Important Information

For taxable years beginning on or after

July 1, 2008, California Revenue and Taxation Code (R&TC) Section 23663 allows the assignor to assign an eligible credit to the eligible assignee. For taxable years beginning on or after January 1, 2010, the eligible assignee may claim all or a portion of the assigned credits against tax for the taxable year in which the assignment occurs, or

any subsequent taxable year, subject to limitations. For more information, see R&TC Section 23663 or go to ftb.ca.gov and search for credit assignment.

After assignment of an eligible credit, the assignee is treated as if it originally generated the assigned credit. All restrictions and limitations, including any carryover limitations that applied to the assignor (entity that originally generated the credit) will also apply to the assignee. See General Information B, Disclosure of Limitations and Restrictions, for more information.

Once a credit amount is assigned to an assignee, the assigned credit amount cannot be reassigned to another assignee.

There is no requirement of payment for assignment of credit by an eligible assignee to an assignor. If the eligible assignee makes a payment for the assignment of credit, the payment is not a deductible expense for the assignee nor income to the assignor.

The assignor and the eligible assignee shall each be liable for the full amount of any tax, addition to tax, or penalty that results from any disallowance of any eligible credit assigned under R&TC Section 23663. The Franchise Tax Board (FTB) may collect such amount in full from either the assignor or the eligible assignee.

If a C corporation received an assigned credit from an assignor, and then converted to an S corporation, the S corporation is entitled to claim 1/3 of the assigned credit as follows:

•The C corporation assigned credit carryovers are reduced to 1/3 when transferred to the S corporation. The remaining 2/3 are disregarded. The allowable assigned credit carryovers may be used to offset the 1.5% tax on net income in accordance with the respective carryover rules.

•These C corporation assigned credit carryovers may not be passed through to the shareholders.

For general information regarding the treatment of S corporations tax credits, get Form 100S Corporation Tax Booklet for more information.

General Information

In general, for taxable years beginning on or after January 1, 2010, California law conforms to the Internal Revenue Code (IRC) as of January 1, 2009. However, there are continuing differences between California and federal law. When California conforms to federal tax law changes, we do not always adopt all of the changes made at the federal level. For more information, go to ftb.ca.gov and search for conformity. Additional information can be found in FTB Pub. 1001, Supplemental Guidelines

to California Adjustments, the instructions for California Schedule CA (540 or 540NR), and the Business Entity tax booklets.

The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. We include information that is most useful to the greatest number of taxpayers in the limited space available. It is not possible to include all requirements of the California R&TC in the tax booklets. Taxpayers should not consider the tax booklets as authoritative law.

A Purpose

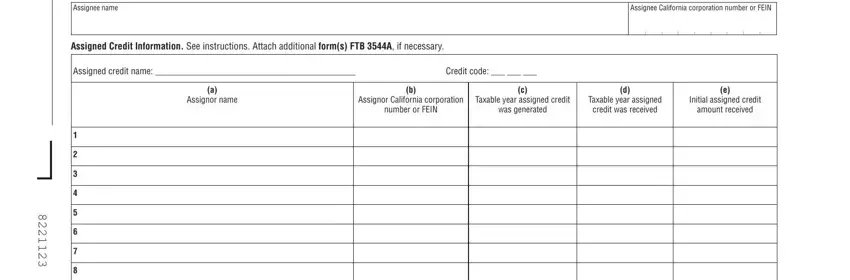

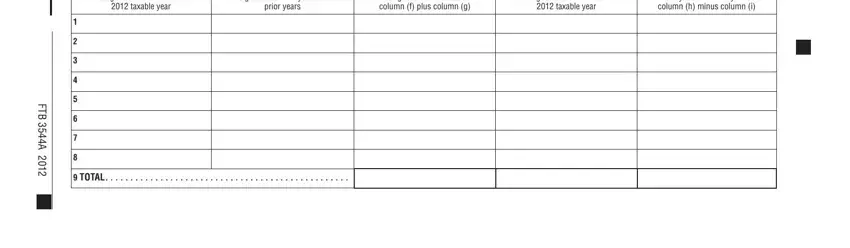

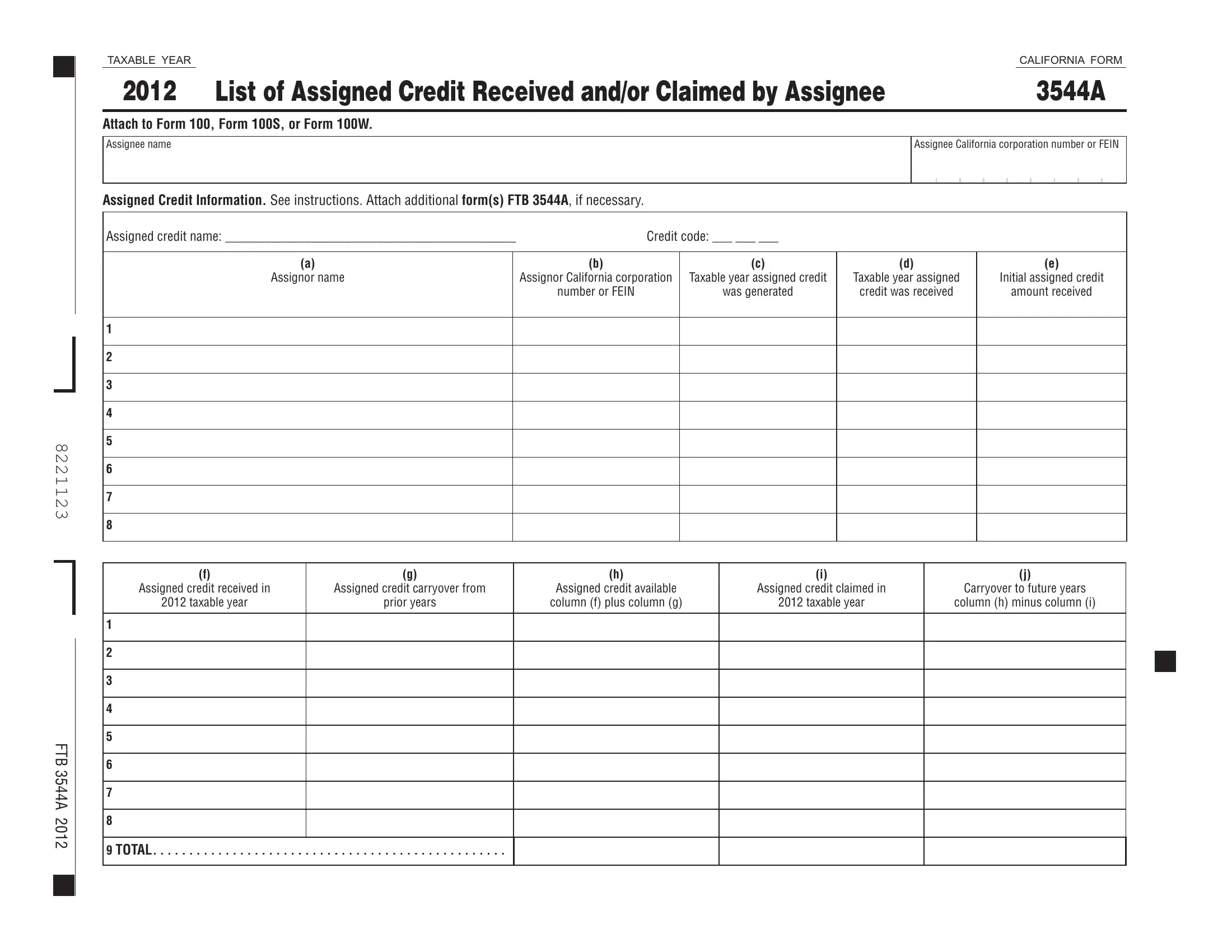

Use form FTB 3544A, List of Assigned Credit Received and /or Claimed by Assignee, to report the following:

•Assigned credit amount received this taxable year and/or carryover from prior taxable years.

•Assigned credit amount claimed in the current taxable year.

•Assigned credit amount carryover to future taxable years.

When more than one type of assigned credit is being received and/or claimed, complete a separate form FTB 3544A for each type of assigned credit and attach it to Form 100, California Corporation Franchise or Income Tax Return; Form 100S, California S Corporation Franchise or Income Tax Return; or

Form 100W, California Corporation Franchise or Income Tax Return – Water’s-Edge Filers.

When attaching form FTB 3544A to the tax return, make sure to check the “Yes” box on Form 100 or Form 100W, Side 1, Schedule Q, Question B5; or Form 100S, Side 2, Schedule Q, Question S.

B Disclosure of Limitations and Restrictions

The eligible assignee is treated as if it originally generated the assigned credit. Any credit limitations or restrictions that applied to the assignor will also apply to the eligible assignee. The assignor shall disclose the existence and nature of any assigned credit limitations to the eligible assignee and to the FTB. Such limitations may include, but are not limited to:

•Limitations imposed on the credit to certain types of income, such as income from one of the California Enterprise Zones (EZ).

•Limitations imposed by California’s incorporation of IRC Section 383.

•Limitations on the number of years the assigned credits may be carried forward.

For example, the amount of EZ credit allowable for use is limited to the tax on income attributable to that enterprise zone. For zone credits assigned, the assignee must have a tax liability on the income attributable to the same zone that the original credit was generated. If the original credit was generated in the Fresno enterprise zone of the assignor, the assignee must have a tax liability on the income attributable to the Fresno enterprise zone.

Also, when a corporation has an “ownership change” as defined in IRC Section 382, tax credits may be subject to limitations imposed under IRC Section 383. In such situations, the annual use of credits is limited to an amount determined under IRC Section 383.

Another example is that the assignor has an Environmental Tax Credit generated during the 2006 taxable year. The credit has not been used and was carried forward and assigned in the 2012 taxable year. The credit will expire in the 2017 taxable year, based on the date that the assignor originally generated the credit. The credit will expire for the assignee in the 2017 taxable year, unless the carryover period is extended by law.

Specific Line Instructions

The assignee shall complete all of the information requested on form FTB 3544A. Attach additional form(s) FTB 3544A, if necessary. Schedules or substitute forms, other than FTB-approved computer-generated substitute versions of form FTB 3544A, will not be accepted.

In addition, the assignee should maintain the information necessary to substantiate any assigned credit amount claimed.

Assigned Credit Information

Enter the assigned credit name and credit code in the space provided. For each type of assigned credit received and/or claimed, the assignee should complete a separate form FTB 3544A. When completing the form, list each assigned credit transaction received separately. See example on the next page for how to report the assigned credit received and/or claimed.

Column (a) – Assignor name. Enter the name of the corporation that assigned the credit.

Column (b) – Assignor California corporation number or FEIN. Enter the California corporation number or FEIN of the corporation that assigned the credit.