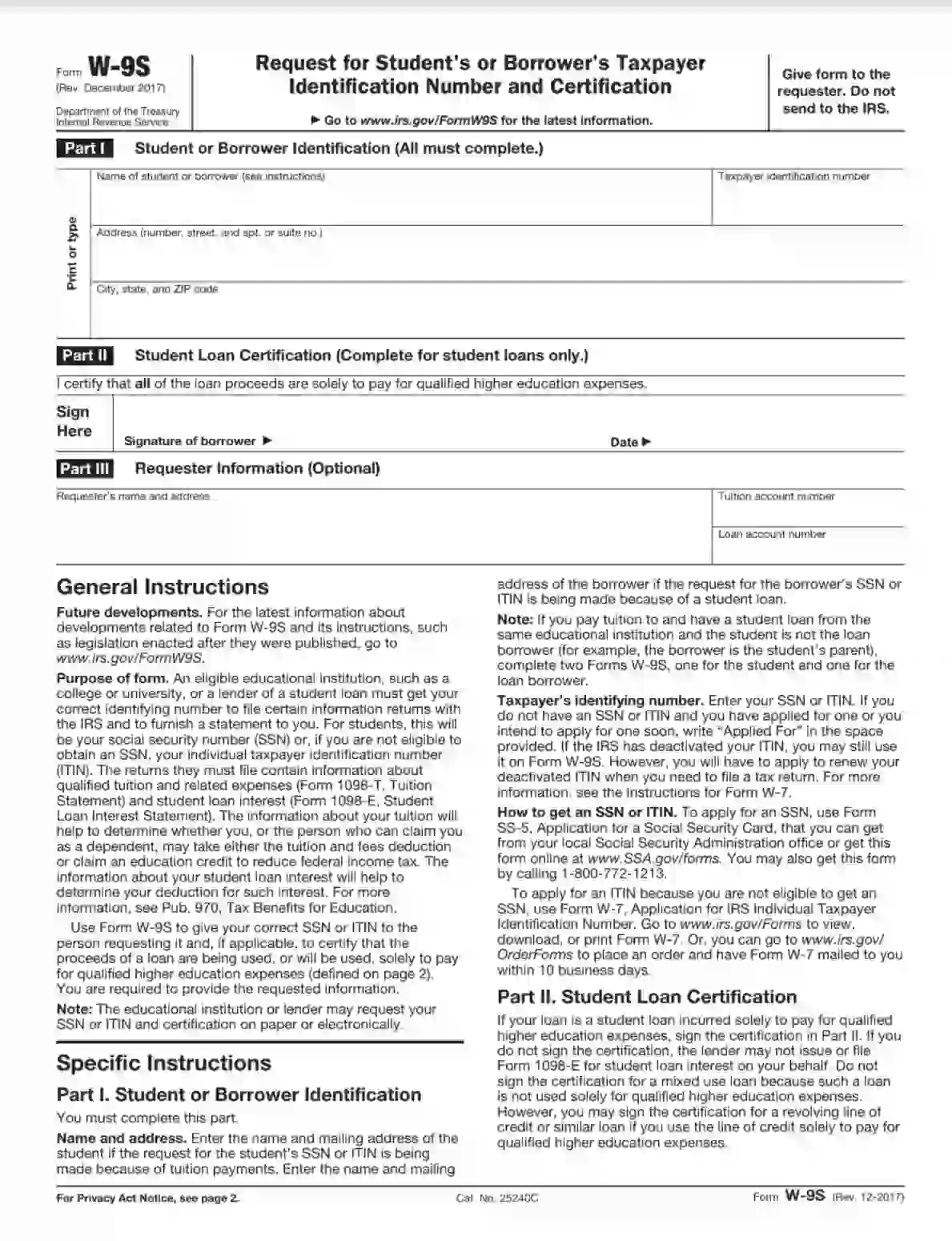

IRS Form W-9S is specifically designed for students and borrowers of student loans. This form provides educational institutions or lenders with the taxpayer identification number (TIN) of the individual, facilitating accurate reporting of tuition payments, interest on student loans, or other educational transactions to the IRS. The form is used primarily for the following purposes:

- To request the student’s or borrower’s TIN for reporting purposes related to Form 1098-E (Student Loan Interest Statement) or Form 1098-T (Tuition Statement),

- To certify that the TIN provided is correct and that the IRS has not notified the student or borrower of an incorrect TIN,

- To certify that the individual is not subject to backup withholding.

By completing and submitting Form W-9S, students and borrowers ensure that their educational institutions or lending agencies have the correct information for IRS reporting, which is crucial for claiming any relevant tax deductions or credits related to education expenses or student loan interest.

Other IRS Forms for Individuals

There are some other IRS forms that might be useful when you take student loans or borrow money. Check what other IRS forms individuals might need.

How to Fill out Form W-9S

Students filing Form W-9S might note they can do it in two possible ways: they can either use the assistance of the form-building software with included PDF editor (which can be done in just a few minutes due to the length of the form and the simplicity of use of the form-building software), or they can resort to the assistance of the detailed guidelines prepared by the experts in the legal field.

Both of these options are possible and have the right to exist. Students have to choose the option they like more and follow the instructions afterward.

Review the General and Specific Guidelines

This is the first step you need to fulfill while filing any of the IRS forms. It is essential to get acknowledged with the given specific and general guidelines because they contain data on the form filling.

Any mistakes made in form filing might lead to the situation when the Internal Revenue Service declines the form and you are not receiving the loan you were requesting. It can affect your opportunity to receive the proper education.

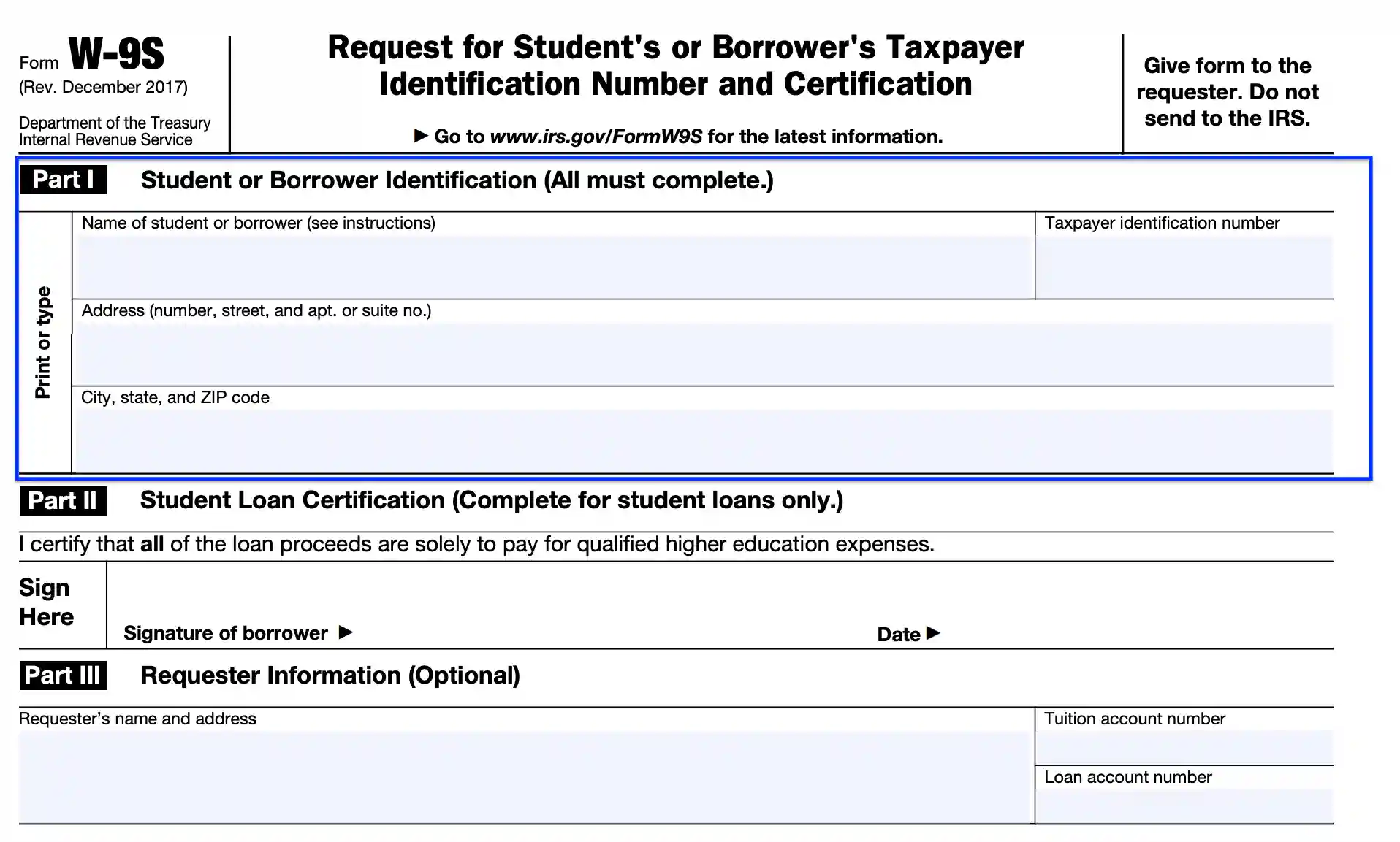

Insert the Baseline Data

In this section, students need to write down their name or the name of their loan recipient. The name must be correct and full.

It is also necessary to include the data regarding the address (with the correct apartment number, name of the street, street number, state, city, and zip code).

Also, students have to register their taxpayer identification numbers.

Confirm the Use of the Loan for its Intended Purpose

As it was previously mentioned, students have to confirm they are going to spend the loan on the education expenses only. It is vital to register it in Form W-9S and, thus, make this statement legal.

Students or their loan recipients need to sign the form and enter the signing date.

Give the Data on the Requester

Enter the name and address of the person requesting the form (this person called the requester). Also, type the loan account number and the tuition account number.

Deliver the Finished Form to the Requester

After you finish filing Form W-9S, transfer it to the requester. You do not have to send it to the Internal Revenue Service.