The 1040T form is a specific tax form used by U.S. citizens and residents to report their income from certain types of sources, including wages, salaries, tips, dividends, interest payments, capital gains, pensions and annuities. This form can be used to calculate your total taxable income for the year as well as any applicable taxes owed. In order to complete the 1040T form correctly, you will need to have all of your pertinent financial information on hand. If you have any questions about how to fill out this form or which specific deductions and credits are available to you, be sure to consult with a qualified tax advisor.

| Question | Answer |

|---|---|

| Form Name | 1040T Form |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | 1040 t form, SSN, 1040t, RTN |

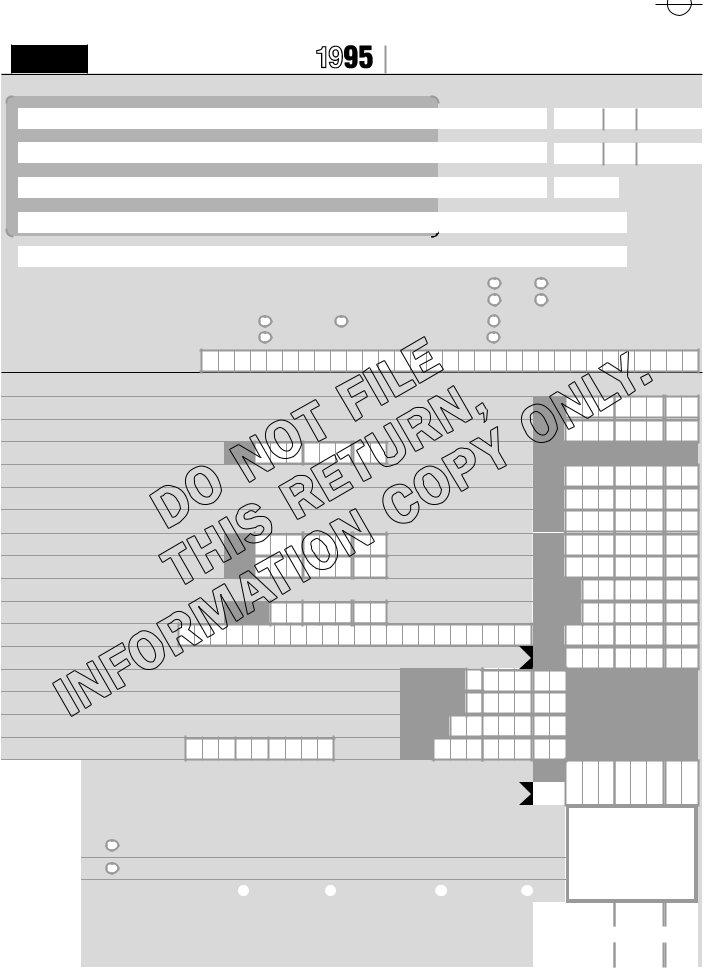

Form

Department of the

U.S. Individual Income Tax Return

IRS Use Only — Do not write or staple in this space.

Label Use the IRS label. Otherwise, print in ALL CAPITAL LETTERS. Leave a single space between names and words. |

|

|

|

|

OMB No. |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

L |

Your last name (surname), space, first name, space, and middle initial. (If either person is deceased, see |

|

page 9 of the instructions.) |

Your social security number |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

- |

|

|

|

|

||||

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

B If filing jointly, spouse’s last name (surname), space, first name, space, and middle initial |

|

|

|

|

|

|

|

|

Spouse’s social security number |

|||||||||||||||||||||||||||||||||||||||||||

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|||

|

L |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Home address (number and street). If P.O. box or foreign address, see page 15. |

|

|

|

|

|

|

|

|

|

Apt./suite no. |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

H |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Privacy |

|||||

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Act and |

||||||

|

R City, state or province, and ZIP code or postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paperwork |

||||||||||||||||||||||||||||||||||

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reduction |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Foreign country. Do not abbreviate. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Act Notice, |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

see page 10. |

||||

Presidential Election |

Do you want $3 to go to this fund? |

|

Yes |

|

No |

Filling in “ Yes” will not |

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

change your tax or |

|||||||||||||||||||||||||||||||||||||||||||||||||||

Campaign Fund See page 15. If filing a joint return, does your spouse want $3 to go to this fund? |

|

Yes |

|

No |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

reduce your refund. |

|||||||||||||||||||||||||||||||||||||||||||||||||||

Filing Status See pages

If Married filing separately, Head of household, or Qualifying widow(er), see pages

Fill in only |

Single |

Married filing jointly |

Head of household (with qualifying person) |

one circle: |

Married filing separately |

Qualifying widow(er) with dependent child |

|

|

|||

Total Income and Adjusted Gross Income

1 |

Wages, salaries, tips, etc. Attach |

|

|

|

|

|

1 |

$ |

, |

. |

||

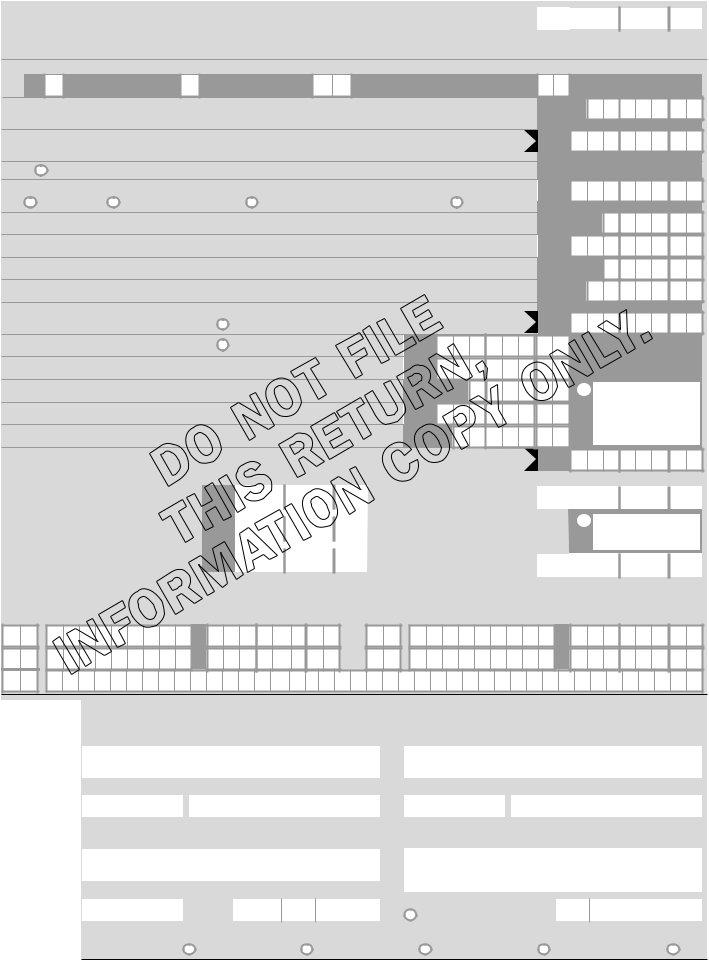

2a |

Taxable interest income. See page 17. If over $400, complete Section A now. |

|

|

2a $ |

, |

. |

||||||

b |

2b $ |

, |

. |

|

|

|

|

|

|

|

|

|

3a |

Dividend income. See page 18. If over $400, complete Section A now. |

|

|

3a $ |

, |

. |

||||||

b |

Capital gain distributions. Caution: Pending tax law may reduce the amount taxed. See page 18. |

|

3b$ |

, |

. |

|||||||

4 |

Taxable refunds, credits, or offsets of state and local income taxes. See page 18. |

|

4 |

$ |

, |

. |

||||||

5a |

Total IRA distributions. |

5a $ |

, |

. |

b Taxable amount. See page 19. |

5b$ |

, |

. |

||||

6a |

Total pensions and annuities. |

6a $ |

, |

. |

b Taxable amount. See page 19. |

6b$ |

, |

. |

||||

7 |

Unemployment compensation. See page 21. |

|

|

|

|

|

7 |

$ |

, |

. |

||

8a |

Social security benefits. |

8a $ |

, |

. |

b Taxable amount. See page 21. |

8b$ |

, |

. |

||||

9 |

Other income from list on page 22. |

|

|

|

|

|

|

|

9 |

$ |

, |

. |

10 |

Total income. Add the amounts in the far right column for lines 1 through 9. |

|

|

10 |

$ |

, |

. |

|||||

11 |

Your IRA deduction. See page 23. |

|

|

|

11 |

$ |

, |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

12 |

Spouse’s IRA deduction. See page 23. |

|

|

12 |

$ |

, |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

13 |

Penalty on early withdrawal of savings. |

|

|

13 |

$ |

, |

. |

|

|

|

|

|

14 |

Alimony paid. Enter recipient’s SSN. |

- |

- |

See page 26. 14 |

$ |

, |

. |

|

|

|

|

|

51T5AAA |

*51T5AAA* |

15 |

Total adjustments. Add lines 11 through 14. See page 26 for other adjustments. |

15 |

$ |

|

, |

. |

|

|

16 |

Adjusted gross income. Subtract line 15 from line 10. |

|

16 |

$ |

|

, |

. |

|

|

If this amount is less than $26,673, see the statement at the right. |

|

|

|

If line 1 and line 16 are |

|||

Standard Deduction or Itemized Deductions |

|

|

||||||

|

|

each |

less than |

$26,673 |

|

|||

17Fill in circle and see page 26 if you are married filing separately and your spouse itemizes deductions. and a child lived with you (less than $9,230 if a child

18Fill in circle if your parents (or someone else) can claim you as a dependent on their return. didn’t live with you), see Earned Income Credit on

19Fill in all that apply. You were: Age 65 or older Blind. Spouse was: Age 65 or older Blind. page 31.

20 |

Enter the larger of your standard deduction (see page 27) OR your itemized deductions from |

20 |

$ |

|

|

, |

|

. |

|

|

Section B, line t. Your Federal income tax will be less if you enter the larger amount here. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

Subtract line 20 from line 16. |

21 |

$ |

|

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

Attach copy B of your |

If you didn’t |

Enclose, but do not attach, |

Form |

Page 1 |

Forms |

get a |

your payment and payment |

|

|

and |

see page 17. |

voucher. See page 39. |

|

|

|

|

|

|

|

22 Enter the amount from line 21. |

22 |

$ |

|

|

, |

|

. |

|

Exemptions ● Complete Section C before you fill in 23c.

●If you filled in the circle on line 18 or are married filing separately, see page 27 before completing line 23.

23 |

|

Enter “1” for yourself |

|

Enter “1” for spouse |

Enter no. of dependents from Section C |

Add a, b, and c |

|||||

|

a |

|

|

+ b |

|

+ c |

|

|

= 23d |

|

|

24 |

If line 16 is $86,025 or less, multiply $2,500 by the total number of exemptions claimed on |

24 |

$ |

|

, |

. |

|||||||

|

line 23d. If line 16 is over $86,025, see the worksheet on page 29 for the amount to enter. |

|

|||||||||||

|

|

|

|

|

|

||||||||

25 |

Taxable income. Subtract line 24 from line 22. If line 24 is more than line 22, |

25 |

$ |

|

, |

. |

|||||||

|

leave line 25 blank. |

|

|

|

|

|

|

|

|

|

|

||

Tax |

Fill in circle if you want the IRS to figure your tax. See page 28. |

|

|

|

|

|

|

|

|||||

26 |

Find the tax on the amount on line 25 and enter here. See page 29. Fill in circle that applies: |

26 |

$ |

|

, |

. |

|||||||

|

|

Tax Table, |

Tax Rate Schedules, |

Capital Gain Tax Worksheet, or |

Form 8615 |

|

|||||||

|

|

|

|

|

|

|

|||||||

27 |

Credit for child and dependent care expenses. Complete Section D now. |

|

27 |

$ |

|

, |

. |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

28 |

Subtract line 27 from line 26. If line 27 is more than line 26, leave line 28 blank. |

28 |

$ |

|

, |

. |

|||||||

29 |

Advance earned income credit payments from Form |

|

|

|

29 |

$ |

|

, |

. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

30 |

Household employment taxes. Attach Schedule H. |

|

|

|

30 |

$ |

|

, |

. |

||||

31 |

Total tax. Add lines 28, 29, and 30. |

|

|

|

|

|

31 |

$ |

|

|

|

||

|

Fill in circle if total tax includes: |

Alternative minimum tax. See page 30. |

|

|

, |

. |

|||||||

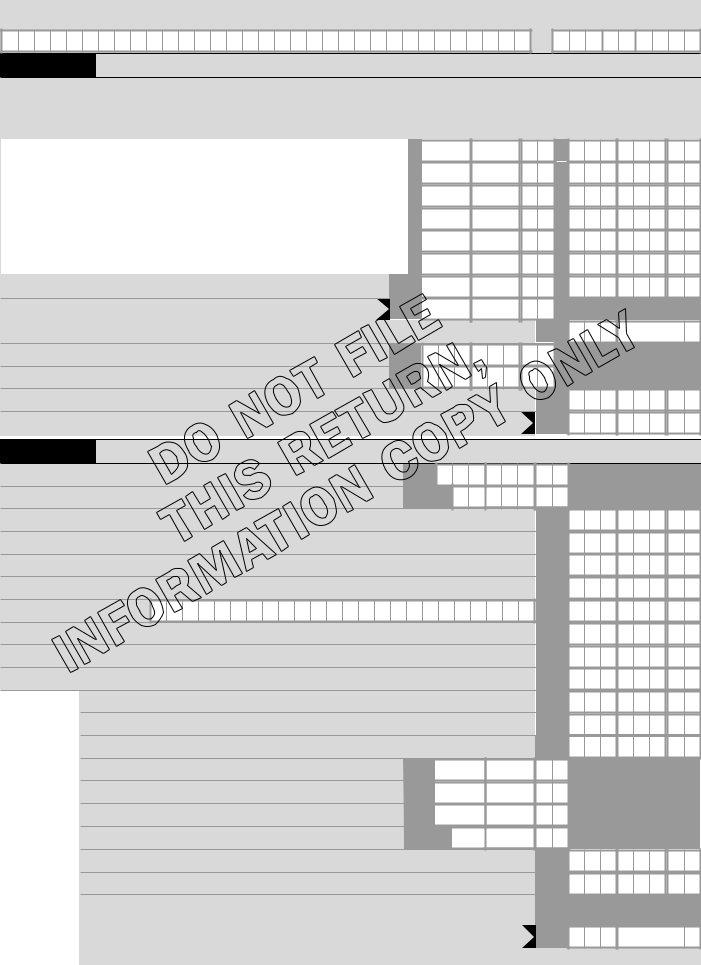

32 |

Federal income tax withheld. Fill in |

if any is from Form(s) 1099. |

32 |

$ |

, |

. |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

33 |

1995 estimated tax payments and amount applied from 1994 return. |

33 |

$ |

, |

. |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

34 |

Earned income credit. If required, complete Section E. See page 31. |

34 |

$ |

, |

. |

|

▶ |

Fill in circle if you want |

|||||

|

the IRS to figure your |

||||||||||||

35 |

Amount paid with Form 4868 (extension request). |

|

|

|

|

|

|

||||||

35 |

$ |

, |

. |

|

|

earned income credit. |

|||||||

|

|

|

|

|

|

|

|

|

|

Complete Section E if |

|||

36 |

Excess social security and RRTA tax withheld. See page 37. |

36 |

$ |

|

|

|

|

||||||

, |

. |

|

|

required. See page 31. |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

37 |

Total payments. Add lines 32 through 36. |

|

|

|

37 |

$ |

|

, |

. |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

If line 37 is more than line 31, figure your refund below. |

If line 37 is less than line 31, figure the amount you owe. |

|||||||||||||||||||||||

38 |

Subtract line 31 from line 37. |

38 |

$ |

|

|

, |

|

|

. |

|

|

|

|

41 Amount you owe. |

41 |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

. |

|

|

|

|||||||||

|

This is the amount you overpaid. |

|

|

|

|

|

|

|

|

|

|

Subtract line 37 from line 31. |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See page 39 for details on |

|

|

|

Fill in circle if you did |

|||||||

39 |

Amount of line 38 you |

39 |

$ |

|

|

, |

|

|

. |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

how to pay and use the |

|

|

|

not pay the full amount |

|||||||||||||

|

want refunded to you. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

payment voucher. |

|

|

|

shown on line 41. |

||||||||

40 |

Amount of line 38 you want |

40 |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

. |

|

|

|

|

42 Estimated tax penalty. See |

42 |

$ |

|

|

, |

|

|

. |

|

|

|

||||

|

applied to your 1996 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

page 39. Also, include this |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

estimated tax. |

|

|

|

|

|

|

|

|

|

|

|

|

amount on line 41. |

|

|

|

|

|

|

|

|

|

|

|

43 Additional Information Use this space only as the instructions show. (More space on page 5 of this form.) See page 40.

Line Entry item |

Amount |

Line Entry item |

Amount |

$ |

, |

. |

$ |

, |

. |

$ |

, |

. |

$ |

, |

. |

Signature Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and accurately list all amounts and sources of income I received during

the tax year. Declaration of preparer (other than the taxpayer) is based on all information of which the preparer has any knowledge.

N1T5AAA |

*N1T5AAA* |

Your signature. Please keep your signature inside the box. |

Spouse’s signature. If a joint return, BOTH must sign. |

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

Your occupation. |

|

|

|

|

|

|

|

Date |

Spouse’s occupation. |

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For paid preparer use only. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Paid preparer’s signature. |

|

|

|

|

|

|

|

Firm’s name (preparer’s name if |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Date |

|

|

|

|

Preparer’s social security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Fill in circle if you |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

- |

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

are |

|

EIN |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

For Official |

TC, TCE |

VITA |

IRS Prepared |

|

|

|

|

IRS Reviewed |

|

|||||||||||||||||||||||||||||||||

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Page 2 Form

Name |

Print your name and SSN as they appear on page 1. |

Your social security number |

|

|

|

-

-

Section A Interest and Dividend Income See page 61.

●If you received interest from a

●If you received a Form

a Name of payer. If more than six payers, see page 61. |

b Taxable interest |

c Gross dividends |

|

|

|

$ |

|

|

, |

|

|

. |

|

|

|

|

$ |

|

|

, |

|

|

. |

|

|

|

|

$ |

|

|

, |

|

|

. |

|

|

|

|

$ |

|

|

, |

|

|

. |

|

|

|

|

$ |

|

|

, |

|

|

. |

|

|

|

|

$ |

|

|

, |

|

|

. |

|

d |

Subtotals from page 5, line d of Interest and Dividend Income. |

d $ |

|

|

, |

|

|

. |

|

|

e |

Total taxable interest. Also, enter this amount on line 2a. |

e $ |

|

|

, |

|

|

. |

|

|

fTotal gross dividends.

g |

Total capital gain distributions included on line f. Also, enter on line 3b. |

g $ |

, |

. |

h |

Nontaxable distributions included on line f. |

h $ |

, |

. |

iAdd lines g and h.

j Total dividends. Subtract line i from line f. Enter the result here and on line 3a.

Section B Itemized Deductions See page 62.

a Medical and dental expenses. |

a $ |

, |

. |

b Multiply line 16 by 7.5% (.075). Enter the result here. |

b $ |

, |

. |

cSubtract line b from line a. If line b is more than line a, leave line c blank.

dState and local income taxes.

eReal estate taxes.

fPersonal property taxes.

g Other taxes. See page 63.

hHome mortgage interest and points reported to you on Form 1098.

iHome mortgage interest and points not reported to you on Form 1098. See page 64.

jInvestment interest. See page 65.

kCharitable gifts made by cash or check. If any one gift is $250 or more, see page 65.

lOther charitable gifts. If over $500 or any gift is $250 or more, see page 66.

|

|

m |

Add lines c through l. |

|

|

|

|

|

|

|

|

|

n |

Unreimbursed employee expenses. If required, list on line 43. See page 67. |

n $ |

|

|

, |

|

|

. |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

|

|

o |

Other expenses from list on page 67. Also, list on line 43. |

o $ |

|

|

, |

|

|

. |

|

|

|

|

|

|

|

|

|

||

|

|

p |

Add lines n and o. |

p $ |

|

|

, |

|

|

. |

|

|

|

|

|

|

|

|

|

||

1T5AAA3 |

*1T5AAA3* |

q |

Multiply line 16 by 2% (.02). Enter the result here. |

q $ |

|

|

, |

|

|

. |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

|

|

r |

Subtract line q from line p. If line q is more than line p, leave line r blank. |

|

||||||

sOther miscellaneous deductions from list on page 67. Also, list on line 43.

tIs line 16 over $114,700 (over $57,350 if married filing separately)?

NO. |

Your deduction is not limited. Add lines m, r, and s. Also, enter on line 20 |

% |

|

the larger of this amount or your standard deduction (see page 27). |

|

YES. Your deduction may be limited. See page 67 for the amount to enter. |

||

$

$

$

$

$

$

$

f$

i$

j$

c$

d$

e$

f$

g$

h$

i$

j$

k$

l$

m$

r$

s$

t$

,.

,.

,.

,.

,.

,.

,.

, .

,.

,.

,.

,.

,.

,.

,.

,.

,.

,.

,.

,.

,.

,.

,.

, .

If you have no entries on this page or page 4, do not send them in. |

Form |

Page 3 |

|

|

Name |

|

|

|

Print your name and SSN as they appear on page 1 only if you have no entries on page 3. |

Your social security number |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section C |

|

|

Dependents If your dependent was born in 1995, see page 69 before completing. |

Fill in circle if child |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

didn’t live with you |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you have more than five dependents, see page 69. |

|

|

|

|

|

but is claimed under a |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

Print last name (surname), then a space, and first name. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

Dependent’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Relationship |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependent’s |

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

Number of months lived |

|

|

|

|

|

|

||||||||||||||||||||||

|

to you |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in your home during 1995 |

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependent’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Relationship |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependent’s |

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

Number of months lived |

|

|

|

|

|

|

||||||||||||||||||||||

|

to you |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in your home during 1995 |

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependent’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Relationship |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependent’s |

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

Number of months lived |

|

|

|

|

|

|

||||||||||||||||||||||

|

to you |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in your home during 1995 |

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Dependent’s |

|

|

|

|

|

name |

|

|

|

|

|

Relationship |

Dependent’s |

- |

- |

Number of months lived |

|

to you |

SSN |

in your home during 1995 |

|||

|

|

Dependent’s |

|

|

|

|

|

name |

|

|

|

|

|

Relationship |

Dependent’s |

- |

- |

Number of months lived |

|

to you |

SSN |

in your home during 1995 |

|||

|

|

No. of your children in |

|

Section C who: |

● lived with you |

●didn’t live with you due to divorce or separation

No. of other dependents in Section C

Add numbers in boxes at left. Enter total here and on line 23c.

Section D |

Credit for Child and Dependent Care Expenses See page 70. |

|

a Care provider’s name and address. If more than two, see page 71. b Provider’s SSN or EIN |

c Amount paid. See page 71. |

|

SSN EIN

- |

- |

-

$

,

.

|

|

|

|

SSN |

|

|

|

- |

|

- |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

. |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

EIN |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d Add amounts in column c. |

|

|

|

|

|

|

|

|

d $ |

|

, |

|

|

. |

|

|

|||||||||

|

e |

Number of qualifying persons cared for in 1995. See page 70. |

|

|

|

|

|

|

|

|

e |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f |

Amount of qualified expenses you incurred and paid in 1995. DO NOT enter more than |

f |

$ |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

$2,400 for one qualifying person or $4,800 for two or more persons. See page 71. |

|

|

|

, |

|

|

|

. |

|

|

||||||||||||||

|

g |

YOUR earned income. See page 70. Do not include your spouse’s income here. |

|

|

|

|

|

|

|

|

g $ |

|

|

|

, |

|

|

. |

|

|

||||||

h |

If filing jointly, SPOUSE’S earned income. (If student or disabled, see page 71.) All others, enter amount from line g. |

h $ |

|

|

|

, |

|

|

. |

|

|

|||||||||||||||

i |

Enter the smallest of line f, line g, or line h. |

|

|

|

|

|

|

|

|

i |

$ |

|

|

|

, |

|

|

|

. |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

j |

Enter the decimal amount from page 71 that applies to you. |

|

|

|

|

|

|

|

|

j |

|

|

|

|

|

|

|

. |

|

|

|||||

|

k Multiply line i by line j. Enter the result. Then, see page 71 for the amount to enter on |

k |

$ |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

, |

|

|

|

. |

|

|

||||||||||||||||

|

|

line 27. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1T5AAA4 |

*1T5AAA4* |

|

Section E |

|

Earned Income Credit See page 28 if you want the IRS to figure your credit. |

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a Nontaxable earned income. See page 34. Enter type |

|

|

|

|

|

|

|

|

|

|

|

|

and amount. |

$ |

|

|

|

, |

|

|

. |

|

|

|

||||||||||||||||||

|

b Give the following information for your qualifying child or children. If the child was born in 1995, see page 72 before completing. |

|

If the child was born |

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

before 1977, fill in circle |

|

||||||||||||||||||||||||||||||||||||||||

|

|

Print last name (surname), then a space, and first name. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

below if the child was: |

|

|||||||||||||||||||||

|

Child’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A student |

Disabled. |

|

||||

|

name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

under age 24. |

See |

|

|||||

|

Relation- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Child’s |

|

|

- |

|

- |

|

|

|

|

|

|

|

|

See page 72. |

page 72. |

|

|||||

|

ship to you |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No. of months lived with you in U.S. in 1995 |

|

|

|

|

Year of birth |

1 |

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Child’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relation- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Child’s |

|

|

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ship to you |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

No. of months lived with you in U.S. in 1995 |

|

|

|

|

Year of birth |

1 |

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 4 Form

If you have no entries on this page or page 3, do not send them in.

Continuation Sheet for Form 1040

Name Print your name and SSN as they appear on page 1. |

Your social security number |

-

-

Section

a Name of payer |

|

b Taxable interest |

|

|

|

|||||

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

. |

|

|

|

|

|

$ |

|

|

, |

|

|

. |

|

|

|

|

$ |

|

|

, |

|

|

. |

|

|

|

|

$ |

|

|

, |

|

|

. |

|

|

|

|

$ |

|

|

, |

|

|

. |

|

|

d Subtotals. On page 3, include on line d. |

d $ |

|

|

, |

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

||

cGross dividends

$ |

, |

. |

$ |

, |

. |

$ |

, |

. |

$ |

, |

. |

$ |

, |

. |

$ |

, |

. |

Name and address of person from whom you received interest, or to whom you paid interest |

That person’s SSN or EIN |

SSN

EIN

- |

- |

-

Interest was (fill in circle):

Received Paid

Section

Print last name (surname), then a space, and first name.

Fill in circle if child didn’t live with you but is claimed under a

Dependent’s |

|

|

|

|

name |

|

|

|

|

Relationship |

Dependent’s |

- |

- |

Number of months lived |

to you |

SSN |

in your home during 1995 |

Dependent’s |

|

|

|

|

|

name |

|

|

|

|

|

Relationship |

Dependent’s |

- |

- |

Number of months lived |

|

to you |

SSN |

in your home during 1995 |

|||

|

|

Dependent’s |

|

|

|

|

|

name |

|

|

|

|

|

Relationship |

Dependent’s |

- |

- |

Number of months lived |

|

to you |

SSN |

in your home during 1995 |

|||

|

|

Dependent’s |

|

|

|

|

|

name |

|

|

|

|

|

Relationship |

Dependent’s |

- |

- |

Number of months lived |

|

to you |

SSN |

in your home during 1995 |

|||

|

|

Section

1T5AAA5 |

*1T5AAA5* |

a Care provider’s name and address

SSN

EIN

SSN

EIN

dSubtotal. Include in total on line d on page 4.

b Provider’s SSN or EIN

- |

- |

- |

|

- |

- |

-

cAmount paid. See page 71.

$ |

|

|

, |

|

. |

|

$ |

|

|

|

|

|

|

|

|

, |

|

. |

|

|

|

|

|

|

|

||

d $ |

|

|

, |

|

. |

|

Line |

|

Entry item |

|

Amount |

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you have no entries on this page or page 6, do not send them in. |

Form |

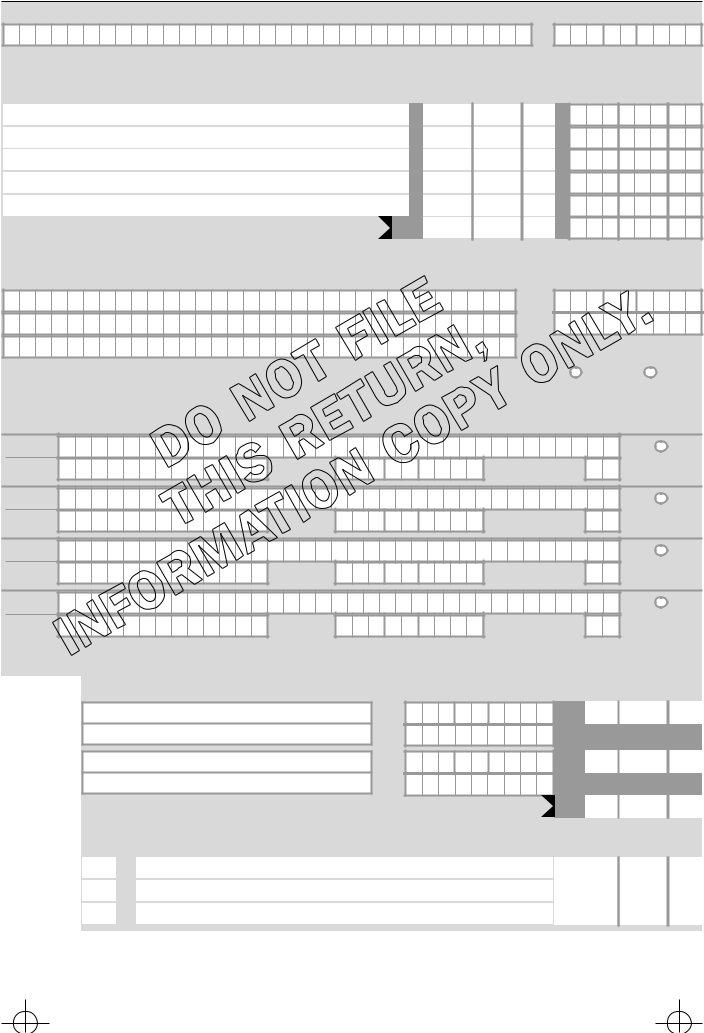

Section F |

Direct Deposit of Refund |

|

|

|

|

Please print in ALL CAPITAL LETTERS in the spaces provided. |

|

|

Your last name (surname), space, first name, space, and middle initial |

Your social security number |

|

-

-

1Name of the financial institution

2Routing transit number (RTN)

The first two numbers of the RTN must be 01 through 12 or 21 through 32.

3 Depositor account number (DAN) |

4 Type of account |

5 Ownership of account |

|||

|

Checking |

Savings |

Self |

Spouse |

Self and spouse |

Purpose of Section

Use Section F to request that we deposit your tax refund into your account at a financial institution instead of sending you a check.

Why Use Direct Deposit?

●Takes less time than issuing a check.

●Is more

●Saves tax dollars. Making a direct deposit costs less than issuing a check.

Requesting Direct Deposit

Requesting direct deposit is easy. Just fill in the few lines in Section F and attach it to your tax return. If you have other forms or schedules to attach to your return, be sure to attach Section F directly behind Form

How To Fill In Section F

TIP |

You can check with your financial |

institution— |

1.To make sure the financial institution will accept direct deposits.

2.To get the correct routing transit number (RTN) and depositor account number (DAN).

Line

Line

sample check below for an example of where the RTN may be shown.

For accounts payable through a financial institution other than the one at which the account is located, check with your financial institution for the correct RTN. Do not use a deposit slip to verify the RTN.

Line

Line

Caution: The account cannot include the name of any other person except as noted above.

Some financial institutions will not allow a joint refund to be deposited into an individual account. Check with your financial institution.

Who Should Not File Section F

You should not file Section F if either of the following apply:

●You file electronically. Instead, you can request direct deposit on Form 8453, U.S. Individual Income Tax Declaration for Electronic Filing (or on Form

●You are filing a return for a taxpayer who died, or filing a joint return as a surviving spouse.

What Happens if There Is a Problem With My Direct Deposit Request?

If we are unable to honor your request for a direct deposit, we will send you a check instead. Some reasons for not honoring a request include:

●The name(s) on your tax return does not match the name(s) on the account. See the instructions for line 5.

●You have requested that the IRS figure your tax for you instead of figuring it yourself.

●The refund amount you claimed differs from the refund to which you are entitled by more than $50.

●The financial institution rejects the direct deposit because of an incorrect DAN.

●You enter an incorrect RTN or DAN, or do not fill in the correct circle for line 4 or 5.

●You asked to have your refund directly deposited into a foreign bank or a foreign branch of a U.S. bank. The IRS can only make direct deposits to accounts in U.S. financial institutions located in the United States.

Checking on Your Refund

Automated refund information is available on

|

|

PAUL MAPLE |

|

1234 |

|

|

LILIAN MAPLE |

|

|

|

|

123 Main Street |

|

|

|

|

|

19 |

|

|

|

Anyplace, NY 10000 |

|

|

|

|

PAY TO THE |

|

$ |

|

|

ORDER OF |

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

1T5AAA6 |

*1T5AAA6* |

ANYPLACE BANK |

RTN |

DAN |

Anyplace, NY 10000 |

(line 2) |

(line 3) |

||

|

|

|

||

|

|

For |

|

|

|

|

|:250000005|:200000"’86". |

1234 |

|

Note: The RTN and DAN may appear in different places on your check.

Page 6 Form

If you have no entries on this page or page 5, do not send them in.