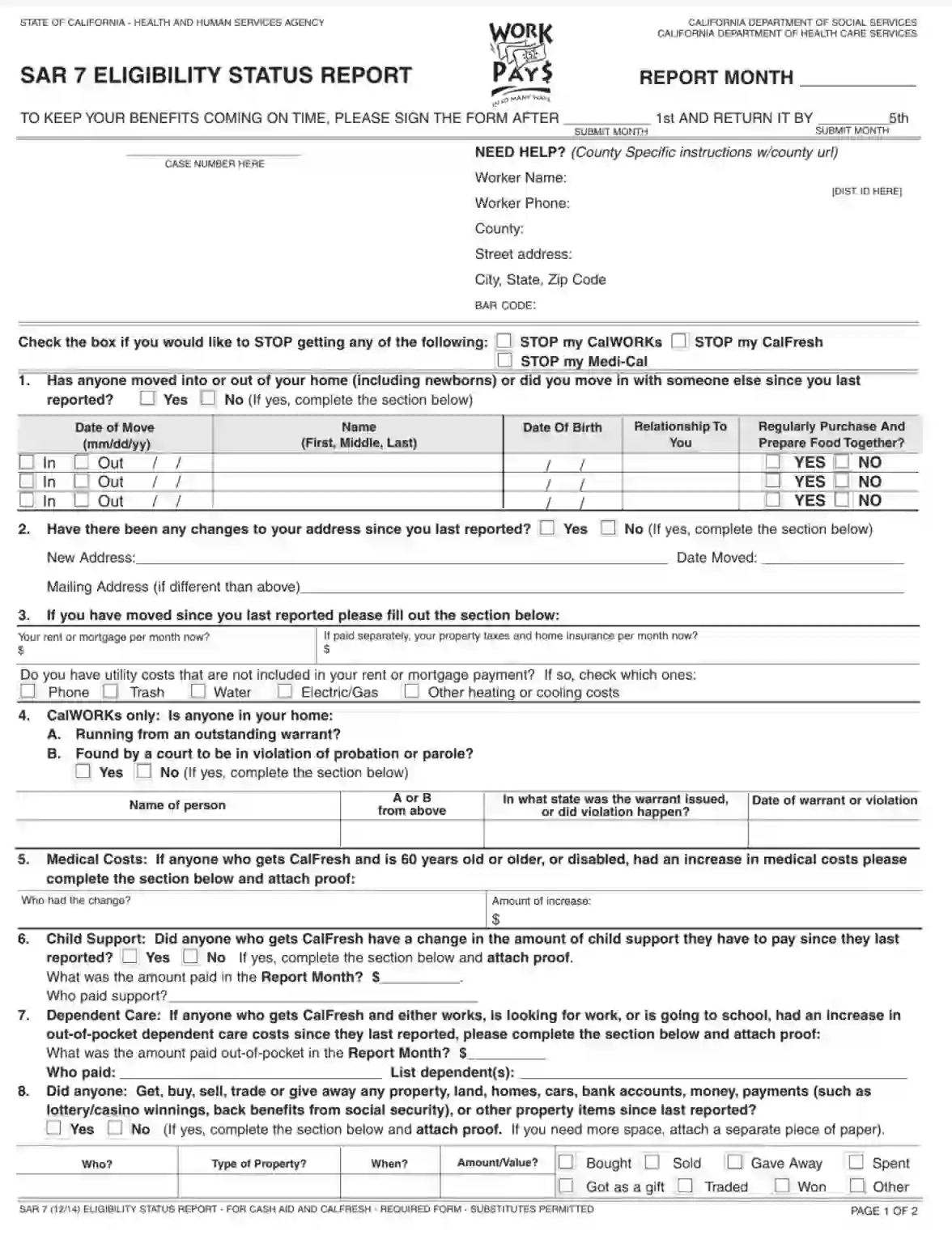

CDSS Form SAR-7 is a semi-annual eligibility status report required by the California Department of Social Services (CDSS) for individuals receiving cash aid and CalFresh benefits. This form is a critical update that recipients must complete to report any changes in their household circumstances that could affect their benefit eligibility. These changes might include variations in income, household composition, residence, or other significant factors.

The form is designed to ensure that all information is current and accurate, helping the state determine the correct benefit amounts. Recipients must complete and return this form to avoid interruptions in their benefits and comply with state regulations regarding benefit accuracy.

Other California Forms

Take a look at some other California forms available for editing in our software. Additionally, keep in mind that you are able to upload, fill out, and edit any PDF form at FormsPal.

How Do I Fill It Out Correctly?

The Form is quite complicated, and a person who completes it for the first time may need to consult a legal specialist. We recommend that you use our form-building software to ensure you obtain the most recent customized PDF template.

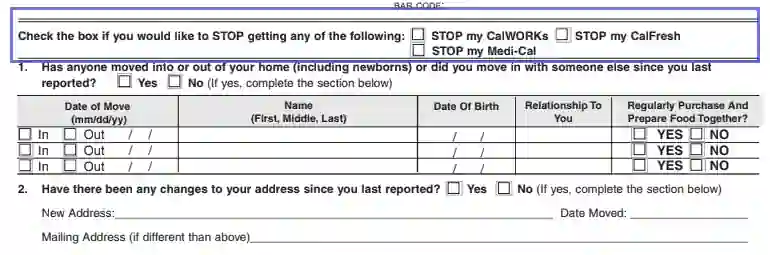

- Ask to Stop Benefits

The first field to complete is declaring that you wish to stop your CalWORKs, CalFresh, or Medi-Cal, if applicable. You may choose to contact your local county to do so.

- Add Household Info

If an individual has moved into or out of your household within the last six months, indicate that in this section. It may be a registered domestic partner, a newborn, a temporarily absent relative (moved away to get medical treatment or education), and so on. You will also have to provide essential data about this person, including their full name, date of birth, relationship to you, and whether you regularly buy and cook food together or not.

- Indicate Address Changes

If you have moved to another location since you last reported, input a new address, the date you moved on, and your phone number.

- Indicate Housing Costs

To prove that you have moved to a new home, you must indicate your current rent or mortgage per month, property taxes, home insurance, and other utility costs.

- Add Fleeing and Parole

If you get CalWORKs benefits, indicate whether a member of your family is running from the law or in violation of parole or probation.

- Insert Medical Costs

Those individuals who are 60 years of age or older or disabled persons might have needed to increase medical expenses. If that happened, insert the name of this person, the amount of increase in US dollars, and attach proof.

- Mind Child Support

If anyone in your household has had changes in their child support payments, indicate the paid amount, and provide information about the minors.

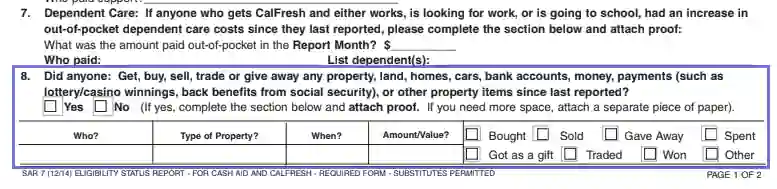

- Specify Dependent Care

Those persons who faced an increase in out-of-pocket dependent care costs and are currently working, looking for a job, or getting an education, have to provide extra details about the situation.

- List Property

List anyone who has bought, sold, given away, won, or spent any property, including land, home, cars, and so on.

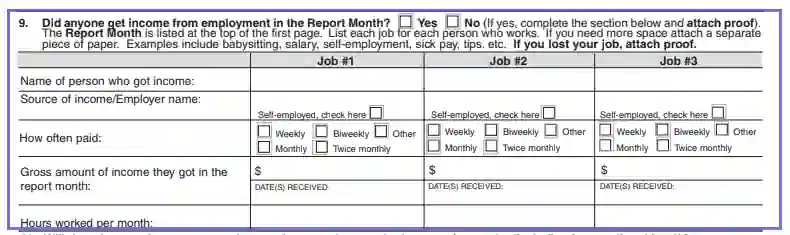

- Add Employment Income

Those persons who are currently employed must indicate their income source, how frequently the salary is paid, the gross amount of income they got in the report month, and the number of working hours.

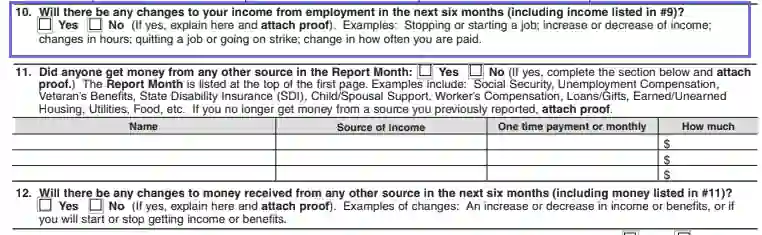

- Fill Out Employment Changes

If you expect your income to change in the following six months, explain why, and attach proof.

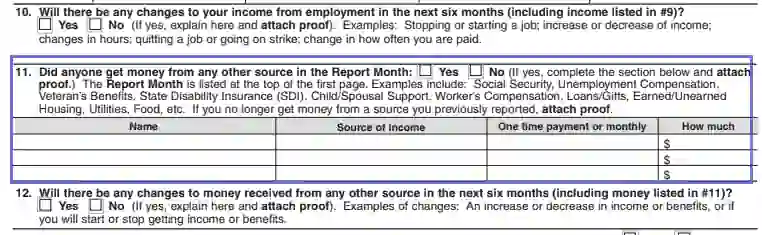

- Indicate Other Income

Apparently, not only being a staff member in a company may provide you with monetary funds. List those people living with you who got social security, SDI, alimony, gifts, and other types of financial support.

If you believe that the situation will change in the foreseeable future, say why, and attach proof.

- Indicate Any Other Changes (CalWORKs Only)

Tick the corresponding boxes if anything has happened to you within the last reporting period, including family change, custody, immigration, or other things.

- Sign the Form

Review all the information submitted. Make sure that it is true and correct — providing misleading and false statements is a crime and will lead to legal punishment.

Append your signature, date the form, indicate your phone numbers, and submit the paper thereafter.