Form 1098-E is a tax form issued by lenders, including banks and educational institutions, to borrowers who pay $600 or more in interest on student loans during the tax year. The “Student Loan Interest Statement” form is crucial for individuals seeking the student loan interest deduction on their federal income tax returns. The IRS Form 1098-E details the amount of interest paid by the borrower over the year, facilitating the deduction process by providing the necessary documentation to support the claim.

Form 1098-E allows taxpayers to deduct student loan interest from their taxable income, which can lead to significant tax savings. This deduction is especially beneficial for recent graduates or individuals in their careers who typically face substantial student loan debt. Using the information provided on Form 1098-E, borrowers can reduce their adjusted gross income, potentially lowering their overall tax burden. The availability of this form simplifies the process of claiming a student loan interest deduction, ensuring that taxpayers do not miss out on this valuable financial relief opportunity.

Other IRS Forms for Government

IRS forms are used for a variety of objectives and to meet the demands of different types of taxpayers. If you haven’t discovered the proper form for your needs yet, go through some additional forms to see if you can locate one.

What Does the Form Consist Of?

On the official Revenue Service website, you will find a 6-page document with the form that includes the following passages:

- Sample warning;

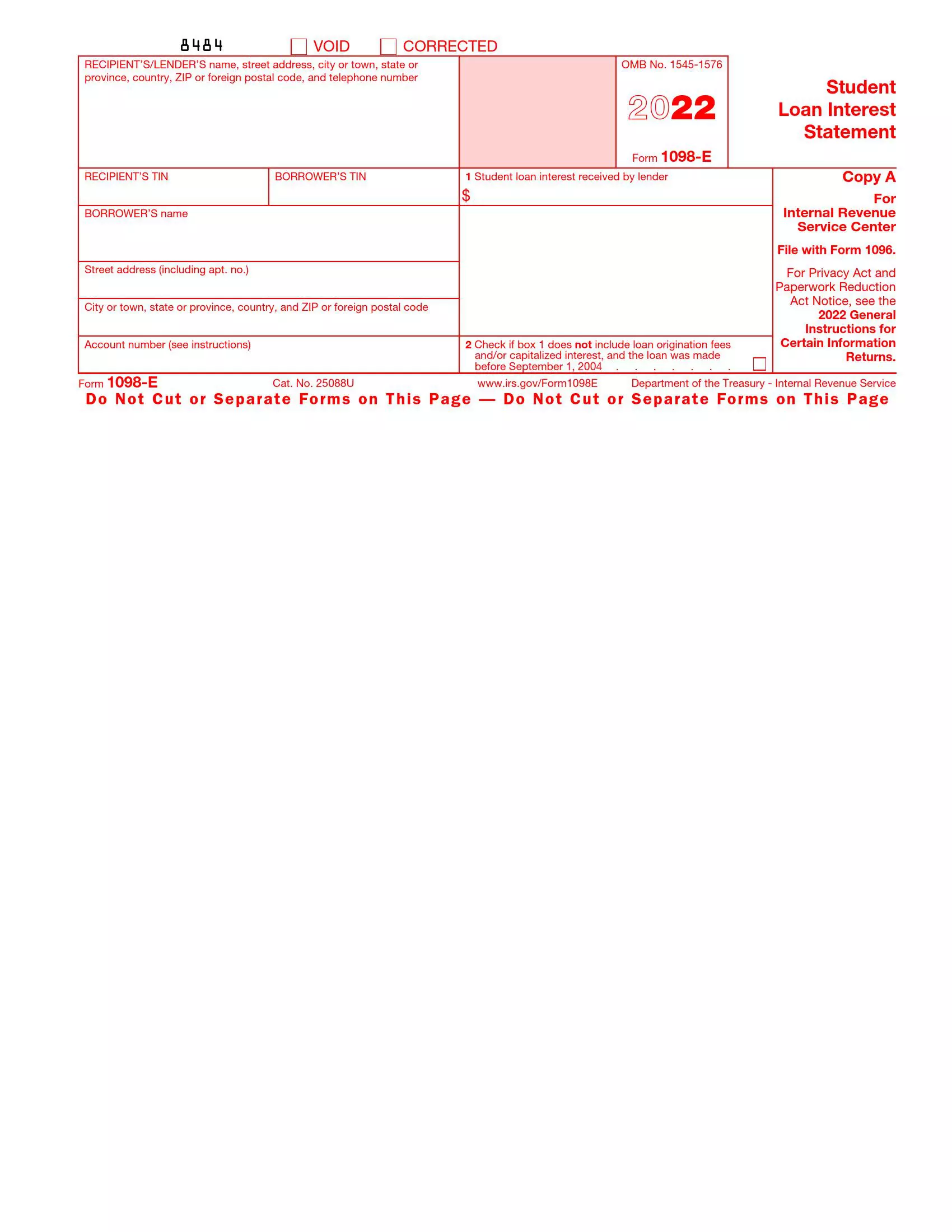

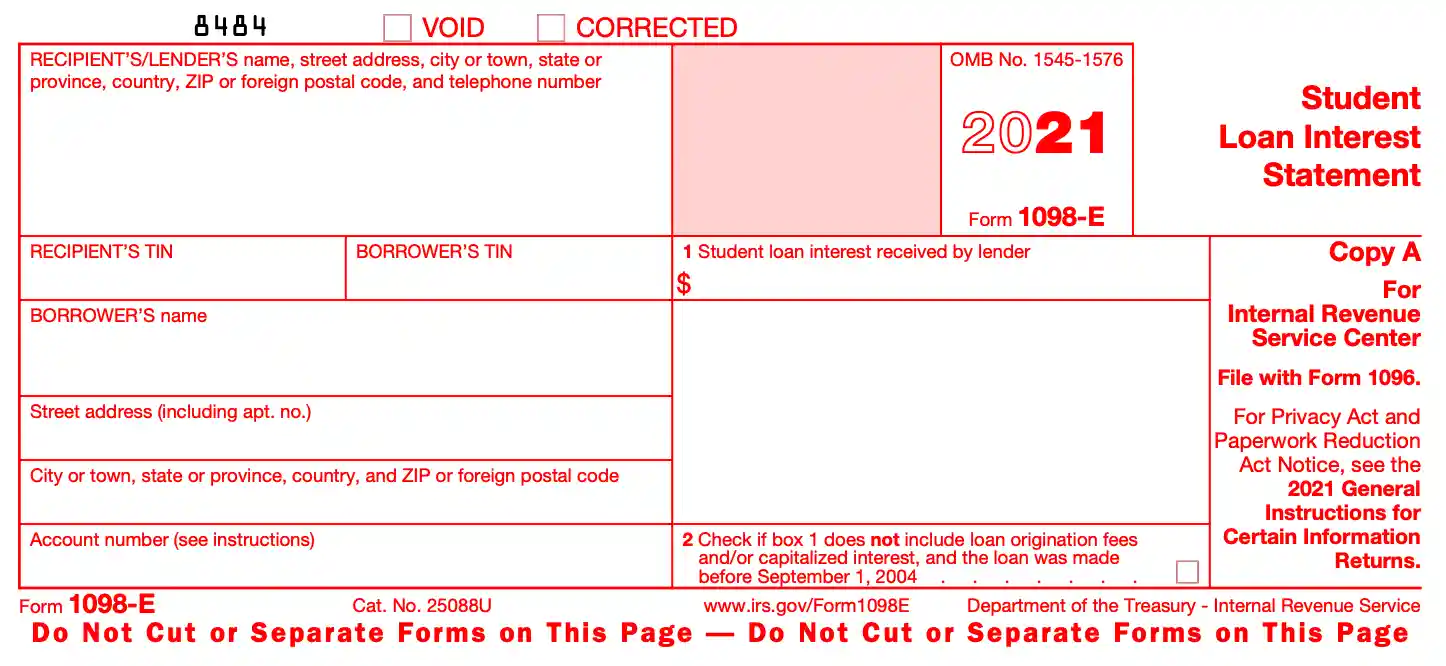

- Copy A is a sample document that is for informational purposes only and is not subject to completion.

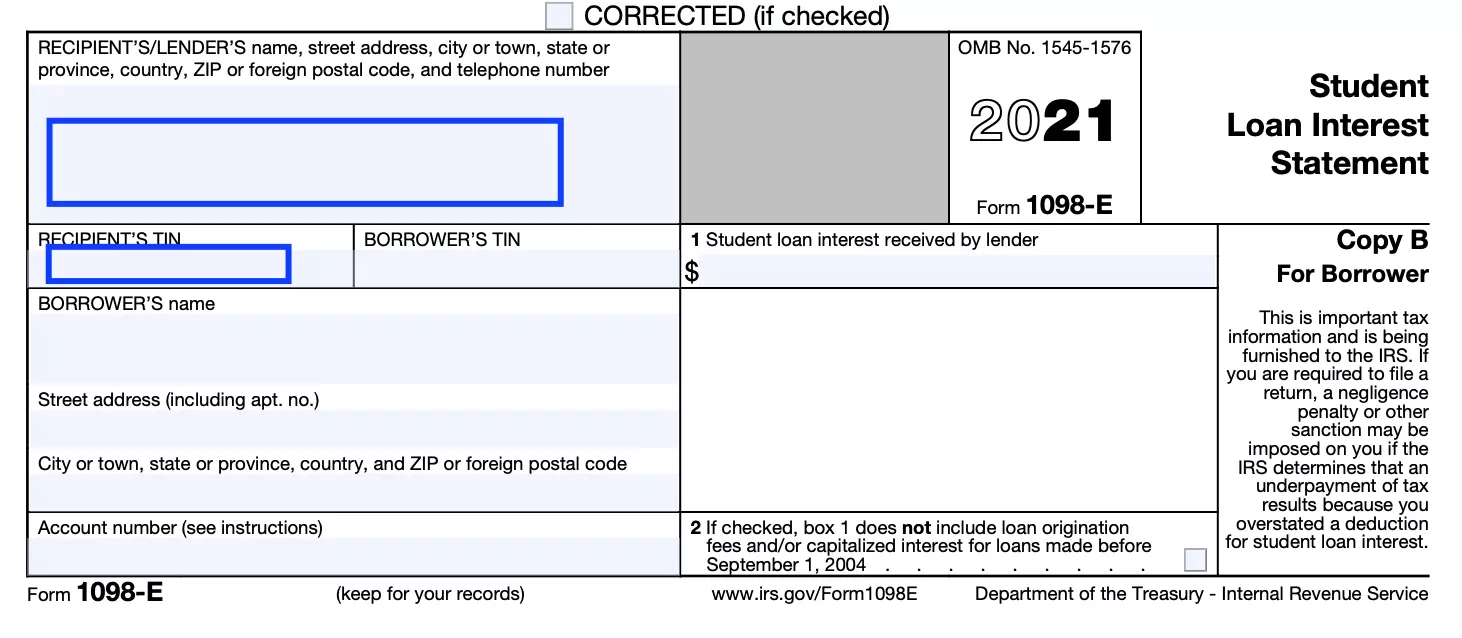

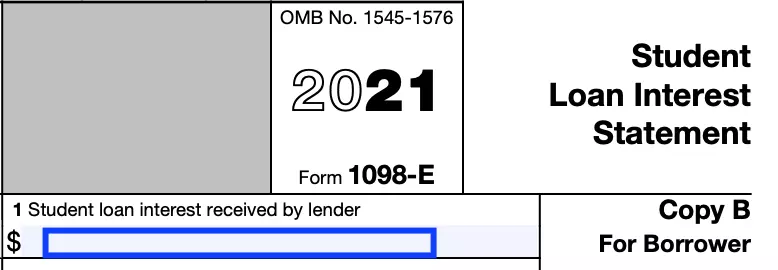

- Copy B for Borrower (meaning the student);

- Instructions for a borrower;

- Copy C for the recipient (for the institution that issued you the loan);

- Instructions for Lender.

Let us consider the contents of the respective copy and learn how to fill it out correctly. Below, you will find a comprehensive guide with the rules, requirements, and recommendations.

Enter the Data of Loan Issuing Organization

These boxes contain the name, full address, and a TIN of the organization to which you pay interest on your student loan.

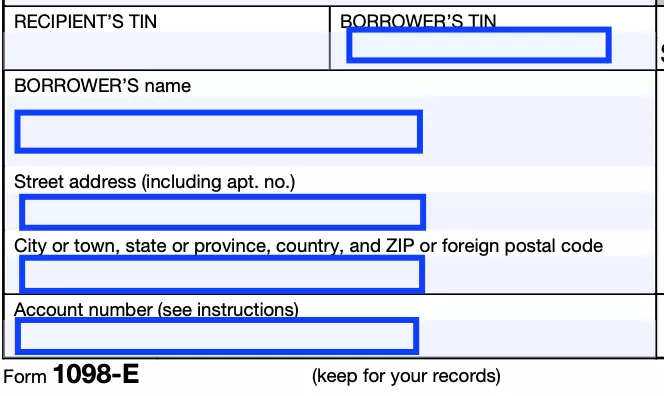

Provide Your Personal Data

Here, you must enter the respective data concerning you personally: full legal name, address, TIN, account number, which identifies you to the creditor.

Insert the Amount Paid Annually

It is at this point of filling out the form that the lender shows the amount of interest paid by you in one year. Remember that you need to meet the requirements of the payment rate to be eligible to file.

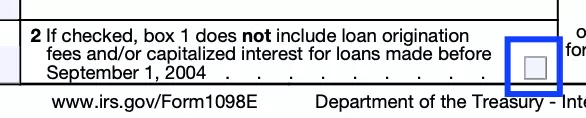

Check the Amounts of Tax Paid

If you put a checkmark in this section, it will show the tax office that the above amount does not include fees made before September 1, 2004.