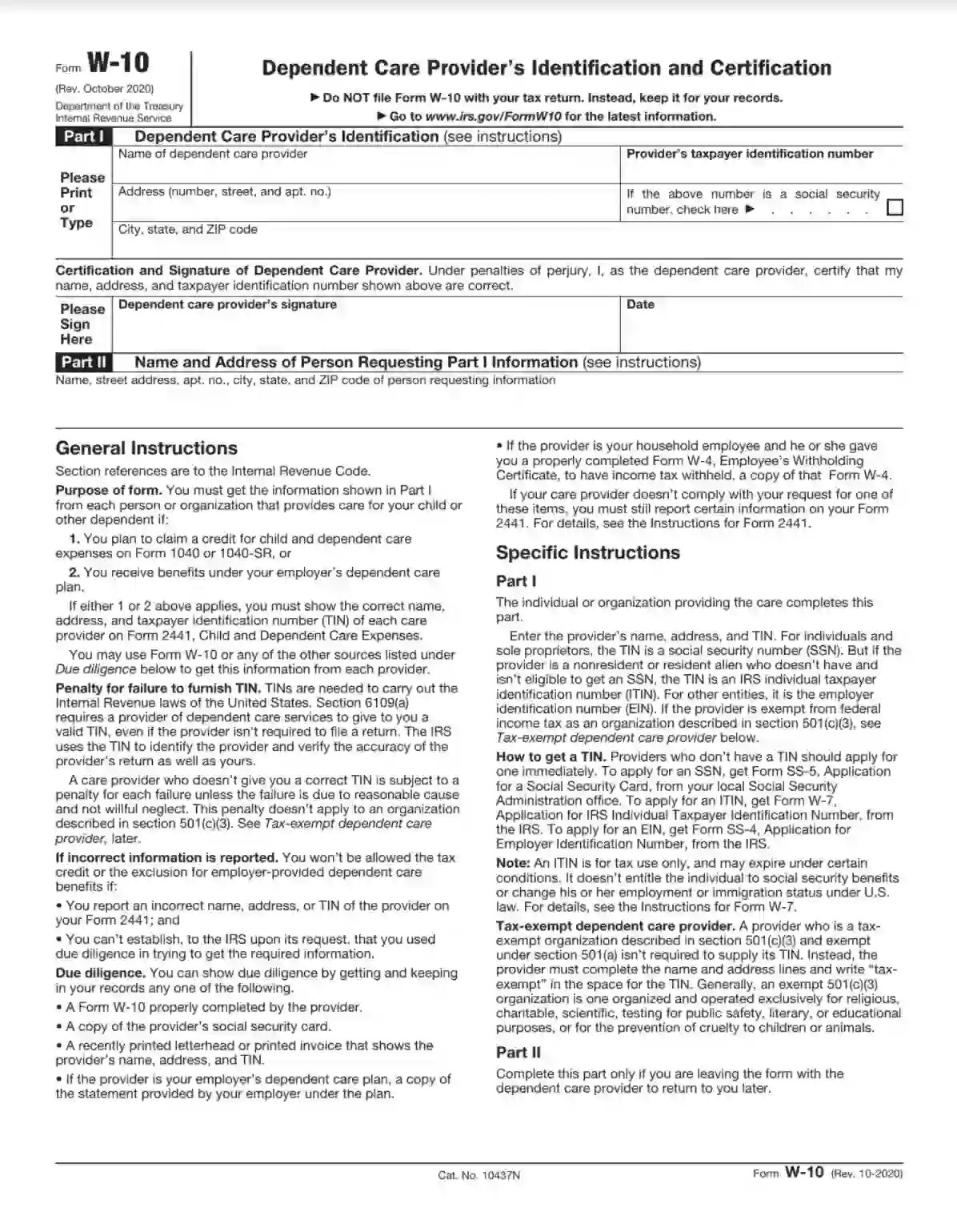

IRS Form W-10 is a tax form used in the United States to provide information about the care provider for dependent care benefits. Taxpayers use this form to identify individuals or organizations that provide care for their dependents, such as a child or disabled spouse, while the taxpayers work or look for work. The information on Form W-10 includes the care provider’s name, address, and taxpayer identification number (either Social Security Number or Employer Identification Number).

The primary use of Form W-10 is to support claims for the child and dependent care expenses credit on a taxpayer’s return. By submitting this form, taxpayers can verify the legitimacy of their child and dependent care expenses and ensure compliance with IRS requirements for claiming the credit. The credit helps offset some of the costs associated with dependent care necessary for employment. Taxpayers need to obtain and keep this form in their records but not submit it with their tax return unless specifically requested by the IRS.

How to Fill Out the Form

The whole procedure will take just a few minutes because the template is extremely easy to complete. Meet your provider and follow the guidelines given below.

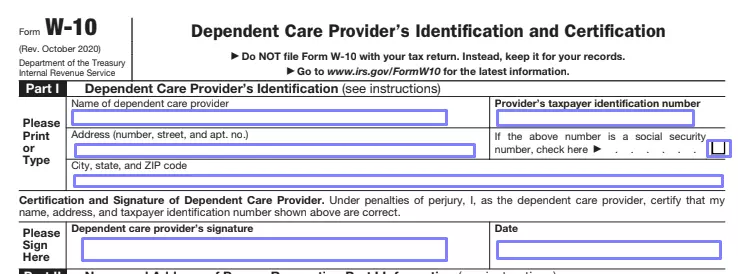

Pass the Form to Your Provider

They should fill out Part I only. The provider must insert their name, TIN (taxpayer identification number), and full address. If they use their SSN (social security number) as their TIN, they should mark the designated box.

After they have given all the info, they must verify it by signing the form. Near the signature, they should write the date of signing.

When the whole thing is done, the provider passes the form back to you, and you complete your part.

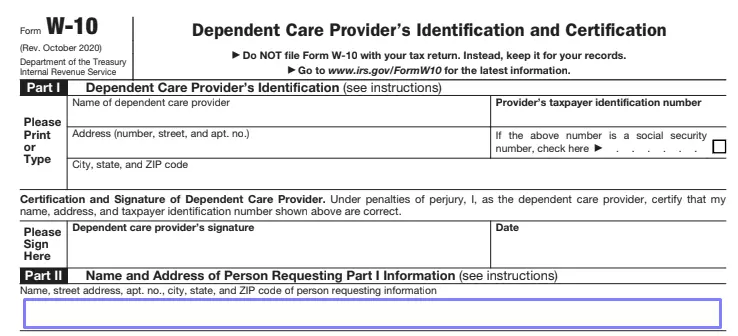

Fill Out Part II

Your part is Part II. Here, you simply insert your name and address.

As you can notice, the document is simple, and you can create it quickly together with your provider. You will not need any professional help from tax experts to do it.

Bear in mind that having incorrect info in the form may lead to not getting credit if the Service discovers that your form has any mistakes in it. So, ensure that both you and your provider have written everything correctly. Also, remember to store the document in a safe place with other forms.