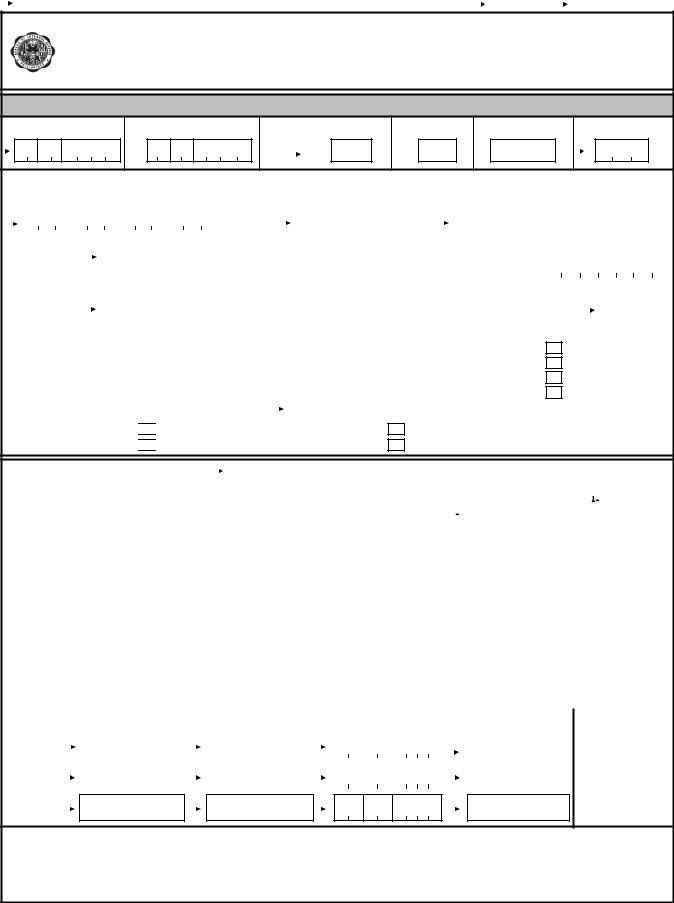

Ensuring compliance with tax obligations is a cornerstone of responsible business management, and the 0613 BIR Form plays a critical role in this endeavor within the Philippines. Designed by the Bureau of Internal Revenue (BIR) as a payment form under the Tax Compliance Verification Drive/Tax Mapping, it serves as a vehicle for taxpayers to settle penalties associated with various tax compliance violations identified during audits or inspections. This comprehensive form, which dates back to December 2004, requires detailed background information from taxpayers, including taxpayer identification number, classification, line of business, and contact details. Notably, it addresses a wide array of violations ranging from registration lapses and invoicing failures to bookkeeping deficiencies, each associated with specific penalties. The form stipulates the process for calculating these penalties and outlines payment protocols, adhering to either full or installment payment strategies. It’s pivotal for taxpayers to accurately complete the form, ensuring that all necessary sections are filled and appropriate boxes are marked, to facilitate a smooth resolution of compliance issues. The form mandates declarations under penalty of perjury, underscoring the seriousness with which these matters are treated, and demands a rigorous adherence to the provisions set forth by the National Internal Revenue Code and its amendments.

| Question | Answer |

|---|---|

| Form Name | 0613 Bir Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | bir 0619 e form download, 0619e bir form, 0619 e bir form, 0619 e bir form download pdf |

(To be filled up the BIR) |

|

|

DLN: |

PSIC |

PSOC: |

|

Payment Form |

BIR Form No. |

|

|

|

Republika ng Pilipinas |

Under Tax Compliance Verification 0613 |

|

Kagawaran ng Pananalapi |

||

Kawanihan ng Rentas Internas

Drive/Tax Mapping |

December 2004 |

|

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

1 Date (MM/DD/YYYY)

2 Date of Mapping (MM/DD/YYYY)

3 No. of Sheets Attached

4Tax Type

FP

5ATC

FP 200

6RDO Code

Part I |

|

|

|

|

B a c k g r o u n d |

I n f o r m a t i o n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7 |

Taxpayer Identification No. |

|

|

8 Taxpayer Classification |

9 Line of Business/Occupation |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

Taxpayer's |

|

(Last Name, First Name, Middle Name for Individuals) / (Registered Name for |

11 |

Telephone Number |

|||||||||||||||||||||||||||||||

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

Registered |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

Zip Code |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 Manner of Payment |

|

|

|

|

|

|

|

|

|

15 |

Type of Payment |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Installment |

|||||||||

|

|

|

|

|

|

|

PENALTIES - TAX COMPLIANCE |

|

VERIFICATION |

DRIVE |

|

|

|

|

|

|

|

|

No. of |

Installment |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partial |

Payment |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full |

Payment |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 Remarks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Registration Requirements

Invoicing Requirements

Bookkeeping Requirements

Others (Specify) _____________________________

Part II |

|

|

|

|

|

|

|

C o m p u t a t i o n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

17 Total Amount of Penalties Payable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Voluntary Payment |

|

|

|

|

|

|

|

|

|

|

|

|

APPROVED BY: |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/W |

e de |

clare, under the penalties of perjury, that this document has been made in good |

faith, |

|

verified by |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

me/us, and to the best of my knowledge and belief, is true and corre |

|

ct, purs |

uant |

to the provis |

ions of the |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

National Internal Revenue Code, as amended, and the regulations issued under autho |

rity t |

here |

of. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

President/Vice President/Principal Officer/Accredited Tax |

|

|

|

|

|

|

Treasurer/Assistant Treasurer |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

Agent/Authorized Representative/Taxpayer |

|

|

|

|

|

|

(Signature over printed name) |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

(Signature over printed name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

Title/Position of Signatory |

|

|

|

|

|

|

|

|

|

|

Title/Position of Signatory |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature Over Printed Name |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

TIN of Accredited Tax Agent (if applicable) |

|

|

|

|

|

|

Tax Agent Accreditation No. (If applicable) |

|

|

|

|

|

of Head of Office |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Part III |

|

|

|

|

|

|

|

D e t a i l s |

of P a y m e n t |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Particulars |

|

|

Drawee Bank/Agency |

|

|

Number |

|

|

|

|

|

|

MM |

DD |

|

YYYY |

|

Amount |

|

|

|

|

|

Stamp of Receiving |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office and |

|||||||||||

20 Cash/Bank20A |

|

|

|

|

|

20B |

|

|

|

|

|

|

20C |

|

|

|

|

|

|

|

|

|

|

|

|

20D |

|

|

|

|

|

|

|

|

|

||||||||||||

Debit Memo |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Receipt |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 Check 21A |

|

|

|

|

|

21B |

|

|

|

|

|

|

21C |

|

|

|

|

|

|

|

|

|

|

|

|

21D |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 Others 22A

22B

22C

22D

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

|

|

|

|

|

|

Taxpayer Classification: |

I - Individual |

N - |

|||

|

|

|

|

|

|

|

|

VIOLATION LISTS |

Apprehesion Slip |

AMOUNT |

|

|

|

Date |

Number |

||

|

|

|

|

||

A. |

REGISTRATION REQUIREMENTS |

|

|

|

|

A1. |

Failure to Register |

|

|

|

|

A2. |

Failure to Pay Annual Registration Fee |

|

|

|

|

A3. |

No Certificate of Registration displayed |

|

|

|

|

A4. |

Failure to display the poster "Notice to the Public" to demand receipts/invoices |

|

|

|

|

B. |

INVOICING REQUIREMENTS |

|

|

|

|

B1. |

Failure to issue receipts/invoices |

|

|

|

|

B2. |

Refusal to issue receipts/invoices |

|

|

|

|

B3. |

Duplicate Copy of the receipts/invoices is blank but the accomplished original is detached |

|

|

|

|

B4. |

Possession or use of unregistered receipts/invoices |

|

|

|

|

B5. |

Incomplete information in the receipts/invoices |

|

|

|

|

B6. |

Use of unregistered Cash Register Machine (CRM) and/or Point of Sales Machine |

|

|

|

|

|

(POS) or similar devices in lieu of invoices or receipts. |

|

|

|

|

|

B6.1 Use of Computerized Accounting System (CAS) and/or components |

|

|

|

|

|

|

thereof, without permit. |

|

|

|

|

B6.2 Failure to inform enhancement/modification/changes in previously issued |

|

|

|

|

|

|

permit to use CAS and/or components thereof. |

|

|

|

|

B6.3 Use of POS machine in training mode in their sales transactions. |

|

|

|

|

B7. |

Failure to register CRM as cash depository only |

|

|

|

|

B8. |

Cash depository CRM is used for issuing sales receipts/invoices |

|

|

|

|

B9. |

Failure to attach or paste original sticker in the machine authorizing the use of the |

|

|

|

|

|

CRM/POS or similar device |

|

|

|

|

B10. |

Failure to attach or paste original sticker in the machine authorizing the use of the |

|

|

|

|

|

CRM for cash depository only |

|

|

|

|

B11. |

Failure to display permit issued by the RDO (for CRM/POS or similar devices) |

|

|

|

|

B12. |

Failure to provide CRM with two (2) roller tapes |

|

|

|

|

B13. |

Failure to notify the Revenue District Office prior to the transfer of |

|

|

|

|

|

CRM/POS or similar device to other business location |

|

|

|

|

|

B13.1 |

Failure to notify the RDO in resetting the accumulated grand total sales of |

|

|

|

|

|

CRM/POS machines |

|

|

|

|

B13.2 |

Failure to notify RDO that the CRM/POS is defective and has been |

|

|

|

|

|

pulled out for repair. |

|

|

|

B14. |

Use of CRM/POS or similar device in a place other than specified in the permit |

|

|

|

|

C. |

BOOKKEEPING REQUIREMENTS |

|

|

|

|

C1. |

Failure to register Books of Accounts/Cash Register Machine's sales books |

|

|

|

|

C2. |

Failure to keep Books of Accounts at the place of business |

|

|

|

|

C3. |

Failure to make entries in the registered Books of Accounts |

|

|

|

|

D. |

OTHERS (refer to Section 275 of NIRC) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GUIDELINES AND INSTRUCTIONS

Who Shall File

Every taxpayer shall use this form, in triplicate, to pay penalties for the violation listed above.

Authorized Representative and Accredited Tax Agent filing in behalf of the taxpayer shall also use this form to pay the penalties listed above in behalf of the taxpayer.

How to Accomplish the Form

Indicate the amount of penalty for each violation listed in the prescribed letter from the concerned BIR Office.

When and Where to File and Pay

This form shall be accomplished everytime a penalty is due.

This form shall be filed and the penalties shall be paid with any Authorized Agent Bank (AAB) under the jurisdiction of the Revenue District Office where the taxpayer is required to register. In places where there are no AABs, this form shall be filed and the penalties shall be paid directly with the Revenue Collection Officer or duly Authorized City or Municipal Treasurer of the Revenue District Office where the taxpayer is required to register, who shall issue Revenue Official Receipt (BIR Form No. 2524) therefor.

Where the return is filed with an AAB, taxpayer must accomplish and submit BIR- prescribed deposit slip, which the bank teller shall machine validate as evidence that payment was received by the AAB. The AAB receiving the tax return shall stamp mark the word “Received” on the return and also machine validate the return as proof of filing the return and payment of the tax by the taxpayer, respectively. The machine validation shall reflect the date of payment, amount paid and transactions code, the name of the bank, branch code, teller’s code and teller’s initial. Bank debit memo number and date should be indicated in the return for taxpayers paying under the bank debit system.

Notes

∙The following violations are not qualified for compromise penalties:

a.If the amount of the transaction stated in the taxpayer’s copy is understated versus the amount per copy of the invoice issued to the purchaser; and

b.Possession or use of double or multiple sets of receipts or invoices.

∙For Annual Registration fee, use BIR Form 0605 as required by law.

∙All background information must be properly

∙The last 3 digits of the

Attachments

§All returns filed by an authorized representative must attach authorization letter.

§All returns filed by an accredited tax agent on behalf of a taxpayer shall bear the following information:

A.For CPAs and others (individual practitioners and members of GPPs); a.1 Taxpayer Identification Number (TIN); and

a.2 Certificate of Accreditation Number, Date of Issuance, and Date of Expiry.

B.For members of the Philippine Bar (individual practitioners, members of GPPs);

b.1 Taxpayer Identification Number (TIN); and

b.2 Attorney’s Roll number or Accreditation Number, if any.

ENCS