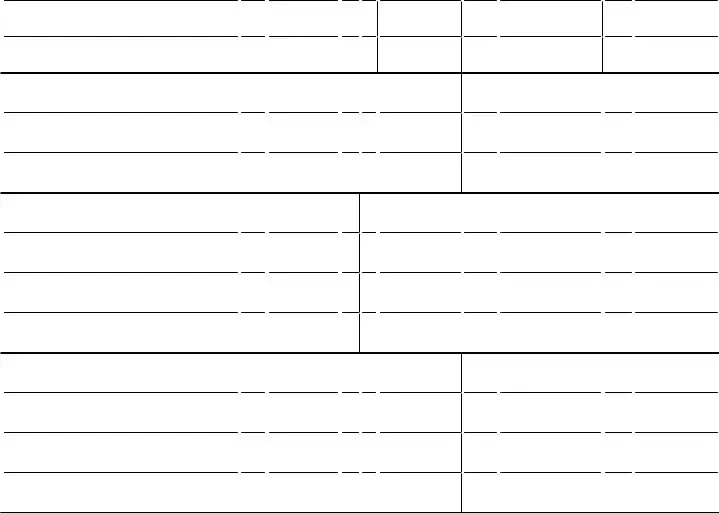

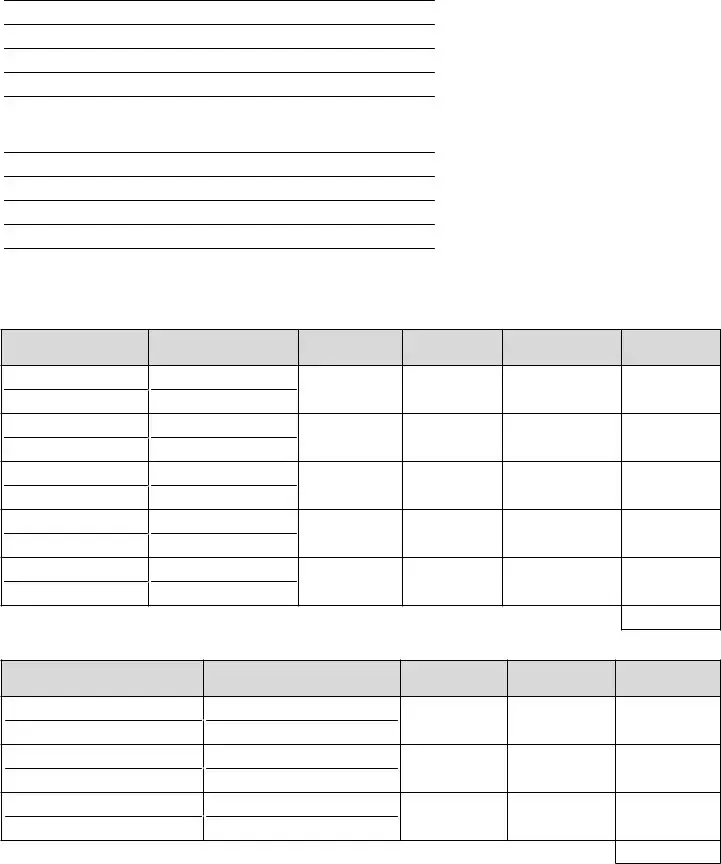

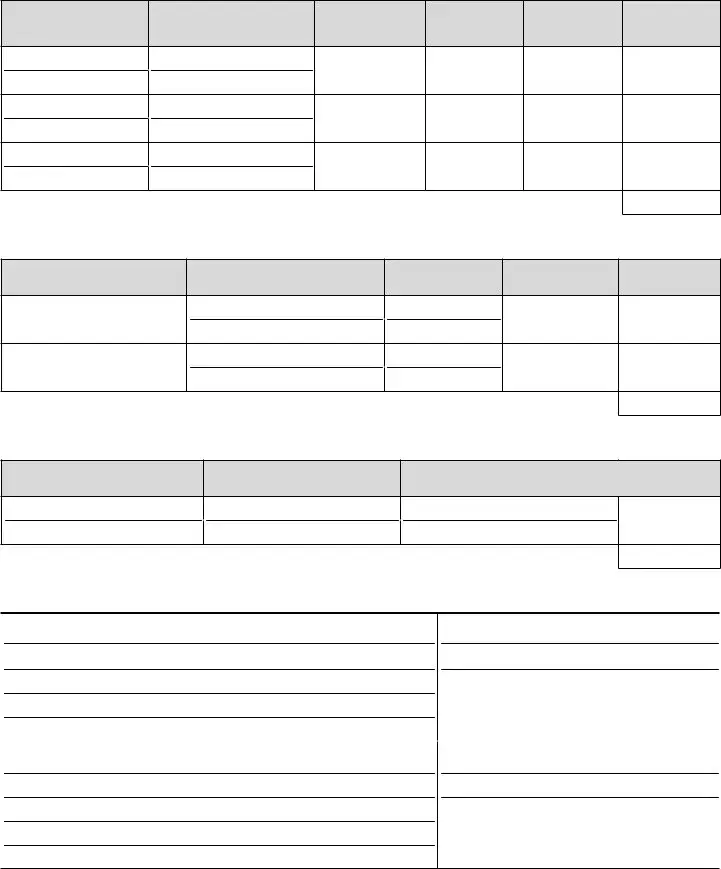

Section 4 – Asset and Liability Analysis

Immediate assets

1. Cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Bank accounts/balance (from Section 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Vehicles/available equity (from Section 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Loan/cash surrender value of life insurance (from Section 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Securities (from Section 3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Safe deposit box value of contents (from Section 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Immediate Assets . . . . . . . . . . . .

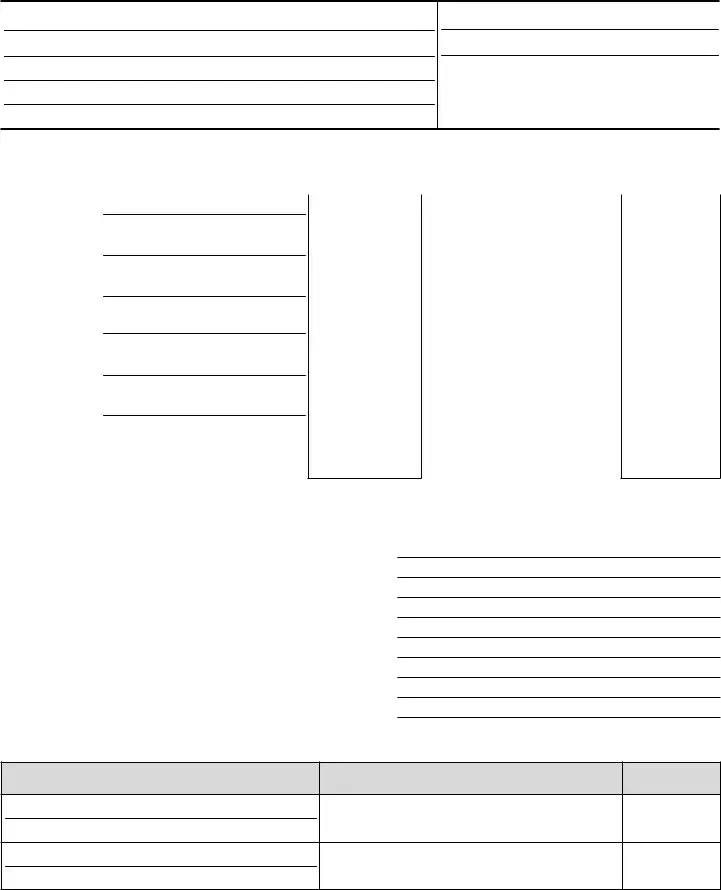

Real property (from Section 3)

|

Address or Location |

Current Market |

Mortgage |

Equity |

|

Value |

Payoff Amount |

|

|

|

7. |

A) |

|

|

|

8. |

B) |

|

|

|

9. |

C) |

|

|

|

Total Equity . . . . . . . . . . . . . . . . . . . . . .

Other assets

10. Notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Judgements/settlements receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Aircraft, watercraft . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Interest in trusts, e.g., trustee, trustor, beneficiary, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. Interest in estates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16. Interest in business entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. Other assets ______________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18. Other assets ______________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19. Other assets ______________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20. Other assets ______________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Other Assets. . . . . . . . . . . . . . . . .

21. Sum Total of Assets (Immediate, Equity, and Other). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

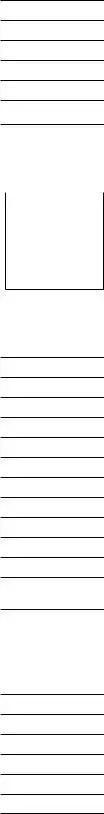

Current liabilities including judgements, notes and other charge accounts. Do not include vehicle or home loans.

22. Total owed for lines of credit (from Section 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23. Taxes owed to IRS (provide a copy of recent notices) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24. Other liabilities _____________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25. Other liabilities _____________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26. Other liabilities _____________________________________. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27. Other liabilities _____________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Liabilities . . . . . . . . . . . . . . . . . .