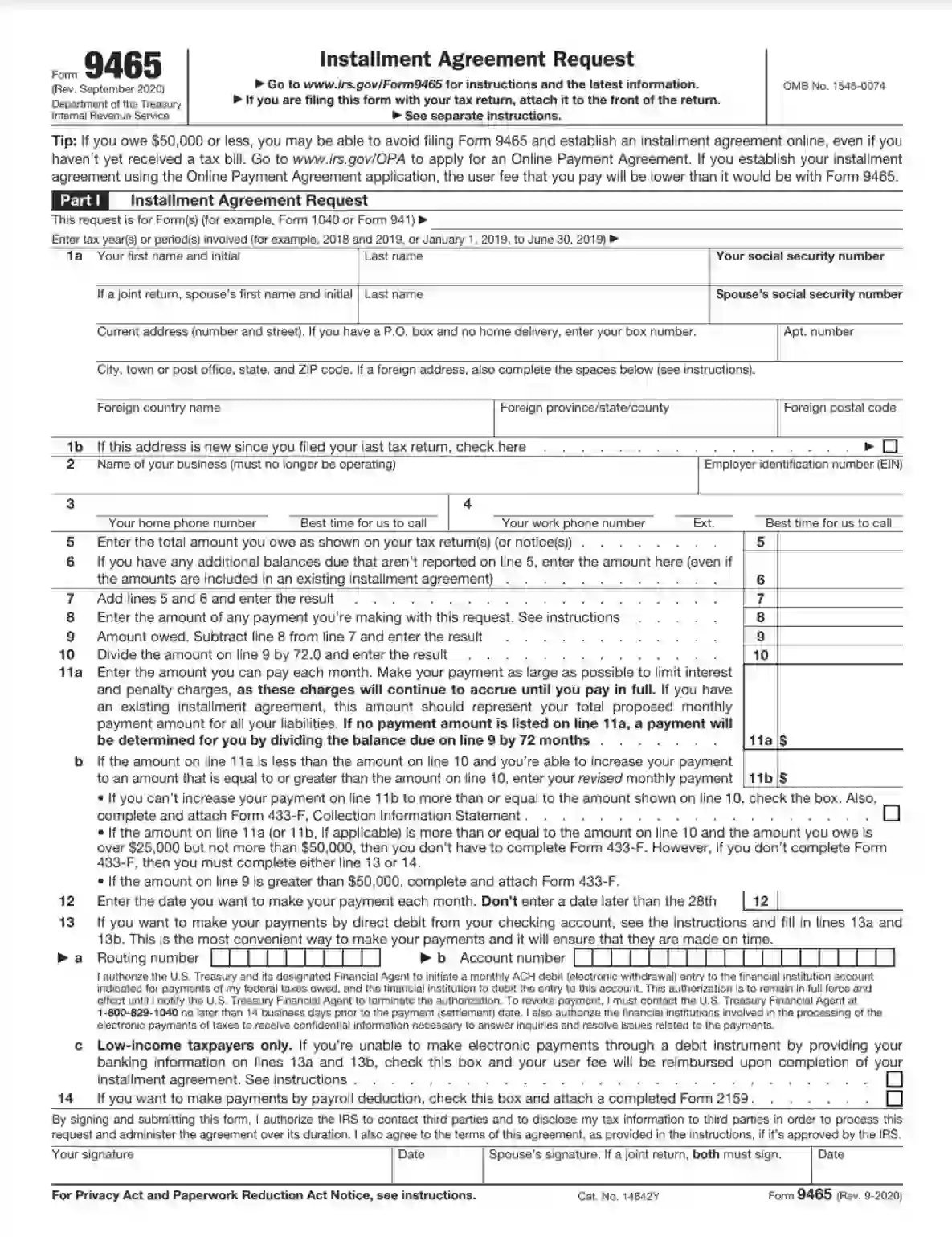

IRS Form 9465, titled “Installment Agreement Request,” is used by taxpayers who must set up a payment plan to pay off their federal tax debt over time. This form is helpful for individuals who cannot pay their entire tax bill by the due date and would like to avoid non-payment consequences, such as penalties and interest. When completing Form 9465, taxpayers must provide:

- The amount of tax they owe,

- The monthly payment amount they propose,

- Their preferred payment due date.

By submitting this form, taxpayers can negotiate terms that fit their financial situation, subject to IRS approval. The IRS will review the taxpayer’s proposed terms and may adjust them based on their overall ability to pay. This form is essential for managing tax debt responsibly and avoiding more severe financial penalties.

Other IRS Forms for Individuals

Individuals as a separate category of taxpayers are required to fill in and send specific tax forms which will depend on the complexity of their finances and some other factors. Learn what IRS forms might be required in your situation.

How To Fill Out the Form

Before filling out and submitting the application, carefully read the step-by-step instructions. Fill in all the lines by the rules, clearly and correctly. Do not rush so as not to make mistakes.

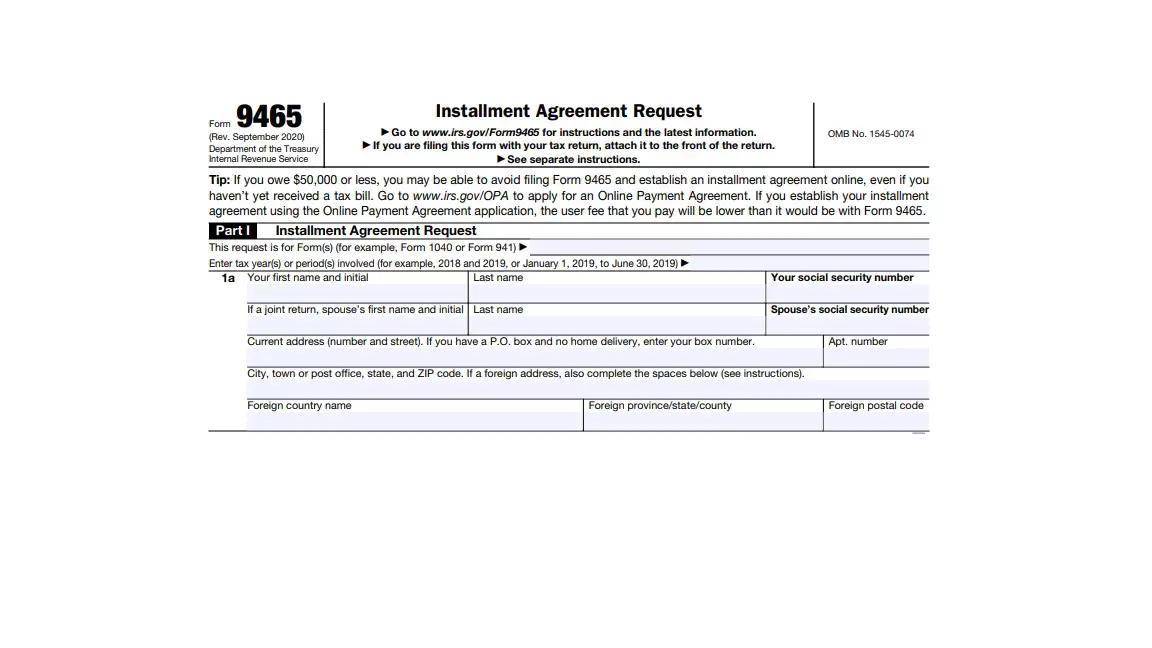

Input general information

Firstly, fill in your details. The form asks for your first name, last name, and social security number. If you complete the form together with your spouse, specify their first and last name and the identification number. Enter your residential address, including street, house, and apartment number. If you are a foreigner, indicate your country without abbreviations.

Next, you fill in the lines about your business, including the name and employer identification number. It is a set of digital signs that serve as the designation of your company for tax purposes. In principle, every business should have such a code. If you haven’t received an identification number yet, contact the relevant institution. Enter the amount you need to repay and list the balances that are not in the fifth line.

By the way, there is a scheme recommended to pay more on the debt to reduce the risk of receiving a fine and interest. Fill in all the lines with the exact amounts. If you encounter difficulties and confusion, use our form-building software.

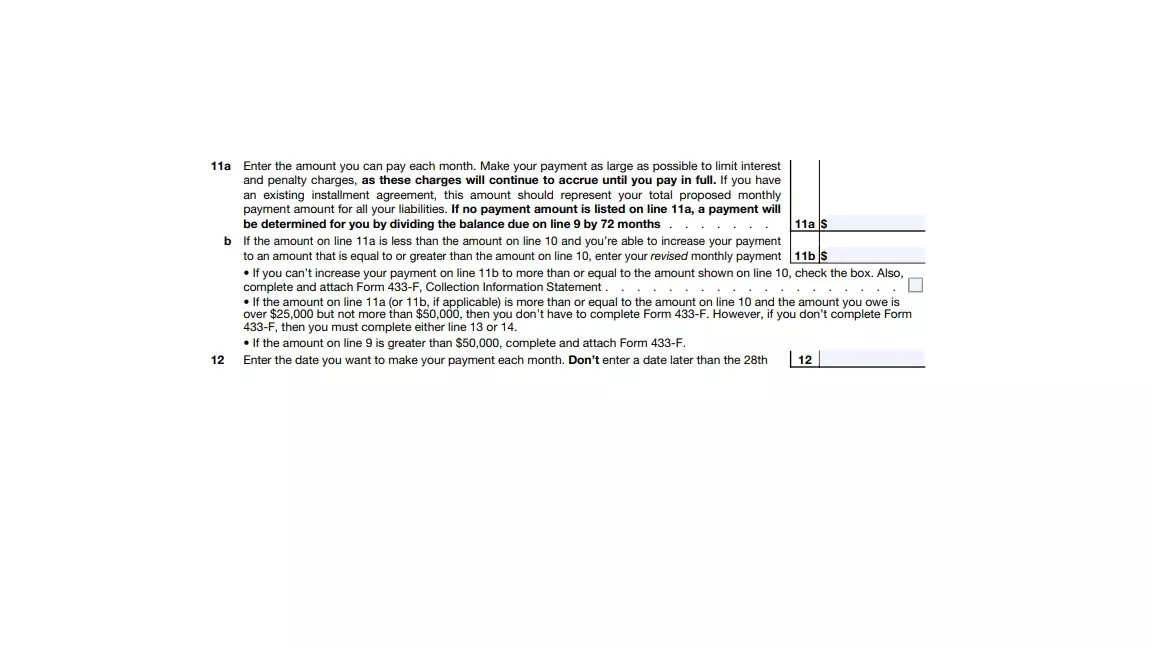

Specify the amounts

All the rest of this section relates to monthly payments and exact amounts of taxes. Usually, the number of months you have to pay depends on the amount owed, as well as the time. This tax return allows you to choose a specific day of the monthly payment yourself.

If you owe $ 50,000, you may need to fill out an additional application. This tax form requires detailed information about your finances and assets.

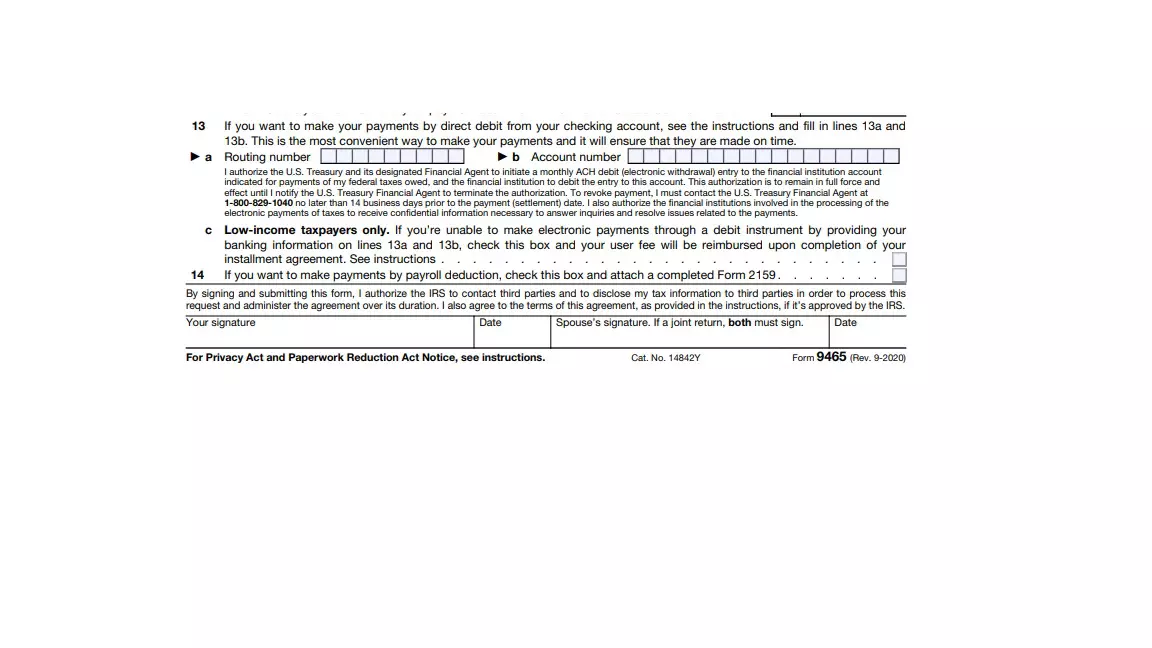

Also, fill in the information regarding direct debit in line 13. Contact your financial institution for help to know for sure that a direct debit is approved. Making payments by direct debit ensures that your payments are made on time. Specify the personal account number and the transaction number. After completing this part, sign the tax document and set the date. A signature is an official confirmation of your data, your integrity, and intentions.

Keep in mind additional issues

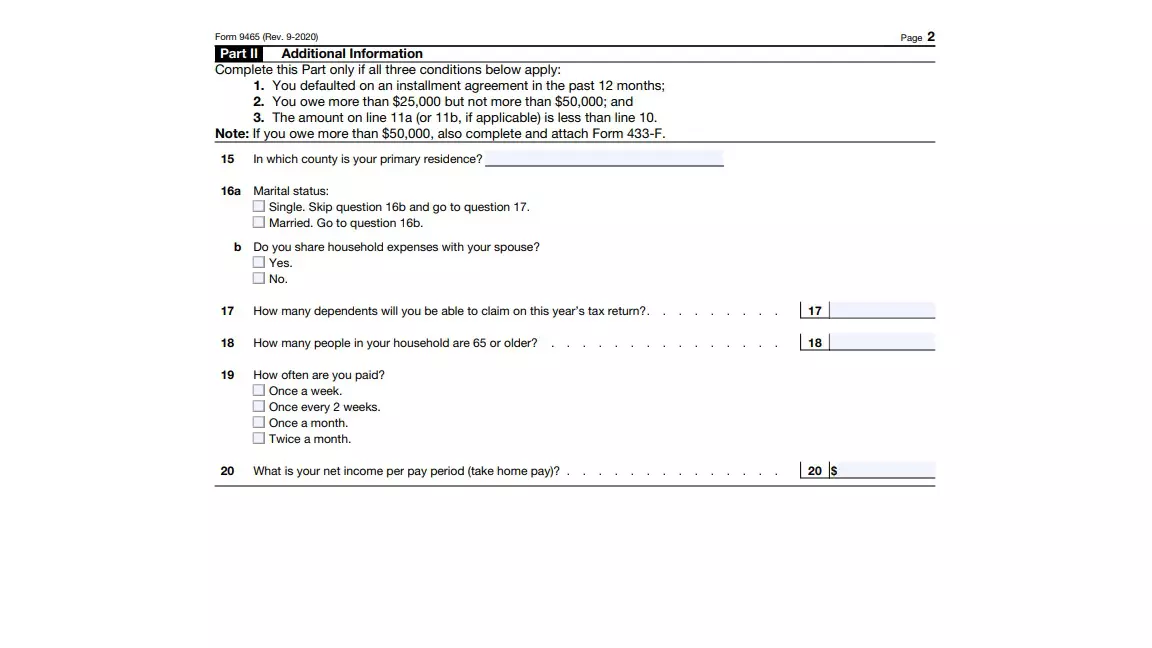

The second section of the tax return must be completed only in case of default in the last 12 months. Also, if you owe an amount of at least $25 000, but not more than $50 000, you fill out this part.

This part of the document includes information about your country of residence, marital status, number of dependents, and the number of people in the house over 65. Provide data about the payment amount and everything related to the debt.

There are cases when the tax return is filled out together with the spouse. You must provide information about your marriage and about sharing expenses with your spouse. By the way, note how many vehicles you have and your monthly vehicle loan payments. Then, you should share if you have health insurance and a monthly premium amount. All this data allows you to track the dynamics of your financial situation, opportunities and identify the payment method.