what irs forms 1125e can be completed online without difficulty. Simply use FormsPal PDF editor to complete the task promptly. Our team is devoted to giving you the absolute best experience with our editor by continuously adding new capabilities and enhancements. With these updates, working with our editor gets better than ever before! All it takes is a couple of basic steps:

Step 1: Press the "Get Form" button in the top part of this webpage to get into our PDF tool.

Step 2: As soon as you open the file editor, you will find the document made ready to be filled in. In addition to filling out various blank fields, you could also do some other things with the form, specifically writing your own textual content, modifying the initial text, adding images, putting your signature on the form, and more.

Be attentive while completing this pdf. Make certain all mandatory blanks are done accurately.

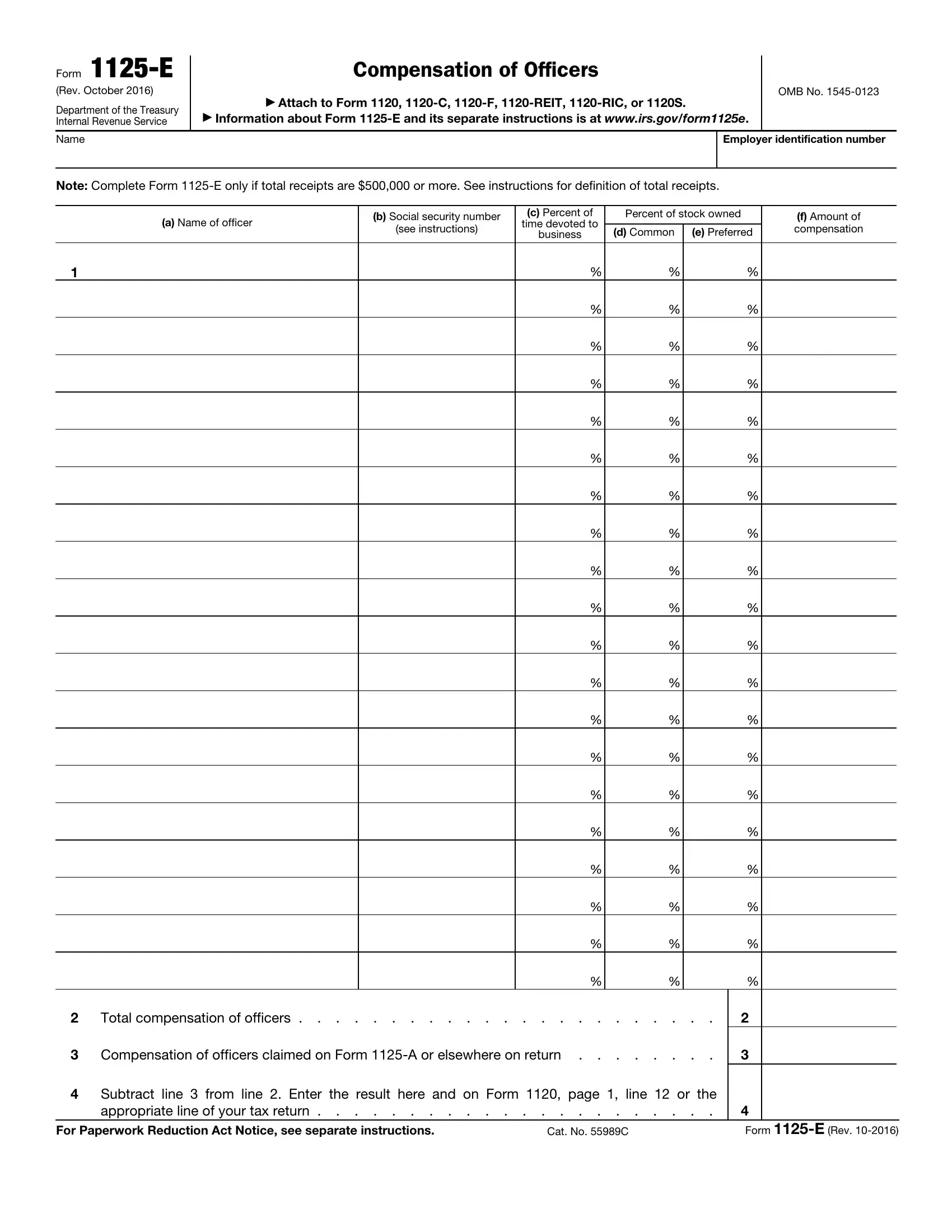

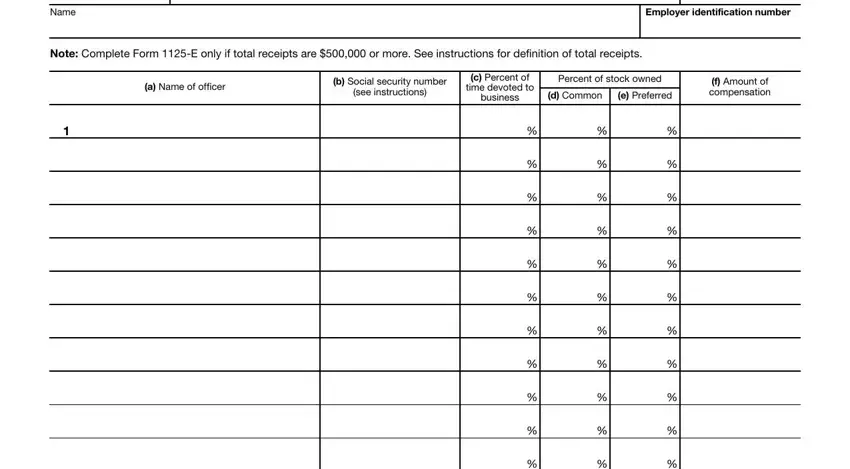

1. Firstly, once filling out the what irs forms 1125e, start out with the form section containing next fields:

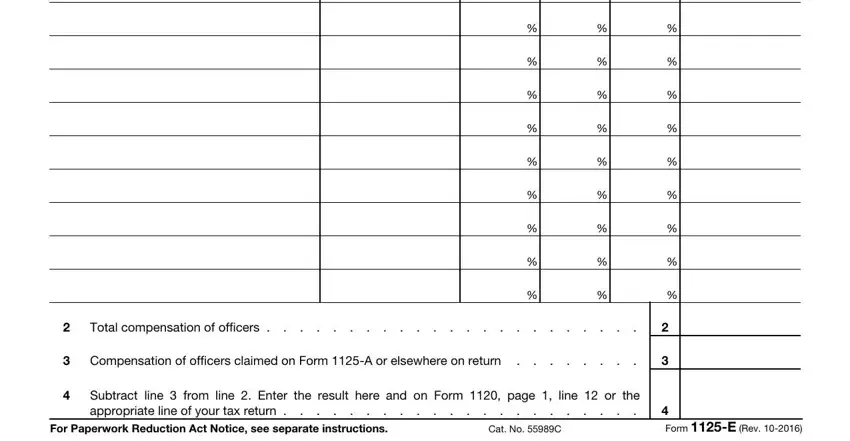

2. Once your current task is complete, take the next step – fill out all of these fields - Total compensation of officers , Compensation of officers claimed, Subtract line from line Enter, For Paperwork Reduction Act Notice, Cat No C, and Form E Rev with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It's simple to make errors when filling in your Total compensation of officers , and so you'll want to go through it again before you decide to finalize the form.

Step 3: Prior to moving on, ensure that all form fields were filled in right. When you determine that it's correct, click “Done." Make a free trial subscription with us and get direct access to what irs forms 1125e - which you can then make use of as you would like from your FormsPal account page. FormsPal offers protected form editor without data recording or any kind of sharing. Feel at ease knowing that your data is secure here!