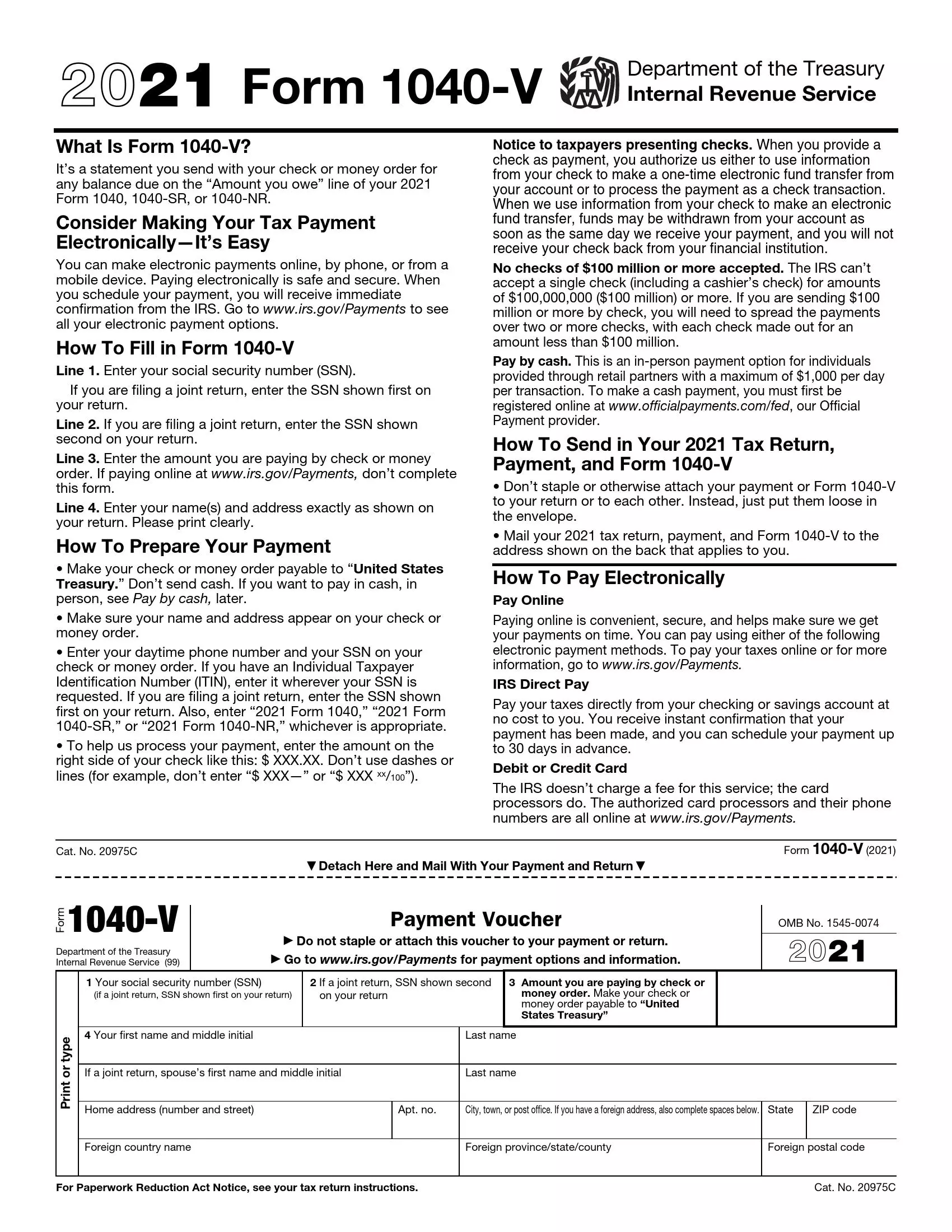

IRS Form 1040-V is a payment voucher used by taxpayers when submitting a payment to the Internal Revenue Service (IRS) for any taxes owed on their federal income tax return. It is not used to calculate taxes but to facilitate processing payments made by check or money order. The form ensures that the taxpayer’s payment is correctly applied to their account, providing essential details like their name, Social Security number, and payment amount.

The primary function of Form 1040-V is to accompany checks or money orders sent to the IRS. Key information included on the form is:

- The tax year for which the payment is being made,

- The taxpayer’s name and address,

- The taxpayer’s Social Security number,

- And the exact amount being paid.

This voucher helps streamline the IRS’s payment processing, reducing the risk of errors in crediting the taxpayer’s account. It is an important tool for ensuring payments are credited promptly and accurately when not using electronic payment methods.

Other IRS Forms for Individuals

Taxpayers who are required to make a payment to the IRS need to file Form 1040-V. Check what other IRS forms are mandatory for individuals.

How to Fill Out IRS Form 1040-V

Form 1040 Voucher should be filed along with the return and payment. It is vital not to staple or glue the document to other papers you report. Compile all required documents and keep them loose in the letter-cover. Serve to the applicable mailing address indicated in Unit 7 of our guide.

Begin with downloading the needed template by using the advanced form-building software we offer on our website. We provide the latest up-to-date PDF versions to help you search for the needed document rapidly.

Detach the template as recommended and follow the guide below to fill out the 1040 Voucher. The document must be printed or completed in a typewritten manner.

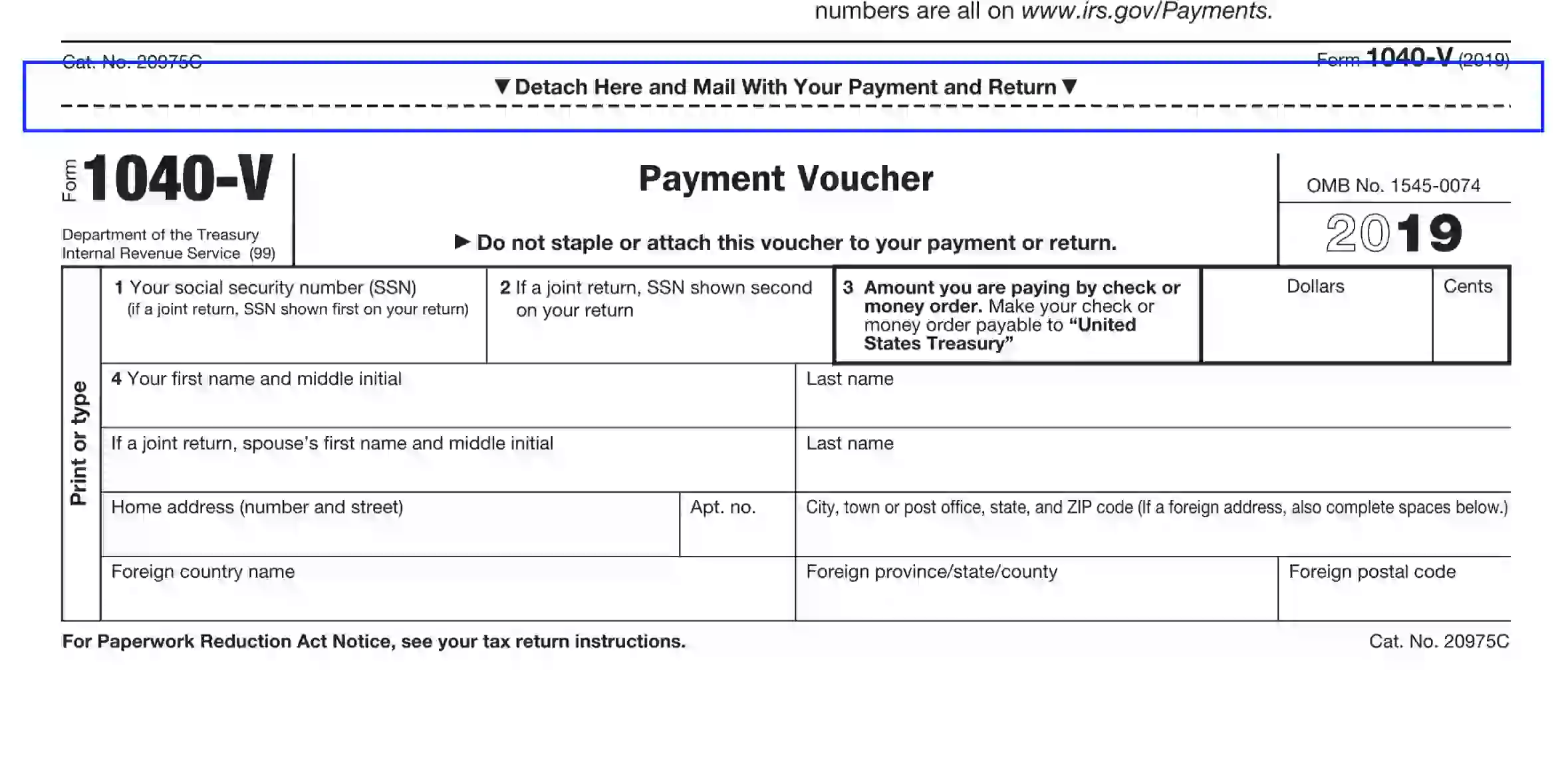

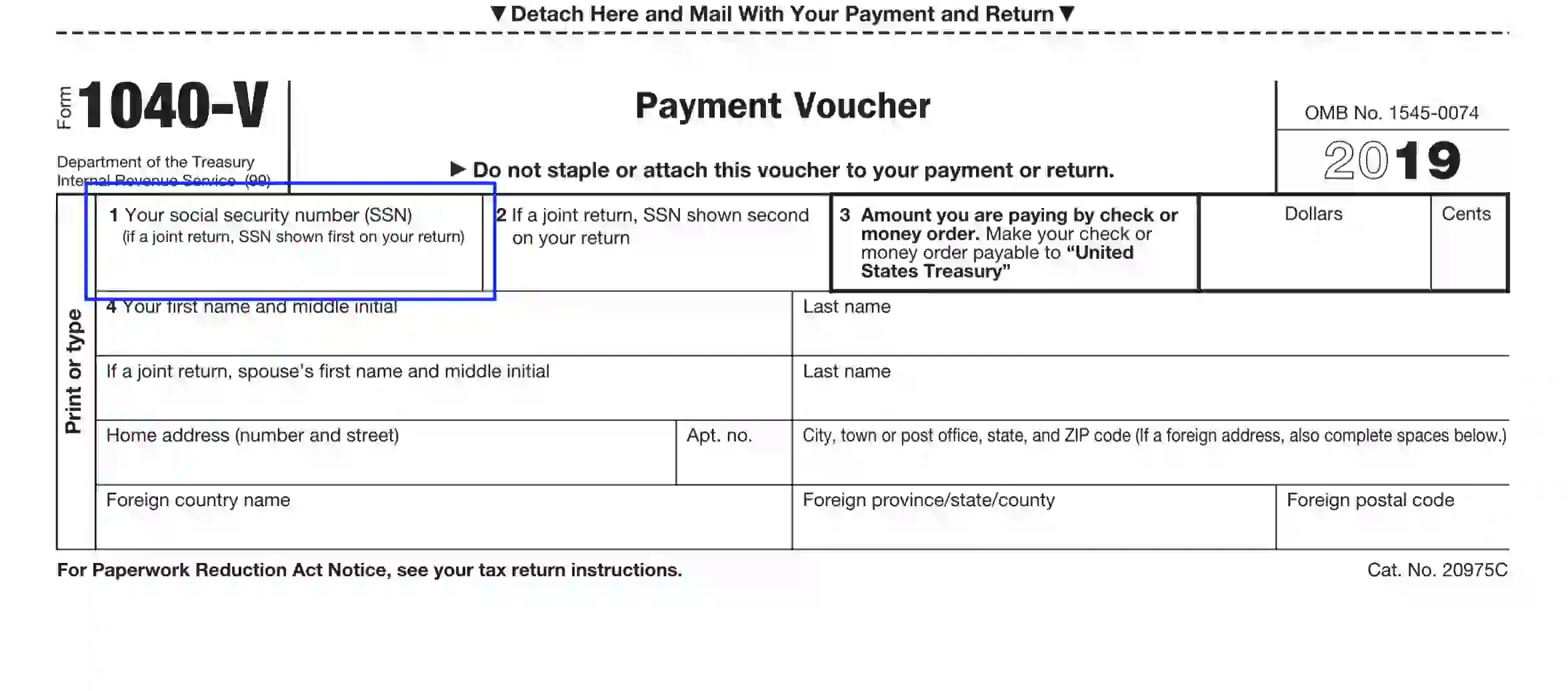

Specify the Preparer’s SSN

In this unit, the preparer should submit their Social Security number. If the voucher is completed jointly, the preparer fills out the SSN that is indicated first on the return paperwork.

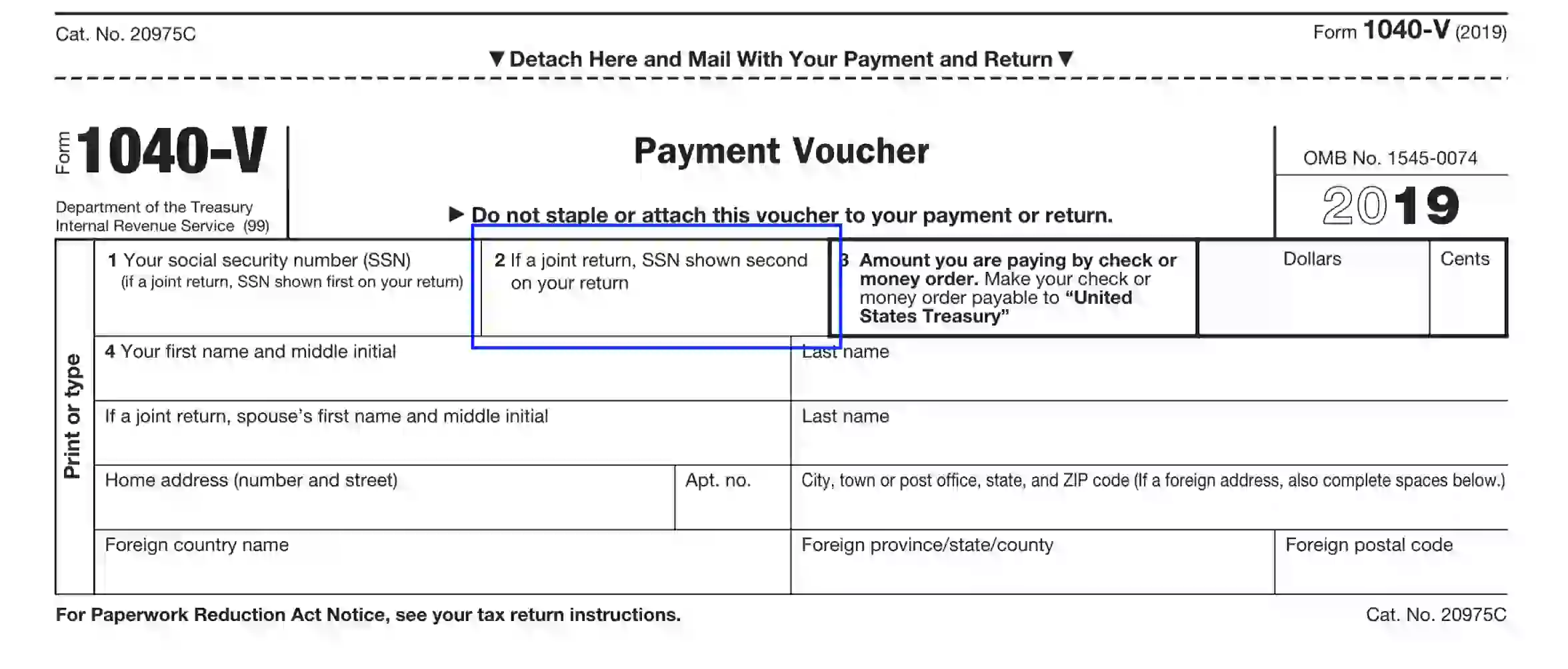

Submit the Second SSN (If Applicable)

In case the return form is completed jointly by spouses, the preparer should also specify the second SSN in the referenced voucher. Enter the required data in slot 2.

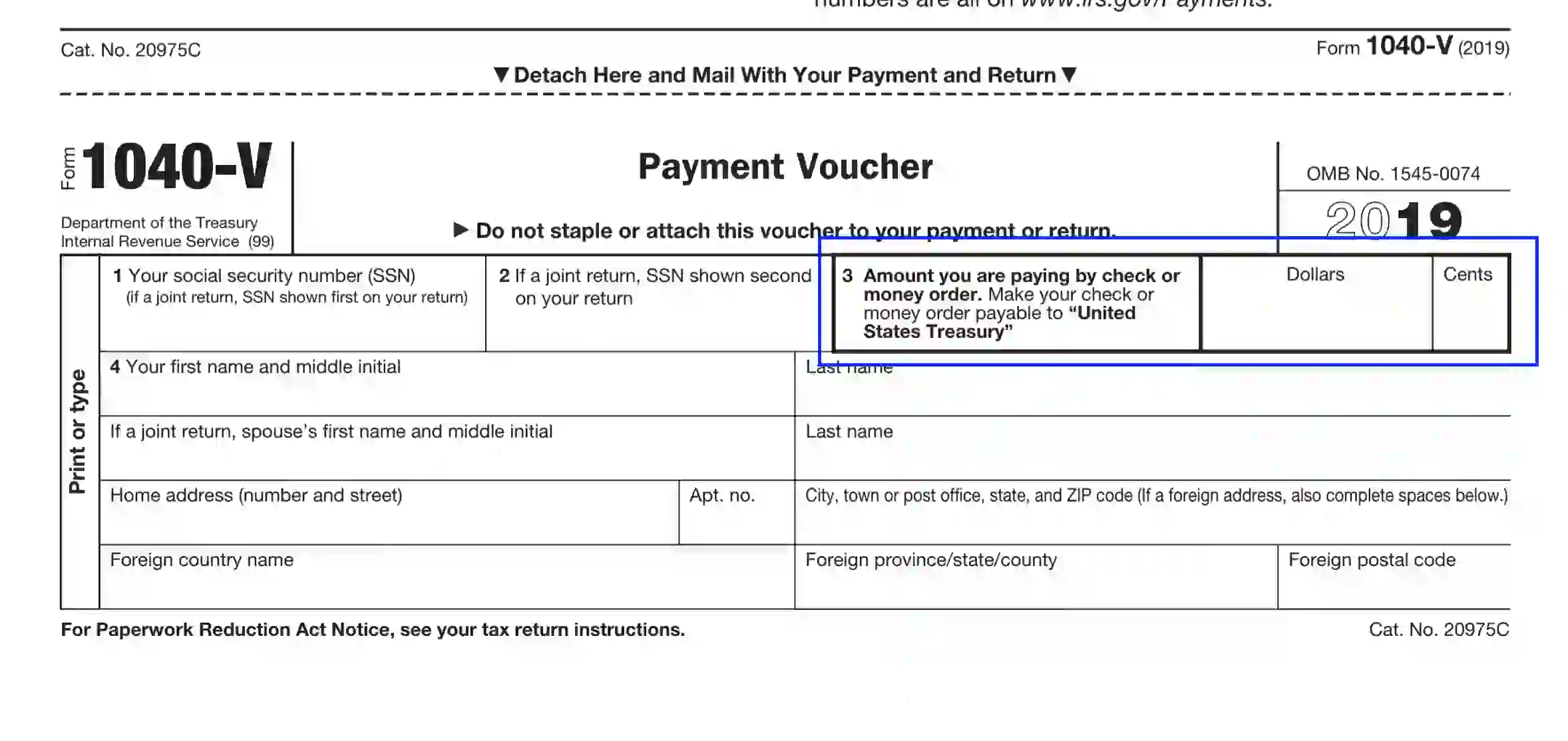

Define the Funds You Submit

Here, you are encouraged to enter the total amount in US dollars and cents. Ensure to print or type the exact sum. If the number is even, please use “00” to indicate cents.

If you choose to pay online at the official IRS webpage, you shouldn’t complete the 1040 voucher.

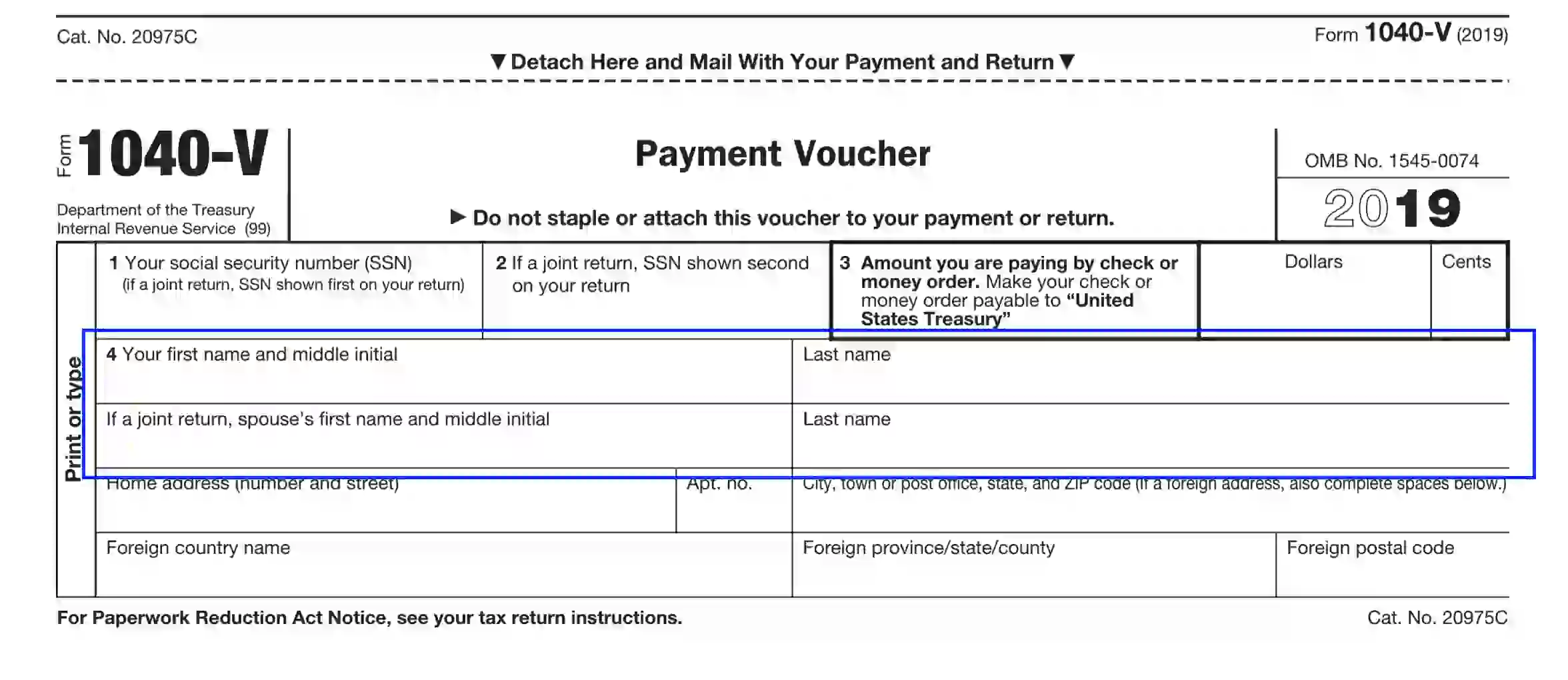

Introduce Yourself

Up next, the applicant is offered to submit their legal first and last names and middle initial. If the spouses fill out the voucher jointly, let the preparer also identify the spouse’s first and last names and middle initial. If not applicable, leave the boxes designed for the spouse blank.

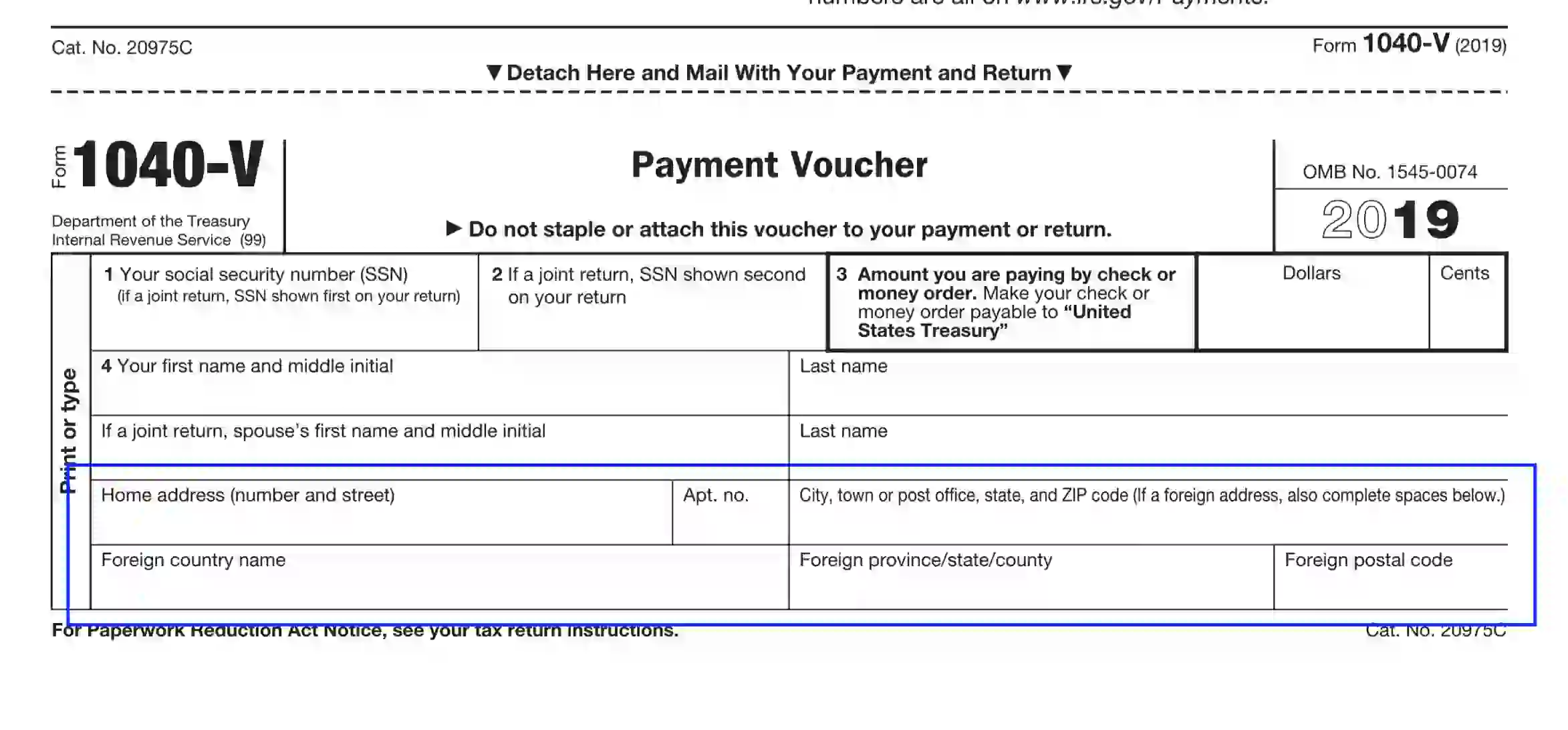

Submit the Address (for U. S. Residents)

S. citizens should enter their mailing (living address), including the following:

- Apartment number, house, and street

- City

- Domiciliary state

- ZIP

The preparer should indicate the exact address location as used on the corresponding return form.

Define the Mailing Address (for Foreign Locations)

In case the preparers file documents from abroad or use a foreign mailing address, they need to submit the following info:

- Apartment number, house, and street

- City, town, or post office

- Country name

- Province, region, or county

- Local postal code

Ensure to submit the same address, as indicated on the return form.

Send the Payment

To mail the payment, both U. S. residents and foreign country citizens should reference their assigned IRS P. O. Box addresses. Below you can see the table of all territories with the correlating mailing locations.