form 10f format in word can be completed online very easily. Simply try FormsPal PDF tool to get it done without delay. In order to make our tool better and simpler to use, we constantly develop new features, with our users' feedback in mind. Here's what you will have to do to get going:

Step 1: Access the PDF in our tool by hitting the "Get Form Button" above on this page.

Step 2: With the help of this handy PDF file editor, you can accomplish more than simply fill out blanks. Express yourself and make your forms seem professional with customized textual content put in, or fine-tune the original input to perfection - all comes along with the capability to insert almost any graphics and sign it off.

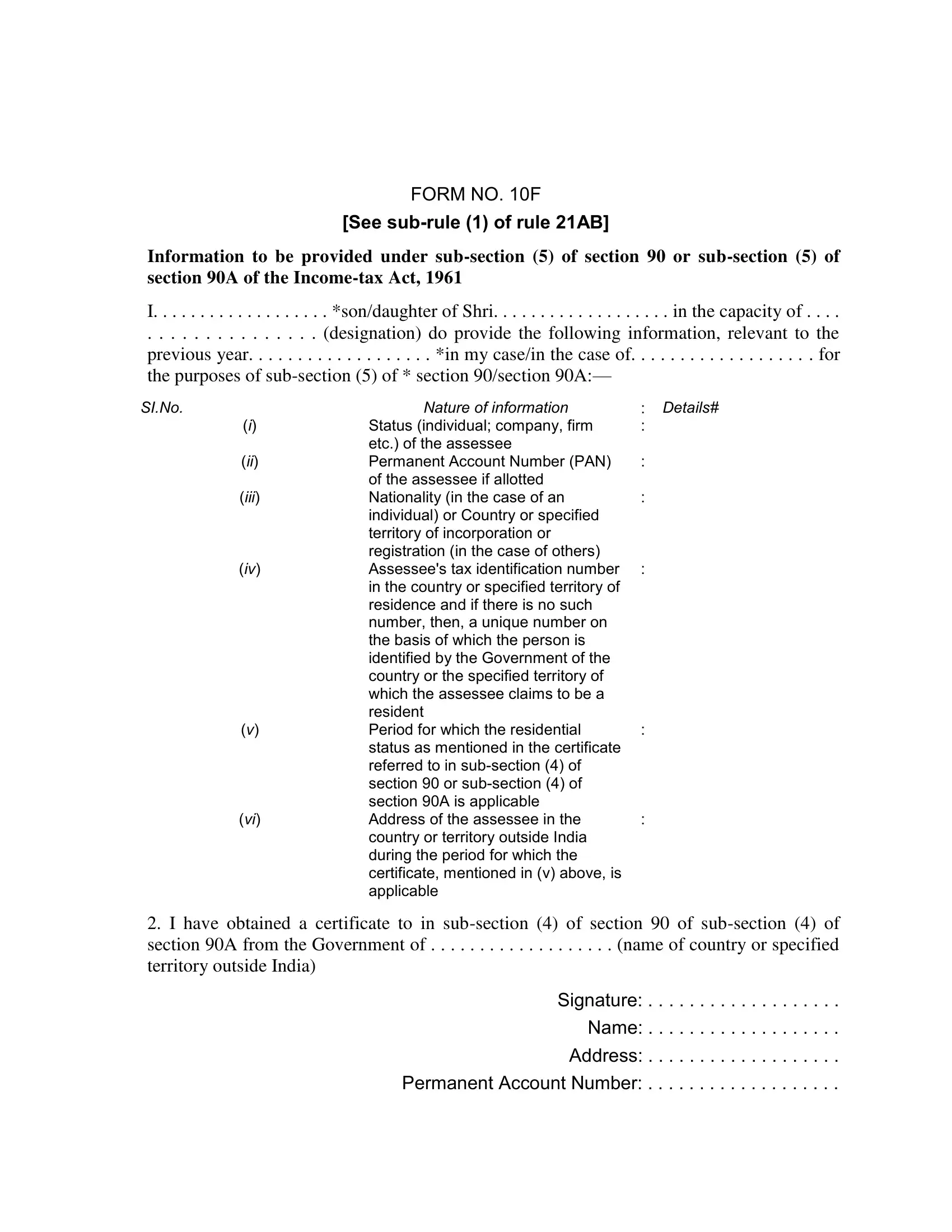

When it comes to fields of this particular form, this is what you should consider:

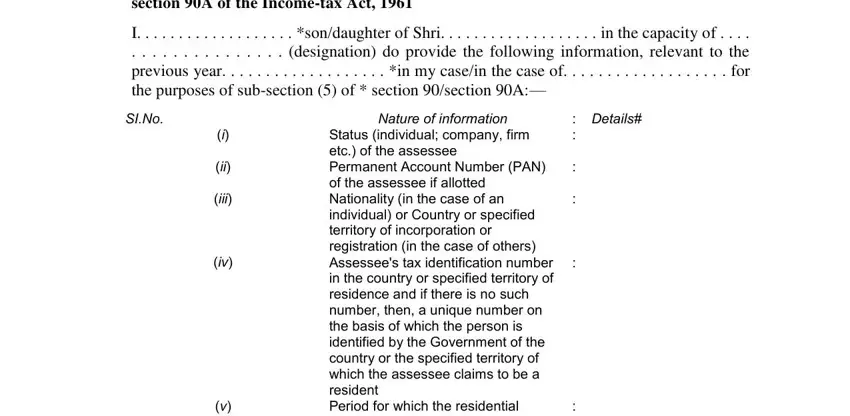

1. To get started, when filling in the form 10f format in word, start with the area that includes the next fields:

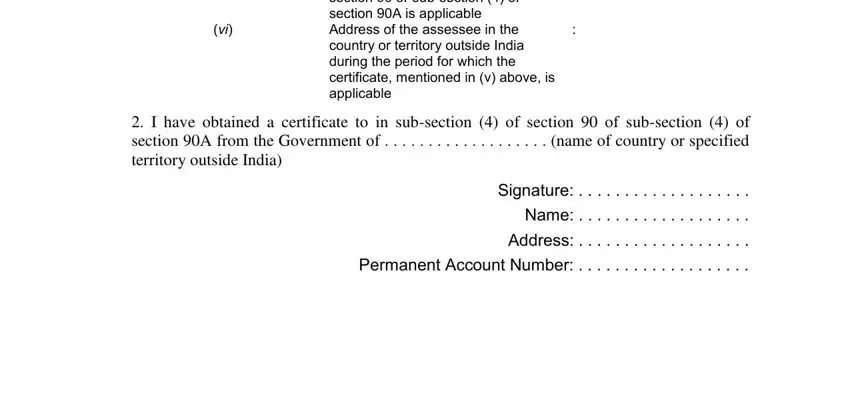

2. The third part is to fill out the following blank fields: Status individual company firm etc, I have obtained a certificate to, Signature, Name, Address, and Permanent Account Number.

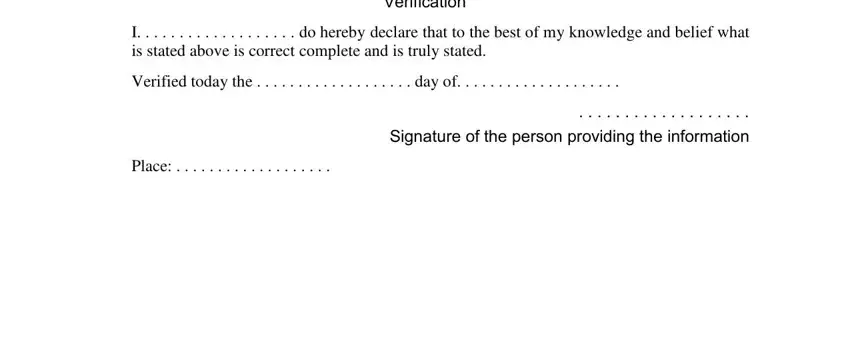

3. The next part is normally simple - complete all the blanks in Verification, I do hereby, Verified today the, Signature of the person providing, and Place to conclude this part.

Be extremely mindful when filling out Verified today the and Place, since this is the section where a lot of people make mistakes.

Step 3: Before moving forward, ensure that blanks were filled in properly. When you believe it's all fine, click “Done." Go for a free trial subscription at FormsPal and acquire immediate access to form 10f format in word - downloadable, emailable, and editable in your FormsPal account. Whenever you work with FormsPal, it is simple to fill out documents without worrying about personal data leaks or data entries getting shared. Our protected system makes sure that your private information is stored safely.