You may fill in social security form 1040 pdf without difficulty with our PDFinity® editor. The editor is constantly maintained by our staff, receiving additional features and growing to be greater. Here's what you'll want to do to start:

Step 1: Open the PDF doc inside our editor by pressing the "Get Form Button" in the top section of this page.

Step 2: The editor enables you to modify your PDF document in various ways. Enhance it by including your own text, adjust original content, and add a signature - all at your convenience!

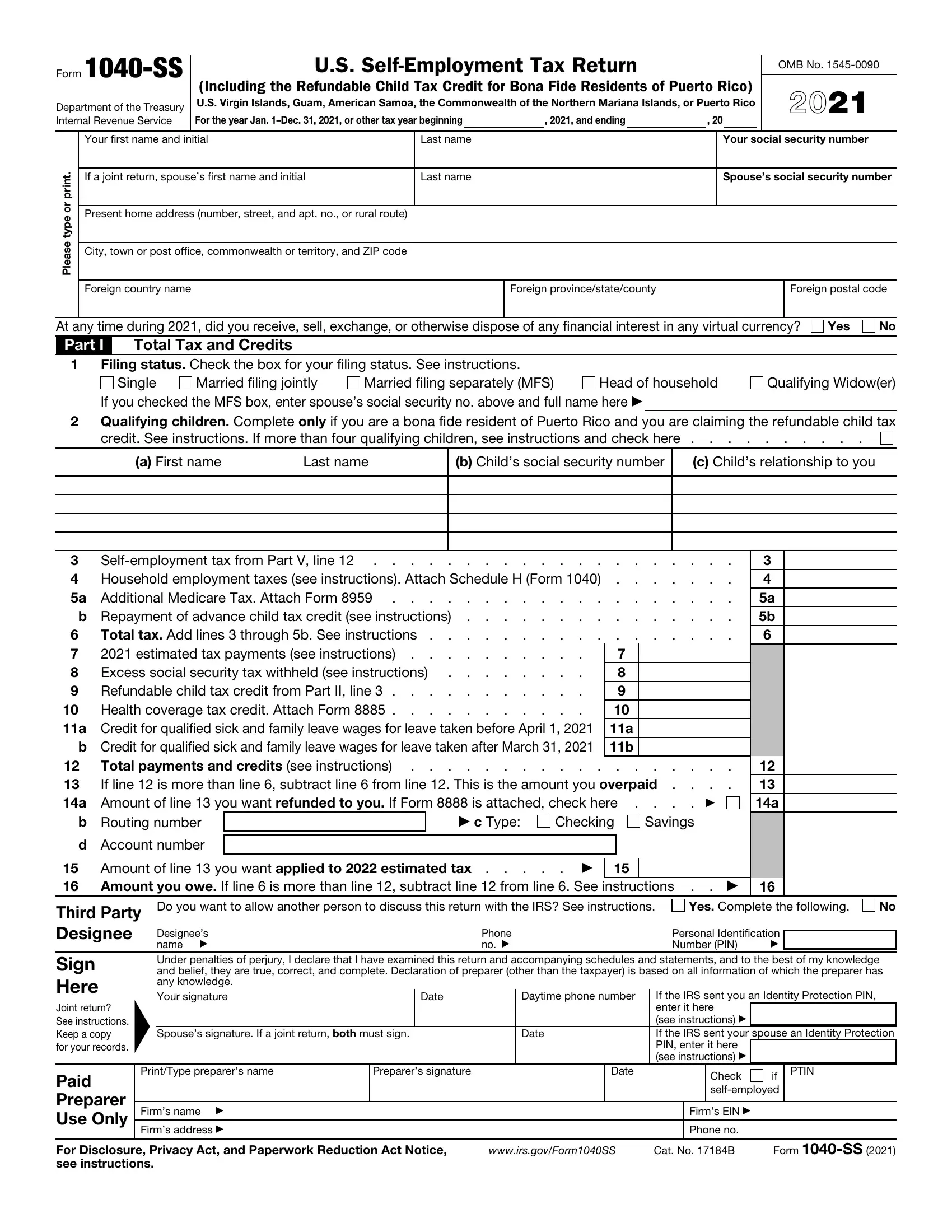

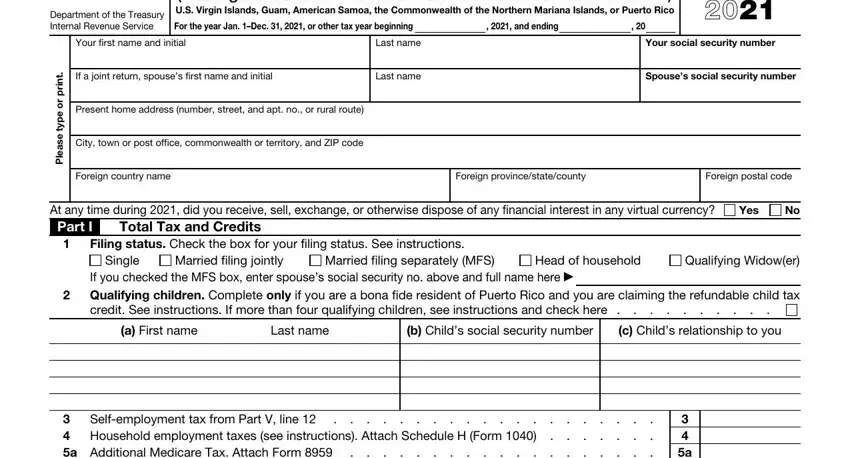

With regards to the fields of this particular document, here's what you should consider:

1. While filling out the social security form 1040 pdf, be sure to incorporate all of the important fields in the associated form section. This will help hasten the work, which allows your information to be processed quickly and properly.

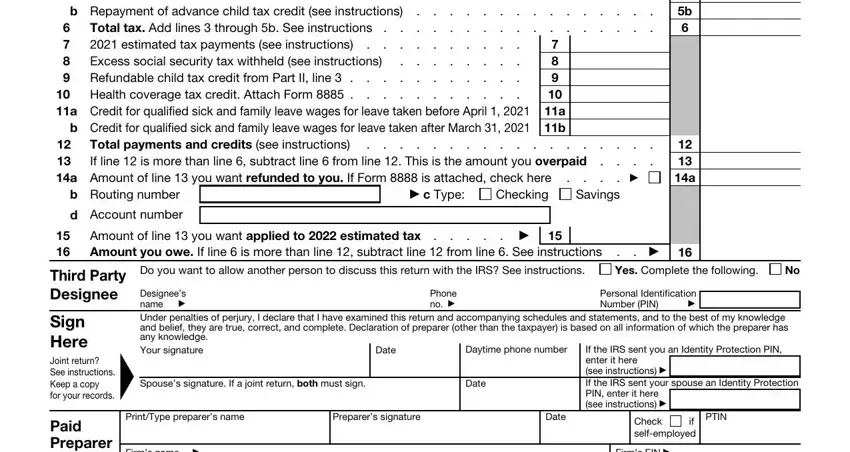

2. Once your current task is complete, take the next step – fill out all of these fields - Household employment taxes see, a b Credit for qualified, a Credit for qualified sick, b Repayment of advance child tax, Total tax Add lines through b, a b , a Amount of line you want, Total payments and credits see, a, b Routing number, d Account number, c Type, Checking, Savings, and Amount of line you want applied with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be extremely careful while filling out d Account number and b Repayment of advance child tax, because this is where a lot of people make a few mistakes.

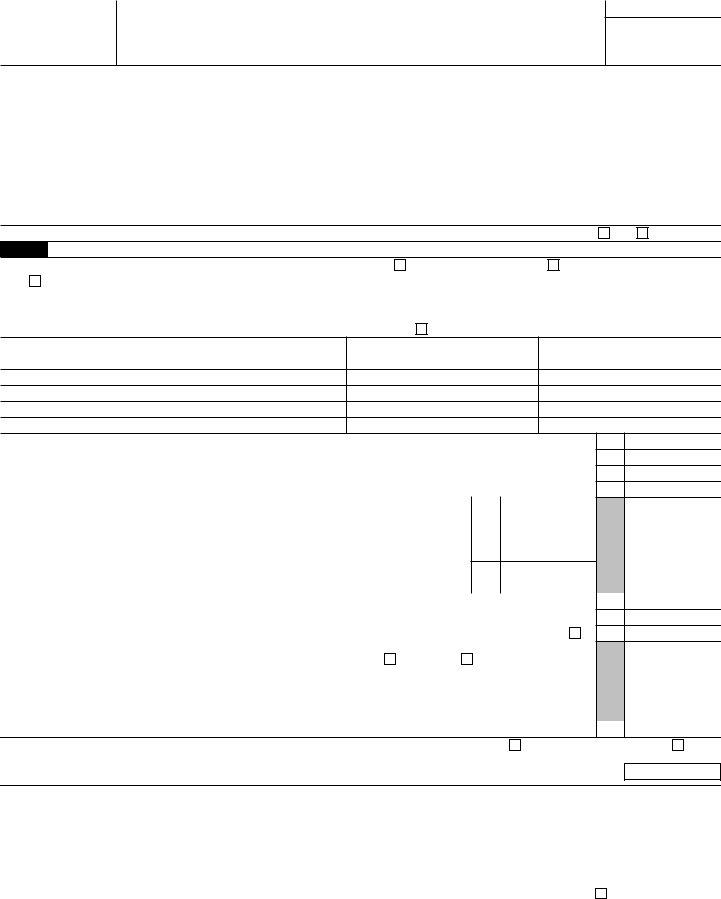

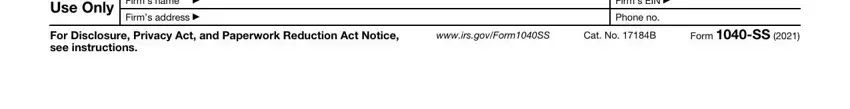

3. The following segment should be relatively straightforward, Paid Preparer Use Only, Firms name , Firms address , Firms EIN , Phone no, For Disclosure Privacy Act and, wwwirsgovFormSS, Cat No B, and Form SS - every one of these empty fields must be filled in here.

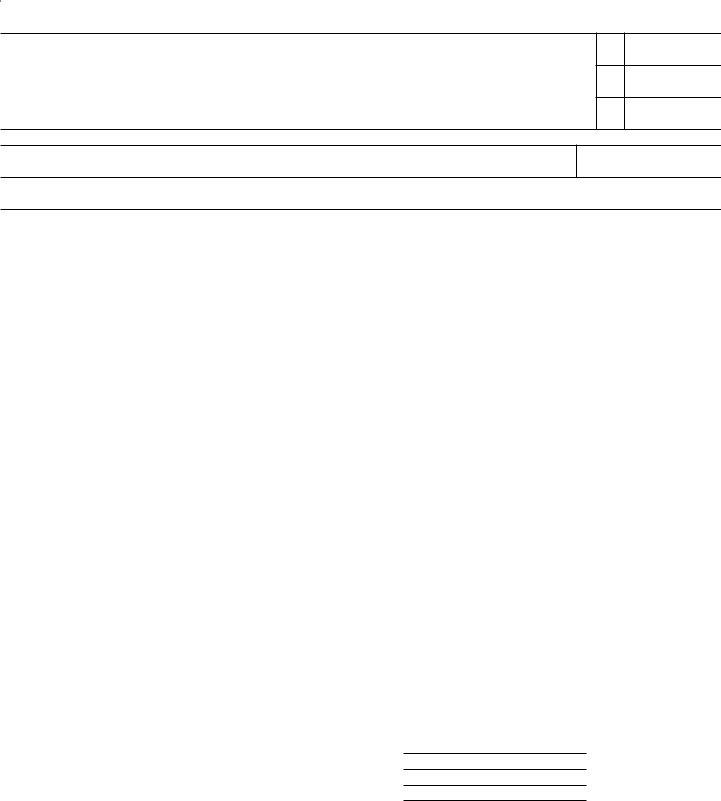

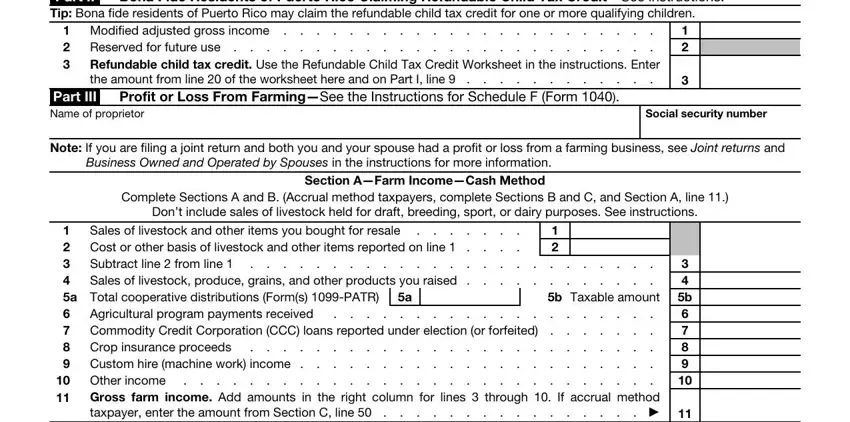

4. It is time to fill in this fourth section! Here you will get all of these Bona Fide Residents of Puerto Rico, Part II Tip Bona fide residents of, Modified adjusted gross income , the amount from line of the, Profit or Loss From FarmingSee, Part III Name of proprietor, Social security number, Note If you are filing a joint, Business Owned and Operated by, Complete Sections A and B Accrual, Dont include sales of livestock, Section AFarm IncomeCash Method, Sales of livestock and other items, Subtract line from line Sales, and Cost or other basis of empty form fields to fill in.

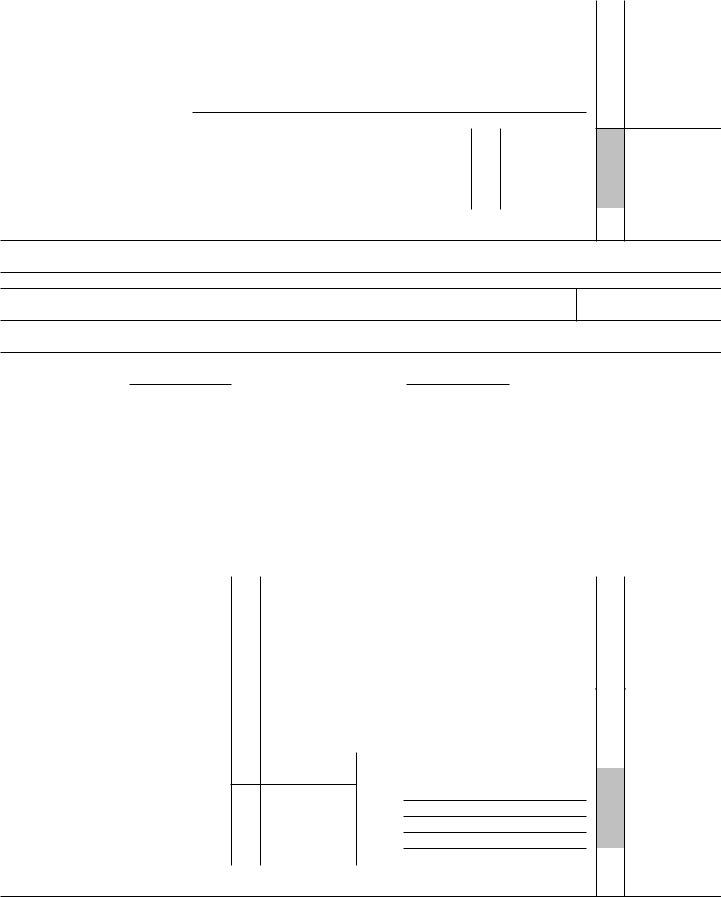

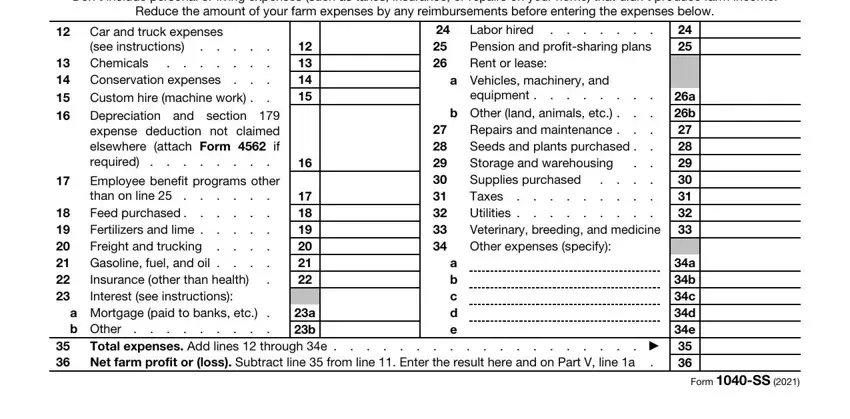

5. This form must be wrapped up by filling in this area. Here you will find a full listing of form fields that have to be filled in with correct information to allow your document usage to be complete: Dont include personal or living, Reduce the amount of your farm, Car and truck expenses, see instructions , Chemicals Conservation, Depreciation and section expense, Employee benefit programs other, Gasoline fuel and oil , Insurance other than health, a Mortgage paid to banks etc b, a b, Labor hired Pension and, a Vehicles machinery and, equipment , and b Other land animals etc .

Step 3: After you have looked over the information in the blanks, simply click "Done" to finalize your document generation. Make a 7-day free trial subscription with us and get immediate access to social security form 1040 pdf - download, email, or edit from your personal account page. At FormsPal, we do our utmost to make sure all of your details are kept secure.