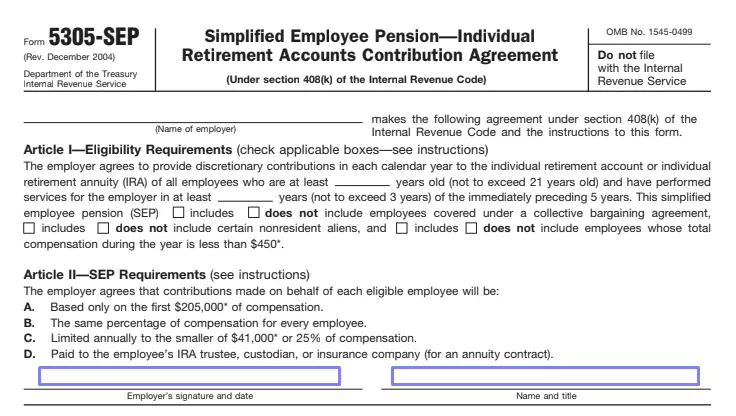

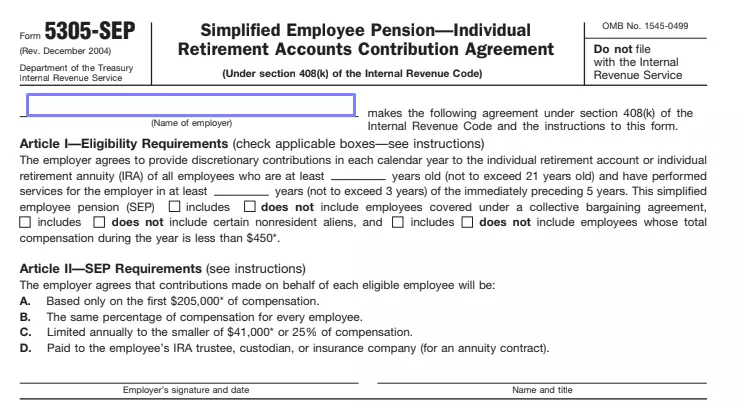

Form 5305-SEP is a standardized agreement offered by the Internal Revenue Service (IRS) to set up a Simplified Employee Pension (SEP) IRA plan. This form simplifies the process for small businesses that want to offer retirement savings options for their employees. By adopting it, employers establish the rules for employee participation, contribution amounts, and allocation methods.

Form 5305-SEP offers several advantages. It eliminates the need for employer-sponsored IRAs and simplifies filing requirements. However, there are limitations. Employers cannot use the form if they already have another qualified retirement plan or use leased employees. Additionally, contributions must follow a set formula and go into traditional IRAs set up by each employee.

Other IRS Forms for Business

Apart from the form for involving the pension plan in business, there are plenty of other forms every business should be familiar with.

How to Fill Out the Template

If you are an employer seeking a proper template to set up your plan, you can use the above-mentioned form or ask experts for help, so they build an accurate template for your business.

Going for the first option makes sense because it is much quicker: you can get the form right here and now, and you do not have to pay any specialists from the outside. Just use our user-friendly form-building software to download the template without effort; our instructions below will show how to fill it out correctly. If needed, you also can get it on the Service’s site, but since you are on this page, why leaving, right?

See our short manual below after you get the form.

Add the Employer’s Name

Introduce the employer who has decided to provide their workers with a simplified plan. It should be the entity’s name here because the signing representative will indicate their name later.

Define the Conditions of Your Plan

You should choose several conditions of the plan your entity will use. In the text of Article II, you will see a couple of blank lines and boxes to mark.

To start, determine the age of workers who can participate in the plan. It should be no less than 21 years old — employees who are younger cannot sign up for the plan. Then, insert the number of years that employees should work for to be the plan participants (must be no less than three according to the SEP rules).

Read the following statements and indicate if they are applicable to your case or not by checking “includes” or “does not include” boxes.

Check the Requirements

In the second part, you will see a set of requirements one needs to be aware of when signing the form. Read them all and check if your entity is qualified for them. If any of those seem obscure, ask your entity’s accountant or tax expert for clarification.

Sign the Paper

You should accomplish a final step to establish the pension plan: sign the document. Near the signature, enter the date of signing. On the right, enter your name and title.