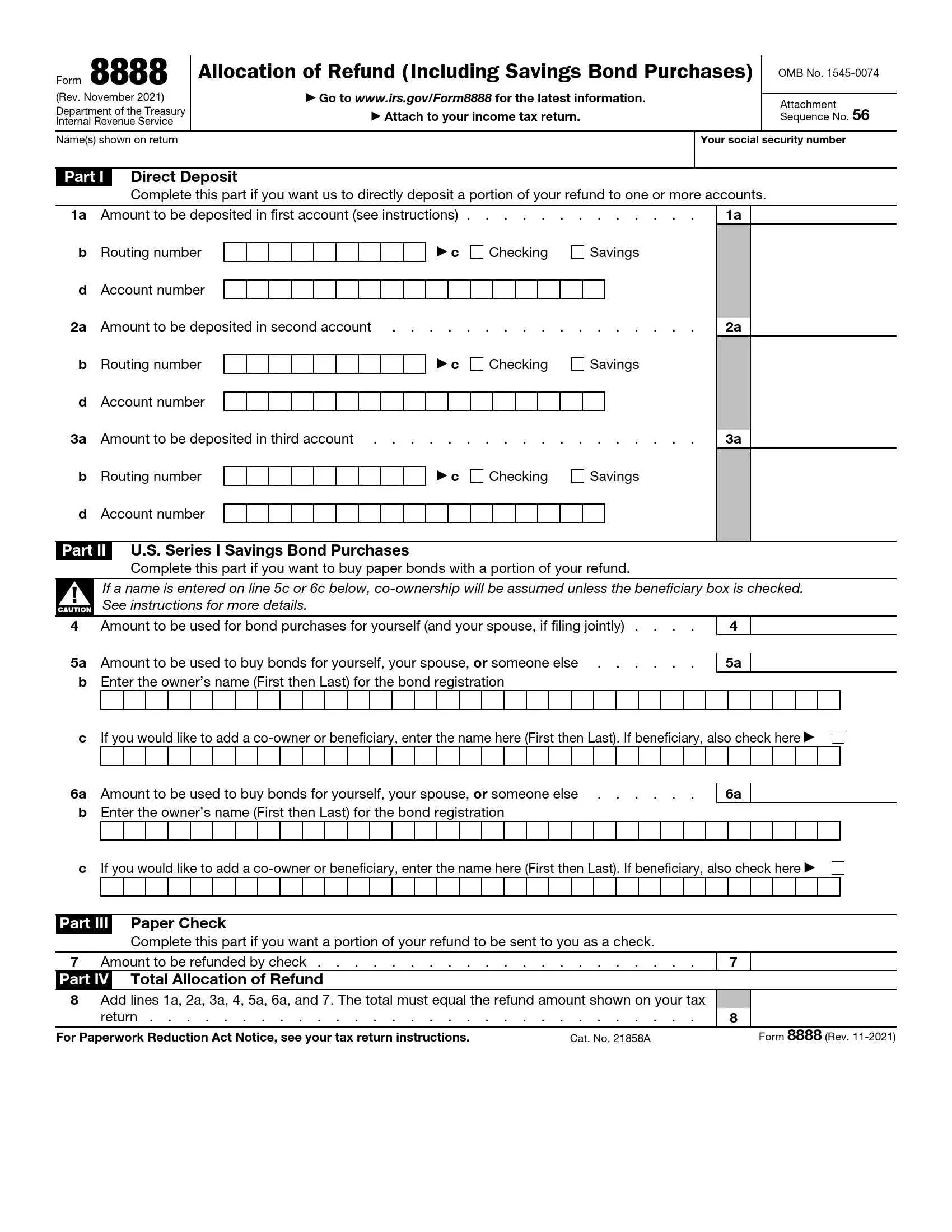

Form 8888 allows taxpayers to allocate their federal tax refund directly among several accounts, such as checking, savings, or retirement accounts. Additionally, taxpayers can use this form to purchase U.S. Series I Savings Bonds with part or all of their refund. Form 8888 enables individuals to manage their refund more efficiently by dividing it into different financial streams to save, invest, or use for immediate expenses directly from their tax return without transferring funds after deposit.

The purpose of Form 8888 is to provide taxpayers with flexibility and control over how they receive and use their tax refunds. By allowing the refund distribution into multiple accounts, the form helps taxpayers plan for immediate and long-term financial goals, encouraging savings and prudent financial management.

Instructions For This Application

Filling out tax returns requires focus, care, and seriousness. It is not an easy process because any mistake or inaccuracy leads to cancellation or even penalties. Therefore, carefully fill in the fields and check your data several times. Use our form-building software if you have difficulties.

Input general data

In the top line of your tax return, enter your first and last name, as well as your social security number. It will allow the tax authorities to identify your identity and generally simplify the procedure for obtaining a refund.

Specify direct pledge and sum

As for the direct deposit, fill in the refund amount you want to get to your bank accounts. As a rule, the minimum deposit is one dollar. The accompanying lines (1b, 2b, 3b) are route numbers, and they consist of nine digits. You may also enter the account number consisting of 17 symbols.

In the “C” items, select only one bank account (checking or savings), select the checkbox in one field. If you have any questions or difficulties, contact your financial institution for support. You must choose the correct account to know for sure that your deposit is accepted.

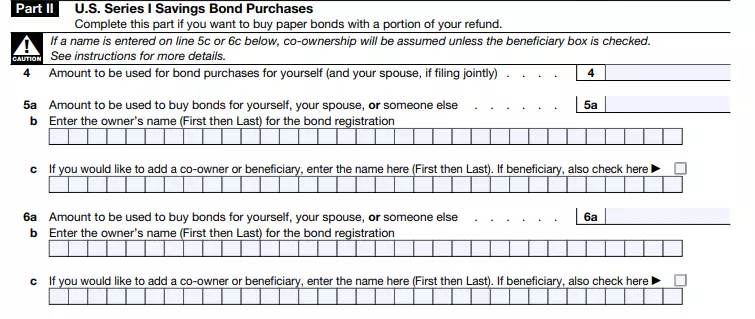

Define the bond

As already noted, thanks to this form and distribution of the refund, taxpayers can buy savings bonds for this amount. When completing this part of the application, request up to three registrations of these securities. According to the rules, each registration must be a multiple of $ 50, and the total amount of the bond purchase must not exceed $ 5,000.

Next, enter the amount you will spend on buying the bonds. If you want to add a co-owner or beneficiary, enter their first and last name in the appropriate lines. When filling out the form, do not use nicknames and write the letters clearly and clearly. By the way, financial institutions issue bonds only in the name that you specify. Use our form-building software.

In general, buying and selling bonds is an effective mechanism for additional earnings. A bond is a promissory note issued by the issuing company. When people buy bonds, they lend money to the company’s representatives. They use the money for their development, which later becomes the reason for a constant income. The bond is the only financial instrument that warns the buyer about the amount of income.

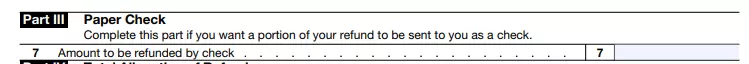

Mind all parts of refund

The Tax Service does not deny the existence of difficulties in transferring the deposit. Therefore, if part of your refund is not considered, request a paper receipt. In the future, the tax authorities will send it to you by mail. Do not neglect this condition to avoid risks and misunderstandings.

Input total sum

The final section of this tax return includes the entire amount of your distribution refund. Specify this in the appropriate line and check the data you entered several times. Also, sign all the documents because it ensures the transparency of the procedure and your responsibility. You may also use the help of a tax specialist or a lawyer. It will reduce the time to fill out tax documents, save you money and nerves.

What else do you need to know when filing tax forms? The Tax Administration, like any other government agency, sets a specific deadline for submitting documents. So, find out in advance all the information that could help you. Late completion and submission of returns lead to the refusal to review your data or even to fines.