income tax form isp 1202 can be filled out without difficulty. Just make use of FormsPal PDF editor to do the job in a timely fashion. In order to make our tool better and more convenient to use, we constantly design new features, taking into consideration feedback coming from our users. Here is what you would want to do to begin:

Step 1: First, access the editor by clicking the "Get Form Button" above on this site.

Step 2: Using this online PDF editor, it is possible to accomplish more than just complete forms. Try all the features and make your forms look sublime with customized text incorporated, or fine-tune the file's original input to excellence - all backed up by an ability to add your personal photos and sign it off.

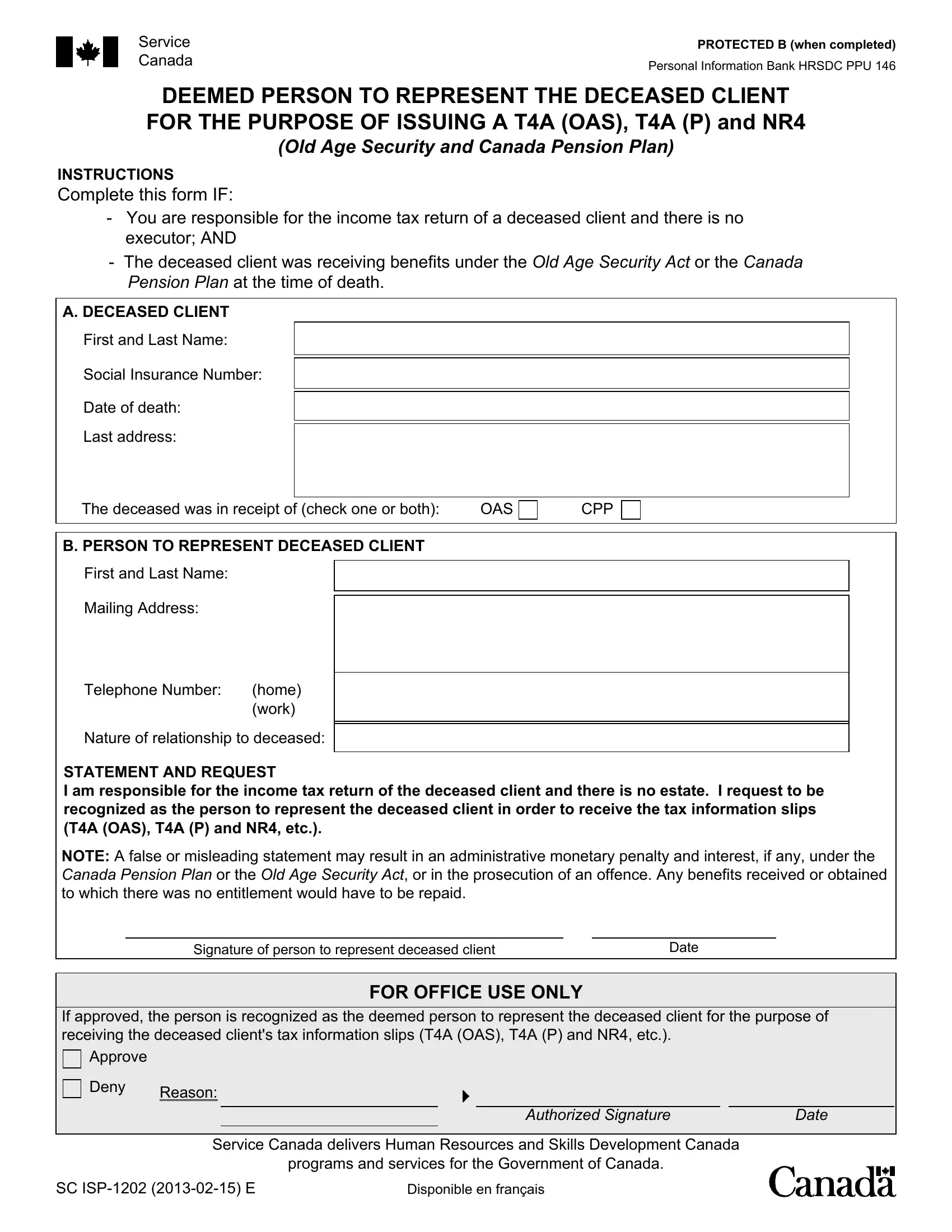

For you to fill out this PDF form, make sure you provide the required information in every single blank field:

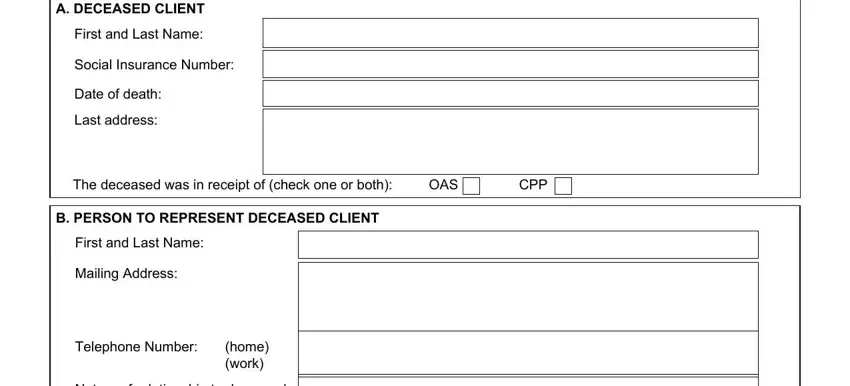

1. Fill out your income tax form isp 1202 with a selection of essential fields. Note all of the information you need and make certain not a single thing missed!

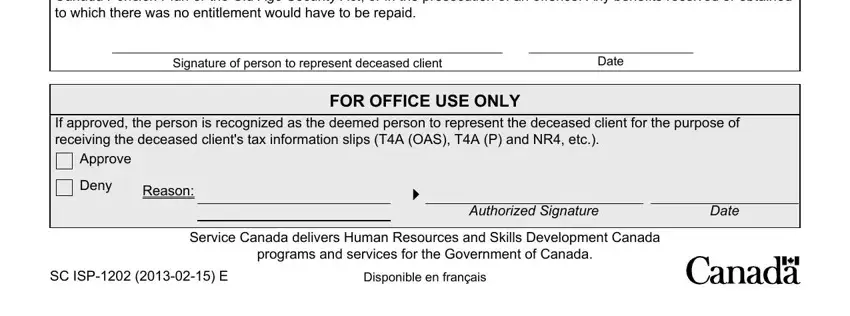

2. Once your current task is complete, take the next step – fill out all of these fields - NOTE A false or misleading, Signature of person to represent, Date, If approved the person is, FOR OFFICE USE ONLY, Approve, Deny, Reason, Service Canada delivers Human, programs and services for the, SC ISP E, Disponible en français, Authorized Signature, and Date with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

You can potentially get it wrong when filling in your Disponible en français, hence make sure you go through it again before you decide to finalize the form.

Step 3: Spell-check the information you have inserted in the form fields and then press the "Done" button. After getting a7-day free trial account with us, it will be possible to download income tax form isp 1202 or email it right away. The PDF document will also be readily available from your personal cabinet with your every modification. Here at FormsPal, we endeavor to be sure that your details are kept secure.