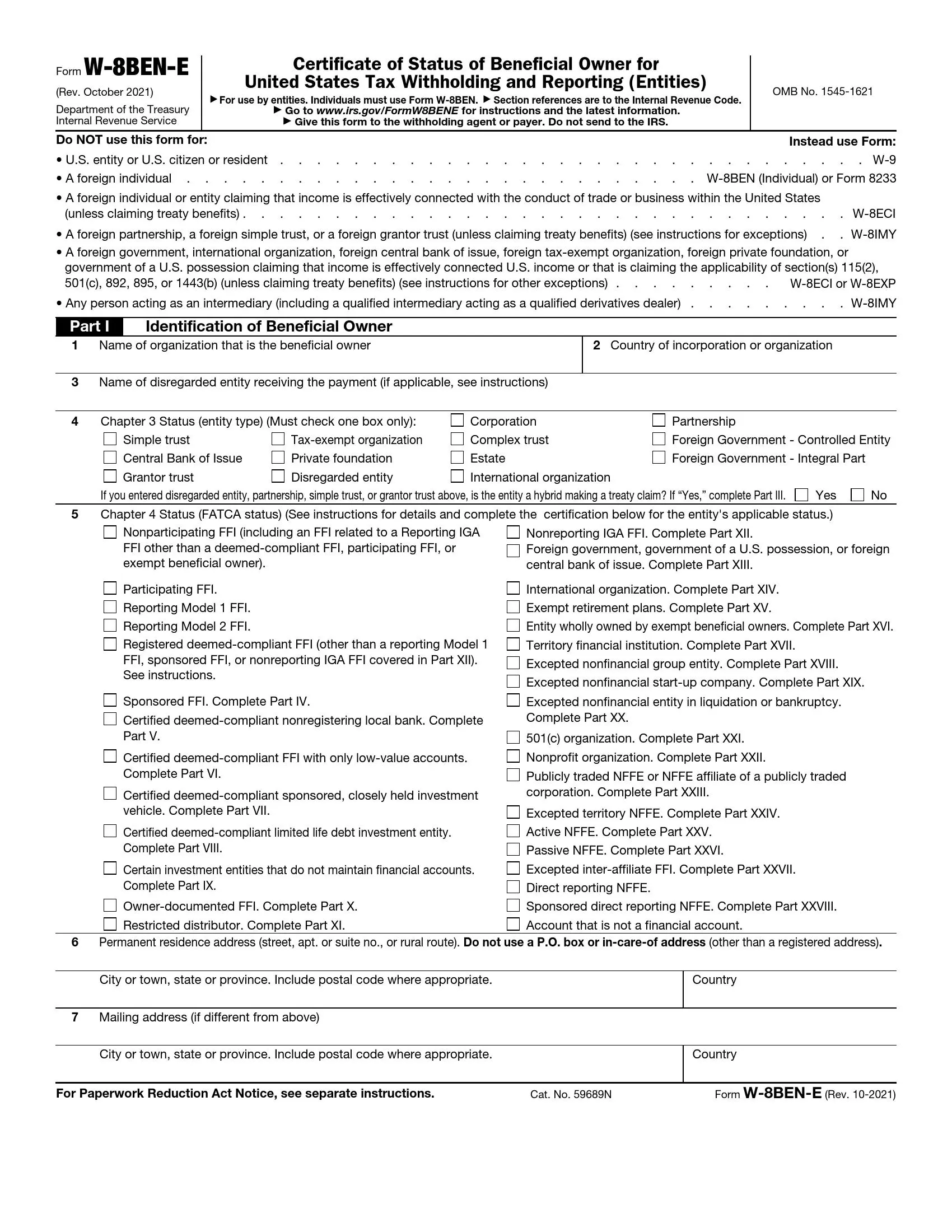

IRS Form W-8BEN-E is a tax form foreign entities use to certify their status as non-U.S. entities. This form is part of the tax compliance measures related to withholding on U.S. source income paid to foreign entities. Form W-8BEN-E documents their status for certain tax treaty benefits or claims exemption from certain U.S. information reporting and withholding.

The primary purpose of Form W-8BEN-E is to establish that a foreign entity is the beneficial owner of the income for which the form is being provided and to indicate whether a reduced rate of or exemption from U.S. withholding tax is justified under U.S. tax laws or a tax treaty between the foreign entity’s country of residence and the United States. It is essential for entities engaging in financial transactions involving U.S. source income to ensure compliance with international taxation’s complex regulations and prevent unnecessary withholding obligations

Other IRS Forms for Corporations

Foreign people in the US might need to be familiar with some other IRS forms. You can read more about them on other pages with IRS forms.

How to fill out the form

To make sure that you are using the Form for its intended purpose, read the warning in the very first part of the document. Pay attention to the status of the legal entities listed here. If you are not one of them, start filling out the Form.

We suggest that you follow our guide that contains the basic steps for completing the Form. We remind you that you can use our online form builder to avoid printing or scanning the document later. Well, let’s get to fill the form out!

Everyone who submits the Form must fill out Part I that concerns the general information. The remaining parts are filled in depending on the company’s status (see point 3 of our guide).

Enter Your Company’s Data

Fill in items 1-2. Specify the name of the organization and the country where it is located (registered).

Line 3 requires you to specify a disregarded entity, meaning a business entity that is not legally considered a corporation. The owner of the disregarded entity files the Form instead of the organization of this type.

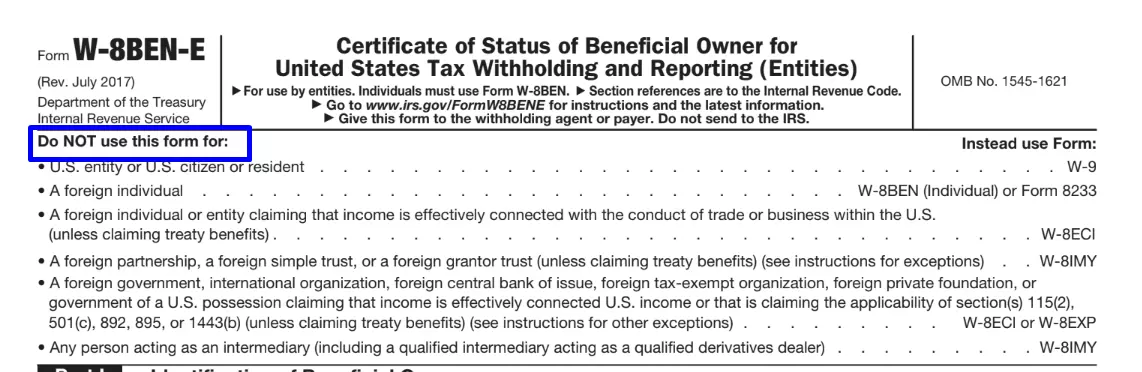

Specify the Legal Status

Check the box according to the legal status of the company or trust.

Pay attention to the lower part of this section. If you have a disregarded entity, select “Yes” and fill in the third part of the Form.

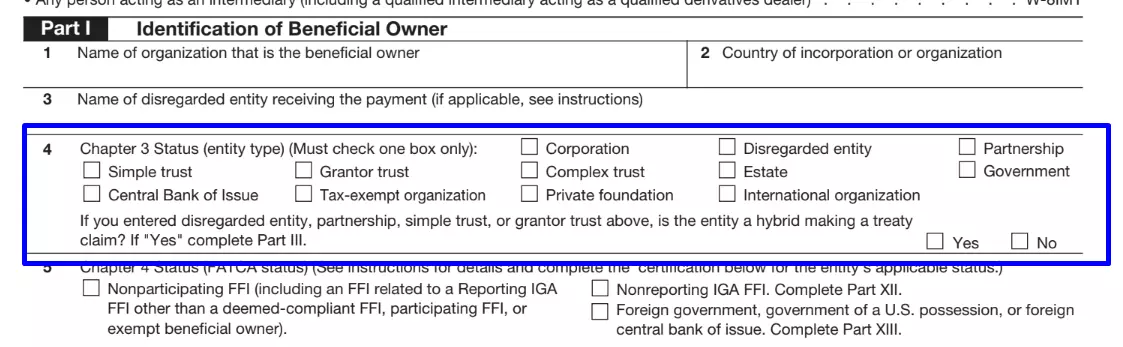

Specify the FATCA Status

Section 5 deals with the Foreign Account Tax Compliance Act. FATCA regulates the obligations of both residents and foreign financial organizations to report to the IRS about their accounts (primarily banks, as well as depositories, insurance companies, and other financial institutions).

This section is the leader for the further parts of the Form. Select the appropriate type and check the box. Then go to the part indicated after the name of the organization type under FATCA. If you want to learn more about the status, see the corresponding section in the official instructions for the Form compilation.

Fill in the Addresses

On lines 6 and 7, write the address of your permanent residence and the address for receiving letters from the IRS.

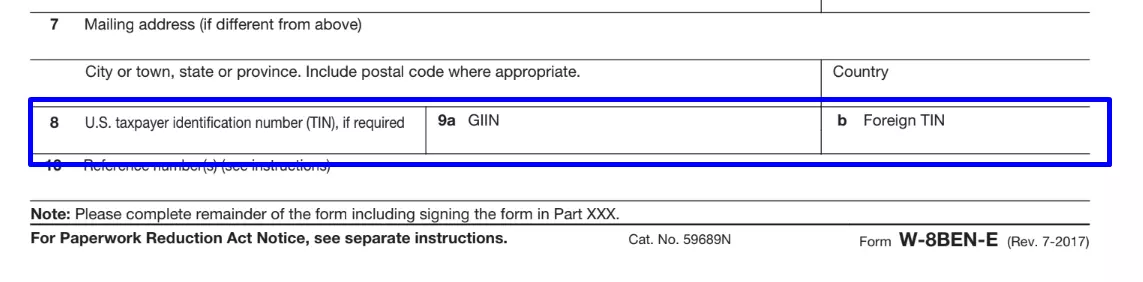

Enter the Identification Codes

Specify the taxpayer ID and the Global Intermediate Identification Number that is assigned to the organizations participating in the FATCA application. Leave line 10 empty; the withholding agent fills it in.

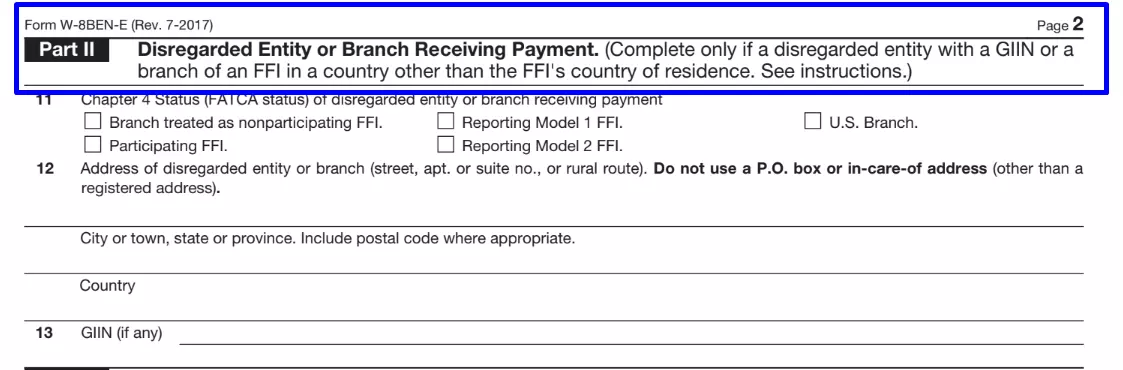

Provide the Data on DE

In the second part of the Form, enter additional information about the Disregarded Entity, if necessary in your case.

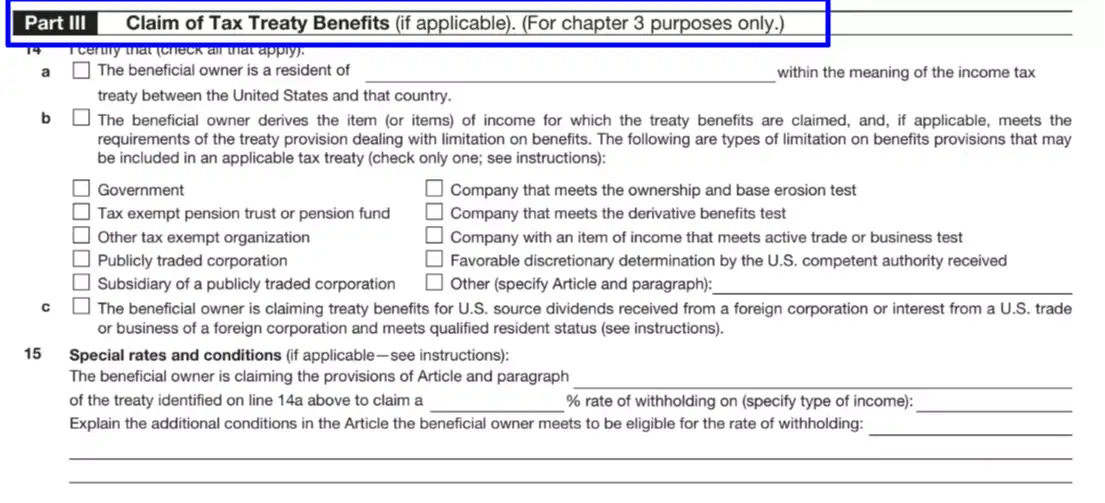

Specify the Exemptions

Fill out the third Part if you require a reduced tax rate or tax exemption. In order to specify the reason for the demotion or release of the post, check the corresponding box.

Fill in the Subsequent Part (If Required)

The following parts of the Form are filled in individually. Enter the data in one of the required parts from 4 to 29. Here you need to complete the appropriate section to confirm the status of the object that you specified in line 5 of Part I. If you checked one of the first four items or direct reporting to the NFFE, you do not need to fill in the subsequent parts of the document. For the remaining ones, check the list provided on Line 5 of Part I.

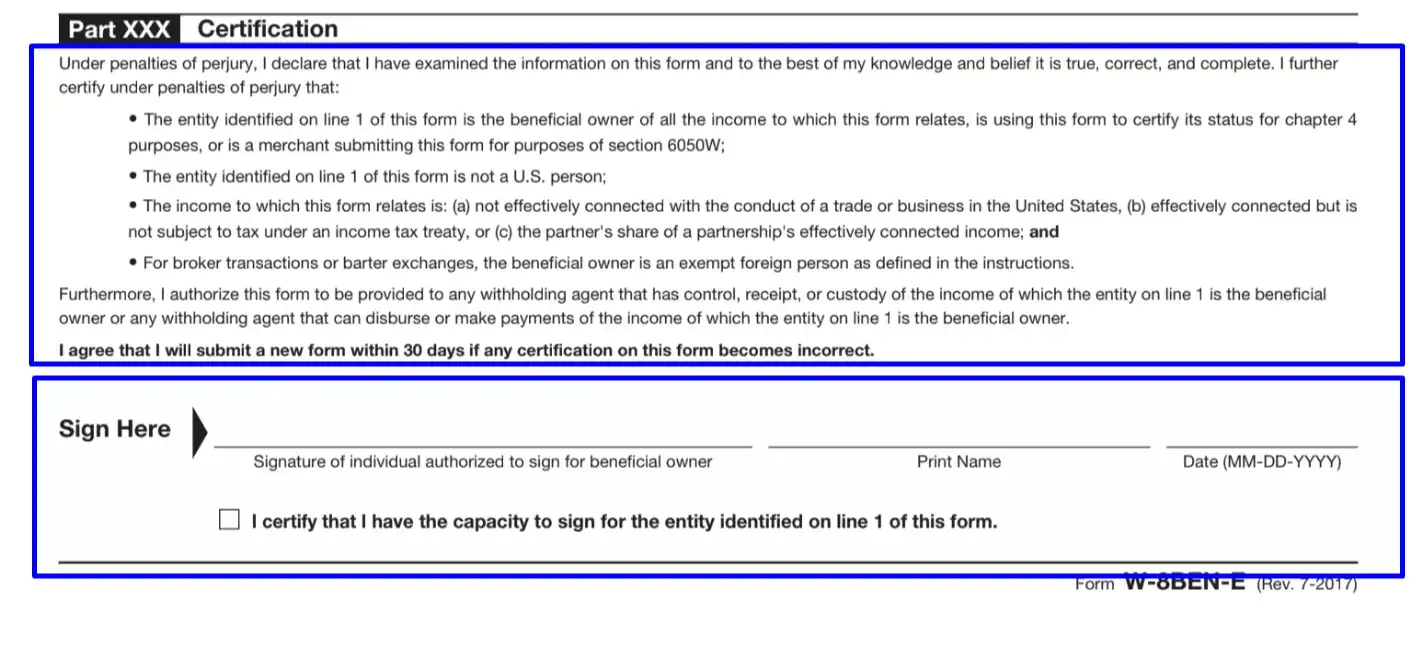

Verify the Form

After you complete the section you need, go to part 30. Here you will find the legal rules for submitting the form and the line for your sign. Read the rules if you do not already know them.

Sign the form if you are an authorized representative or employee of the beneficial owner or FFI account holder. Please note that only an individual who has one of these posts has the right to sign the document. Enter your name and date the document, and check the box to confirm your legal ability to sign the Form.