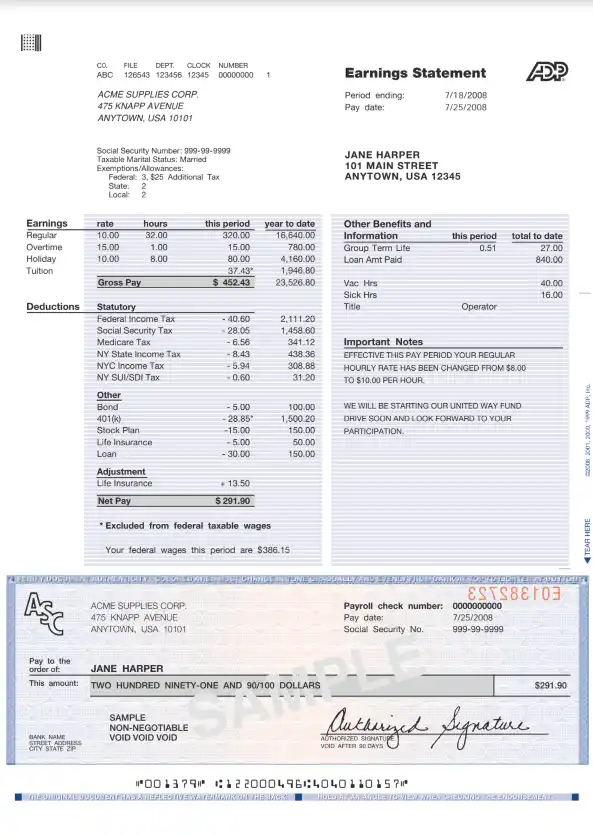

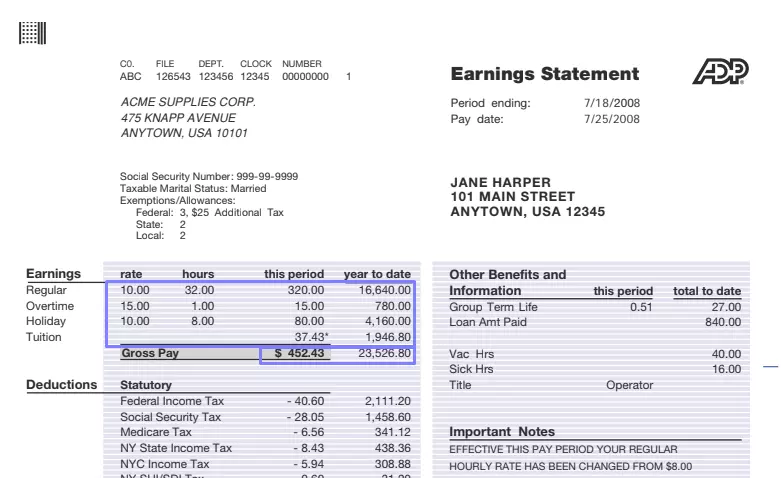

ADP Pay Stub Template is a standardized document provided by ADP, a leading payroll and HR solutions provider. This template is designed to generate pay stubs for employees, detailing their earnings, deductions, and net pay for a specific pay period. The template is formatted to include all necessary financial information:

- Employee information. Name, employee ID, and department.

- Payment details. Gross earnings, hourly rate or salary, and total hours worked.

- Deductions. Federal and state taxes, social security, Medicare, and other withholdings, such as retirement plans or health insurance.

- Net pay. The amount the employee receives after all deductions.

This structured format helps prevent payroll disputes and discrepancies. It also helps employees manage their finances by providing a clear snapshot of their earnings and deductions. For businesses, using the ADP Pay Stub Template ensures compliance with financial reporting requirements and simplifies the payroll process.

Other Financial Forms

You will discover even more fillable financial forms accessible with our tool. Down below, we selected several of the more popular forms available in this category. Additionally, keep in mind that you can actually upload, fill out, and edit any PDF form at FormsPal.

Filling Out and Reading the Template

The template must be filled out by an employer, and one copy should go to a concerned worker. The employer has to store the form in their document archives to have proof of payment with the description of the work done.

While ADP provides businesses with a special software where you, as an employer, can create all pay stubs, we also offer our advanced form-building software right here. You can draw your own ADP Pay Stub Template in a moment using our site.

Below, we will tell you how to make the form step by step. If you are a worker who has never seen any ADP pay stub ever, these guidelines may also be useful for you because we will explain what each line means. Employers, in turn, can read these instructions to define what details they should add to the form.

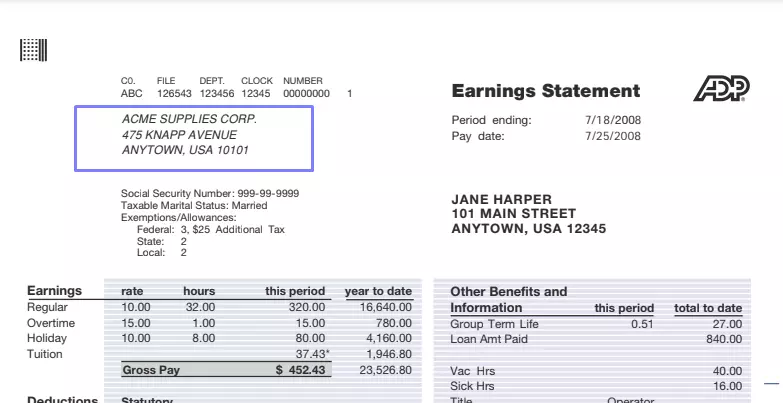

Insert Business Details

Look at the top of the page, left-hand side. Here, you should insert your business’s info: name and full address (with a postal code).

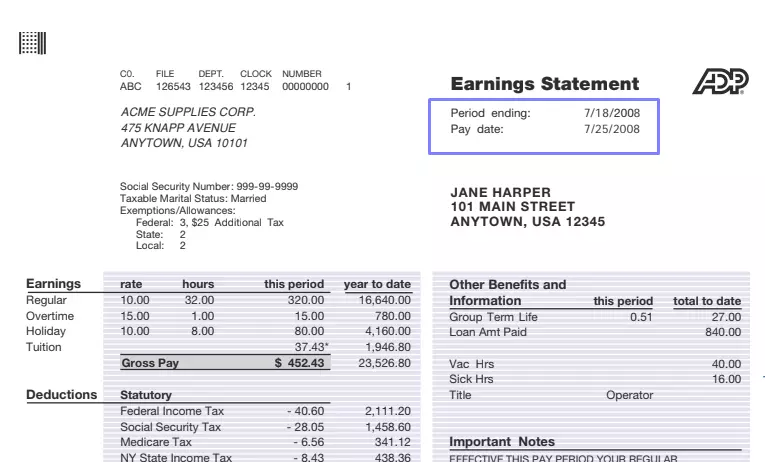

Add the Period

On the right, you have to state the period for which your worker gets this particular form. Enter the date when the period ends and when you plan to pay your employee.

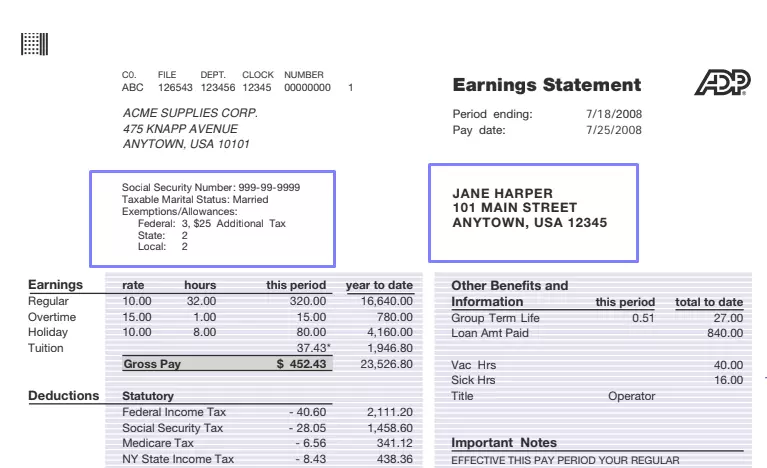

Identify the Worker

Below the period, enter the worker’s name and address. On the left, define their social security number (SSN), taxable marital status, and other details on taxation.

Describe the Earnings

You must include all appropriate types of earnings here: regular, overtime, tuition, and holiday. Each category has four columns to fill out: “rate,” “hours,” “this period,” and “year to date.”

Complete them with the worker’s earnings: add their rate per hour, how many hours they were working during the stated period, and multiply these numbers to get “this period” result for each line. At the bottom of the “this period” column, enter the total gross sum. In the “year to date” column, write the sum to receive by the worker since the year has started.

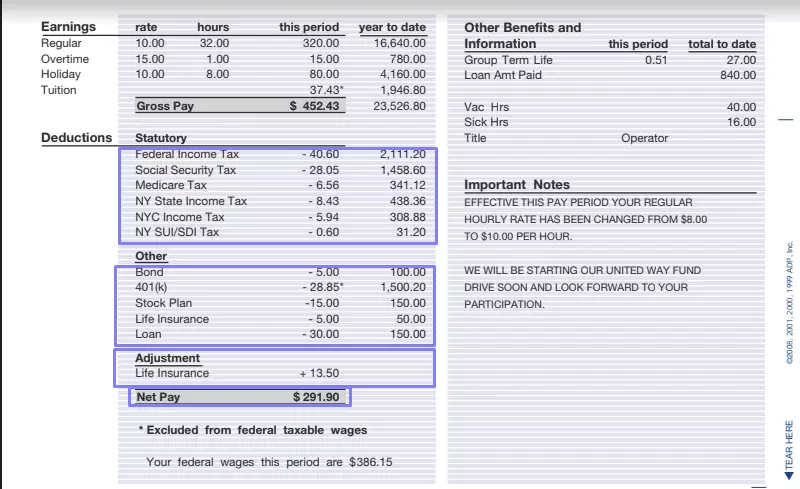

Add Info about Deductions

Below the “Earnings” chart, you will see a chart where you should describe deductions from the worker’s earnings. Line by line, enter all taxes that apply, payments that are transferred to retirement plans, insurance payments, loans, and other costs you deduct as the employer.

Count the total costs. Take the gross pay from earnings above and subtract the total costs. You will get the net sum the worker should receive. Enter the number in the “Net pay” section.

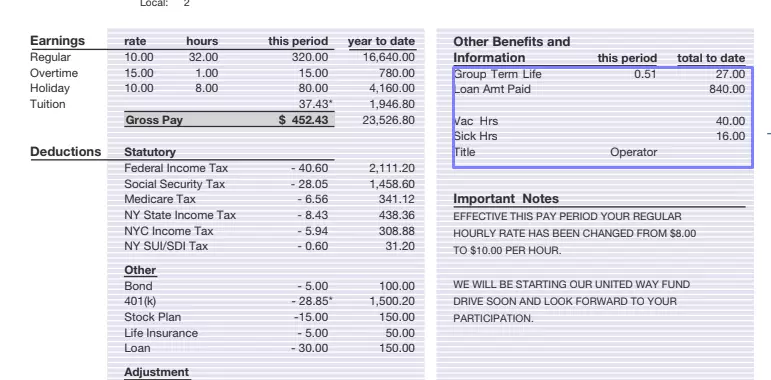

Include Other Benefits and Information

On the right, there is a chart called “Other benefits and information.” Complete this section with details if it is relevant for you and the worker in question. Here, you can add info about perks to pay while the worker was sick or on vacation, for example.

Add Important Notes

Below, you can add important notes that the worker has to read and know about. For one, here, you can notify workers about any changes that will happen soon with their wages. Another news you can add here is about starting new activities in your organization, including those requiring workers’ financial participation. If you have nothing to write in this section, you can leave it blank.

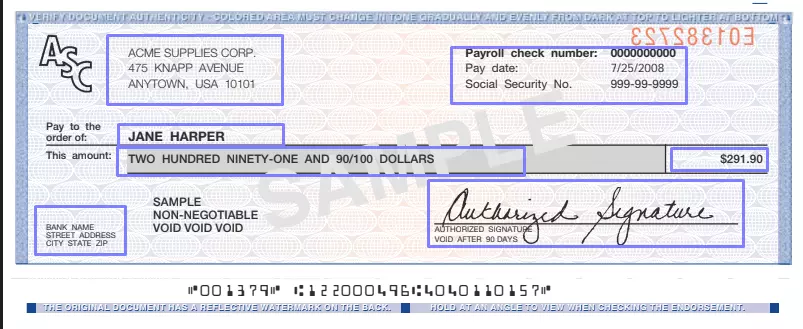

Fill Out the Check

Under all charts with calculations, you can see a payroll check itself. You have to fill it out, too, if you use paychecks to pay your workers.

Duplicate your entity’s name and address on the right. On the left, write the check number, the date of payment, and the worker’s SSN.

Enter the payee’s name and the sum written in words. Then, write the sum in numbers on the right. Below, on the left, your bank’s details should appear (its name and address).

Then, print the form and sign the check in the appropriate line. If you can sign electronically, you may not print anything and send the form to your employee digitally. You, as an employer, also should keep a copy of the form in your records.