Using PDF forms online is definitely very simple with our PDF tool. Anyone can fill in injured spouse 502 here effortlessly. To maintain our editor on the forefront of practicality, we aim to integrate user-oriented capabilities and improvements regularly. We're routinely looking for suggestions - play a pivotal part in revolutionizing the way you work with PDF documents. It just takes just a few simple steps:

Step 1: Click the "Get Form" button above. It is going to open our pdf editor so that you can begin filling out your form.

Step 2: After you start the editor, you'll see the document all set to be filled in. In addition to filling in different blanks, you could also perform other things with the file, including writing custom words, editing the initial textual content, inserting illustrations or photos, putting your signature on the document, and much more.

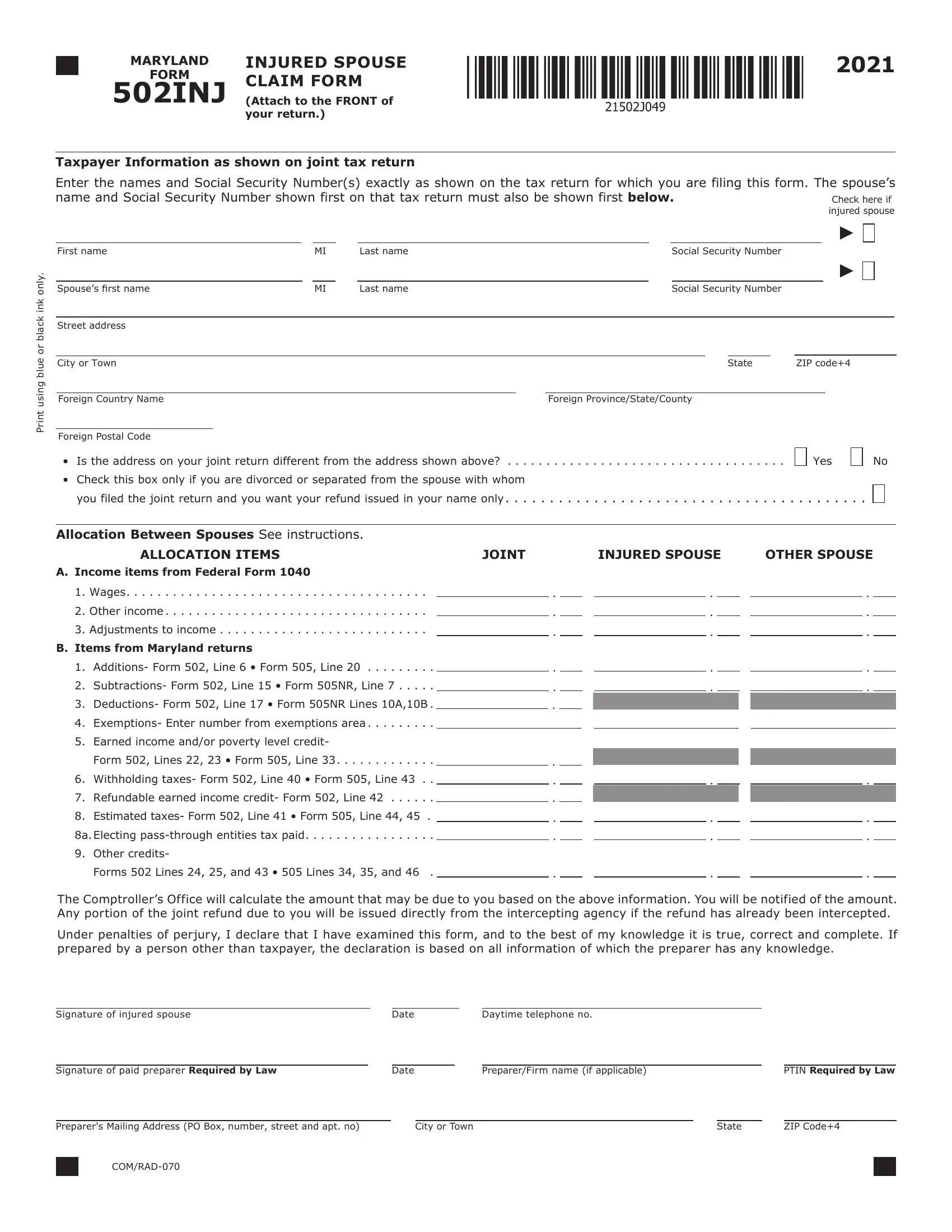

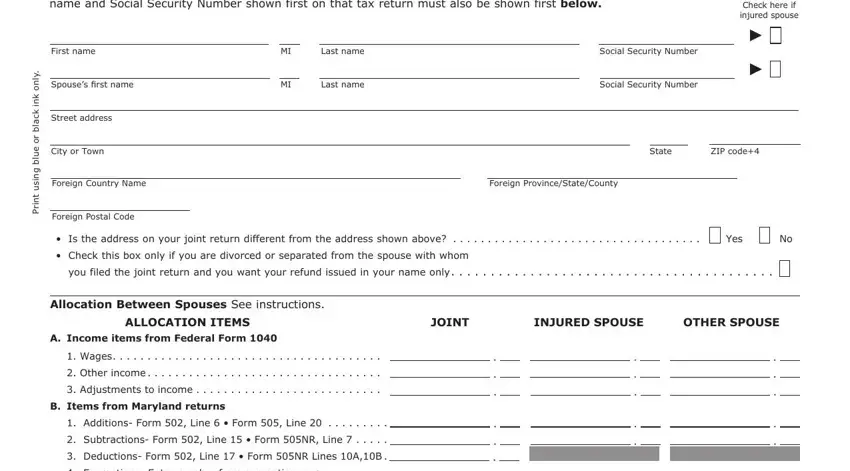

This form will require particular data to be filled in, hence make sure to take some time to fill in precisely what is asked:

1. Complete the injured spouse 502 with a group of essential blanks. Consider all the required information and be sure there is nothing left out!

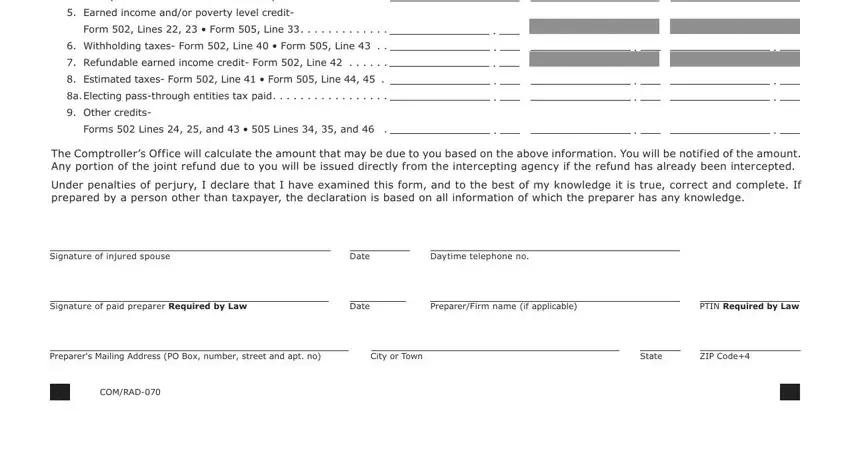

2. Once this section is finished, you'll want to add the required particulars in Exemptions Enter number from, Earned income andor poverty level, Form Lines Form Line , Withholding taxes Form Line , Refundable earned income credit, Estimated taxes Form Line Form, a Electing passthrough entities, Other credits, Forms Lines and Lines and , The Comptrollers Office will, Under penalties of perjury I, Signature of injured spouse, Date, Daytime telephone no, and Signature of paid preparer so that you can progress to the third stage.

It's simple to make a mistake when filling in the Exemptions Enter number from, therefore make sure that you go through it again prior to deciding to finalize the form.

Step 3: Prior to submitting this file, make certain that form fields have been filled out the right way. The moment you’re satisfied with it, click on “Done." Get hold of your injured spouse 502 as soon as you sign up at FormsPal for a 7-day free trial. Instantly view the document in your personal account page, with any modifications and changes automatically kept! Here at FormsPal, we do our utmost to ensure that all of your information is stored private.