Our PDF editor makes it simple to fill in forms. You don't have to perform much to enhance vat 201 form in excel format forms. Just simply keep to all of these steps.

Step 1: This page includes an orange button saying "Get Form Now". Click it.

Step 2: Once you have accessed the editing page vat 201 form download, you'll be able to see every one of the functions available for the form inside the top menu.

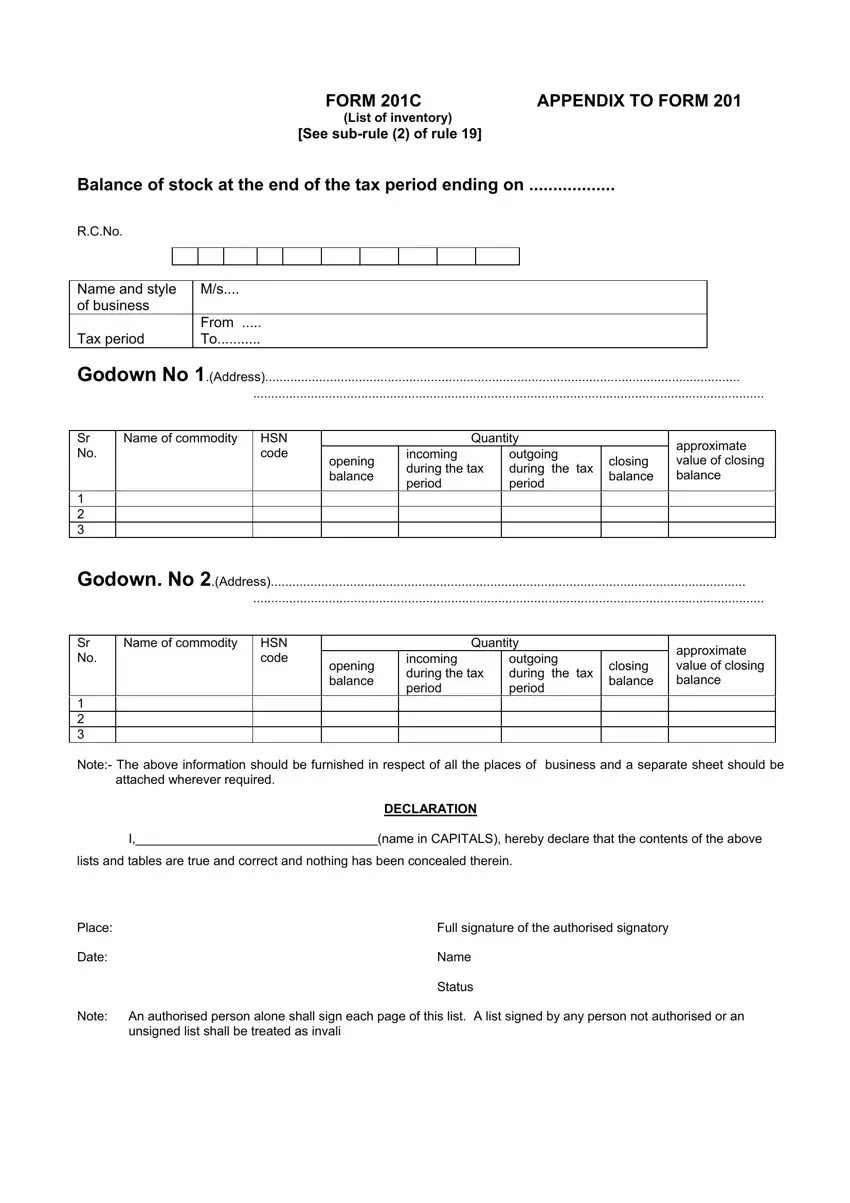

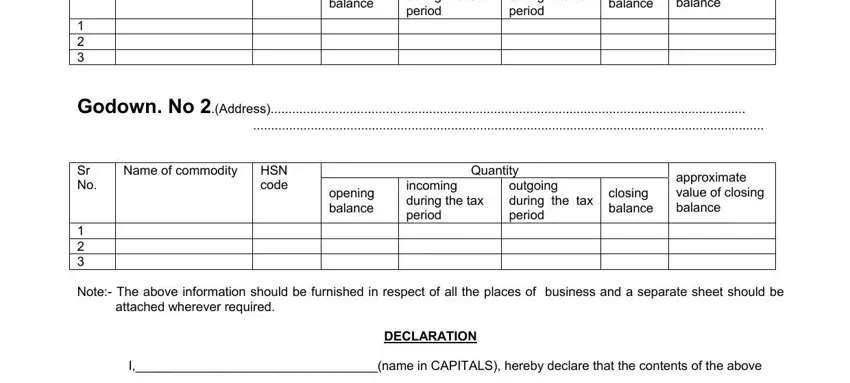

You'll have to provide the next information so you can create the file:

Step 3: As soon as you are done, select the "Done" button to transfer your PDF form.

Step 4: Get at least several copies of the file to stay clear of any specific possible future challenges.