Form 1099-A is a tax document that reports a lender’s acquisition or abandonment of secured property due to foreclosure or similar proceedings. It is typically issued by banks, financial institutions, or governmental agencies to individuals who have lost property through foreclosure, deed in lieu of foreclosure, or abandonment. The form provides essential information to both the IRS and the taxpayer regarding the transfer of ownership of the property and any potential tax consequences resulting from the transaction. Key details included on IRS Form 1099-A are:

- The borrower’s name, address, and taxpayer identification number (TIN),

- The lender’s information,

- The date of acquisition or abandonment of the property,

- And the property’s fair market value at the time of acquisition or abandonment.

This form helps ensure accurate reporting of foreclosure-related transactions and allows taxpayers to fulfill their tax obligations by reporting any resulting gains or losses on their tax returns.

Other IRS Forms for Government

If you lend money in connection with your trade or business, you might need some other IRS forms apart from the IRS Form 1099-A.

How to Fill Out the Form

If you are a debtor reading this article, you should just wait until the filled-out form is delivered to you. If you are a lender who needs to complete the template, think twice before reading the instructions below: it is much better to hire a professional who specializes in various tax records and knows how to create them properly.

It would be such a mess if you create your IRS Form 1099-A, issue it to everybody, and then find out that mistakes occurred, and you have to start the whole process over (even better with missed deadlines, right?). So, complete this template only as a last resort, when there is absolutely no possibility to hire someone who will do it for you.

Download the Proper File to Fill Out

Looking for the right and current template may be tricky, especially for some legal records. Our up-to-date form-building software is designed for those who want to get any template as fast as possible. You can use it to download the file effortlessly. Of course, you can go to the Tax Service’s official website but, with our software, you can skip this step.

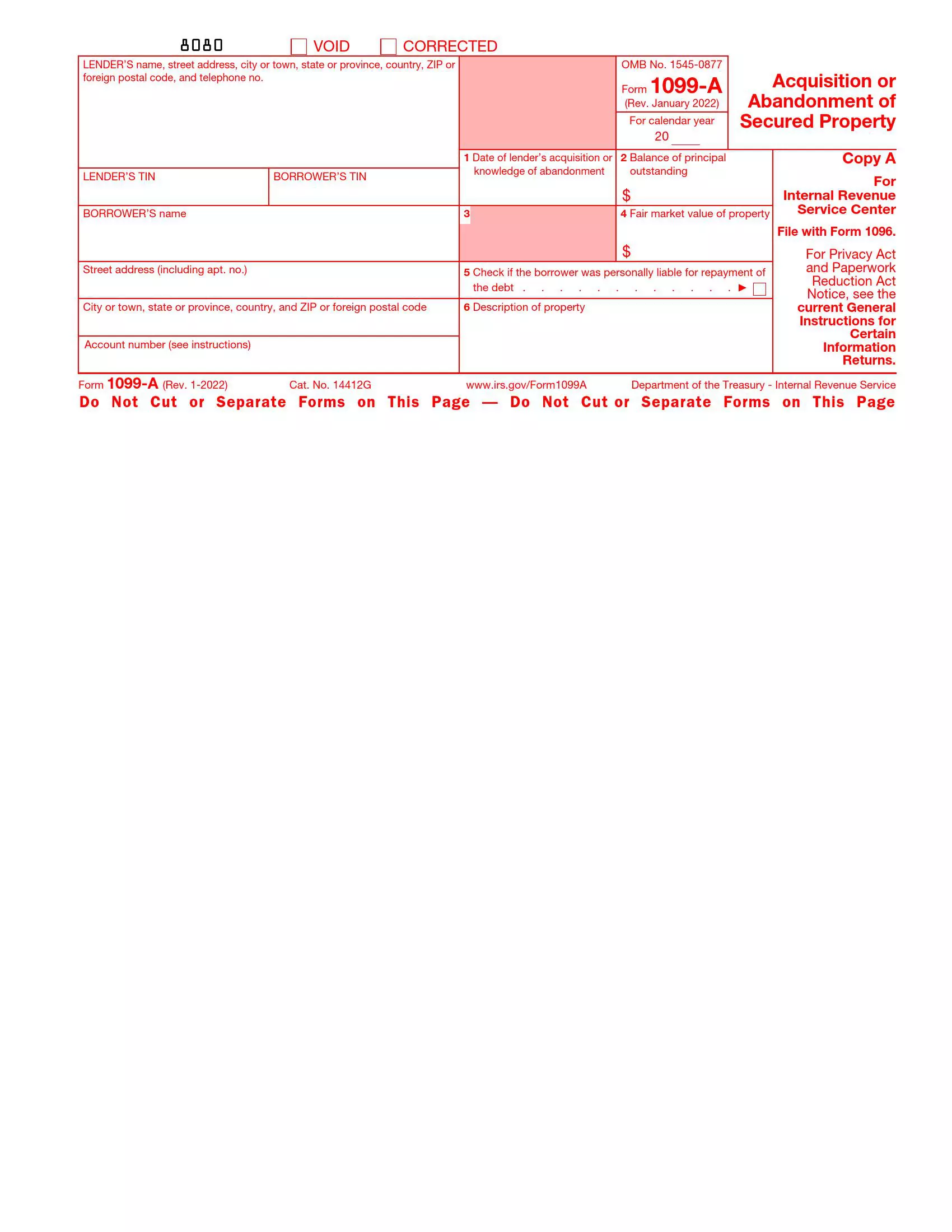

Skip the “Copy A” Part

It is crucial to understand that you, as a creditor, must know that regardless of where you download the PDF file from (be it our site or the official Service’s website), you cannot fill out the form part that you should send to the IRS. You can complete only those two parts you will use by yourself and deliver to your debtor. To get the official copy that you can submit to the Service, you must contact its representatives via the official website. If you use the downloaded copy, you will be subject to a penalty.

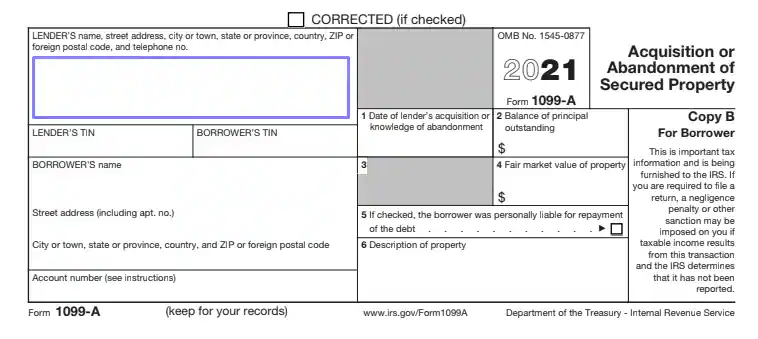

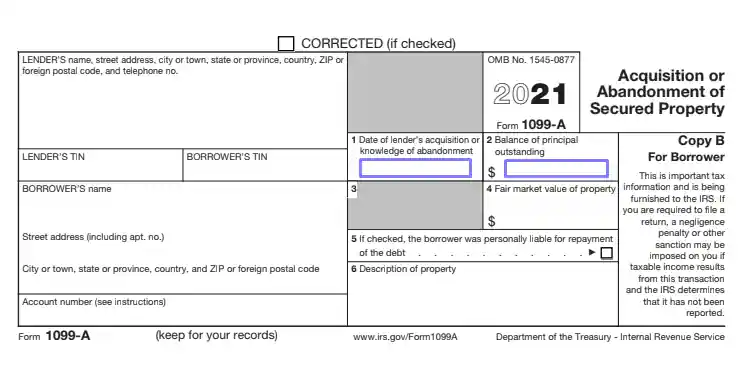

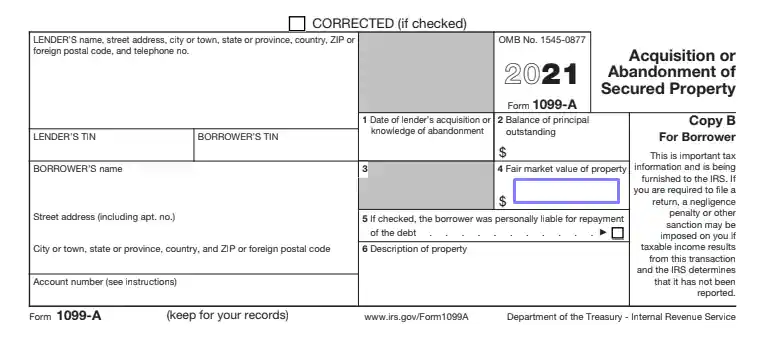

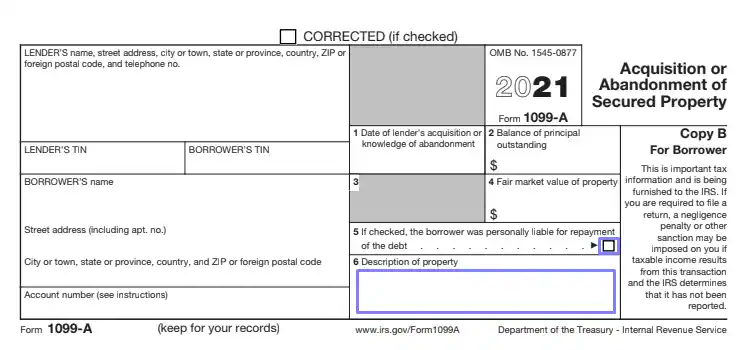

Prepare the Debtor’s Copy

The first part to fill out is Copy B or the one you will later send to your obligor. The chart you see here is quite simple.

The left-hand side fields require inserting the creditor’s and obligor’s data. Write your name, valid telephone number, and full address (including your postal code). If the obligor has any concerns regarding this record, they will be able to reach you using the address or phone number you have added here.

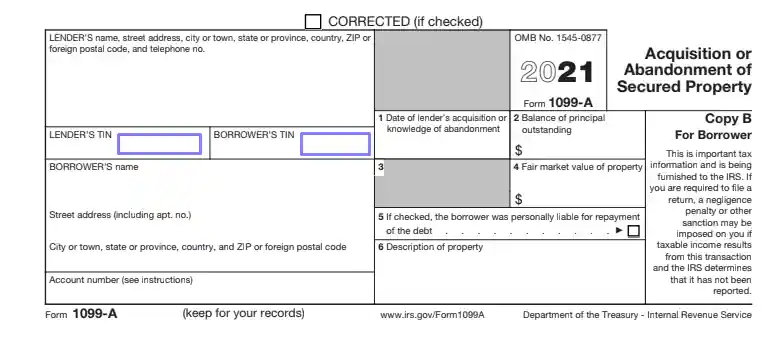

Below your data, insert your TIN (tax identification number). Nearby, write the borrower’s TIN, too.

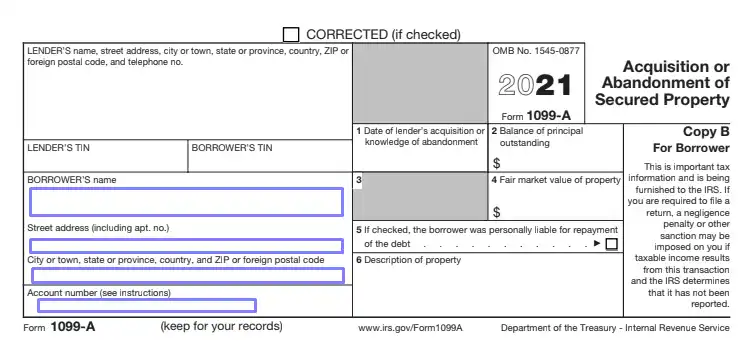

Then, introduce the borrower: put their full address and account number (many lenders use such numbers to identify their obligors easily).

After adding all the basic details, proceed to the right-hand side of the chart. Here, you will describe the debt and related circumstances. Box 1 is for the date when you acquired the property or found out that it was abandoned. In the next box, write the debt’s balance on the day indicated in Box 1.

Leave Box 3 blank because it is reserved for future Service’s purposes if the template needs to be changed. Insert the property’s fair market value in the following box.

If the obligor was personally liable to cover the debt, mark the box in Line 5 below. In Box 6, describe the abandoned or acquired estate. If it is real estate, you can enter its address. If it is anything tangible (for example, a vehicle), you can add its brand, model, manufacturing year, serial number, and other relevant details.

Remember that all borrowers must receive this copy prior to the deadline. When everything is ready, send the required number of papers to your debtors so they can review the written info and use the document for their further tax returns.

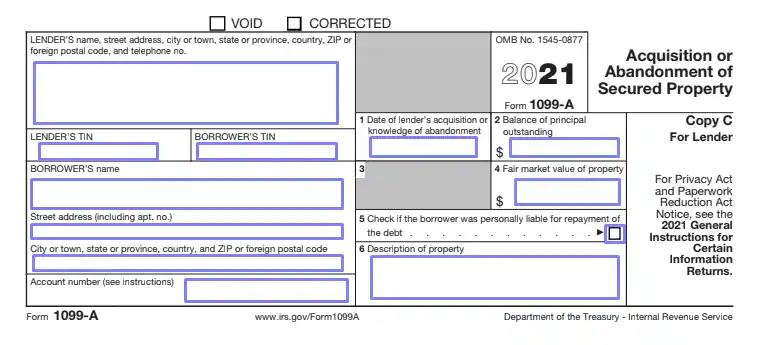

Duplicate the Details

Copy C is the one that creditors will keep among their financial records. The chart represented here is the same as in Copy B, so you shall just duplicate everything you have inserted above.

Get the Copy A to Fill Out

Bear in mind that you should get the additional Copy A file. After you get it, duplicate the inserted data because the visible chart remains the same. This record should then go to the IRS office before the deadline.

Even though the form content and the compilation process may seem simple, remember that anytime you, deliberately or not, state the incorrect or untrue details there, the consequences may be tough (including fines or even jail).