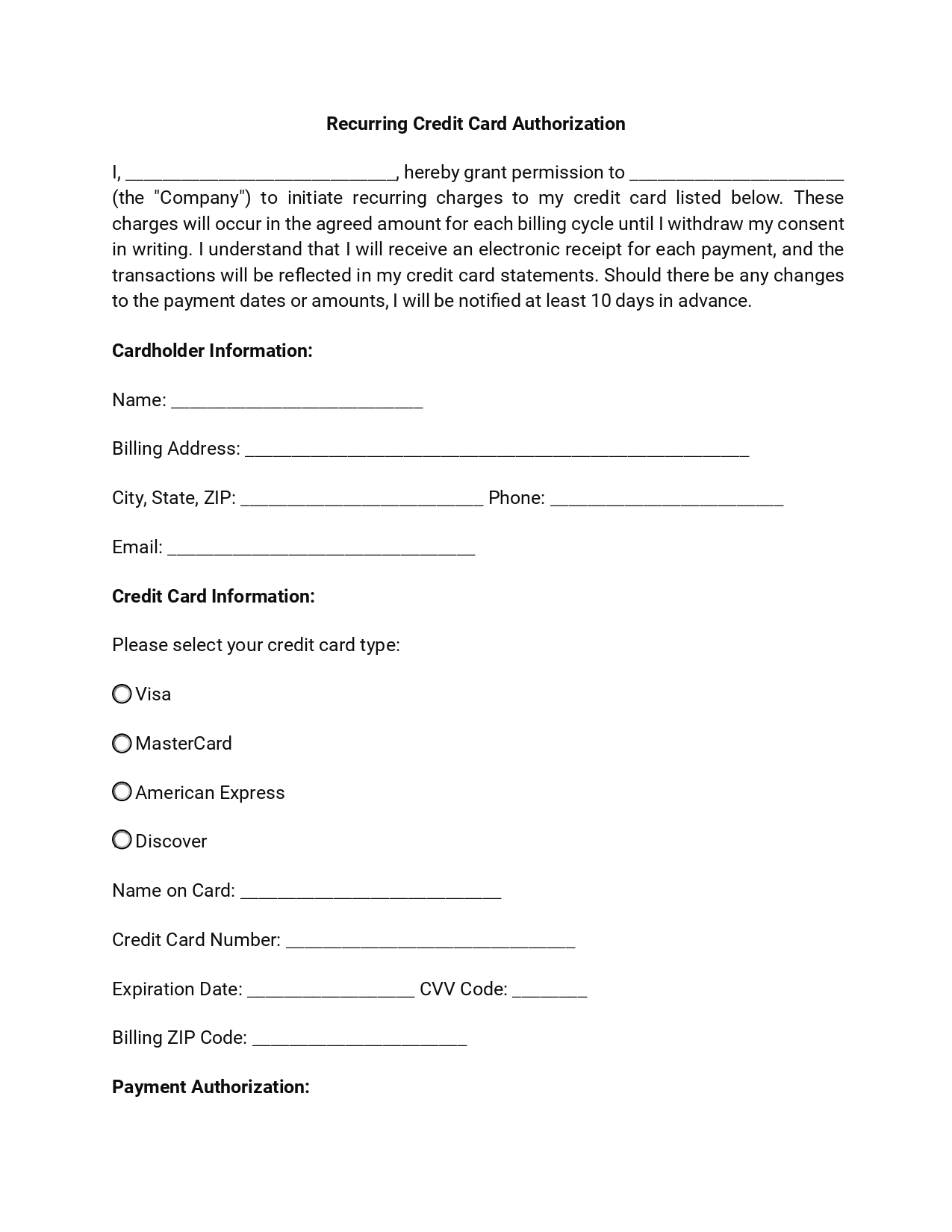

A recurring credit card authorization form is a legal document that a customer signs to grant a business permission to regularly charge their credit card for the agreed-upon amounts over a set period. The credit card authorization form is used for recurring transactions from a bank account, such as monthly subscriptions, membership fees, or regular service payments. It includes critical details like the customer’s credit card information, the billing schedule (how often and when the charges will be made), and the amount to be charged each time.

A credit card authorization form ensures businesses have the necessary consent to process these transactions automatically. It provides a streamlined, efficient billing process that benefits the business and the customer by ensuring a timely payment and reducing administrative overhead. This also means the convenience of “set-and-forget” transactions without paperwork, where customers can rest assured that their subscriptions or services continue uninterrupted without acting before each billing cycle.

Moreover, credit card authorization forms are designed to be comprehensive, often including details such as the amount to be charged, the frequency of charges, and the authorization duration. This level of detail provides a clear framework for the transactions, helping to prevent misunderstandings and disputes. It also facilitates easier account management for companies, as they have a documented agreement to refer back to, ensuring that all charges are authorized and expected.

How To Fill Out Recurring Credit Card Authorization Forms

Filling out a credit card authorization form is a straightforward process that ensures your payments are processed automatically. Here’s a step-by-step guide to accurately complete the document.

1. Understand the Terms

Before you start, carefully read through the entire form to understand the terms of the authorization, including payment amounts, billing frequency, and cancellation policy. This form section is a declaration where you, the cardholder, permit regularly scheduled charges to your credit card. It specifies that you’ll be charged a set amount at each billing period and receive a receipt for each payment.

2. Filling in Your Details

You must fill in your and the merchant’s names, establishing the parties involved in the transaction. The form asks you to specify the amount to be charged and the specific billing period (daily, weekly, monthly, etc.), clarifying how often and how much your credit card will be charged.

3. Billing Information

This part is straightforward; you’re asked to provide your billing address, phone number, city, state, zip code, and email. This information ensures that any correspondence related to the billing can be directed to you without any confusion.

4. Card Details

Here, you select the type of credit card (and provide essential details such as the cardholder’s name, account or credit card number, expiration date, CVV, and zip code associated with the credit card. This information is critical for processing the recurring payment.

5. Authorization and Agreement

The final section is your acknowledgment and agreement to the terms. You understand that the authorization remains effective until you cancel it in writing and agree to notify the merchant of any changes in your account information or if you wish to terminate the authorization. This ensures both parties understand the commitment and the procedure for any changes or cancellations.

6. Signature and Date

To finalize the form, your signature and the date confirm your consent and agreement to the recurring charges specified in the form. This act of signing legally binds you to the terms and conditions outlined, making the document a formal agreement between you and the merchant.

How to Cancel a Recurring Payment

Start by examining the recurring payment authorization form or the service agreement you initially agreed to. This document should outline the process for canceling the payments, including any notice period required and the form of notice (e.g., written, email, phone call).

Reach out to the company or merchant you have the recurring payment set up with. You can usually find contact information on their website or directly on the authorization form. When contacting them:

- Clearly state that you want to cancel your payments.

- Provide your account or customer ID and any other information they need to identify your account.

- Ask for a confirmation of the cancellation in writing (email is usually sufficient) for your records.

If you’re having difficulty canceling directly with the merchant or want an added layer of security, contact your bank or credit card issuer. After initiating the cancellation, monitor your bank or credit card statements closely to ensure the payments have been stopped. Keep an eye on your statements for at least a couple of billing cycles to confirm no further charges are being made.

By taking these steps, you can effectively manage and control your financial transactions. Also, it’s crucial to keep all documentation related to the cancellation. This includes emails, letters, and notes from phone calls (with dates and names of representatives you spoke with). This documentation can serve as evidence of your attempt to cancel the recurring payment should there be any disputes in the future.