Using PDF files online is actually easy with our PDF editor. You can fill out form motor vehicle exemption here effortlessly. The editor is constantly updated by us, receiving useful functions and becoming greater. For anyone who is seeking to get going, this is what it will take:

Step 1: Hit the "Get Form" button in the top section of this page to get into our tool.

Step 2: The tool grants the ability to modify the majority of PDF documents in a range of ways. Improve it by writing your own text, correct existing content, and add a signature - all at your disposal!

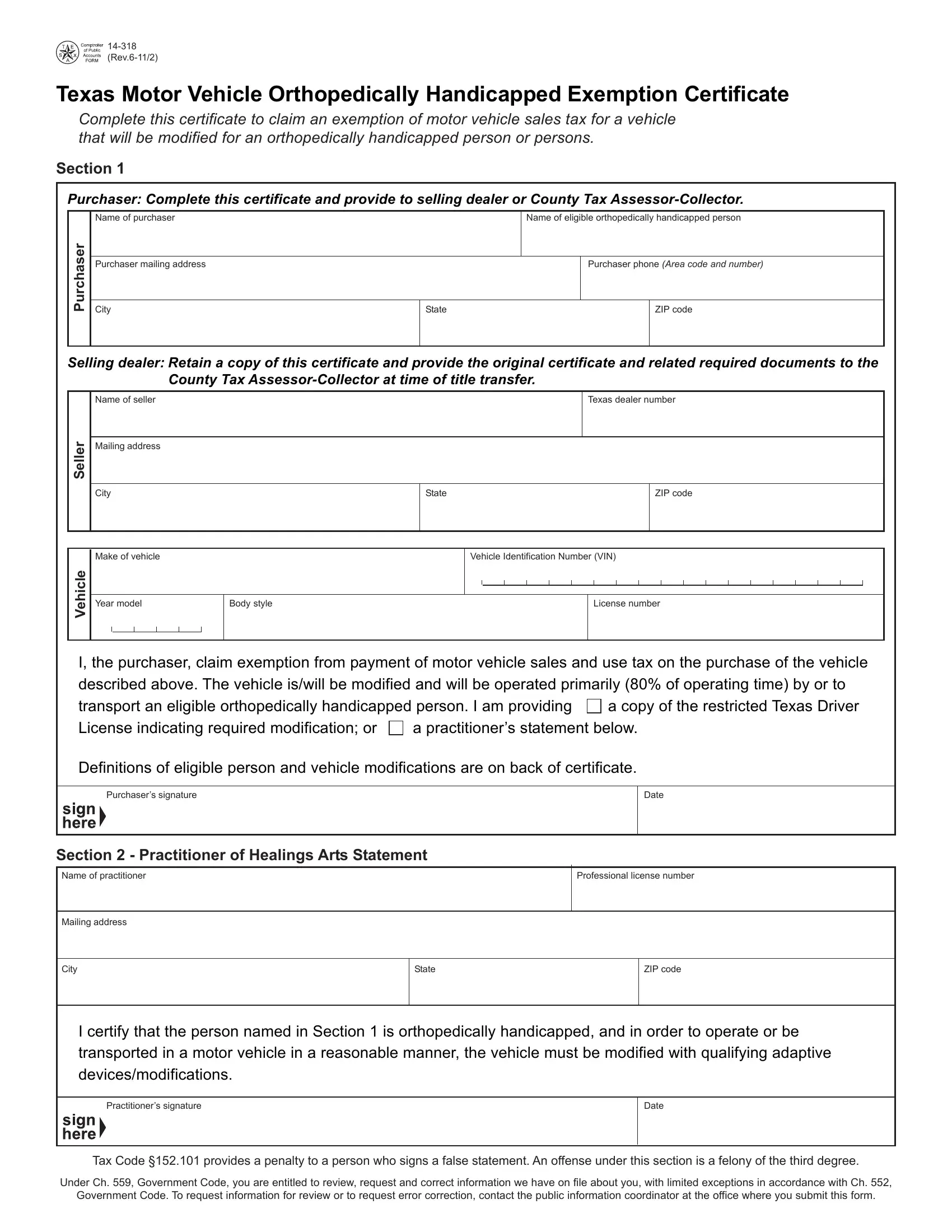

As a way to fill out this form, be certain to enter the required information in every field:

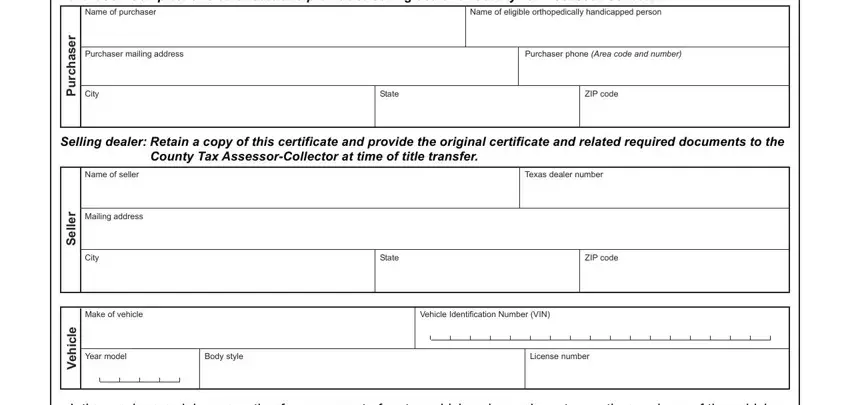

1. It is advisable to complete the form motor vehicle exemption correctly, so pay close attention while working with the areas containing these particular fields:

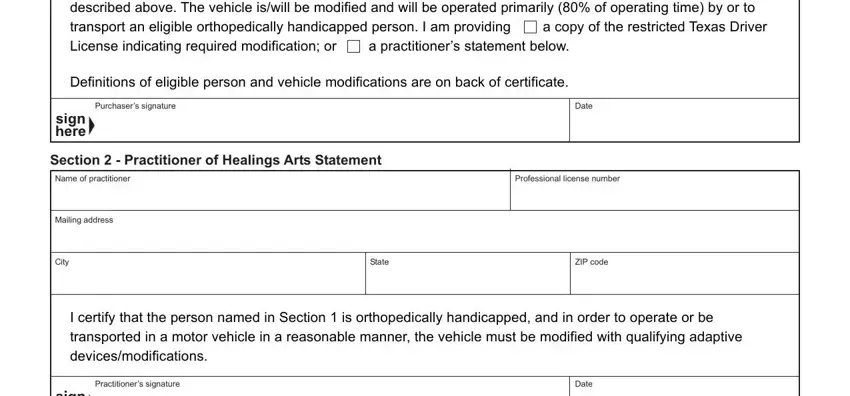

2. Just after performing the last section, go on to the next step and fill out all required particulars in all these blank fields - I the purchaser claim exemption, a copy of the restricted Texas, a practitioners statement below, Definitions of eligible person and, Purchasers signature, Date, Section Practitioner of Healings, Name of practitioner, Mailing address, Professional license number, City, State, ZIP code, I certify that the person named in, and Practitioners signature.

People generally make some mistakes while filling in I certify that the person named in in this part. Be sure you read again whatever you type in right here.

Step 3: Spell-check what you've inserted in the form fields and then click the "Done" button. Grab your form motor vehicle exemption when you register at FormsPal for a free trial. Immediately access the pdf document inside your FormsPal account page, along with any edits and changes being conveniently synced! When using FormsPal, you'll be able to fill out forms without stressing about database leaks or entries being distributed. Our secure software makes sure that your private data is maintained safe.