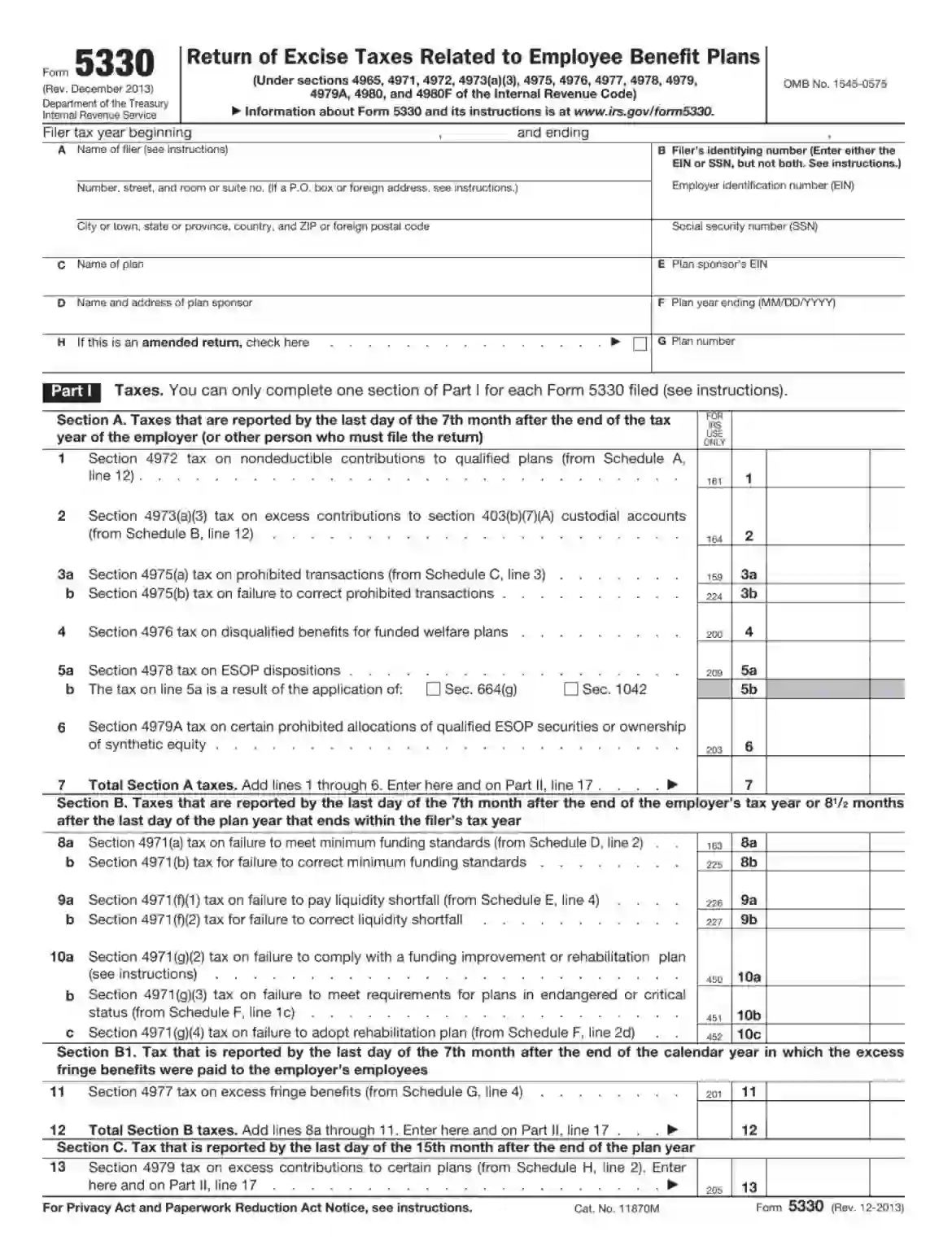

Form 5330 is an Internal Revenue Service (IRS) document called the “Return of Excise Taxes Related to Employee Benefit Plans.” It’s used to report and pay certain taxes incurred by these plans, most commonly retirement accounts like 401(k)s or 403(b)s. These taxes might arise from various situations, such as making contributions that exceed allowed limits, failing to meet minimum funding requirements, or making late deposits.

By filing Form 5330, you calculate and submit the owed excise tax to the IRS. This form helps ensure your employee benefit plan remains compliant with tax regulations.

Other IRS Forms for Business

The Form 5330 is one of the complex documents a business entity needs to file with the IRS. Look through other IRS forms every business should know about.

Filling Out the Form

To outline the scope of the form, let’s highlight some use cases of it. Under this topic, you will find situations, examples, and an indication of the person who must file the paper.

- Banned Fiscal Action

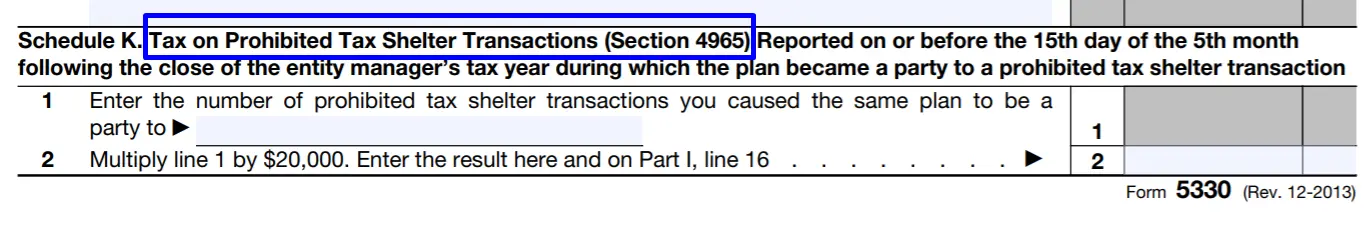

This position can be illustrated by the following example. The lessee enters into a lease agreement for the space remises and undertakes not to sublet the room without notifying the state Authority. If they make operations such as sublease, concession, or other management, it means that the Authority involuntarily becomes a participant in the operation of tax shelter. This type of violation gives the Authority the right to collect tax from the lessee.

Hereunder you will find screenshots of the Form parts that are given for a better understanding of the structure. In this case, use section 4965 in Section F (Screenshot 1) and Schedule K (Screenshot 2) of Form 5330.

This section is required to be filed by the plan entity manager who knows about conducting a prohibited transaction as well as approves it or encourages the organization to make a prohibited tax shelter transaction during a certain period (tax year).

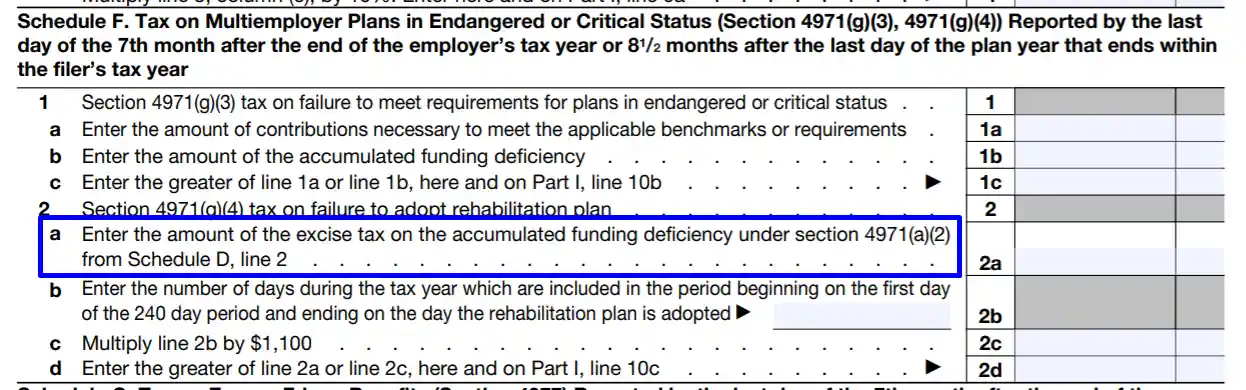

- Minimum Funding Shortage

See sections 4971(a) and (b) to apply for this occasion. This section of Form 5330 applies to employers who take part in the multiemployer plan and do not complete the funding improvement or rehabilitation program. The law imposes an excise tax liability on the employer. This means that they are responsible for each failure to pay the required contribution within the period stipulated by the plan.

“Accumulated funding deficit” means that the minimum contributions required under the plan were not paid on time for a certain period. Specify the amount of each contribution that was not paid in due time.

The section is filed by the employer who is responsible for meeting the minimum funding standards in the company, according to the general agreement.

- Non-Payment of the Liquidity Deficit

A liquidity shortfall refers to any financial obligation or liability that exceeds the cash required to meet that obligation. The deficit can be temporary or permanent.

If there is a liquidity shortfall in your tax year plan, look for section 4971(f)(1) to fill it out. Enter the required information in lines 1 through 4 and the corresponding data in Schedule E.

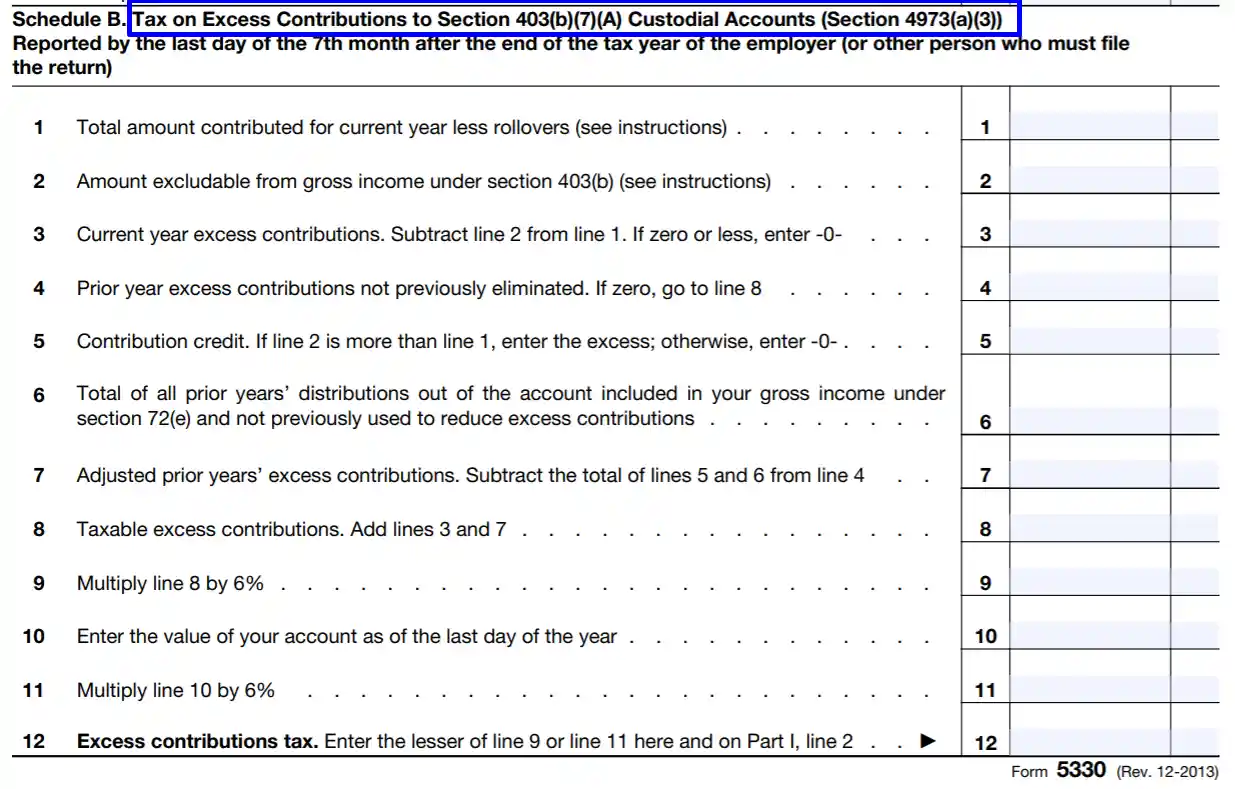

- Extra Payment to the Custodial Account

For this case, section 4973(a) is allotted in the Form. Under the 26 U.S. Code § 4973 (Tax on excess contributions to certain tax-favored accounts and annuities), excess deposit contributions on individual accounts or annuities are levied with a tax of 6%. The contribution is made by the owner of an individual tax account at the end of the taxable year. In case of a deed of gift, the insurance of life, health, and other cases provided for by the insurance are not taxed.

There are various forms of a custodial account, such as a bank, financial, or trust accounts. This can be an account created by parents for a minor or a company trust account for quick transactions with small amounts. Different exemptions may cover particular types of custodial accounts, so you should specify the terms for such an account operation when opening it.

The paper with these sections completed is filed by the individual responsible for tax payment for excess contribution to the depository account.

- Extra Fringe Benefits

Fringe benefits are the additional payment to the compensation that the company provides to employees. In general, fringe benefits are of two types, those that are provided only to managers and those that are given to all employees. Some fringe benefits offset employee costs, while others are aimed at job satisfaction. Benefits help the employer to attract new employees and retain current ones.

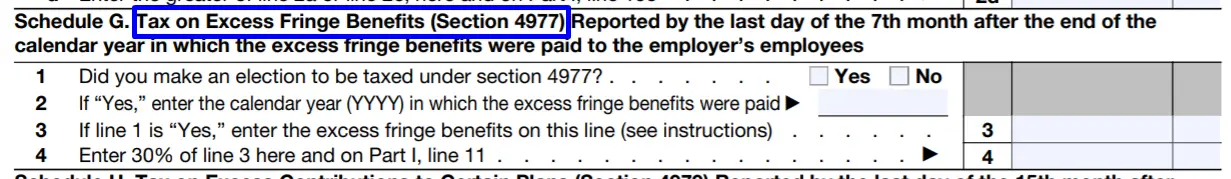

To submit a form for paying taxes on extra fringe benefits, fill out section 4977 and the corresponding Schedule G.

In this case, the application is submitted by the employer, who is accountable for paying the excess fringe benefits and has decided to be taxed under section 4977.

- Employer reversion

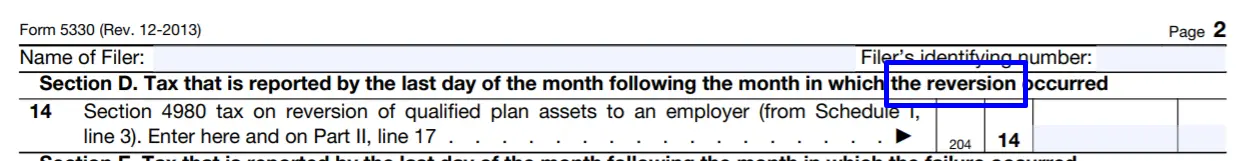

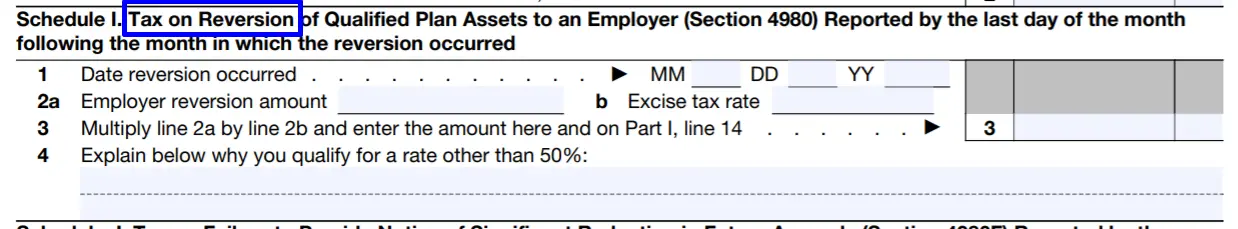

The term “employer reversion” means the amount of cash at the fair market value of the item received by the employer from the qualified plan. The tax is paid on the last day of the month after the month when employer reversion was made. See screenshots of the Form fragments to see which sections need to be filled in.

Find Section D and Schedule I for submitting Form 5330 on this issue.

This section, like the others, is regulated by law. In paragraph 4980 of the U. S. Code that is named “Tax on the return of qualified assets of the plan to the employer.”IRS Form 5330. The rest of the sections can be filled in following the example of these items. The main thing to consider is which sections of the document to complete and who must file the paper. More information about mentioned and other sections is provided by the official instruction, so we do not intend to analyze all the points. Instead, let’s take a look at the general guide on filling in, where the most important points are once again marked.