1120 due date can be filled out effortlessly. Simply try FormsPal PDF tool to accomplish the job promptly. The tool is consistently upgraded by us, receiving useful functions and growing to be a lot more convenient. With a few basic steps, it is possible to begin your PDF editing:

Step 1: Firstly, access the tool by clicking the "Get Form Button" above on this webpage.

Step 2: This tool enables you to modify PDF files in a variety of ways. Enhance it with customized text, adjust what is originally in the file, and place in a signature - all readily available!

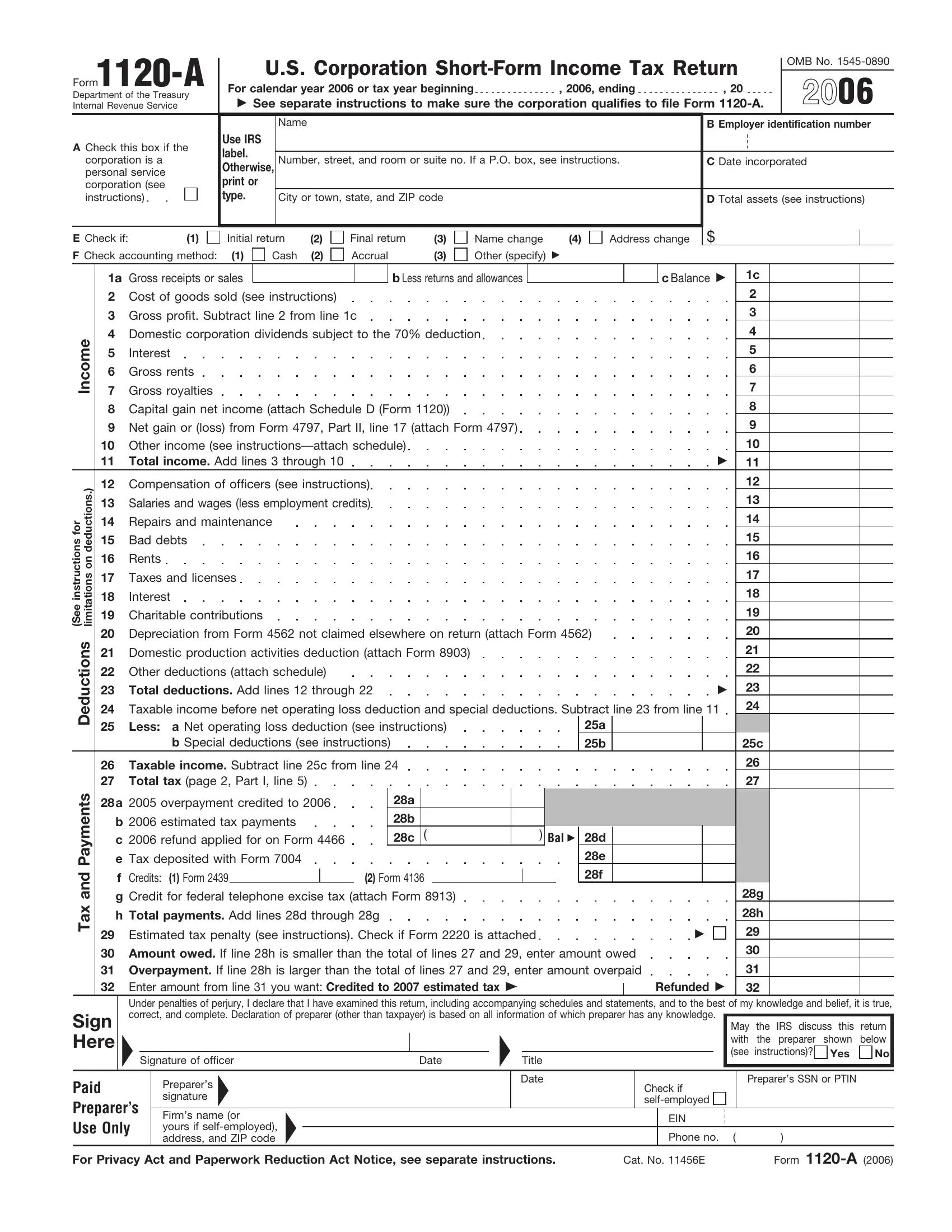

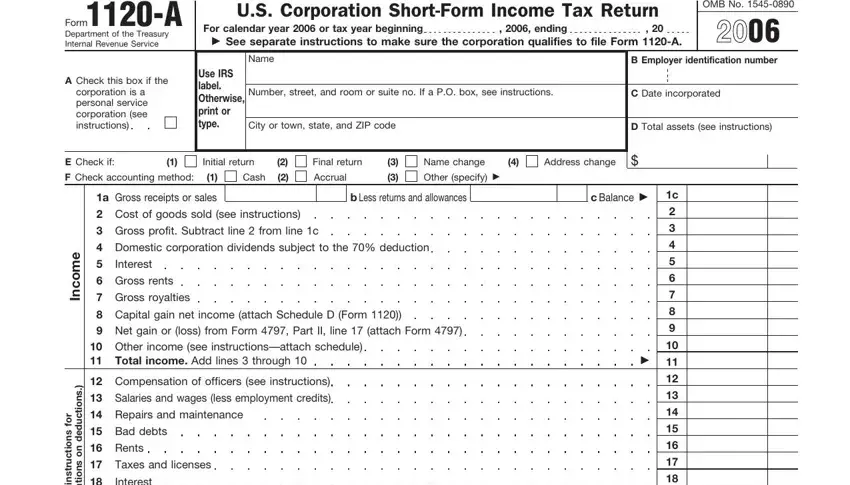

With regards to the blank fields of this specific PDF, here is what you need to do:

1. To begin with, while completing the 1120 due date, start out with the section containing subsequent fields:

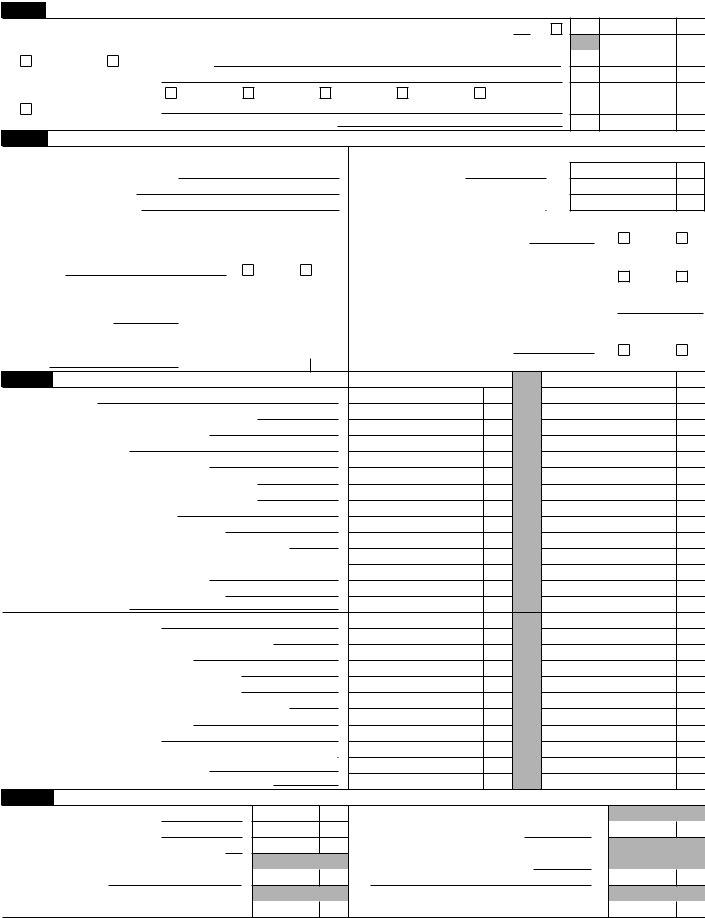

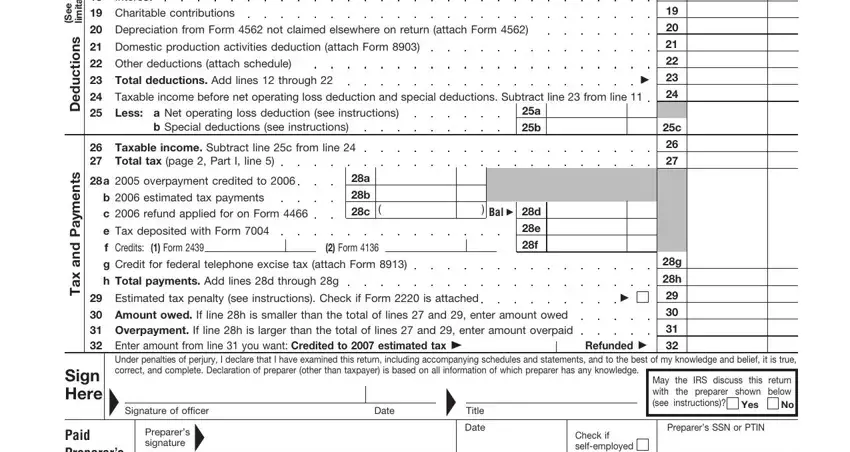

2. After completing this part, head on to the subsequent stage and enter all required details in all these blank fields - c , c , h , Taxes and licenses Interest, Domestic production activities, a b, a b, Net operating loss deduction see, overpayment credited to , Tax deposited with Form , Form , Credits Credit for federal, Form , Total payments Add lines d through, and Bal .

As for Form and Bal , be sure that you double-check them in this current part. Those two could be the most important ones in this file.

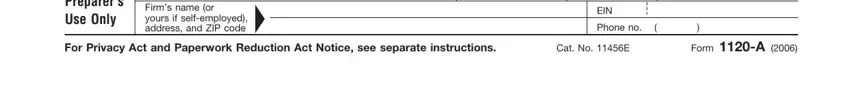

3. This next section is about Paid Preparers Use Only For, Preparers signature Firms name or, Check if selfemployed, EIN Phone no, Cat No E, and Form A - fill in all these fields.

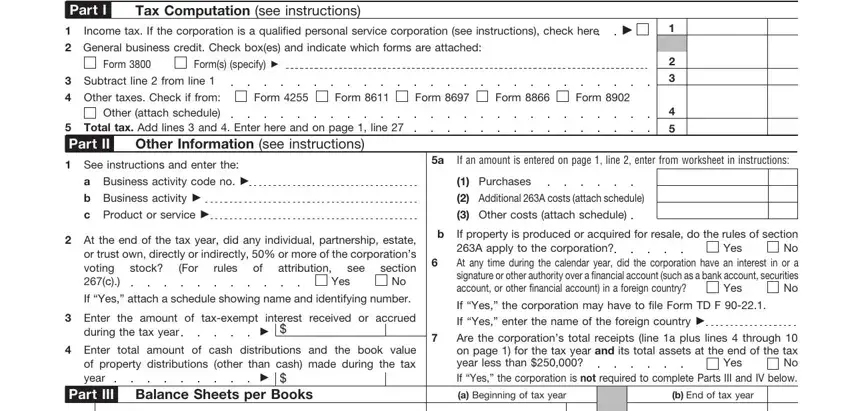

4. To go forward, this fourth part will require typing in a handful of form blanks. These comprise of Part I, Tax Computation see instructions, Income tax If the corporation is a, Forms specify , Form , Form , Form , If an amount is entered on page , Purchases Additional A costs, Yes, If property is produced or, Yes, Yes, Beginning of tax year, and End of tax year, which you'll find key to moving forward with this PDF.

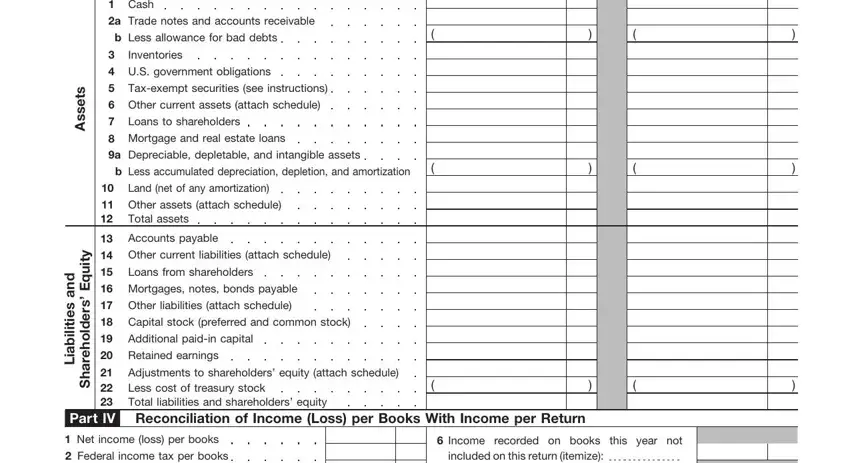

5. The pdf should be wrapped up by dealing with this area. Here you'll see a full set of fields that must be completed with specific details for your document submission to be accomplished: Beginning of tax year, End of tax year, Cash Trade notes and accounts, b Less allowance for bad debts, Inventories US government, Accounts payable Other current, s t e s s A a b, d n a, s e i t i l i, b a L, y t i u q E, Part IV, s r e d o h e r a h S, Loans from shareholders Mortgages, and Reconciliation of Income Loss per.

Step 3: Immediately after looking through the filled in blanks, press "Done" and you're done and dusted! Acquire the 1120 due date after you sign up at FormsPal for a 7-day free trial. Conveniently use the pdf file within your personal account, along with any modifications and changes being all saved! We don't share or sell any details that you type in while completing documents at our website.