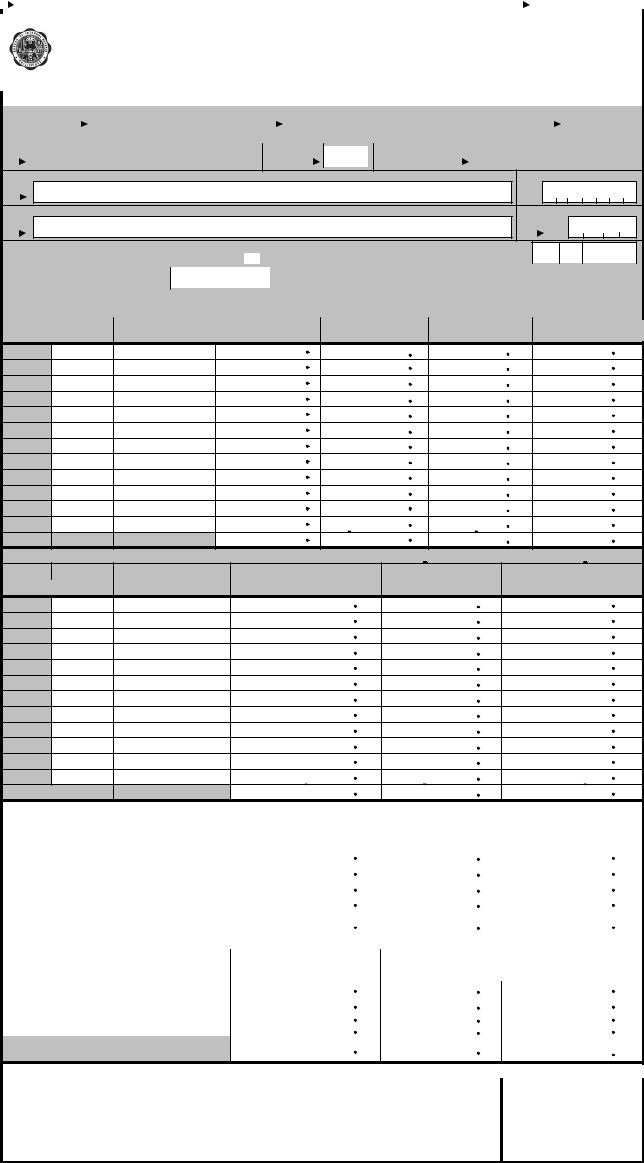

The 1604 Cf Form is a document used in the Canadian province of Ontario. It is used to report on financial activity for a particular business or organization. This form is due annually, and must be submitted before the end of the fiscal year. The information reported on this form can be used to assess a company's financial health, and make decisions about lending money or providing other services. Anyone who owns, operates, or has an interest in a business in Ontario must complete this form.

| Question | Answer |

|---|---|

| Form Name | 1604 Cf Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | 1604cf form 2020, bir online form, how to file 1604cf alphalist, bir form no 1604 cf |

(To be filled up by the BIR) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

DLN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PSOC: |

PSIC: |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Information Return |

BIR Form No. |

|||||||||||||

|

|

|

|

|

Republika ng Pilipinas |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

of Income Taxes Withheld on |

||||||||||||||||||||||||||||||||

|

|

|

|

|

Kagawaran ng Pananalapi |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

Kawanihan ng Rentas Internas |

|

|

|

|

July 1999 (ENCS) |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and Final Withholding Taxes |

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fill in all applicable spaces. Mark all appropriate boxes with an “X”. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

1 |

For the Year |

|

|

|

|

|

|

|

|

|

2 Amended Return? |

|

|

|

|

|

|

3 No of Sheets Attached |

|

|

|

|

|||||||||||||||||||||

|

(YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Part I |

|

|

B a c k g r o u n d I n f o r m a t i o n |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

4 |

TIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 RDO Code |

|

6 Line of Business/ |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Occupation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7 |

Withholding Agent's Name (Last Name, First Name, Middle Name for Individuals)/(Registered Name for |

|

9 |

Registered Address |

10 Zip Code |

11In case of overwithholding/overremittance after the

have you released the refunds to your employees? |

|

Yes |

|

No |

|

|

the date of refund |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 Total Amount of Overremittance on |

|

|

|

|

13 Month of First Crediting |

of |

|

|

14 Category of Withholding Agent |

||||||||||||||||

Tax Withheld under compensation |

|

|

|

|

|

|

Overremittance |

|

|

|

|

|

Private |

|

|

Government |

|||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Part II |

|

|

S u m m a r y |

o f R e m i t t a n c e s |

|

|

|

|

|

|

|

|

|||||||||||||

Schedule 1 |

|

R e m i t t a n c e |

p e r B I R F o r m N o. |

|

|

|

|

|

|

|

|

||||||||||||||

MONTH |

DATE OF |

NAME OF BANK/BANK CODE/ |

TAXES WI THHELD |

ADJUSTMENT |

|

|

PENALTI ES |

|

TOTAL AMOUNT |

||||||||||||||||

REMITTANCE |

ROR NO., IF ANY |

|

|

|

|

REMITTED |

|||||||||||||||||||

JAN

FEB

MAR

APR

MAY

JUN

JUL

AUG

SEP

OCT

NOV

DEC

TOTAL

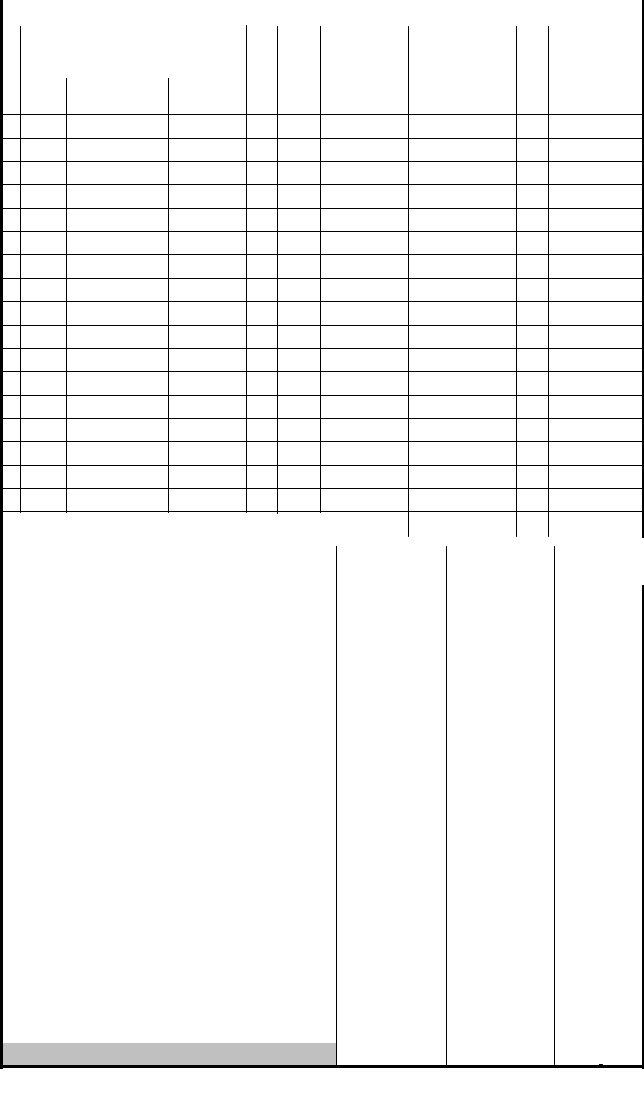

Schedule 2 |

R e m i t t a n c e p e r |

B I R F o r m N o. |

|

|

DATE OF |

NAME OF BANK/BANK CODE/ |

TAXES |

PENALTI ES |

TOTAL AMOUNT |

MONTH |

|

|

|

|

REMITTANCE |

ROR NO., IF ANY |

WITHHELD |

|

REMITTED |

JAN

FEB

MAR

APR

MAY

JUN

JUL

AUG

SEP

OCT

NOV

DEC

TOTAL

Schedule 3 |

R e m i t t a n c e |

p e r |

B I R |

F o r m |

N o. 1602 |

|

|||||

QUARTER |

DATE OF |

NAME OF BANK/BANK CODE |

|

TAXES |

|

|

PENALTI ES |

|

TOTAL AMOUNT |

||

|

|

|

WITHHELD |

|

|

|

REMITTED |

||||

|

REMITTANC |

ROR NO., IF ANY |

|

|

|

|

|

|

|||

1ST QTR |

|

|

|

|

|

|

|

|

|

|

|

2ND QTR |

|

|

|

|

|

|

|

|

|

|

|

3RD QTR |

|

|

|

|

|

|

|

|

|

|

|

4TH QTR |

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

Schedule 4 |

R e m i t t a n c e |

p e r |

B I R |

F o r m |

N o. 1603 |

|

|||||

QUARTER |

DATE OF |

NAME OF BANK/BANK CODE |

|

TAXES |

|

|

PENALTI ES |

|

TOTAL AMOUNT |

||

|

|

|

|

|

|

|

|

|

|||

|

REMITTANC |

ROR NO., IF ANY |

|

WITHHELD |

|

|

|

|

|

REMITTED |

|

1ST QTR |

|

|

|

|

|

|

|

|

|

|

|

2ND QTR |

|

|

|

|

|

|

|

|

|

|

|

3RD QTR |

|

|

|

|

|

|

|

|

|

|

|

4TH QTR |

|

|

|

|

|

|

|

|

|

|

|

TOTAL

I declare, under the penalties of perjury that this return has been made in good faith, verified by meStamp of Receiving Office and

best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Re

Code, as amended, and the regulations issued under authority thereof.

1516

|

|

|

|

|

|

|

T |

axpayer/Authorized Agent Signature over Printed |

Name |

Title/Position of Signator |

y |

||

|

|

|

|

|

|

|

Date of Receipt

|

|

|

|

|

|

BIR Form |

|

||

Part III |

Alphabetical List of Employees/ Payees from whom Taxes were Withheld (format only) |

|

|||||||

Schedule 5 |

ALPHALIST OF PAYEES SUBJECT TO FINAL WITHHOLDING TAX (Reported Under Form 2306) |

|

|||||||

SEQ |

Taxpaye |

NAME OF PAYEES |

ADDRESS OF * STATUS |

ATC |

NATURE OF INCOME |

AMOUNT OF |

RATE AMOUNT OF TAX |

||

NO. Identificati(Last Name, First Name, |

PAYEES |

(As to residence/ |

PAYMENT |

INCOME |

OF |

WITHHELD |

|||

|

NUMBER (TI Middle Name for Individuals, |

|

Nationality) |

|

(Refer to BIR Form No. 1601- |

PAYMENT |

TAX |

(Not Creditable) |

|

|

complete name for Non - individuals) |

|

|

|

|

|

|

||

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

(10) |

|

|

|

|

|

|

P |

|

P |

|

Total |

|

|

|

|

|

|

|

|

|

P |

|

|

|

|

|

|

|

||||

Schedule 6 ALPHALIST OF EMPLOYEES OTHER THAN RANK AND FILE WHO WERE GIVEN FRINGE BENEFITS DURING THE YEAR (Reported |

||||||||||

SEQ |

Taxpayer |

NAME |

OF EMPLOYEES |

|

ATC |

AMOUNT OF |

GROSSED - UP |

AMOUNT OF |

||

NO. |

Identification |

|

|

|

|

|

|

FRINGE BENEFIT |

MONETARY |

TAX WITHHELD |

|

Number (TIN) |

Last Name |

|

First Name |

Middle Name |

|

|

VALUE |

(NOT CREDITABLE) |

|

(1) |

(2) |

(3a) |

|

(3b) |

(3c) |

|

(4) |

(5) |

(6) |

(7) |

|

|

|

|

|

|

|

P |

|

P |

P |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

P

P

P

*A - Citizens of the Philippine B - Resident Alien Individuals C -

E - Domestic Corporation F - Resident Foreign Corp. G -

H - Alien employees of oil exploration service contractors and subcontractors, offshore banking units and regional or area headquarters of multinational co

BIR Form No.

ALPHABETICAL LIST OF EMPLOYEES/PAYEES FROM WHOM TAXES WERE WITHHELD (FORMAT ONLY)

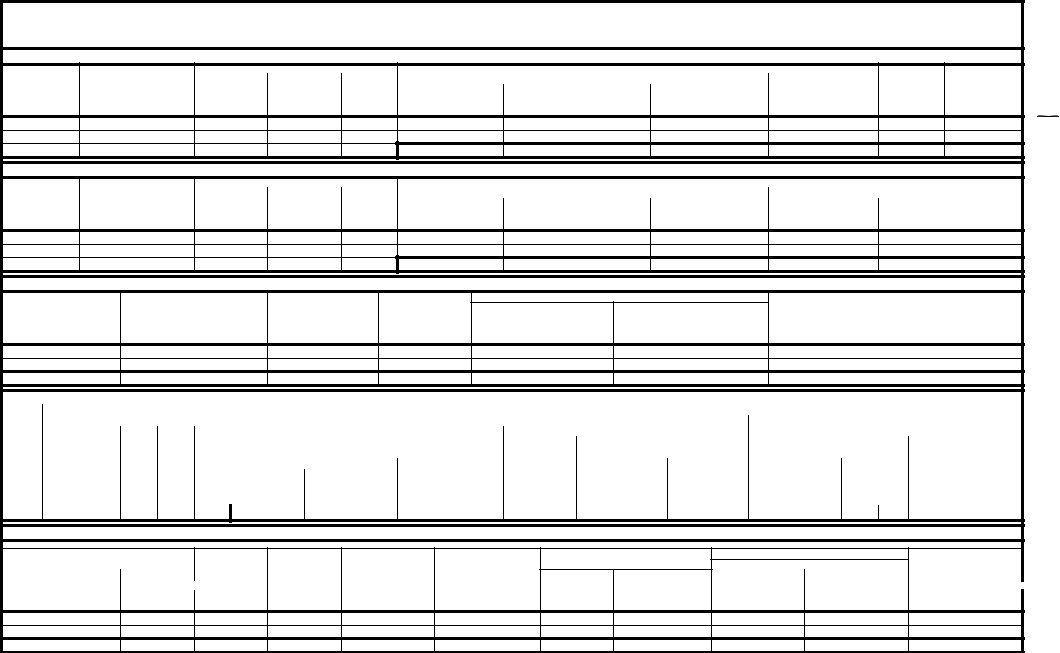

Schedule 7.1 |

ALPHALIST OF EMPLOYEES TERMINATED BEFORE DECEMBER 31 (Reported Under BIR Form 2316) |

|

(Use the same format as in Schedule 7.3 but prepare a separate column (before Gross Compensation) for inclusive date of employment. |

|

The annualized method should have been applied in computing the tax due from the employee upon termination of the employment contract.) |

Schedule 7ALPHALIST.2 |

OF EMPLOYEES WHOSE COMPENSATION INCOME ARE EXEMPT FROM WITHHOLDING TAX BUT SUBJECT TO INCOME TAX (Reported Under BIR Form 2316) |

|

|

SEQ

NO

(1)

TAXPAYER

IDENTIFICATION

NUMBER

(2)

NAME OF EMPLOYEES |

|

|

(4) GROSS COMPENSATION INCOME |

|

|

|

||

Last |

First |

Middle |

|

NON - TAXABLE |

|

TAXABLE |

Amount of |

Premium paid |

Name |

Name |

Name |

13th Month Pay |

SSS,GSIS,PHIC, & Pag - ibig |

Other Forms |

Salaries & Other Forms |

Exemption |

on health and/or |

|

|

|

& Other Benefits |

Contributions, and Union Dues |

of Compensation |

of Compensation |

|

Hospital |

(3a) |

(3b) |

(3c) |

4(a) |

4(b) |

4(c) |

4(d) |

( 5) |

Insurance (6) |

TOTALS P

P

P

P

P

Schedule 7.3 |

ALPHALIST OF EMPLOYEES AS OF DECEMBER 31 WITH NO PREVIOUS EMPLOYER WITHIN THE YEAR (Reported Under BIR Form 2316) |

|

|

SEQ

NO

(1)

TAXPAYER

IDENTIFICATION

NUMBER

(2)

NAME OF EMPLOYEES |

|

|

(4) GROSS COMPENSATION INCOME |

|

|||

Last |

First |

Middle |

|

NON - TAXABLE |

|

|

TAXABLE |

Name |

Name |

Name |

13th Month Pay |

SSS,GSIS,PHIC, & Pag - ibig |

Salaries & Other Forms |

13th Month Pay |

Salaries & Other Forms |

|

|

|

& Other Benefits |

Contributions, and Union Dues |

of Compensation |

& Other Benefits |

of Compensation |

(3a) |

(3b) |

(3c) |

4(a) |

4(b) |

4(c) |

4(d) |

4(e) |

TOTALS P

P

P

P

P

Schedule 7.3 (continuation) |

ALPHALIST OF EMPLOYEES AS OF DECEMBER 31 WITH NO PREVIOUS EMPLOYER WITHIN THE YEAR |

|

|

AMOUNT OF EXEMPTION

(5)

Premium Paid on

Health and/or Hospital Insurance

(6)

TAX DUE

(JAN.

(7)

TAX WITHHELD (JAN. - NOV.)

(8)

YEAR - END ADJUSTMENT (9a or 9b)

AMOUNT WITHHELD |

OVER WITHHELD TAX |

AND PAID FOR |

REFUNDED TO |

IN DECEMBER |

EMPLOYEE |

(9a) = (7) - (8) |

(9b)=(8) - (7) |

AMOUNT OF TAX

WITHHELD

AS ADJUSTED

(to be reflected in BIR Form 2316) (10)=(8+9a) or

P

P

P

P

P

P

P

Schedule 7.4 |

|

ALPHALIST OF EMPLOYEES AS OF DECEMBER 31 WITH PREVIOUS EMPLOYER/S WITHIN THE YEAR |

(Reported Under Form 2316) |

|

|

|

||||||||||

SEQ |

TAXPAYER |

NAME OF EMPLOYEES |

|

|

|

|

GROSS COMPENSATION INCOME |

|

|

|

|

|||||

NO |

DENTIFICATION |

|

|

|

|

PREVIOUS EMPLOYER |

|

|

|

|

|

PRESENT EMPLOYER |

||||

|

NUMBER |

Last |

First |

Middle |

|

|

NON - TAXABLE |

|

TAXABLE |

|

|

NON - TAXABLE |

|

|||

|

|

Name |

Name |

Name |

13th Month Pay |

SALARIES & |

SSS,GSIS,PHIC & |

13th Month Pay |

SALARIES & |

|

Total Taxable |

13th Month Pay |

|

SALARIES & |

SSS,GSIS,PHIC & |

|

|

|

|

|

|

& Other |

|

OTHER FORMS Pag - ibig Contributions |

& Other |

OTHER FORMS (Previous Employer |

& Other |

|

OTHER FORMS |

Pag - ibig Contributions, |

|||

|

|

|

|

|

Benefits |

OF COMPENSATIO |

and Union Dues |

Benefits |

OF COMP |

|

Benefits |

|

OF COMP. |

and Union Dues |

||

(1) |

(2) |

(3a) |

(3b) |

(3c) |

(4a) |

|

(4b) |

(4c) |

(4d) |

(4e) |

(4f = 4d + 4e) |

(4g) |

|

(4h) |

(4i) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS P

P

P

P

P

P

P

P

P

Schedule 7.4 (continuation) |

ALPHALIST OF EMPLOYEES AS OF DECEMBER 31 WITH PREVIOUS EMPLOYER/S WITHIN THE YEAR |

|

|

PRESENT EMPLOYER |

Total Taxable |

|

TAXABLE |

(Previous & Presen |

|

13th Month Pay |

SALARIES & |

Employers ) |

& Other |

OTHER FORMS |

|

Benefits |

OF COMP. |

|

(4j) |

(4k) |

(4l = 4f + 4j + 4k) |

AMOUNT |

Premium paid on |

OF |

Health and/or |

EXEMPTION |

Hospital |

|

Insurance |

(5) |

(6) |

TAX

DUE

(JAN. - DEC.)

(7)

TAX WITHHELD (JAN. - NOV.)

PREVIOUS PRESENT EMPLOYER EMPLOYER

(8a) |

(8b) |

YEAR - END ADJUSTMENT (9a or 9b)

AMOUNT W/HELDOVER WITHHELD TA

& PAID FOR |

REFUNDED TO |

IN DECEMBER |

EMPLOYEE |

AMOUNT OF TAX

WITHHELD

AS ADJUSTED

(To be reflected in Form 2316 issued

by the present employer )

(10)=(8b+9a) or

P

P

P

P

P

P

P

P

P

P

P

Note: For schedule numbers 5, 6 and 7.1, 7.2, 7.3, 7.4 prepare separate schedules for foreign nationals/payees

BIR Form No.

Guidelines and Instructions

Who Shall File

This return shall be filed in triplicate by every employer or withholding agent/payor who is either an

individual, |

estate, |

trust, |

partnership, |

corporation, |

government |

agency |

and instrumentality, |

government- |

|

owned and controlled corporation, local government unit and other juridical entity required to deduct and withhold taxes on compensation paid to employees and on other

income payments subject |

to Final Withholding |

Taxes. The |

||||

tax rates |

for and nature of |

income payments |

subject to |

|||

withholding tax |

on compensation |

and final withholding |

||||

taxes are |

printed |

in |

BIR |

Form |

||

respectively. |

|

|

|

|

|

|

If the payor is the Government of the Philippines or any political subdivision or agency/instrumentality thereof, or

If the person required to withhold and pay the tax is a corporation, the return shall be made in the name of the corporation and shall be signed and verified by the president, vice president or authorized officer and shall be countersigned by the treasurer or assistant treasurer.

With respect to fiduciary, the return shall be made in the name of the individual, estate or trust for which such fiduciary acts, and shall be signed and verified by such fiduciary. In case of two or more fiduciaries, the return shall be signed and verified by one of such fiduciaries.

When and Where to File

The return shall be filed on or before January 31 of the year following the calendar year in which the compensation payment and other income payments subjected to final withholding taxes were paid or accrued.

The return shall be filed with the Revenue Collection Officer or duly authorized City/Municipal Treasurer of the Revenue District Office having jurisdiction over the withholding agent's place of business/office.

Ataxpayer may file a separate return for the head office and for each branch or place of business/office or a consolidated return for the head

office |

and all the branches/offices except in the |

case |

of |

large |

taxpayers where only one consolidated |

return |

is |

required.

Penalty for failure to file information returns

In the case of each failure to file an informati return, statement or list, or keep any record, or supp any information required by the Code or by t Commissioner on the date prescribed therefor, unless it shown that such failure is due to reasonable cause and n to willful neglect, there shall, upon notice and demand the Commissioner, be paid by the person failing to fi keep or supply the same, One thousand pes

(=P 1,000.00) for each such failure: Provided, howev that the aggregate amount imposed for all such failur during a calendar year shall not exceed Twenty fi thousand pesos

(P= 25,000.00).

Attachments Required

1.Alphalist of Employees as of December 31 with N Previous Employer within the Year.

2.Alphalist of Employees as of December 31 w Previous Employer/s within the Year.

3.Alphalist of Employees Terminated befo December 31.

4.Alphalist of Employees Whose Compensati Income Are Exempt from Withholding Tax b Subject to Income Tax.

5. |

Alphalist of |

Employees other than Rank & F |

|

Who Were Given Fringe Benefits During the year. |

|

6. |

Alphalist of |

Payees Subjected to Final Withholdi |

|

Tax. |

|

Note: All background information must be proper filled up.

§The last 3 digits of the

§Box No. 1 refers to transaction period and not t date of filing this return.

§TIN= Taxpayer Identification Number.

§ The |

ATC |

in the |

Alphabetical List |

Payees/Employees |

shall be |

taken from BIR For |

|

Nos. 2316 and 2306. |

|

||

§Employees earning an annual compensation incom of not exceeding =P 60,000 from one employer w did not opt to be subjected to withholding tax compensation shall be reported under Schedule 7 (Alphalist of Employees Whose Compensati Income are Exempt from Withholding Tax B Subject to Income Tax)

ENCS